When is the earliest you can get Medicare?

- If you were born on January 1 st, you should refer to the previous year.

- If you were born on the 1 st of the month, we figure your benefit (and your full retirement age) as if your birthday was in the previous month. ...

- You must be at least 62 for the entire month to receive benefits.

- Percentages are approximate due to rounding.

When is it too late to enroll in Medicare?

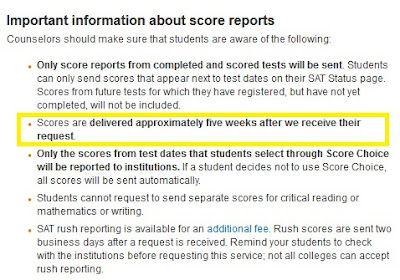

You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other

When is the best time to enroll in Medicare?

When Should I Enroll in a Medicare Supplement Plan?

- When to enroll in a Medicare Supplement plan. ...

- Enrolling in Medicare Supplement plans if you’re under 65. ...

- Enrolling after your Medicare Supplement Open Enrollment Period is over. ...

- Finding Medicare Supplement plans. ...

When your early Medicare can begin?

You’re first eligible to sign up for Medicare 3 months before you turn 65. You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS (also called Lou Gehrig’s disease). Follow these steps to learn about Medicare, how to sign up, and your coverage options. Learn about it at your own pace. Step 1

Is special enrollment period retroactive?

If you get married, you're eligible to get coverage effective the first of the following month, regardless of how late in the month you enroll. If you have a baby, adopt a child, or receive a court order for medical child support, the coverage can be backdated to the date of the birth, adoption, or court order.

How does the Medicare enrollment period work?

You can sign up between January 1-March 31 each year. This is called the General Enrollment Period. Your coverage starts July 1. You might pay a monthly late enrollment penalty, if you don't qualify for a Special Enrollment Period.

What does special enrollment period mean?

A time outside the yearly Open Enrollment Period when you can sign up for health insurance. You qualify for a Special Enrollment Period if you've had certain life events, including losing health coverage, moving, getting married, having a baby, or adopting a child, or if your household income is below a certain amount.

When you enroll in Medicare Part A you receive up to six months of retroactive coverage?

Part A, and you can enroll in Part A at any time after you're first eligible for Medicare. Your Part A coverage will go back (retroactively) 6 months from when you sign up (but no earlier than the first month you are eligible for Medicare).

What is initial enrollment period?

Initial Enrollment Period You have a seven-month window to join – from three months before the month you turn 65, through your birthday month and three months after the month you turn 65. This includes. 3 months before. Your 65th birthday month.

What are the three enrollment periods for Medicare?

It starts three months before your 65th birthday, includes the month of your 65th birthday, and ends three months later. Most people don't need to sign up; you're automatically enrolled in Medicare if you're already receiving Social Security or Railroad Retirement Board benefits when you turn 65.

Can health insurance start immediately?

The initial waiting period completely varies from insurer to insurer, however the minimum waiting period is at least 30 days. The only exception in initial waiting period is accidental claims wherein the claims are approved if the insured meets with an accident and requires immediate hospitalisation.

How long is the special enrollment period for Medicare Part B?

8 monthsWhat is the Medicare Part B special enrollment period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse's current job. You usually have 8 months from when employment ends to enroll in Part B.

What is a waiting period for insurance?

A waiting period is the amount of time an insured must wait before some or all of their coverage comes into effect. The insured may not receive benefits for claims filed during the waiting period. Waiting periods may also be known as elimination periods and qualifying periods.

Why does Medicare backdate coverage?

Beginning in 1983, the Department of Health and Human Services (HHS) started backdating Medicare coverage retroactively for six months to ensure that people coming off employer-sponsored health coverage would not inadvertently find themselves uninsured while transitioning to Medicare.

Why was my Medicare Part A backdated?

Robertson: Beginning in 1983, the Department of Health and Human Services started backdating Medicare coverage retroactively for six months to ensure that people coming off of employer health coverage would not inadvertently find themselves uninsured while transitioning to Medicare.

Can I opt out of Medicare Part A retroactive?

Can you opt out of Retroactive Medicare coverage? You may be able to opt out of retroactive Medicare coverage by contacting the Social Security Administration.

When is the open enrollment period for Medicare?

Learn more and use this guide to help you sign up for Medicare. Open Enrollment: The fall Medicare Open Enrollment Period has officially begun and lasts from October 15 to December 7, 2020. You may be able to enroll in ...

What is a special enrollment period?

A Special Enrollment Period (SEP) is an enrollment period that takes place outside of the annual Medicare enrollment periods, such as the annual Open Enrollment Period. They are granted to people who were prevented from enrolling in Medicare during the regular enrollment period for a number of specific reasons.

How long do you have to disenroll from Medicare Advantage?

If you enrolled in a Medicare Advantage plan when you first became eligible for Medicare, you have 12 months to disenroll from the plan and transition back to Original Medicare.

What happens if you don't enroll in Medicare at 65?

If you did not enroll in Medicare when you turned 65 because you were still employed and were covered by your employer’s health insurance plan, you will be granted a Special Enrollment Period.

How long does Medicare Advantage coverage last?

If you had a Medicare Advantage plan with prescription drug coverage which met Medicare’s standards of “creditable” coverage and you were to lose that coverage through no fault of your own, you may enroll in a new Medicare Advantage plan with creditable drug coverage beginning the month you received notice of your coverage change and lasting for two months after the loss of coverage (or two months after receiving the notice, whichever is later).

How often can you change your Medicare Advantage plan?

If you move into, out of, or currently reside in a facility of special care such as a skilled nursing home or long-term care hospital, you may enroll in, disenroll from, or change a Medicare Advantage plan one time per month.

What to do if you don't fit into Medicare?

If your circumstances do not fit into any of the Special Enrollment Periods described above, you may ask the Centers for Medicare and Medicaid Services (CMS) for your own Special Enrollment Period based on your situation.

What is a special enrollment period for Medicare?

A Medicare Special Enrollment Period allows you to switch plans or sign up for Medicare outside of the standard Medicare enrollment periods. If you have Medicare: For people who already have Medicare and who experience a qualifying life event, there is a two-month Special Enrollment Period for switching a Medicare Advantage or Part D plan.

What happens if you enroll in Medicare after 2 months?

If you enroll after the two-month mark, you’ll face late enrollment penalties for Part D (regardless of whether you end up with a stand-alone Part D plan or a Medicare Advantage plan that includes drug coverage).

How long does it take to enroll in a 5 star plan?

You want to enroll in a 5-star plan at any time or drop your first Medicare Advantage plan within 12 months of enrolling. You move into or out of a qualified institutional facility, like a nursing home. You are enrolled in or lose eligibility for a qualified State Pharmaceutical Assistance Program.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What Events Trigger a Special Enrollment Period for Medicare?

Lorraine Roberte is an insurance writer for The Balance. As a personal finance writer, her expertise includes money management and insurance-related topics. She has written hundreds of reviews of insurance products.

The Purpose of Medicare Special Enrollment

Normally, you can only enroll in Medicare or make changes to your plan during specific enrollment windows, including the initial enrollment period, open enrollment, and general enrollment. However, sometimes life’s events require that you make changes outside of these periods. That’s where Medicare's special enrollment comes in.

What if You Miss Special Enrollment?

If you miss special enrollment, you’ll have to wait for another enrollment period to make changes to or enroll in a plan.

How many times can you change Medicare plans during a special enrollment period?

During a special enrollment period, you can make the changes allowed by that type of SEP. Once you make the changes, you’ll need to wait until the next applicable enrollment period to change plans again.

What is a SEP for Medicare?

What is the Medicare Part B Special Enrollment Period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isn’t through a current job – such as COBRA benefits, ...

When do you have to take Part B?

You have to take Part B once your or your spouse’s employment ends. Medicare becomes your primary insurer once you stop working, even if you’re still covered by the employer-based plan or COBRA. If you don’t enroll in Part B, your insurer will “claw back” the amount it paid for your care when it finds out.

What is a Part B SEP?

The Part B SEP allows beneficiaries to delay enrollment if they have health coverage through their own or a spouse’s current employer. SEP eligibility depends on three factors. Beneficiaries must submit two forms to get approval for the SEP. Coverage an employer helps you buy on your own won’t qualify you for this SEP.

How long can you delay Part B?

You can delay your Part B effective date up to three months if you enroll while you still have employer-sponsored coverage or within one month after that coverage ends. Otherwise, your Part B coverage will begin the month after you enroll.

What to do if your Social Security enrollment is denied?

If your enrollment request is denied, you’ll have the chance to appeal.

Can you enroll in health insurance outside of the open enrollment period?

Special Enrollment Period may let you enroll in health coverage outside of the annual Open Enrollment Period , or during Open Enrollment for an earlier coverage start date. You may qualify for a Special Enrollment Period through the Health Insurance Marketplace in these situations:

Do I need to submit documents to enroll in Marketplace?

If you’re enrolling in Marketplace coverage for the first time, you may need to submit documents to prove you qualify for a Special Enrollment Period due to a marriage or due to an adoption, foster care placement, or child support or other court order.