How is the Medicare trust fund financed?

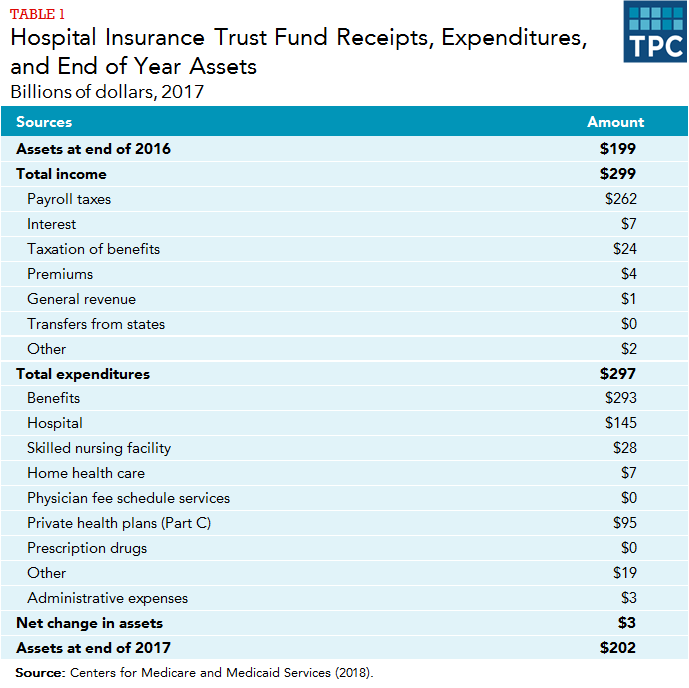

In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds. Medicare Trust Funds. Medicare is paid for through 2 trust fund accounts held by the U.S. Treasury. These funds can only be used for Medicare. Hospital Insurance (HI) Trust Fund How is it funded?

When will the Medicare trust fund be depleted?

Trustees Report & Trust Funds The Medicare Program is the second-largest social insurance program in the U.S., with 62.6 million beneficiaries and total expenditures of $926 billion in 2020. The Boards of Trustees for Medicare (also Boards) report annually to the Congress on the financial operations and actuarial status of the program.

What is part a of the hospital insurance trust fund?

Jul 21, 2020 · At least $60 billion of the funding provided as part of the CARES Act to help hospitals weather the pandemic came not from the general treasury, but from the Trust Fund itself. That money in...

How is Medicare Part A funded?

Dec 20, 2021 · According to a 2021 report by the Biden administration, the Medicare Hospital Insurance (HI) trust fund will be depleted if healthcare expenses continue to exceed money flowing in. Without new legislation, it’s estimated that by 2026, Medicare Part A may only be able to pay for 91% of the costs it covers today. 1.

Is the Medicare trust fund running out?

A report from Medicare's trustees in April 2020 estimated that the program's Part A trust fund, which subsidizes hospital and other inpatient care, would begin to run out of money in 2026.Dec 30, 2021

What is the current state of the Medicare trust fund?

Reserves in Medicare's Hospital Insurance (HI) Trust Fund decreased by $60 billion to a total of $134 billion at the end of 2020....A SUMMARY OF THE 2021 ANNUAL REPORTS.HIHospital assumptions-.01Other provider assumptions.00Methodological changes.24COVID-19 spending assumptions.008 more rows

What will happen if Medicare runs out of money?

It will have money to pay for health care. Instead, it is projected to become insolvent. Insolvency means that Medicare may not have the funds to pay 100% of its expenses. Insolvency can sometimes lead to bankruptcy, but in the case of Medicare, Congress is likely to intervene and acquire the necessary funding.Dec 20, 2021

Why is the Social Security trust fund depleted?

Part of the reason for the stable depletion date is the higher mortality rate from COVID-19, which reduces some long-term care costs, offset by higher expected healthcare costs for people weakened by the virus, a Department of Health and Human Services official told reporters.Sep 1, 2021

How much money has the government borrowed from the Social Security fund?

All of those assets are held in "special non-marketable securities of the US Government". So, the US government borrows from the OASI, DI and many others to finance its deficit spending. As a matter of fact, as of this second, the US government currently has "intragovernmental holdings" of $4.776 trillion.

How much money is in the Social Security fund right now?

Measured at end of year. A 2020 annual surplus of $10.9 billion increased the asset reserves of the combined OASDI trust funds to $2.91 trillion at the end of the year. This amount is equal to 253 percent of the estimated annual expenditures for 2021.

Does Medicare have a lifetime limit?

In general, there's no upper dollar limit on Medicare benefits. As long as you're using medical services that Medicare covers—and provided that they're medically necessary—you can continue to use as many as you need, regardless of how much they cost, in any given year or over the rest of your lifetime.

Is Medicare in the red?

Medicare's True Contribution to the National Debt America's fiscal trajectory is unsustainable, and Medicare is the primary source of red ink. Medicare's cash shortfall is responsible for one-third of the federal debt.Sep 1, 2021

How Long Will Social Security Last?

According to the 2021 annual report of the Social Security Board of Trustees, the surplus in the trust funds that disburse retirement, disability and other Social Security benefits will be depleted by 2034.

How much money did the U.S. collect in Social Security and Medicare taxes?

How massive is it? Since its inception, FICA has collected more than $20 trillion for Social Security and Medicare. Congress enacted FICA in 1935.Dec 6, 2021

How much does Social Security pay out annually?

Fact #4: Social Security benefits are modest. Social Security benefits are much more modest than many people realize; the average Social Security retirement benefit in January 2022 was about $1,614 per month, or about $19,370 per year. (The average disabled worker and aged widow received slightly less.)Mar 4, 2022

How much money did the U.S. collect in Social Security and Medicare taxes in 2019?

The Federal Insurance Contributions Act (FICA) tax rate, which is the combined Social Security tax rate of 6.2% and the Medicare tax rate of 1.45%, will be 7.65% for 2019 up to the Social Security wage base. The maximum Social Security tax employees and employers will each pay in 2019 is $8,239.80.Dec 13, 2019

How many people did Medicare cover in 2017?

programs offered by each state. In 2017, Medicare covered over 58 million people. Total expenditures in 2017 were $705.9 billion. This money comes from the Medicare Trust Funds.

What is the CMS?

The Centers for Medicare & Medicaid Services ( CMS) is the federal agency that runs the Medicare Program. CMS is a branch of the. Department Of Health And Human Services (Hhs) The federal agency that oversees CMS, which administers programs for protecting the health of all Americans, including Medicare, the Marketplace, Medicaid, ...

What is Medicare Part B?

Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. and. Medicare Drug Coverage (Part D) Optional benefits for prescription drugs available to all people with Medicare for an additional charge.

What is SNF in nursing?

Skilled nursing care and rehabilitation services provided on a daily basis, in a skilled nursing facility (SNF). Examples of SNF care include physical therapy or intravenous injections that can only be given by a registered nurse or doctor. , home health care.

What is covered by Part A?

Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.

Who pays payroll taxes?

Payroll taxes paid by most employees, employers, and people who are self-employed. Other sources, like these: Income taxes paid on Social Security benefits. Interest earned on the trust fund investments. Medicare Part A premiums from people who aren't eligible for premium-free Part A.

Does Medicare cover home health?

Medicare only covers home health care on a limited basis as ordered by your doctor. , and. hospice. A special way of caring for people who are terminally ill. Hospice care involves a team-oriented approach that addresses the medical, physical, social, emotional, and spiritual needs of the patient.

What is the hospital insurance trust fund?

As we discussed, The Hospital Insurance Trust Fund funds Medicare Part A. The Hospital Insurance Trust Fund is the particular fund that is expected to lose its money by the year 2026.

How is Medicare Part D funded?

Like Medicare Part B, Medicare Part D is funded by monthly premiums and government expenditures. As with Medicare Part B, there will be increases in medical expenses over time. This increase in expenses will lead to the need for an increase in spending by Medicare trust funds. The financial issues will lead to an increase in ...

What is Medicare for 65?

Surprisingly, a lot of people don’t know what this governmental service is and what its purpose was upon creation. Medicare is a kind of federal health insurance in the United States that is meant for those who are 65 and older. However, some young people with certain disabilities can also apply for the benefits.

Why is Medicare Part B and Part D slowing down?

Because of the increase that was found in both Medicare Part B and Medicare Part D, a proven solution had to be found. The trustees of the Medicare trust funds have found that the Affordable Care Act along with the Medicare Access and CHIP Reauthorization Act may cause the medical expense growth rates to slow down.

What are the parts of Medicare?

Medicare Part A covers hospital expenses, like inpatient stays and hospice care. Medicare Part B covers medical expenses, like doctors’ visits and medical supplies. Medicare Part D covers prescription drugs which include any medications you may pick up at your pharmacy.

Will the Hospital Insurance Trust Fund become insolvent?

This is not the first time that The Hosptial Insurance Trust Fund has been projected to become insolvent. Medicare will still be able to cover some of the financial loss if the Hospital Insurance Trust Fund does become insolvent. This will decrease over time, but we will still be able to cover the majority of Medicare costs.

Is Medicare a financial projection?

However, the financial projection of the Medicare program is not as simple as that. There is much more that goes into the projection of future finances and the stability of the future of the program. Let’s discuss some of the major issues surrounding the Medicare Trust Fund and how exactly you should interpreting their financial struggles.

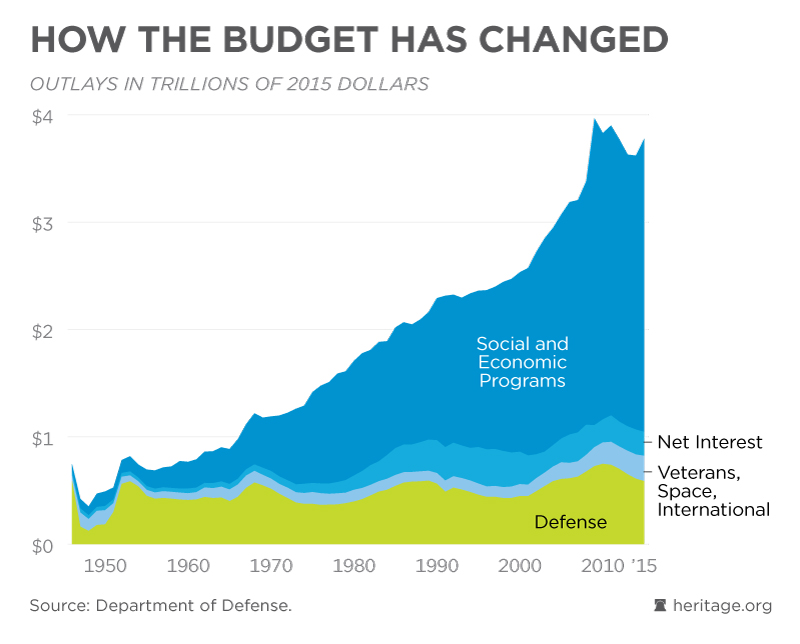

How much does Medicare cost?

In 2018, Medicare spending (net of income from premiums and other offsetting receipts) totaled $605 billion, accounting for 15 percent of the federal budget (Figure 1).

What percentage of Medicare is spending?

Key Facts. Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the Medicare Hospital Insurance (Part A) trust fund is projected to be depleted in 2026, the same as the 2018 projection.

How fast will Medicare spending grow?

On a per capita basis, Medicare spending is also projected to grow at a faster rate between 2018 and 2028 (5.1 percent) than between 2010 and 2018 (1.7 percent), and slightly faster than the average annual growth in per capita private health insurance spending over the next 10 years (4.6 percent).

Why is Medicare spending so high?

Over the longer term (that is, beyond the next 10 years), both CBO and OACT expect Medicare spending to rise more rapidly than GDP due to a number of factors, including the aging of the population and faster growth in health care costs than growth in the economy on a per capita basis.

What has changed in Medicare spending in the past 10 years?

Another notable change in Medicare spending in the past 10 years is the increase in payments to Medicare Advantage plans , which are private health plans that cover all Part A and Part B benefits, and typically also Part D benefits.

How is Medicare's solvency measured?

The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years when annual income to the trust fund exceeds benefits spending, the asset level increases, and when annual spending exceeds income, the asset level decreases.

How much will Medicare per capita increase in 2028?

Medicare per capita spending is projected to grow at an average annual rate of 5.1 percent over the next 10 years (2018 to 2028), due to growing Medicare enrollment, increased use of services and intensity of care, and rising health care prices.

Where does Medicare funding come from?

The funding largely comes from a 1.45% payroll tax paid by employees and employers. Funding is shrinking for Medicare's Part A trust fund, which pays for hospitalization and in-patient care. The funding largely comes from a 1.45% payroll tax paid by employees and employers. Everyone involved even tangentially in health care today is consumed by ...

How does a trust fund get into trouble?

There are two ways the trust fund can get into trouble: Either the money flowing in is too little, or the payments going out for care are too much. Most of those who watch Medicare finances agree that the larger problem right now is how much money is being collected for the trust fund.

What does it mean when a trust fund is insolvent?

Insolvent means the Trust Fund would still have money flowing in, but not enough to pay for all the care Medicare patients will consume. Most budget experts think that Medicare would reimburse hospitals and other Part A providers 100% of their claims until the fund literally runs out of money, and then would pay claims only as more money flows in.

How much money was given to hospitals in the Cares Act?

At least $60 billion of the funding provided as part of the CARES Act to help hospitals weather the pandemic came not from the general treasury, but from the Trust Fund itself. That money in " accelerated and advance payments " is supposed to be paid back, via a reduction in future payments.

When will the Part A fund be unable to pay its bills?

The Committee for a Responsible Federal Budget, a nonpartisan group of budget experts focused on fiscal policy, estimates that the pandemic will cause the Part A trust fund to be unable to pay all of its bills starting in late 2023 or early 2024.

When will Medicare run out of money?

In April, Medicare's trustees reported that the Part A trust fund, which pays for hospital and other inpatient care, would start to run out of money in 2026. That is the same as the projection in 2019. But the trustees cautioned at the time that their projections did not include the impact of COVID-19 on the trust fund.

Is Medicare Part B insolvent?

(Medicare Part B, which pays physicians and other outpatient costs, is funded by beneficiary premiums and general tax funding, so it cannot technically become insolvent.)

What is the source of Medicare trust funds?

The money collected in taxes and in premiums make up the bulk of the Medicare Trust Fund. Other sources of funding include income taxes paid on Social Security benefits and interest earned on trust fund investments.

How much is Medicare payroll tax?

Medicare payroll taxes account for the majority of dollars that finance the Medicare Trust Fund. Employees are taxed 2.9% on their earnings, 1.45% paid by themselves, 1.45% paid by their employers. People who are self-employed pay the full 2.9% tax.

How much did Medicare spend in 2016?

In 2016, people on Original Medicare (Part A and Part B) spent 12% of their income on health care. People with five or more chronic conditions spent as much as 14%, significantly higher than those with none at 8%, showing their increased need for medical care. 9.

What is the CMS?

As the number of chronic medical conditions goes up, the Centers for Medicare and Medicaid Services (CMS) reports higher utilization of medical resources, including emergency room visits, home health visits, inpatient hospitalizations, hospital readmissions, and post-acute care services like rehabilitation and physical therapy .

Why is the Department of Justice filing suit against Medicare?

The Department of Justice has filed law suits against some of these insurers for inflating Medicare risk adjustment scores to get more money from the government. Some healthcare companies and providers have also been involved in schemes to defraud money from Medicare.

Why is there a doctor shortage?

As it stands, there is already an impending doctor shortage because of limited Medicare funding to support physician training. Decrease Medicare fraud, waste, and abuse. Private insurance companies run Medicare Advantage and Part D plans.

How long will a 65 year old live on Medicare?

A Social Security Administration calculator notes a man who turned 65 on April 1, 2019 could expect to live, on average, until 84.0. A women who turned 65 on the same date could expect to live, on average, until 86.5.

What is a medicaid trust?

A Medicaid Trust, sometimes erroneously called a Medicare Trust, is an irrevocable trust. It holds the assets of the future nursing home patient. You must have a properly worded trust. Your Medicaid Trust must have an a trustee, which can be your children, other relative, or an independent third party.

How long does Medicaid need to be in a trust?

US government Medicaid assistance will pay for your care, including nursing home costs, if required. Your assets need to be in the trust for five years before receiving Medicaid assistance (the 5-year lookback period). Your children can be the trustees of the trust.

What does it mean to take steps to safeguard assets from nursing care costs?

Doing so means you have a higher chance of being eligible for Medicaid long-term care benefits. It also means, you get to leave something behind for the people you care about the most. Last Updated on April 12, 2021.

What is an irrevocable trust?

Set up properly, an irrevocable Medicaid trust protects your assets from a Medicaid spend down. It allows you to qualify for long-term care at the same time. It also means your assets can pass down to your spouse and children when you die. That is, if it is so stated in the terms of the trust.

How to protect assets from nursing home costs?

Protect Assets from Nursing Home Costs. There are ways to mitigate the cost of long-term care insurance and protect more of your assets from nursing home costs. For example, you could buy a plan with a limited coverage. Then pay for what the plan does not cover from your savings.

How early can you set up a Medicaid trust?

Keep in mind, to make sure Medicaid will not disallow any assets included in the trust, set it up early. That is, at least five years prior to entering a nursing home or applying for long-term care.

How long do you have to transfer assets to Medicaid?

Then transfer assets to it at least five years before you apply for Medicaid long-term care benefits. If you do not meet this five-year minimum, Medicaid may judge your transfer and the trust itself as void, and so will count your assets in determining your eligibility (or ineligibility) for long-term care.

What is a Medicaid asset protection trust?

Medicaid Asset Protection Trusts (MAPT) can be a valuable planning strategy to meet Medicaid’s asset limit when an applicant has excess assets. Simply stated, these trusts protect a Medicaid applicant’s assets from being counted for eligibility purposes. This type of trust enables someone who would otherwise be ineligible for Medicaid ...

What is the maximum amount of Medicaid for elderly?

Generally speaking, the asset limit for eligibility purposes for an elderly individual applying for long-term care Medicaid is $2,000. However, this asset limit can be lower or higher depending on the state in which one resides. (For state specific asset limits, click here ).

What is look back on Medicaid?

During the look back period, Medicaid checks to ensure no assets were sold or given away for less than they are worth in order for one to meet the asset eligibility limit. For Medicaid purposes, the transfer of assets to a Medicaid asset protection trust is seen as a gift. Therefore, it violates the look back rule.

What are some alternatives to Medicaid?

Alternatives to a Medicaid Asset Protection Trust. In addition to Medicaid asset protection trusts, there are other planning strategies to help lower one’s countable assets. These may include funeral trusts and annuities. In addition, there are also strategies to help lower one’s income to become eligible for Medicaid.

What is an irrevocable trust?

Irrevocable funeral trusts, also known as burial trusts, are used to protect small amounts of assets specifically for funeral and burial costs. There are also qualifying income trusts (or qualified income trusts, abbreviated as QITs).

Is gifting assets a legal requirement for Medicaid?

Gifting Assets vs. Creating a Medicaid Asset Protection Trust. While there is more flexibility with gifting assets and it does not require any legal work, it also violates Medicaid’s look back rule. As previously mentioned, this results in a period of Medicaid ineligibility as a penalty.

Does Medicaid count as assets?

Therefore, the assets are counted towards Medicaid’s asset limit.

How is the HI Trust Fund funded?

The HI Trust Fund, just like the Social Security Trust Fund, is primarily financed through payroll taxes. And just as with Social Security, the HI Trust Fund suffered from decreased funding long before COVID came along.

What is Social Security and Medicare?

Social Security and Medicare are federal programs that provide income and health insurance to qualifying populations, mostly older Americans and the disabled. Beneficiaries of both programs have been severely impacted by the COVID-19 pandemic.

What is the Medicare system?

The Medicare system provides healthcare coverage to people 65 and older, as well as those under 65 with disabilities. These populations are the most vulnerable when it comes to COVID-19. In addition to health concerns, these same populations will be financially vulnerable going forward.

How many changes did Medicare make in 2020?

Consider that between January 1 and July 24, 2020, more than 200 Medicare-related regulatory changes were made.

What is the NAWI for Social Security?

The amount you receive in Social Security benefits depends, in part, on something called the National Average Wage Index (NAWI). NAWI tracks wage growth to measure inflation. Due to COVID, the wage index for 2020 is expected to be lower than normal.

How does Social Security work?

Social Security is commonly known as a “pay-as-you-go” retirement benefit. Current workers and their employers pay into the program through payroll taxes. The money goes into the Social Security Trust Fund , which pays benefits to current recipients.

What happens if you turn 60 in 2020?

If you turned 60 in 2020, this lower wage index will affect the amount you receive in Social Security benefits. That’s because the Social Security Administration (SSA) uses the wage index from the year you turn 60 as part of the formula used to determine your lifetime benefit amount. 5.

Summary

- Medicare, the federal health insurance program for nearly 60 million people ages 65 and over and younger people with permanent disabilities, helps to pay for hospital and physician visits, prescription drugs, and other acute and post-acute care services. This issue brief includes the most recent historical and projected Medicare spending data published in the 2018 annual repor…

Health

- In 2017, Medicare spending accounted for 15 percent of the federal budget (Figure 1). Medicare plays a major role in the health care system, accounting for 20 percent of total national health spending in 2016, 29 percent of spending on retail sales of prescription drugs, 25 percent of spending on hospital care, and 23 percent of spending on physician services.

Cost

- In 2017, Medicare benefit payments totaled $702 billion, up from $425 billion in 2007 (Figure 2). While benefit payments for each part of Medicare (A, B, and D) increased in dollar terms over these years, the share of total benefit payments represented by each part changed. Spending on Part A benefits (mainly hospital inpatient services) decreased ...

Causes

- Slower growth in Medicare spending in recent years can be attributed in part to policy changes adopted as part of the Affordable Care Act (ACA) and the Budget Control Act of 2011 (BCA). The ACA included reductions in Medicare payments to plans and providers, increased revenues, and introduced delivery system reforms that aimed to improve efficiency and quality of patient care …

Effects

- In addition, although Medicare enrollment has been growing around 3 percent annually with the aging of the baby boom generation, the influx of younger, healthier beneficiaries has contributed to lower per capita spending and a slower rate of growth in overall program spending. In general, Part A trust fund solvency is also affected by the level of growth in the economy, which affects …

Impact

- Prior to 2010, per enrollee spending growth rates were comparable for Medicare and private health insurance. With the recent slowdown in the growth of Medicare spending and the recent expansion of private health insurance through the ACA, however, the difference in growth rates between Medicare and private health insurance spending per enrollee has widened.

Future

- While Medicare spending is expected to continue to grow more slowly in the future compared to long-term historical trends, Medicares actuaries project that future spending growth will increase at a faster rate than in recent years, in part due to growing enrollment in Medicare related to the aging of the population, increased use of services and intensity of care, and rising health care pri…

Funding

- Medicare is funded primarily from general revenues (41 percent), payroll taxes (37 percent), and beneficiary premiums (14 percent) (Figure 7). Part B and Part D do not have financing challenges similar to Part A, because both are funded by beneficiary premiums and general revenues that are set annually to match expected outlays. Expected future increases in spending under Part B and …

Assessment

- Medicares financial condition can be assessed in different ways, including comparing various measures of Medicare spendingoverall or per capitato other spending measures, such as Medicare spending as a share of the federal budget or as a share of GDP, as discussed above, and estimating the solvency of the Medicare Hospital Insurance (Part A) trust fund.

Purpose

- The solvency of the Medicare Hospital Insurance trust fund, out of which Part A benefits are paid, is one way of measuring Medicares financial status, though because it only focuses on the status of Part A, it does not present a complete picture of total program spending. The solvency of Medicare in this context is measured by the level of assets in the Part A trust fund. In years whe…

Benefits

- A number of changes to Medicare have been proposed that could help to address the health care spending challenges posed by the aging of the population, including: restructuring Medicare benefits and cost sharing; further increasing Medicare premiums for beneficiaries with relatively high incomes; raising the Medicare eligibility age; and shifting Medicare from a defined benefit s…