Starting January 1, 2013, a new 3.8% Medicare tax will apply to the investment and “unearned income” of individuals, trusts and estates. The tax is intended to apply to income exempt from the regular FICA or self-employment taxes.

What is the unearned income Medicare contribution tax?

The Health Care and Education Reconciliation Act of 2010 (HCERA, P.L. 111-152) contains a provision that will subject certain individuals to a 3.8% “unearned income Medicare contribution” tax beginning in 2013.1The tax has been labeled by some as a “home sales tax” or

What is the Medicare tax?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000). Example: Phil and Penny are a married couple who file a joint return.

What is the additional Medicare tax?

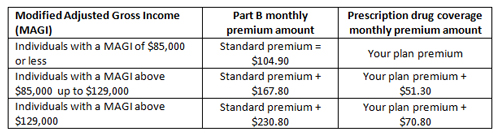

The Additional Medicare Tax was added by the Affordable Care Act in November 2013. The ACA increased Medicare by an additional 0.9% for individuals whose incomes are over a certain threshold. Those affected pay a total of 3.8% in Medicare tax. As of 2019, the income thresholds are:

How much Medicare tax do I have to pay on investment income?

They must pay the 3.8% Medicare tax on the lesser of (1) their $350,000 of net investment income, or (2) the amount their AGI exceeds the $250,000 threshold for married taxpayers—$300,000. Since $300,000 is less than $350,000, they'll have to pay the 3.8% tax on $300,000.

Do you pay Medicare tax on unearned income?

In addition to wages and earnings, the new Medicare tax also applies to investment income (or “unearned income”) to the extent a taxpayer's modified adjusted gross income exceeds $200,000 on a single return, $250,000 on a joint return, or $125,000 if married filing separately.

Do you pay Social Security and Medicare on unearned income?

Understanding Unearned Income Most unearned income sources are not subject to payroll taxes, and none of it is subject to employment taxes, such as Social Security and Medicare.

What income is subject to 3.8 net investment tax?

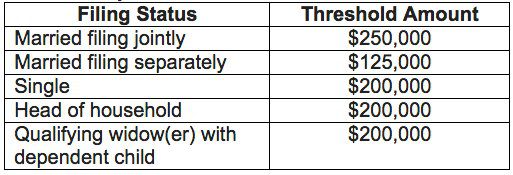

As an investor, you may owe an additional 3.8% tax called net investment income tax (NIIT)....Is your MAGI greater than the threshold?Filing statusMAGI thresholdSingle$200,000Married filing jointly$250,000Married filing separately$125,000

What does the 3.8 surtax apply to?

The net investment income tax is a 3.8% tax on investment income that typically applies only to high-income taxpayers. 1 It applies to individuals, families, estates, and trusts, but certain income thresholds must be met before the tax takes effect. Net investment income can be capital gains, interest, or dividends.

Does unearned income affect Social Security taxation?

Unearned income we do not count. (a) General. While we must know the source and amount of all of your unearned income for SSI, we do not count all of it to determine your eligibility and benefit amount. We first exclude income as authorized by other Federal laws (see paragraph (b) of this section).

How does unearned income affect taxes?

While unearned income is frequently subject to taxes, it is typically not subject to payroll taxes. For example, earned interest is not subject to payroll taxes, but is frequently subject to a capital gains tax. Unearned income also is not subject to employment taxes, like Social Security and Medicare taxes.

Who has to pay the 3.8 Obamacare tax?

individual taxpayersEffective Jan. 1, 2013, individual taxpayers are liable for a 3.8 percent Net Investment Income Tax on the lesser of their net investment income, or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status.

Does investment income affect Social Security benefits?

Wages, bonuses, commissions, and vacation pay count against your Social Security benefits, while investment income, dividends, and interest (among others) are excluded.

Who is exempt from net investment income tax?

Since up to $250,000 of gain for single individuals and $500,000 for taxpayers filing jointly generally is exempt (if the ownership, use, and other requirements are met), many or most taxpayers are unaffected by the net investment income tax on the sale of their principal residences.

Who is subject to the additional Medicare tax?

A 0.9% Additional Medicare Tax applies to Medicare wages, self-employment income, and railroad retirement (RRTA) compensation that exceed the following threshold amounts based on filing status: $250,000 for married filing jointly; $125,000 for married filing separately; and. $200,000 for all other taxpayers.

At what income level does the 3.8 surtax kick in?

$250,000There is a flat Medicare surtax of 3.8% on net investment income for married couples who earn more than $250,000 of adjusted gross income (AGI). For single filers, the threshold is just $200,000 of AGI.

How do I avoid Medicare surtax?

Despite the complexity of this 3.8% surtax, there are two basic ways to “burp” income to reduce or avoid this tax: 1) reduce income (MAGI) below the threshold, or 2) reduce the amount of NII that is subject to the tax.

3 Rules You Must Know About the 3.8% Surtax

Here is what you need to know to navigate the 3.8% surtax on unearned ...

Will You Have to Pay the 3.8% Medicare Tax When You Sell Your House? - Nolo

Tax Planning Tips To Minimize Your 3.8% Medicare Surtax

How much is Medicare tax?

The Medicare tax is a 3.8% tax, but it is imposed only on a portion of a taxpayer's income. The tax is paid on the lesser of (1) the taxpayer's net investment income, or (2) the amount the taxpayer's AGI exceeds the applicable AGI threshold ($200,000 or $250,000).

How much tax do you pay on $300000?

Since $300,000 is less than $350,000, they'll have to pay the 3.8% tax on $300,000. Their Medicare contribution tax for the year will be $11,400 (3.8%. Talk to a Tax Attorney.

What is the AGI for Medicare?

Their AGI is $550,000, including $350,000 in net investment income. They must pay the 3.8% Medicare tax on the lesser of (1) their $350,000 of net investment income, or (2) the amount their AGI exceeds the $250,000 threshold for married taxpayers—$300,000.

What is the AGI for married filing jointly?

Married taxpayers filing jointly must have an AGI over $250,000 to be subject to the tax. Your adjusted gross income is the number on the bottom of your IRS Form 1040.

What is gross income?

gross income from interest, dividends, annuities, royalties, and rents other than those derived from an active business. the net gain earned from the sale or other disposition of investment and other non-business property, and. any other gain from a passive trade or business.

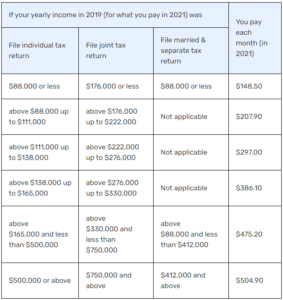

Does Medicare affect high income?

The Medicare Tax Only Affects High Income Taxpayers. The tax applies only to people with relatively high incomes. If you're single, you must pay the tax only if your adjusted gross income (AGI) is over $200,000. Married taxpayers filing jointly must have an AGI over $250,000 to be subject to the tax.

What is Medicare contribution tax?

A Medicare contribution tax of 3.8% now additionally applies to "unearned income"—that which is received from investments, such as interest or dividends, rather than from wages or salaries paid in compensation for labor or self-employment income. This tax is called the Net Investment Income Tax (NIIT). 7 .

When was Medicare tax added?

The Additional Medicare Tax (AMT) was added by the Affordable Care Act (ACA) in November 2013. The ACA increased the Medicare tax by an additional 0.9% for taxpayers whose incomes are over a certain threshold based on their filing status. Those affected pay a total Medicare tax of 3.8%.

What is the Medicare tax rate for 2020?

Updated December 07, 2020. The U.S. government imposes a flat rate Medicare tax of 2.9% on all wages received by employees, as well as on business or farming income earned by self-employed individuals. "Flat rate" means that everyone pays that same 2.9% regardless of how much they earn. But there are two other Medicare taxes ...

How much is Medicare Hospital Insurance tax?

Unlike the Social Security tax—the other component of the Federal Insurance Contributions Act, or FICA, taxes—all of your wages and business earnings are subject to at least the 2.9% Medicare Hospital Insurance program tax. Social Security has an annual wage limit, so you pay the tax only on income ...

How much is Social Security taxed in 2021?

Social Security has an annual wage limit, so you pay the tax only on income above a certain amount: $137,700 annually as of 2020 and $142,800 in 2021. 5 . Half the Medicare tax is paid by employees through payroll deductions, and half is paid by their employers. In other words, 1.45% comes out of your pay and your employer then matches that, ...

When did Medicare start?

The Medicare program and its corresponding tax have been around since President Lyndon Johnson signed the Social Security Act into law in 1965 . 2 The flat rate was a mere 0.7% at that time. The program was initially divided up into Part A for hospital insurance and Part B for medical insurance.

Can an employer withhold AMT?

Any shortfall to withholding must be paid by the taxpayer at tax time. Employers can be subject to penalties and interest for not withholding the AMT, even if the oversight was due to understandable circumstances.