The mandatory reporting requirements apply to Medicare beneficiaries who have coverage under group health plan arrangements and to those who receive settlements, judgments, awards or other payment from liability insurance (including self-insurance), no-fault insurance or workers’ compensation.

Full Answer

What are the requirements for mandatory reporting?

- Sexual abuse (any)

- Physical abuse

- Emotional/psychological abuse

- Neglect

- Exposure to family violence

What is the timeframe for mandatory reporting?

User facilities must also submit annual reports to the FDA by January 1 of each year as described in 803.33. Form 3419 Annual User Facility Report. Medical Device Reporting Annual User Facility ...

Is Medicare mandatory if I have other insurance?

Those who receive Social Security benefits are automatically enrolled in Medicare. Therefore, participation in Medicare really is not optional. However, you may be able to opt out of parts of Medicare, provided that you have health insurance coverage from another private insurance carrier.

Is the Medicare annual wellness visit mandatory?

The most common preventive care service is the Medicare Annual wellness visit. The Medicare Annual Wellness Visit is not mandatory. It is a medical visit that you can take advantage of voluntarily and free of charge.

What is the reporting process of CMS?

Reporting is accomplished by either the submission of an electronic file of liability, no-fault, and workers' compensation claim information, where the injured party is a Medicare beneficiary, or by entry of this claim information directly into a secure Web portal, depending on the volume of data to be submitted.

What is the purpose of CMS reporting?

In exchange, CMS provides the RRE with Medicare entitlement and enrollment information for those individuals in the GHP that can be identified as Medicare beneficiaries. This mutual data exchange helps to ensure that claims will be paid by the appropriate organization at first billing.

What is MSP reporting?

The MSP Input File is used to report GHP coverage information for Active Covered Individuals who are Medicare beneficiaries. It assists the Benefits Coordination & Recovery Center (BCRC) in determining when Medicare should be paying secondary for a GHP covered individual.

What is the Medicare Secondary Payer Act?

In 1980, Congress passed legislation that made Medicare the secondary payer to certain primary plans in an effort to shift costs from Medicare to the appropriate private sources of payment.

What is the role of CMS in healthcare?

The Centers for Medicare and Medicaid Services (CMS) provides health coverage to more than 100 million people through Medicare, Medicaid, the Children's Health Insurance Program, and the Health Insurance Marketplace.

What is a responsible reporting entity?

Responsible Reporting Entity (RRE) — the party that is responsible for funding a claim payment to an individual eligible for Medicare benefits is considered the Responsible Reporting Entity (RRE) under the provisions of the Medicare, Medicaid, and SCHIP Extension Act (MMSEA) of 2007.

What are CMS reports?

The cost report contains provider information such as facility characteristics, utilization data, cost and charges by cost center (in total and for Medicare), Medicare settlement data, and financial statement data. CMS maintains the cost report data in the Healthcare Provider Cost Reporting Information System (HCRIS).

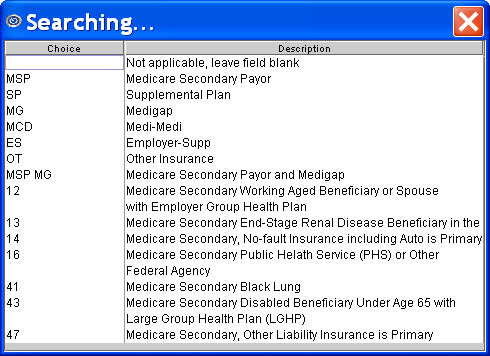

What is MSP insurance type code?

The MSP insurance type identifies the type of other insurance specific to the MSP provision that is the basis for the beneficiary's MSP status. For claims billed electronically, the code is submitted in loop 2000B, within the SBR 05 segment of the ANSI X12 5010 format.

What is the Medicare Medicaid and Schip Extension Act of 2007?

The MMSEA substantially expands the federal government's ability to seek reimbursement of past and future Medicare payments in covered claims, including liability claims.

Is Medicare always the primary payer?

Medicare is always primary if it's your only form of coverage. When you introduce another form of coverage into the picture, there's predetermined coordination of benefits. The coordination of benefits will determine what form of coverage is primary and what form of coverage is secondary.

Does Medicare automatically forward claims to secondary insurance?

If a Medicare member has secondary insurance coverage through one of our plans (such as the Federal Employee Program, Medex, a group policy, or coverage through a vendor), Medicare generally forwards claims to us for processing.

How do you fill out CMS 1500 when Medicare is secondary?

0:239:21Medicare Secondary Payer (MSP) CMS-1500 Submission - YouTubeYouTubeStart of suggested clipEnd of suggested clipHere when the insured. And the patient are the same the biller enters the word. Same if medicare isMoreHere when the insured. And the patient are the same the biller enters the word. Same if medicare is primary this item is left blank.

What are CMS reports?

The cost report contains provider information such as facility characteristics, utilization data, cost and charges by cost center (in total and for Medicare), Medicare settlement data, and financial statement data. CMS maintains the cost report data in the Healthcare Provider Cost Reporting Information System (HCRIS).

What does CMS stand for in school?

If you're looking into e-learning, you might start to hear the acronyms CMS and LMS thrown around a lot. They stand for "content management system" and "learning management system".

What is the difference between the FDA and CMS?

Although FDA and CMS regulate different aspects of health care—FDA regulates the marketing and use of medical products, whereas CMS regulates reimbursement for healthcare products and services for two of the largest healthcare programs in the country (Medicare and Medicaid)—both agencies share a critical interest in ...

Is CMS the same as Medicare?

The Centers for Medicare and Medicaid Services (CMS) is a part of Health and Human Services (HHS) and is not the same as Medicare. Medicare is a federally run government health insurance program, which is administered by CMS.

What is mandatory insurance reporting?

Mandatory Insurer Reporting for Group Health Plans (GHP ) Section 111 of the Medicare , Medicaid, and SCHIP Extension Act of 2007 (MMSEA) added mandatory reporting requirements with respect to Medicare beneficiaries who have coverage under group health plan (GHP) arrangements as well as for Medicare beneficiaries who receive settlements , judgments, ...

Who must report under Section 111?

Who Must Report. A GHP organization that must report under Section 111 is an entity serving as an insurer or third party administrator (TPA) for a group health plan. In the case of a group health plan that is self-insured and self-administered, this would be the plan administrator or fiduciary. These organizations are referred to as Section 111 GHP ...

What is the purpose of 111 reporting?

The purpose of Section 111 reporting is to enable Medicare to correctly pay for the health insurance benefits of Medicare beneficiaries by determining primary versus secondary payer responsibility. Section 111 authorizes CMS and GHP RREs to electronically exchange health insurance benefit entitlement information.

What is GHP reporting?

GHP reporting is done on a quarterly basis in an electronic format. The Section 111 statutory language, Paperwork Reduction Act Federal Register Notice, and Supporting Statement can be found in the Downloads section below.

What is a Section 111 MSP response file?

Through this process, a monthly file will be sent to the participating RRE to notify them whenever another entity changes or deletes MSP information previously submitted by them . The file will contain information about the RRE’s prior submission and information regarding the data modifications that were applied, the reason for the change, and the source of the new information. While receipt of this file is optional, GHP RREs are encouraged to consider participation since it improves the overall accuracy of MSP information used and stored by Medicare, RREs, and employer GHP sponsors. More information on the benefits of the Unsolicited Response File and how to enroll in this process can be found in the GHP User Guide.

Who Must Report?

The responsible reporting entity (RRE) for a claim. This includes but is not limited to:

Penalties for Noncompliance

Failure by an RRE to timely report a claim to Centers for Medicare & Medicaid Services (CMS) has a penalty payment of up to $1,000 per day per claim.

When was Medicare first enacted?

Medicare was first enacted on July 30, 1965 as a part of the Social Security Act (“theAct”). The United States Social Security Administration; SSA History; History of SSA Duringthe Johnson Administration 1963-1968; December 7, 2011;(http://www.ssa.gov/history/ssa/lbjmedicare1.html). Under the original system, Medicare was, in almostall instances, the primary payer – that is, it paid health claims first. In workers’ compensationclaims, however, the worker’s compensation plan was deemed the primary payer, and Medicareacted as only a secondary payer. As one would expect, the costs of Medicare soared.

Does Medicare have to reimburse a primary payer?

Pursuant to 42 C.F.R.§ 411.22, a primary payer must reimburse Medicare “if it isdemonstrated that the primary payer has or had a responsibility to make a payment.” The quotedlanguage seems to infer that, absent liability (or responsibility), there is no reimbursementobligation. However, the regulation quickly dispels that notion by providing that a primarypayer’s responsibility may be demonstrated by a judgment, a payment conditioned upon therecipient’s compromise, waiver or release (whether or not there is a determination or admissionof liability), or by other means, including but not limited to a settlement. The regulation evendelineates the agency to whom the payment should be made.

What is Medicare Part A?

Medicare is a public health insurance program designed for individuals age 65 and over and people with disabilities. The program covers hospitalization and other medical costs at free or reduced rates. The hospitalization portion, Medicare Part A, usually begins automatically at age 65. Other Medicare benefits require you to enroll.

What happens if you decline Medicare?

Declining. Late enrollment penalties. Takeaway. If you do not want to use Medicare, you can opt out, but you may lose other benefits. People who decline Medicare coverage initially may have to pay a penalty if they decide to enroll in Medicare later. Medicare is a public health insurance program designed for individuals age 65 and over ...

Is there a penalty for not signing up for Medicare Part B?

If you choose not to sign up for Medicare Part B when you first become eligible, you could face a penalty that will last much longer than the penalty for Part A.

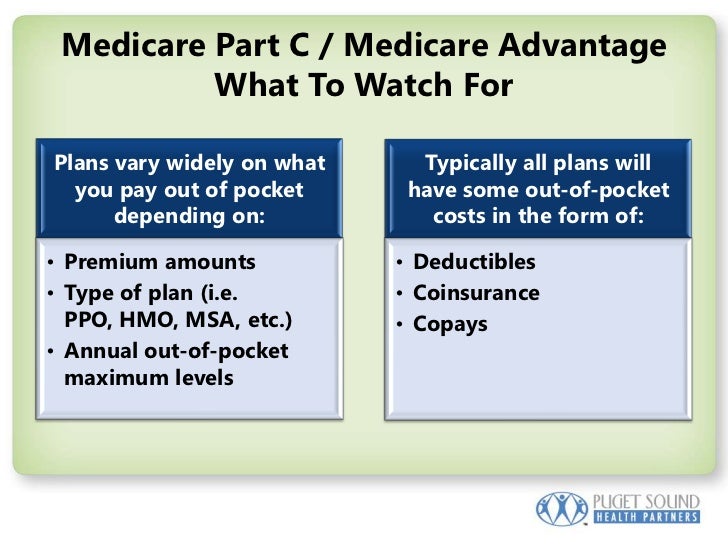

Does Medicare Advantage have penalties?

Medicare Part C (Medicare Advantage) is optional and does not have penalties on its own, but penalties may be included for late enrollment in the parts of Medicare included within your Medicare Advantage plan.

Is Medicare mandatory at 65?

While Medicare isn’t necessarily mandatory, it is automatically offered in some situations, and may take some effort to opt out of.

Is Healthline Media a licensed insurance company?

Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S . jurisdiction. Healthline Media does not recommend or endorse any third parties that may transact the business of insurance. Last medically reviewed on May 14, 2020.

Is Medicare Part D mandatory?

Medicare Part D is not a mandatory program, but there are still penalties for signing up late. If you don’t sign up for Medicare Part D during your initial enrollment period, you will pay a penalty amount of 1 percent of the national base beneficiary premium multiplied by the number of months that you went without Part D coverage.

Why is CMS reporting required?

The reason underlying the new CMS reporting requirement is simple: CMS wants to recoup money it uses to pay bills for an injured person if that individual later receives a settlement from or verdict against the employer or health care provider responsible for causing those injuries .

Why do self insureds have to report settlements to CMS?

The new Section 111 Rules require self-insured health care providers to report such settlements or verdicts to CMS so that Medicare can impose a lien on the money received by the injured person.

What do employers and health care providers need to remember when it comes to the new Section 111 Rules?

What do employers and health care providers need to remember when it comes to the new Section 111 Rules? If you settle a workers' comp or health care liability claim, and you insure such risks through a pool, then make sure that your pool files the required Medicare report. If you self-insure such risks on your own, then you are responsible for filing the Medicare reports yourself. If you insure such risks through conventional insurance, then it is up to your insurer to file the Medicare reports.

How much is the penalty for filing a new health insurance report?

Employers and health care providers that self-insure these liabilities, however, may be required to complete the new reports themselves or face serious financial penalties of up to $1,000 for each day after the report should have been filed.

Do health care providers have to report malpractice settlements?

Health care providers that self-insure their professional liability risk must report settlements or verdicts paid to patients whose injuries resulting from alleged malpractice were previously paid for, in part, by CMS. The rules are different, however, when the professional liability risk is self-insured through a pool.

Do employers have to file new Medicare reports?

Similarly, in states where employers can self-insure workers' comp coverage themselves, rather than through a pool, the employer is also required to file the new Medicare reports.

Who Must Report

- An organization that must report under Section 111 is referred to as a responsible reporting entity (RRE). In general terms, NGHP RREs include liability insurers, no-fault insurers, and workers’ compensation plans and insurers. RREs may also be organizations that are self-insured with respect to liability insurance, no-fault insuran…

Reporting

- The purpose of Section 111 reporting is to enable CMS to pay appropriately for Medicare-covered items and services furnished to Medicare beneficiaries. Section 111 NGHP reporting of applicable liability insurance (including self-insurance), no-fault insurance, and workers’ compensation claim information helps CMS determine when other insurance coverage is primary to Medicare, meaning that it should pay for the items and services firs…

Reporting Requirements – Nghp User Guide and Alerts

- Reporting requirements are documented in the NGHP User Guide which is available as a series of downloads on the NGHP User Guide page. The NGHP User Guide is made up of five chapters: Introduction and Overview, Registration Procedures, Policy Guidance, Technical Information, and Appendices. Each chapter can be referenced independently, but are designed to function together to provide complete information and instruction…

Registration and The Section 111 COBSW

- Section 111 RREs are required to register for Section 111 reporting and fully test the data exchange before submitting production files. The registration process provides notification to CMS of the RRE’s intent to report data to comply with the requirements of Section 111 of the MMSEA. NGHP RREs must register on the Section 111 COB Secure Website (COBSW), This interactive Web portal may also be used to maintain current account inform…

Reporting Assistance

- After registration, you will be assigned an Electronic Data Interchange (EDI) Representative to assist you with the reporting process and answer related technical questions. CMS conducts NGHP Town Hall Teleconferences to provide updated policy and technical information related to Section 111 reporting. Announcements for upcoming NGHP Town Hall events are posted to the NGHP What’s New page. Transcripts from the current year can be fou…

Compliance

- In addition to the provisions found at 42 U.S.C. 1395y(b)(8), please refer to the NGHP User Guide and CMS Guidancepublished in the Downloads section below.

Who Must Report

- A GHP organization that must report under Section 111 is an entity serving as an insurer or third party administrator (TPA) for a group health plan. In the case of a group health plan that is self-insured and self-administered, this would be the plan administrator or fiduciary. These organizations are referred to as Section 111 GHP responsible reporting entities, or RREs. GHP RREs may use agents to submit data on their behalf but the RR…

Reporting

- The purpose of Section 111 reporting is to enable Medicare to correctly pay for the health insurance benefits of Medicare beneficiaries by determining primary versus secondary payer responsibility. Section 111 authorizes CMS and GHP RREs to electronically exchange health insurance benefit entitlement information. On a quarterly basis, an RRE must submit a file of information about employees and dependents who are Medicare beneficiaries with …

Reporting Requirements - GHP User Guide and Alerts

- Reporting requirements are documented in the MMSEA Section 111 Medicare Secondary Payer (MSP) Mandatory Reporting GHP User Guide which is available for download on the GHP User Guide page. The GHP User Guide is the primary source for Section 111 reporting requirements. RREs must also be sure to refer to important information published on the GHP Al...

Registration and The Section 111 Coordination of Benefits Secure Website

- Section 111 RREs are required to register for Section 111 reporting and fully test the data exchange before submitting production files. The registration process provides notification to CMS of the RRE’s intent to report data to comply with the requirements of Section 111. GHP RREs must register on the Section 111 COB Secure Website (COBSW). This interactive Web portal may also be used to maintain current account information, monit…

Reporting Assistance

- After registration, you will be assigned an Electronic Data Interchange (EDI) Representative to assist you with the reporting process and answer related technical questions. CMS conducts GHP Town Hall Teleconferences to provide updated policy and technical information related to Section 111 reporting. Announcements for upcoming GHP Town Hall events are posted to the GHP What’s New page. Transcripts from the current year can be found …

Unsolicited Response File

- Section 111 GHP RREs can elect to receive the GHP Unsolicited MSP Response File. Through this process, a monthly file will be sent to the participating RRE to notify them whenever another entity changes or deletes MSP information previously submitted by them. The file will contain information about the RRE’s prior submission and information regarding the data modifications that were applied, the reason for the change, and the source of the …

Compliance

- In addition to the provisions for GHP arrangements found at 42 U.S.C. 1395y(b)(7), please refer to the GHP User Guide and CMS Guidancepublished in the Downloads section below.