How many days does Medicare cover in a benefit period?

Dec 16, 2021 · Medicare benefit periods usually involve Part A (hospital care). A period begins with an inpatient stay and ends after you’ve been out of …

How long do you have to be in a hospital before Medicare?

Original Medicare will only cover 90 days of inpatient hospital care in a single benefit period. The first 60 days of that don’t require any cost sharing. Days 61 to 90 do. These rates change each year. Starting on day 91, you’ll have to tap into what Medicare calls your “lifetime reserve days.” You only get 60 lifetime reserve days for your life.

How long does my chance to join a Medicare plan last?

July – September. If you make a change, it will begin the first day of the following month. You’ll have to wait for the next period to make another change. You can’t use this Special Enrollment Period October – December. However, all people with Medicare can make changes to their coverage October 15 – December 7.

How many days does Medicare pay for hospitalization?

May 06, 2021 · N. Fewer than 60 days have passed since your hospital stay in June, so you’re in the same benefit period. · Continue paying Part A deductible (if you haven’t paid the entire amount) · No coinsurance for first 60 days. · In the SNF, continue paying the Part A deductible until it’s fully paid.

How long is each benefit period for Medicare?

60 daysThe benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period.

What is the 60 day rule for Medicare?

The 60-day rule requires anyone who has received an overpayment from Medicare or Medicaid to report and return the overpayment within the latter of (1) 60 days after the date on which the overpayment was identified and (2) the due date of a corresponding cost report (if any).Feb 12, 2016

What are the 3 enrollment periods for Medicare?

This is called your Initial Enrollment Period. It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month....When your coverage starts.If you sign up:Coverage starts:2 or 3 months after you turn 653 months after you sign up3 more rows

What happens when you run out of Medicare days?

Medicare will stop paying for your inpatient-related hospital costs (such as room and board) if you run out of days during your benefit period. To be eligible for a new benefit period, and additional days of inpatient coverage, you must remain out of the hospital or SNF for 60 days in a row.

Does Medicare have a lifetime limit?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

How long before you turn 65 do you apply for Medicare?

3 monthsGenerally, you're first eligible starting 3 months before you turn 65 and ending 3 months after the month you turn 65. If you don't sign up for Part B when you're first eligible, you might have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

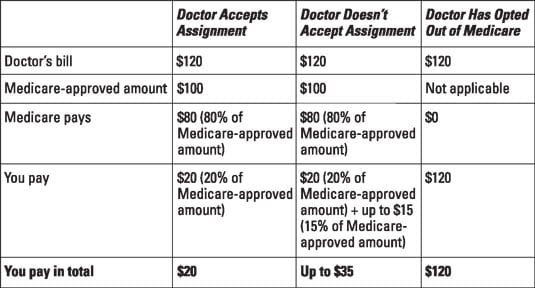

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Guide to Explaining The Medicare Hospital Benefit Period

Under Medicare, the hospital benefit period starts once you’ve been admitted to the hospital and expires once you’ve been at home for 60 consecutiv...

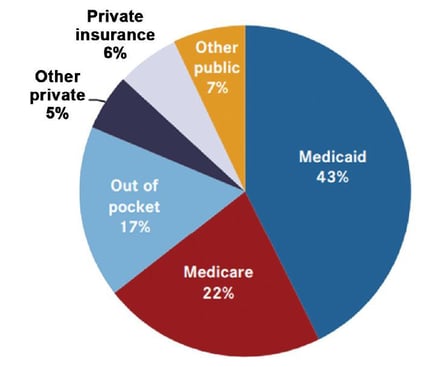

Traditional Medicare Hospital Coverage

Here is a breakdown of how much Medicare will cover and how much you’ll owe out-of-pocket for individual hospital benefit periods: 1. You will be e...

Skilled Nursing With Traditional Medicare Coverage

In an Original Medicare plan, you have to stay for a minimum of three days, or more than two nights, to officially be admitted as a patient in a ho...

Options With Medicare Advantage

You are subject to Medicare’s hospital benefit periods if you have a Medicare Advantage health plan. However, the costs for skilled nursing and hos...

How Does Medicare Cover Hospital Stays?

When it comes to hospital stays, Medicare Part A (hospital insurance) generally covers much of the care you receive: 1. As a hospital inpatient 2....

What’S A Benefit Period For A Hospital Stay Or SNF Stay?

A benefit period is a timespan that starts the day you’re admitted as an inpatient in a hospital or skilled nursing facility. It ends when you have...

What’S A Qualifying Hospital Stay?

A qualifying hospital stay is a requirement you have to meet before Medicare covers your stay in a skilled nursing facility (SNF), in most cases. G...

How Might A Medicare Supplement Plan Help With The Costs of My Hospital Stay?

Medicare Supplement insurance is available from private insurance companies. In most states, there are up to 10 different Medicare Supplement plans...

How much is Medicare coinsurance?

The Medicare recipient is charged a daily coinsurance for any lifetime reserve days used. The standard coinsurance amount is $682 per day. If you’re enrolled in a supplemental Medicare insurance program, also known as “Medigap,” you will receive another 365 days in your lifetime reserve with no additional copayments.

How long do you have to stay in a hospital?

In an Original Medicare plan, you have to stay for a minimum of three days, or more than two nights, to officially be admitted as a patient in a hospital. Only then will Medicare start to pay for your care in a skilled nursing center for additional treatment, like physical therapy or for regular IV injections. The amount of time you spend in the hospital as well as the skilled nursing center will be counted as part of your hospital benefit period. Furthermore, you are required to have spent 60 days out of each in order to be eligible for another benefit period.#N#However, the portion you are expected to pay for the costs of a skilled nursing center differs from the portion you pay for hospital care. In facilities like these, you must pay in any given benefit period: 1 $0 for your room, bed, food and care for all days up to day 20 2 A daily coinsurance rate of $161 for days 21 through 100 3 All costs starting on day 101

Do you have to be hospitalized for 3 days to be eligible for Medicare?

Furthermore, each plan may have rules that differ from the ones found under Original Medicare policies. For instance, with most policies, you don’t have to be hospitalized for three days before you can be moved to a skilled nursing center. If you have one of these policies, refer to the documentation for your coverage. You could also call your provider to find out exactly what hospitalization or a stay in a skilled nursing center will cost you as well as the rules surrounding it.

When does Medicare change coverage?

You can’t use this Special Enrollment Period from October–December. However, all people with Medicare can make changes to their coverage from October 15–December 7, and the changes will take effect on January 1.

What is a special enrollment period?

Special circumstances (Special Enrollment Periods) You can make changes to your Medicare Advantage and Medicare prescription drug coverage when certain events happen in your life, like if you move or you lose other insurance coverage. These chances to make changes are called Special Enrollment Periods (SEPs).

How long is a benefit period?

A benefit period is a timespan that starts the day you’re admitted as an inpatient in a hospital or skilled nursing facility. It ends when you haven’t been an inpatient in either type of facility for 60 straight days. Here’s an example of how Medicare Part A might cover hospital stays and skilled nursing facility ...

What is Medicare Part A?

When it comes to hospital stays, Medicare Part A (hospital insurance) generally covers much of the care you receive: 1 As a hospital inpatient 2 In a skilled nursing facility (SNF)

How many Medicare Supplement plans are there?

In most states, there are up to 10 different Medicare Supplement plans, standardized with lettered names (Plan A through Plan N). All Medicare Supplement plans A-N may cover your hospital stay for an additional 365 days after your Medicare benefits are used up.

Does Medicare cover SNF?

Generally, Medicare Part A may cover SNF care if you were a hospital inpatient for at least three days in a row before being moved to an SNF. Please note that just because you’re in a hospital doesn’t always mean you’re an inpatient – you need to be formally admitted.

Does Medicare cover hospital stays?

When it comes to hospital stays, Medicare Part A (hospital insurance) generally covers much of the care you receive: You generally have to pay the Part A deductible before Medicare starts covering your hospital stay. Some insurance plans have yearly deductibles – that means once you pay the annual deductible, your health plan may cover your medical ...

What happens if Medicare overpayment exceeds regulation?

Medicare overpayment exceeds regulation and statute properly payable amounts. When Medicare identifies an overpayment, the amount becomes a debt you owe the federal government. Federal law requires we recover all identified overpayments.

How long does it take to get an ITR letter?

If you fail to pay in full, you get an ITR letter 60–90 days after the initial demand letter. The ITR letter advises you to refund the overpayment or establish an ERS. If you don’t comply, your MAC refers the debt for collection.

What is SSA 1893(f)(2)(A)?

SSA Section 1893(f)(2)(A) outlines Medicare overpayment recoupment limitations. When CMS and MACs get a valid first- or second-level overpayment appeal , subject to certain limitations , we can’t recoup the overpayment until there’s an appeal decision. This affects recoupment timeframes. Get more information about which overpayments we subject to recoupment limitation at

How long does it take to submit a rebuttal to a MAC?

Rebuttal: Submit a rebuttal within 15 calendar days from the date you get your MAC’s demand letter. Explain or provide evidence why no recoupment should occur. The MAC promptly evaluates your rebuttal statement.

What is an overpayment?

An overpayment is a payment made to a provider exceeding amounts due and payable according to existing laws and regulations. Identified overpayments are debts owed to the federal government. Laws and regulations require CMS recover overpayments. This fact sheet describes the overpayment collection process.

How many reserve days can you use for Medicare?

You may use up to 60 lifetime reserve days at a per-day charge set by Medicare for days 91–150 in a benefit period. You pay 100 percent of the cost for day 150 and beyond in a benefit period. Your inpatient rehab coverage and costs may be different with a Medicare Advantage plan, and some costs may be covered if you have a Medicare supplement plan. ...

How long does Medicare cover inpatient rehab?

Medicare covers inpatient rehab in a skilled nursing facility – also known as an SNF – for up to 100 days. Rehab in an SNF may be needed after an injury or procedure, like a hip or knee replacement.

What is Medicare Part A?

Published by: Medicare Made Clear. Medicare Part A covers medically necessary inpatient rehab (rehabilitation) care , which can help when you’re recovering from serious injuries, surgery or an illness. Inpatient rehab care may be provided in of the following facilities: A skilled nursing facility.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is an inpatient rehab facility?

An inpatient rehabilitation facility (inpatient “rehab” facility or IRF) Acute care rehabilitation center. Rehabilitation hospital. For inpatient rehab care to be covered, your doctor needs to affirm the following are true for your medical condition: 1. It requires intensive rehab.

Does Medicare cover speech therapy?

Medicare will cover your rehab services (physical therapy, occupational therapy and speech-language pathology), a semi-private room, your meals, nursing services, medications and other hospital services and supplies received during your stay.

How long does Medicare last?

Your Medicare benefit period starts the day you are hospitalized as an inpatient and ends once you have been out of the hospital or a skilled nursing facility for 60 days.

How long does Medicare reserve days last?

Medicare offers you 60 lifetime reserve days to extend your Medicare benefit period. Any hospital stays lasting longer than 91 days will require use of lifetime reserve days. These reserve days cost $704 per hospital day in 2020. Medicare only allows you 60 lifetime reserve days total.

When will Medicare Part A start?

on December 14, 2020. Medicare Part A has a benefit period that not only affects how much you will pay for care in the hospital or in a skilled nursing facility (SNF) but how long you will be covered. Unfortunately, understanding how these benefit periods work is not always clear cut.

Does Medicare cover coinsurance?

These plans are not part of the official Medicare program but are standardized by the federal government. Although they do not directly cover medical services, these plans help to pay down expenses that Medicare leaves on the table, e.g., deductibles, coinsurance, copayments, and more.

How long does it take for Medicare to pay for skilled nursing?

That inpatient stay must be at least three days long, not including the day of transfer to the nursing facility.

How much is the Part A deductible?

You are admitted to the hospital on February 1 (day 1) and are discharged to home on April 11 (day 70). The Part A deductible, $1,408, covers the first 60 days of your inpatient hospital stay.

When is SNF discharged?

You are transferred to a skilled nursing facility on June 8 (day 8). June 8 counts as day 1 for your SNF coverage. You are discharged from the SNF on July 8 (day 30 of SNF coverage). Your Part A deductible, $1,408, covers your hospital stay and the first 20 days of your SNF stay.