See more

What Medicare health plans cover. Medicare health plans include Medicare Advantage, Medical Savings Account (MSA), Medicare Cost plans, PACE, MTM. Preventive & screening services. Part B covers many preventive services. What's not covered by Part A & Part B. Learn about what items and services aren't covered by Medicare Part A or Part B.

Does Medicare pay for everything?

Original Medicare (Parts A & B) covers many medical and hospital services. But it doesn't cover everything.

What does Medicare not normally cover?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

What benefits do you get with Medicare?

The Parts of Medicare Part A also pays for some home health care and hospice care. Medicare Part B (medical insurance) helps pay for services from doctors and other health care providers, outpatient care, home health care, durable medical equipment, and some preventive services.

What are the four types of coverage in Medicare?

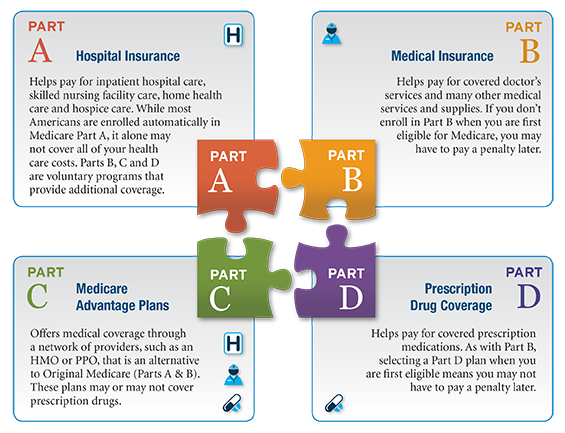

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Does Medicare pay for surgery?

Yes. Medicare covers most medically necessary surgeries, and you can find a list of these on the Medicare Benefits Schedule (MBS). Since surgeries happen mainly in hospitals, Medicare will cover 100% of all costs related to the surgery if you have it done in a public hospital.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the maximum out-of-pocket expense with Medicare?

The amount varies from plan to plan, from about $3,000 to $6,700. After your spending meets your plan's limit, you pay no more for the rest of the calendar year. Usually the definition of out-of-pocket spending includes deductibles and copays but excludes premiums.

Is Medicare free for seniors?

Medicare is a federal insurance program for people aged 65 years and over and those with certain health conditions. The program aims to help older adults fund healthcare costs, but it is not completely free. Each part of Medicare has different costs, which can include coinsurances, deductibles, and monthly premiums.

Do I automatically get Medicare when I turn 65?

Medicare will automatically start when you turn 65 if you've received Social Security Benefits or Railroad Retirement Benefits for at least 4 months prior to your 65th birthday. You'll automatically be enrolled in both Medicare Part A and Part B at 65 if you get benefit checks.

Whats the difference between Medicare Part A and B?

Medicare Part A and Medicare Part B are two aspects of healthcare coverage the Centers for Medicare & Medicaid Services provide. Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care.

What is the difference between Medicare Part C and Part D?

Medicare part C is called "Medicare Advantage" and gives you additional coverage. Part D gives you prescription drug coverage.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.Jan 3, 2022

Medicare Part A Coverage

Medicare.gov explains that Medicare Part A is often referred to as “Hospital Insurance.” Rightfully so, as this is the part of Medicare that covers expenses related to hospital, nursing facility care, hospice, and home health care.

Medicare Part B Coverage

Part B is the “Medical Insurance” piece of Medicare and covers most preventative services fully. It also provides at least partial coverage for medically necessary services and supplies needed to diagnose and/or treat existing conditions. Part B also pays a set amount toward other expenses, such as:

Medicare Part C Coverage

As an alternative to purchasing Part A and Part B, some participants receive Medicare benefits through Part C, which is commonly known as Medicare Advantage. Instead of the federal government providing healthcare coverage, Medicare Advantage’s benefits are offered through private insurance companies that have been pre-approved by Medicare.

Medicare Part D Coverage

Part D refers to the prescription drug coverage portion of Medicare and each plan has its own set of covered drugs. Additionally, each drug is placed in a designated tier within that plan, which ultimately determines the copayment and/or coinsurance cost of the drug.

Medicare Supplement (Medigap) Coverage

Medicare Supplement policies, also known as Medigap, are designed to help cover expenses not covered under Original Medicare Parts A and B.

What Medicare Does Not Cover

Medicare as a whole covers a wide variety of physical and mental health services—whether in whole or in part—but there are some expenses it will not pay toward. Among them are:

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

What is the standard Part B premium for 2020?

The standard Part B premium amount in 2020 is $144.60. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

What is Medicare Part A?

Under Medicare Part A, hospital care as well as some nursing home, rehabilitation, mental health, and hospice care are generally covered. However, you may have to meet certain qualifications. Inpatient hospital care. Medicare Part A covers general nursing services, a semi-private room, meals, medical supplies, and certain medications.

What are the different parts of Medicare?

Here’s a quick rundown of the “parts” of Medicare, and the choices you may have about your Medicare coverage. Medicare Part A and Part B make up Original Medicare. Many people are automatically enrolled in Part A and Part B. You may be automatically enrolled if you’re receiving Social Security retirement or disability benefits when you qualify ...

What is skilled nursing in Medicare?

Skilled nursing facility care. Medicare covers room, board, and a range of skilled nursing services provided in a skilled nursing facility . This may include certain medications, tube feedings, and wound care, among other approved services.

How many days of home health care is covered by Medicare?

Medicare covers up to 100 days of part-time daily care or intermittent care if medically necessary. You must have spent at least three consecutive days as a hospital inpatient within 14 days of receiving home health care. If you don’t qualify for home health care coverage under Part A, you might have Medicare coverage under Part B.

What is medically necessary?

Medically necessary services you receive from a doctor or other licensed health professional. This includes some preventive care services, such as annual wellness exams, flu shots, and screens to help detect certain forms of cancer. Durable medical equipment such as walkers, wheelchairs, and oxygen tanks.

What is an ambulance service?

Ambulance services, usually in an emergency situation where ambulance transportation is medically necessary. Therapies such as speech, physical, and occupational you receive from a Medicare-certified therapist. Certain medications, usually given in a doctor’s office or clinic.

What medical equipment do you need to be a doctor?

Durable medical equipment such as walkers, wheelchairs, and oxygen tanks. This is medical equipment your doctor certifies you need that you use repeatedly and typically at home. You generally rent or purchase durable medical equipment from a Medicare-certified supplier. Diagnostic tests such as lab work and x-rays.

What is not covered by Medicare?

The biggest potential expense that’s not covered is long-term care, also known as custodial care. Medicaid, the federal health program for the poor, pays custodial costs but typically only for low-income people with little savings. Other common expenses that Medicare doesn’t cover include:

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a type of health plan offered by private insurance companies that provides the benefits of Parts A and Part B and often Part D (prescription drug coverage) as well. These bundled plans may have additional coverage, such as vision, hearing and dental care.

How long do you have to sign up for Medicare Part B?

You can avoid the penalty if you had health insurance through your job or your spouse’s job when you first became eligible. You must sign up within eight months of when that coverage ends.

What are the most common medical expenses that are not covered by Medicaid?

The biggest potential expense that’s not covered is long-term care, also known as custodial care . Medicaid, the federal health program for the poor, pays custodial costs but typically only for low-income people with little savings. Hearing aids and exams for fitting them. Eye exams and eyeglasses.

Does Medicare Part A cover hospice?

Part A also helps pay for hospice care and some home health care. Medicare Part A has a deductible ($1,484 in 2021) and coinsurance, which means patients pay a portion of the bill. There is no coinsurance for the first 60 days of inpatient hospital care, for example, but patients typically pay $371 per day for the 61st through 90th day ...

Is Medicare the same as Medicaid?

No. Medicare is an insurance program, primarily serving people over 65 no matter their income level. Medicare is a federal program, and it’s the same everywhere in the United States. Medicaid is an assistance program, serving low-income people of all ages, and patient financial responsibility is typically small or nonexistent.

Does Medicare cover eye exams?

Medicare also doesn’t cover eye exams for eyeglasses or contact lenses. Some Medicare Advantage Plans (Medicare Part C) offer additional benefits such as vision, dental and hearing coverage. To find plans with coverage in your area, visit Medicare’s Plan Finder.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Does Medicare cover assignment?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it.

Do you have to choose a primary care doctor for Medicare?

No, in Original Medicare you don't need to choose a. primary care doctor. The doctor you see first for most health problems. He or she makes sure you get the care you need to keep you healthy. He or she also may talk with other doctors and health care providers about your care and refer you to them.