Who is eligible for Medicare and how does it work?

Who is eligible for Medicare? Generally, Medicare is available for people age 65 or older, younger people with disabilities and people with End Stage Renal Disease (permanent kidney failure requiring dialysis or transplant). Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance).

Who is eligible for premium-free Medicare Part A?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What do you need to know about Medicare?

Here’s what to know. Original, or basic, Medicare consists of Part A (hospital coverage) and Part B (outpatient care coverage). Part A has no premium as long as you have at least a 10-year work history of contributing to the program through payroll (or self-employment) taxes.

Can I get Medicare Part A without paying taxes?

If you (or your spouse) did not pay Medicare taxes while you worked, and you are age 65 or older and a citizen or permanent resident of the United States, you may be able to buy Part A. If you are under age 65, you can get Part A without having to pay premiums if:

Can you have Medicare if you are rich?

Wealthy enrollees pay more into Medicare than poorer people do (in the form of general federal tax revenues and payroll taxes). However, they reap greater benefits over their lifetimes because they live longer and use more medical services.

How much do wealthy people pay for Medicare?

The wealthiest senior couples will be paying nearly $14,000 a year in Medicare Part B premiums. Part B (the base and the surcharge) covers doctors' and outpatient services. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

Can you be on Medicare and still work?

Key takeaways: You can get Medicare coverage if you're still working. If you or your spouse work for a large employer that provides insurance, you can often put off enrollment without penalty. If you work for a company that has fewer than 20 employees, you must sign up for Medicare as soon as you are eligible.

Do celebrities get Medicare?

TV ads with famous spokespeople can grab our attention, but most celebrities aren't experts in Medicare. They paint a picture of the perfect plan that's ready for you to enroll, but private entities pay those same celebrities to advertise for them.

Can millionaires get Social Security?

In the eyes of the IRS, investment income, such as dividends from stocks and interest from bonds, doesn't count as “earned income.” As many millionaires and billionaires inherited their wealth and live off investment income, this means they don't pay Social Security taxes and are thus ineligible for retirement benefits ...

What income level triggers higher Medicare premiums?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage.

Can you be denied Medicare?

In all but four states, insurance companies can deny private Medigap insurance policies to seniors after their initial enrollment in Medicare because of a pre-existing medical condition, such as diabetes or heart disease, except under limited, qualifying circumstances, a Kaiser Family Foundation analysis finds.

Do you pay Medicare after retirement?

Working in Retirement Your age doesn't change whether or not you pay Medicare taxes. If you retire from your career at the age of 65 and decide to start working part-time, your income is subject to Medicare taxation.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because private insurance companies make it difficult for them to get paid for their services.

What kind of health insurance do the rich have?

For wealthy people, it's especially important to make sure they are fully covered, because they typically have a lot of assets to protect. As a result, many high-income people buy a special type of insurance called umbrella insurance.

Do Hollywood actors have health insurance?

In the industry, actors and other movie workers typically get insurance through their unions. But many say they don't get enough hours or steady work as actors to meet the income requirements to apply.

What kind of insurance do famous people have?

5 Insurance Policies for the Rich and FamousScandal Insurance. ... Body Part Insurance. ... Yacht Insurance. ... Private Jet Insurance. ... Exotic Car Insurance.

What to do if you are 65 and still working?

If you’ll hit age 65 soon and are still working, here’s what to do about Medicare 1 The share of people age 65 to 74 in the workforce is projected to reach 30.2% in 2026, up from 26.8% in 2016 and 17.5% in 1996. 2 If you work at a company with more than 20 employees, you generally have the choice of sticking with your group health insurance or dropping the company option to go with Medicare. 3 If you delay picking up Medicare, be aware of various deadlines you’ll face when you lose your coverage at work (i.e., you retire).

How long does Medicare last?

Original, or basic, Medicare consists of Part A (hospital coverage) and Part B (outpatient and medicare equipment coverage). You get a seven-month window to sign up that starts three months before your 65th birthday month and ends three months after it.

What happens if you delay picking up Medicare?

It’s becoming a common scenario: You’re creeping closer to your 65th birthday, which means you’ll be eligible for Medicare, yet you already have health insurance through work.

How many employees can you delay signing up for Medicare?

If you work at a large company. The general rule for workers at companies with at least 20 employees is that you can delay signing up for Medicare until you lose your group insurance (i.e., you retire). At that point, you’d be subject to various deadlines to sign up or else face late-enrollment penalties.

How much does a 65 year old pay for medicare?

A 65-year-old male will pay anywhere from $126 to $464 monthly for a Medigap policy, according to the American Association for Medicare Supplement Insurance. For 65-year-old women, the range is $118 to $464.

What is your 2018 income used for?

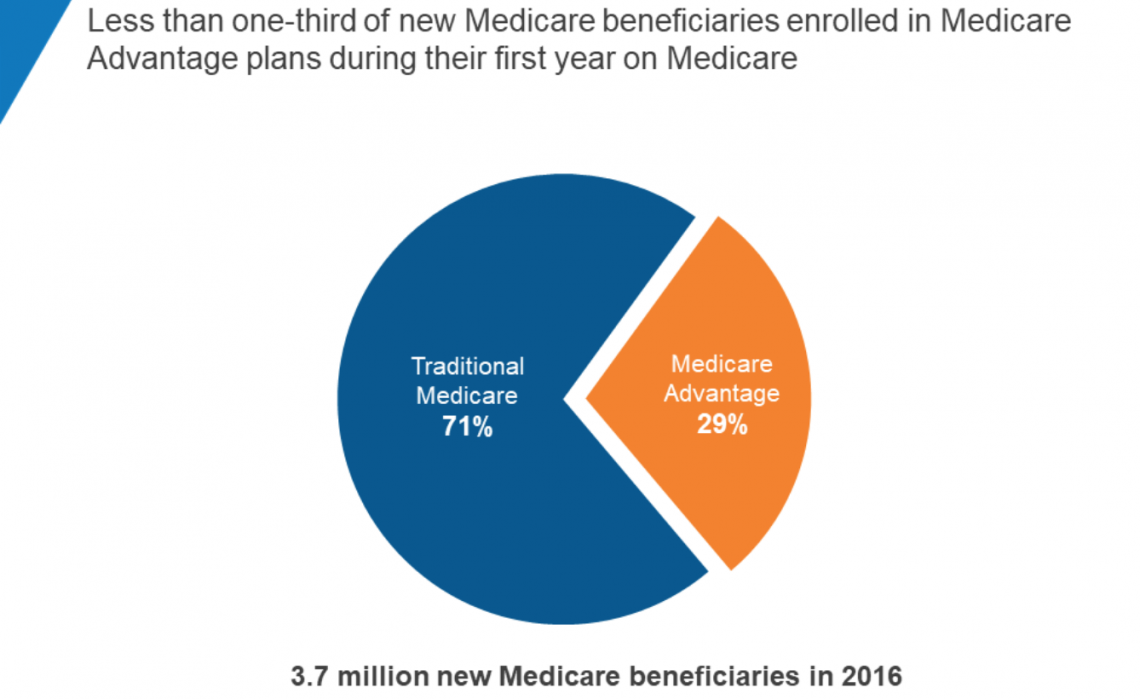

In other words, your 2018 income is used for your 2020 premiums. (There’s a form you can fill out to request a reduction in that income-related amount due to a life-changing event, such as retirement.) Roughly a third of Medicare enrollees choose to get their Parts A and B delivered through an Advantage Plan.

What happens if you don't sign up for Part A?

If you don’t sign up when eligible and you don’t meet an exception, you face late-enrollment penalties. Having qualifying insurance — i.e., a group plan through a large employer — is one of those exceptions. Many people sign up for Part A even if they stay on their employer’s plan.

What is Medicare for disabled people?

Medicare is a federal program to reimburse medical costs in people who are disabled, have kidney failure, or are elderly. Under Medicare, the government determines reimbursement rates. If your favorite orthopedic surgeon takes care of Medicare enrollees, she doesn’t decide how much to charge the government for the care she provides;

Do orthopedic surgeons get less money from Medicare?

The greater the proportion of low-income patients that orthopedic surgeons care for, the less money they receive from Medicare to reward them for high quality of care. Here's a summary of that finding, with healthcare providers split into quintiles. At the top are the providers with the smallest percent of low-income patients.

Do people with complicated life circumstances have more complications after joint replacement surgery?

As it turns out, patients with lots of other medical problems, and those with complicated life circumstances, are more likely to experience complications after joint replacement surgeries, and also more likely to report low satisfaction with the procedures.

Is Medicare fee uniform across the country?

Medicare fees are not uniform across the country. The government takes account of local cost of living, for example, in determining payment rate; consequently, Medicare fees are higher in San Francisco than in Oklahoma City.

How long does Medicare take to apply?

Typically, Medicare offers a 7-month window to apply around your date of eligibility. This is called your initial enrollment period. You can apply 3 months before the month of your 65th birthday, during your birthday month, and for 3 months afterward.

How long can you keep your group health plan?

However, if you or your spouse is employed when you become eligible, you may be eligible for an 8-month special enrollment period. During a special enrollment period, you can keep your existing group health plan for as long as it’s available. If you leave that employer or the employer terminates your coverage, you will typically have this 8-month ...

What is Medicare Part A?

Medicare Part A is the hospital coverage portion of Medicare. It includes services such as:

How old do you have to be to get medicare?

You become eligible for Medicare once you turn 65 years old if you’re a U.S. citizen or have been a permanent resident for the past 5 years. You can also enroll in Medicare even if you’re covered by an employer medical plan. Read on to learn more about what to do if you’re eligible for Medicare and are still employed. Share on Pinterest.

What happens if you decline Medicare?

If you initially decline Medicare coverage, you may have to pay a penalty if you decide to enroll at a later date.

What is the Part B premium for 2021?

The standard Part B premium for most people in 2021 starts at $148.50. The higher your income, the higher your rates will be.

Does Medicare help with medical expenses?

If you work for a small company (fewer than 20 employees) or have a health insurance plan through your employer with minimal coverage, enrolling in Medicare may help reduce your medical expenses. Medicare will often become the primary payer in these cases and may provide better coverage than you currently receive.

Why do people reap greater benefits over their lifetimes?

However, they reap greater benefits over their lifetimes because they live longer and use more medical services. Hear the phrase "Medicare beneficiary" and you might picture someone counting pennies in a modest house or apartment. Think again.

What is the second highest income decile?

For example, the second-highest income decile has a lifetime net gain of $18,900, while the third-lowest decile has a lifetime net gain of $15,500. In other words, the Medicare program effectively transfers money from low to high income groups.

Who benefits the most from Medicare?

According to a study recently published by the National Bureau of Economic Research, those who benefit the most from Medicare are the wealthiest older Americans , not the poorest ones.

How to protect your income from Medicaid?

Every month the Pooled Income Trust will debit your bank account for the “excess” money, will keep a small administrative fee for itself, and use the remaining money to pay any bills that you submit to them that are related to the Medicaid recipient . Items such as rent, utilities, food, additional home care services, travel and entertainment can all be paid from this Pooled Income Trust.

Why do people want to qualify for Medicaid?

Why do people want to qualify for Medicaid in the first place? Because, even though this knowledge may come as a shocking surprise, neither Medicare nor any supplemental insurance coverage policies pay for long term care. Long term care includes home care services and nursing home services. When paid for privately, the cost of long term care runs to approximately $150K-$200K in New York.

What are exempt assets for Medicaid?

Exempt assets for the purposes of Medicaid constitute your primary home (if you are receiving long term care at home), an income producing property and your qualified retirement accounts (401K and IRA). There are complications here, of course, as Medicaid may put a lien on any of your property that will go through probate after your death.

How much money do you need to qualify for medicaid?

To be eligible, you cannot have more than $15K of assets and no more than $842 a month of income. Most people who worked their entire life in the United States will have significantly more assets and a larger Social Security ...

Can you qualify for medicaid if you have a high income?

As a result, you can see that planning for Medicaid can be complicated. Yet do not assume that just because you have some assets or a high monthly income, you will not qualify for Medicaid.

How long does Medicare enrollment last?

The general rule for Medicare signup is that unless you meet an exception, you get a seven-month enrollment window that starts three months before your 65th birthday month and ends three months after it. Having qualifying insurance through your employer is one of those exceptions. Here’s what to know.

How long can you wait to sign up for Medicare?

The general rule for workers at companies with at least 20 employees is that you can delay signing up for Medicare until you lose your group insurance (i.e., you retire).

How much is the surcharge for Part B?

For Part B, that surcharge is 10% for each 12-month period you could’ve had it but didn’t sign up. For Part D, the penalty is 1% of the base premium ($33.06 in 2021) multiplied by the number of full, uncovered months you didn’t have Part D or creditable coverage.

Can Medicare be paired with Part D?

The remaining beneficiaries stick with basic Medicare and may pair it with a so-called Medigap policy and a standalone Part D plan. Be aware that higher-income beneficiaries pay more for drug coverage, as well (see chart below).

Does Medicare have a premium?

Part A has no premium as long as you have at least a 10-year work history of contributing to the program through payroll (or self-employment) taxes.

Can a 65 year old spouse get Medicare?

Some 65-year-olds with younger spouses also might want to keep their group plan. Unlike your company’s option, spouses must qualify on their own for Medicare — either by reaching age 65 or having a disability if younger than that — regardless of your own eligibility.

Do small companies pay more in premiums than large companies?

Often, workers at small companies pay more in premiums than employees at larger firms.

How many hours do you have to work to become a mega rich?

For one, these mega rich professionals oftentimes have nothing better to do. “Usually in order to become that wealthy, you typically have to work more than 40 hours a week,” says Shullman. “Being a workaholic doesn’t leave much time for other things. So when you drop out, what else are you going to do? Your whole life was work.”

How many hours do mega rich people work?

Despite the fact they have more than enough money to spend the rest of their lives on their yachts, many mega-rich professionals devote more than 40 hours a week in jobs that are oftentimes banal and stressful.

How much is Alan Meckler worth?

For Alan Meckler, CEO of WebMediaBrands, whose net worth is more than $400 million, the answer is “for posterity. Need to go out with another winner.”. Millionaire PR executive Barry Schwartz continues to work because he loves the game.

Do millennials forget their exit strategy?

The mega rich believe that many Millennials will forget their exit strategy over time, and chose to continue working. And they may be right.

Do boomers see retirement as cash out?

Boomers don’t see [retirement as] cash out, but what’s next? Their retirement mindset is to remain engaged.”. And now that most workers remain healthy well into their 70s and 80s, they remain happily engaged in the workforce. Not because they have to, but because they want to.

Is Ipsos MediaCT addictive?

It’s no surprise that it’s very addictive. “Many downplay their success,” says Steve Kraus, Chief Insights Officer of the Ipsos MediaCT's Audience Measurement Group. “They are dismissive of their accomplishments and it drives them to reach higher. The mega rich didn’t set out to be rich.

Do the mega rich have white collar jobs?

The mega rich also largely hold white-collar positions and are able to take advantage of flexible work environments. “It’s not as if they are out there with a shovel and are physically worn out,” says Shullman. “The vast majority of the mega rich are C-level suite executives with comfortable lives.