Is Plan C available in every state? Medigap

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

What are the top 5 Medicare supplement plans?

- Plan G

- Plan N

- Plan A

- Plan F

- High Deductible Plan F

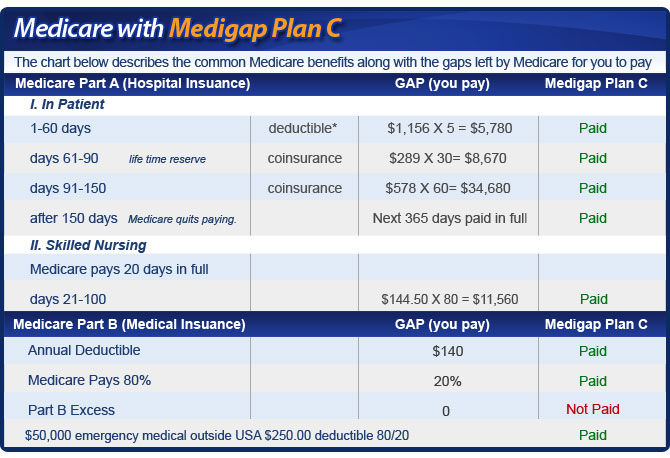

What does Medicare supplement plan C cover?

Where sold, AARP's Plan C policy offers the following coverage:

- Medicare Part A hospital coinsurance and hospital costs up to 365 days after Original Medicare benefits are exhausted

- Part A hospice care coinsurance payment or co-payment

- Medicare Part B co-payment or coinsurance payment

- Part B preventive care coinsurance payment

- First three pints of blood for a medical procedure

What Medicare supplement company is best?

The Best's Market Segment Report, titled, "U.S. Medicare Supplement: COVID-19 Depresses Claims ... Headquartered in the United States, the company does business in over 100 countries with regional offices in London, Amsterdam, Dubai, Hong Kong, Singapore ...

Do I really need Medicare supplement?

YES. Because we have many options for covering the gaps, there is no need to run around without supplemental coverage. If you find yourself asking whether you really need a Medicare supplement, ask yourself if you can afford to pay 20% of a $50,000 knee replacement or 20% of eight weeks of cancer chemotherapy.

Is Medicare Part C still available?

Is Medicare Part C discontinued? Medicare Part C has not been discontinued. However, Medigap Plan C is no longer available to new Medicare enrollees from January 1, 2020. Medicare is a federal insurance plan for people aged 65 and older.

What is Medicare Supplement Part C?

Plan C covers basic Medicare benefits including: Hospitalization: pays Part A coinsurance plus coverage for 365 additional days after Medicare benefits end. Medical Expenses: pays Part B coinsurance—generally 20% of Medicare-approved expenses—or copayments for hospital outpatient services.

When can you get Medicare Part C?

65When you first get Medicare (Initial Enrollment Periods for Part C & Part D)If you joinYour coverage beginsDuring one of the 3 months before you turn 65The first day of the month you turn 65During the month you turn 65The first day of the month after you ask to join the plan1 more row

Is Medicare Part C the same as supplemental insurance?

These are also called Part C plans. Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare (Part A and B). It is not part of the government's Medicare program, but provides coverage in addition to it.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What is the cost for Medicare Part C?

Currently insured? For 2022, a Medicare Part C plan costs an average of $33 per month. These bundled plans combine benefits for hospital care, medical treatment, doctor visits, prescription drugs and frequently, add-on coverage for dental, vision and hearing.

Can you add Medicare Part C at any time?

It runs from October 15 to December 7 each year. You can add, change, or drop Medicare Advantage plans during the AEP, and your new coverage starts on January 1 of the following year.

Does Medicare Part C replace A and B?

Part C (Medicare Advantage) Under Medicare Part C, you are covered for all Medicare parts A and B services. Most Medicare Advantage plans also cover you for prescription drugs, dental, vision, hearing services, and more.

Does Medicare Part C have a late enrollment penalty?

Medicare Part C (Medicare Advantage) doesn't have a late enrollment penalty. You can switch over to this type of plan during certain enrollment periods. Medicare supplement insurance (Medigap) also does not have a set penalty.

Does Medicare Part C cover prescriptions?

Unlike Original Medicare, Medicare Part C generally offers coverage for prescription drugs you take at home. The exact prescription drugs that are covered are listed in the plan's formulary. Formularies may vary from plan to plan.

What does AARP supplement plan C cover?

Medicare Supplement Plan C. Plan C is a very robust plan. It covers the Medicare Part B deductible, skilled nursing facility care, and foreign travel. This plan is available only to people who were eligible for Medicare before January 1, 2020.

What is the difference between Medicare Part A and Medicare Part C?

Part A provides inpatient/hospital coverage. Part B provides outpatient/medical coverage. Part C offers an alternate way to receive your Medicare benefits (see below for more information). Part D provides prescription drug coverage.

What is Medicare Supplement Plan C?

Medicare Supplement Insurance Plan C. Medigap Plan C is one of the standardized Medicare Supplement insurance plan options available in most states. (Massachusetts, Minnesota, and Wisconsin have different options.) Learn more about what Plan C covers, its cost and why it might be the right Medigap plan for you.

How many people were on Medicare Supplement C in 2017?

As of 2017, 75 percent of all insurance companies that sold Medicare Supplement Insurance offered Plan C.¹. More than 781,000 people were enrolled in Plan C in 2017, which made it the 4th-most popular Medigap plan that year.

What is Medicare Part B?

Medicare Part B usually charges a coinsurance and copayments for doctor visits and other outpatient care . Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services, leaving a 20% coinsurance in most cases.

What does Plan C cover?

Plan C covers 8 out of the 9 standardized Medigap benefits. The only other Medigap plan option with more benefits is Plan F. The only Medigap benefit that Plan C does not include is coverage of Medicare Part B excess charges. Standard Medicare Supplement Insurance benefits. Plan C.

What is the deductible for Medicare Part A?

The Part A deductible is $1,408 in 2020. Plan C covers the entire cost of the Part A deductible.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

When will Plan C be available for sale?

Due to recent legislation, Plan C will not be available for sale to new Medicare beneficiaries who become eligible for Medicare on or after January 1, 2020.

What is Medigap Plan C?

Medigap Plan C is designed to provide enrollees with fewer out-of-pocket expenses because it covers a portion of the remaining balance of hospital or doctor bills not covered by Original Medicare (Parts A and B), such as Medicare deductibles, copayments, and coinsurance.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as Medigap, is a policy designed to help pay some of the health care costs that Original Medicare doesn’t cover. Medigap Plan C is one such option, and (considering it covers all but one of the available Medicare Supplement benefits) it happens to be one of the most comprehensive.

What is Medicare Part A deductible?

At its most basic level, this plan specifically covers the following costs and benefits: Medicare Part A deductible. Part A hospital and coinsurance costs (up to an additional 365 days after Medicare benefits are exhausted) Part A hospice care copayment or coinsurance. Part B deductible. Part B copayments and coinsurance.

When to buy Medigap insurance?

The ideal time to purchase any Medigap policy is during your open enrollment period, which is a six-month period that begins the month you turn 65 and enroll in Medicare Part B. During this time period, insurance companies cannot decline coverage, even if you have pre-existing conditions or are in poor health.

Does Medigap Plan C make a difference?

Medigap Plan C can make a substantial difference in out-of-pocket costs and coverage. If any of the following scenarios apply to you, it’s worth considering Plan C supplemental coverage:

Is Charlie on Medicare?

Charlie has been eligible for Medicare for a few years, but he's just now retiring at age 71 and enrolling in Medicare for the first time. He plans to spend much of his free time traveling the world, so coverage while abroad is at the top of his needs list.

Does Medicare cover medical expenses?

Typically, Medicare doesn’t cover health care outside of the United States, which means a medical emergency while on vacation can leave you with 100% of the costs incurred. Plan C pays 80%of approved costs up to plan limits in foreign countries.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also called Medigap, is a type of private insurance that is used together with your Original Medicare coverage (Medicare Part A and Part B) to help cover certain Medicare out-of-pocket expenses, such as copays and deductibles. Medigap Plan C is one of the 10 Medigap plans available in most states, ...

What is the cost of Medicare Part B?

After you meet your Medicare Part B deductible (which is $203 per year in 2021), you are typically responsible for a coinsurance or copay of 20 percent of the Medicare-approved amount for covered services.

How much is coinsurance for skilled nursing?

Skilled nursing facility care coinsurance. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

How much does Medicare Part A cover in 2021?

If you are admitted to a hospital for inpatient treatment, Medicare Part A helps cover your hospital costs once you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021. For the first 60 days of your hospital stay, you aren’t required to pay any Part A coinsurance.

Does Medicare Supplement Insurance cover out-of-pocket costs?

Medigap Plan C helps cover some of the out-of-pocket Medicare costs listed above. Medicare Supplement Insurance does not offer any medical benefits or coverage for prescription drugs and other services. Medigap plans only cover certain Medicare Part A and Part B out-of-pocket costs as outlined above.

Is Medicare Part C the same as Medigap?

Medigap Plan C should not be confused with Medicare Part C. Medicare Supplement Insurance Plan C could sometimes be mistaken for Medicare Part C. But these are actually two very different things. Medicare Part C is another name for the Medicare Advantage program.

Is Medicare Part A deductible annual?

The Medicare Part A deductible is not annual — you could potentially need to meet this deductible more than once in a given year. Medigap Plan C covers 100 percent of the Medicare Part A deductible.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

Does Medigap cover everything?

Medigap policies don't cover everything. Medigap policies generally don't cover. long-term care. Services that include medical and non-medical care provided to people who are unable to perform basic activities of daily living, like dressing or bathing.

Can you buy a Medigap and Medicare?

If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums. It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

What is the maximum out of pocket for Medicare 2021?

The Plan K out-of-pocket maximum is $6,220 in 2021. The 2021 Plan L out-of-pocket spending limit is $3,110.

How Medicare works with other insurance

Learn how benefits are coordinated when you have Medicare and other health insurance.

Retiree insurance

Read 5 things you need to know about how retiree insurance works with Medicare. If you're retired, have Medicare and have group health plan coverage from a former employer, generally Medicare pays first. Your retiree coverage pays second.

What's Medicare Supplement Insurance (Medigap)?

Read about Medigap (Medicare Supplement Insurance), which helps pay some of the health care costs that Original Medicare doesn't cover.

When can I buy Medigap?

Get the facts about the specific times when you can sign up for a Medigap policy.

How to compare Medigap policies

Read about different types of Medigap policies, what they cover, and which insurance companies sell Medigap policies in your area.

Medigap & travel

Read about which Medigap policies offer coverage when you travel outside the United States (U.S.).

What does Part C cover?

In addition to prescription drug coverage that is offered by many plans, some Part C plans may also cover some or all of the following: Routine dental care. Vision exams and coverage for eyeglasses. Routine hearing care and coverage for hearing aids. Fitness memberships.

What is Part C insurance?

Part C plans may also include costs such as deductibles and coinsurance (or copayments). A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in.

What are the costs of Medicare Advantage?

What Other Costs Do Medicare Advantage Plans Have in 2020? 1 A deductible represents the amount of money you must pay out of your own pocket for covered services during a calendar year before your Medicare Advantage plan coverage kicks in. Some Medicare Advantage plans may offer a $0 deductible. 2 Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.

How much does Medicare Advantage cost?

The average premium for a Medicare Part C plan (also known as Medicare Advantage) was $35.55 per month in 2018. 1. Medicare Advantage plans are sold by private insurance companies. Part C plan costs can vary depending on several factors, including what plan you have and where you live.

Does Medicare Advantage cover hospital insurance?

Medicare Advantage plans must offer at least the same benefits that are covered by Medicare Part A (hospital insurance) and Part B (medical insurance). Medicare Advantage plan carriers are able to also offer extra benefits that Original Medicare (Part A and Part B) don’t cover. In addition to prescription drug coverage that is offered by many ...

Does Medicare Advantage have a deductible?

Some Medicare Advantage plans may offer a $0 deductible. Coinsurance or copayments are the portion of the bill that you must pay for covered services after you meet your annual deductible. Coinsurance is generally a percentage of the bill while copayments are typically a flat fee.