For instance, Medicare typically only pays for health-related services provided within the United States. However, certain Medigap plans will pay a portion of medical costs incurred while traveling to foreign lands.

Full Answer

What services are covered by Medicare?

Step 1 What does Medicare cost? Generally, you pay a monthly premium for Medicare coverage and part of the costs each time you get a covered service. There’s no yearly limit on what you pay out-of-pocket, unless you have supplemental coverage, like a Medicare Supplement Insurance ( Medigap ) policy, or you join a Medicare Advantage Plan .

What drugs are covered with Medicare?

$233. After your deductible is met, you typically pay 20% of the Medicare-Approved Amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and durable medical equipment (dme) [glossary] Part C premium: The Part C monthly premium varies by plan.

Does Medicare cover all my medical expenses?

Dec 10, 2020 · Medicare is the federal government health insurance program for people 65 and older and younger people living with certain illnesses or disabilities. Its coverage plays an important role in...

Does Medicare cover all costs?

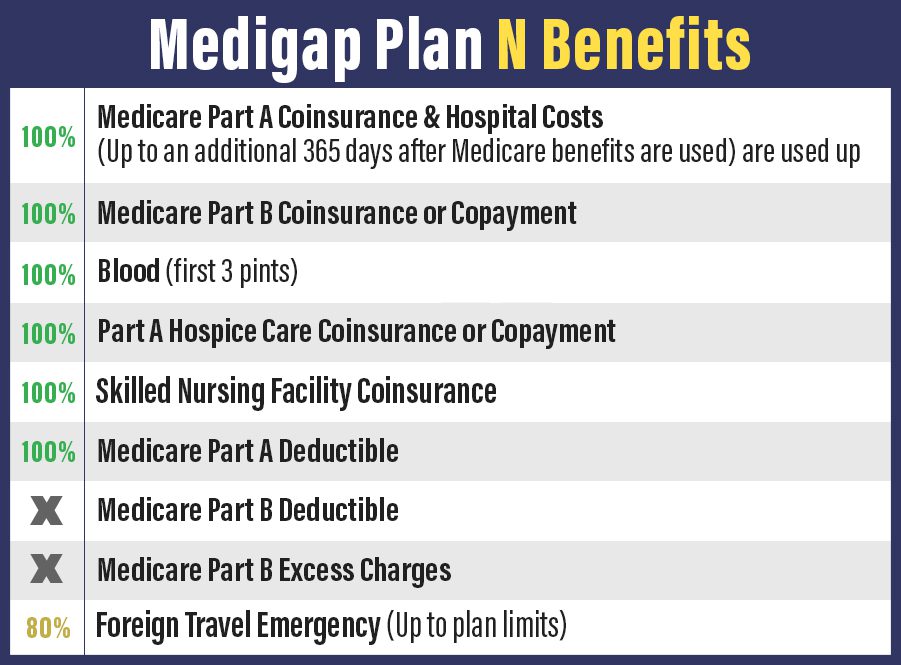

May 06, 2021 · Medicare Supplement insurance plans typically pay up to 365 days of hospital costs when your Part A benefits are used up. (Under Medicare Supplement Plan N, you might have to pay a copayment up to $20 for some office visits, and up to $50 for emergency room visits if they don’t result in hospital admission.)

What is Medicare used to pay for?

What are the parts of Medicare? Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

What is covered by Australian Medicare?

Medicare in Australia If you have a Medicare card, you can access a range of health care services for free or at a lower cost, including: medical services by doctors, specialists and other health professionals. hospital treatment. prescription medicines.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Does Medicare Part A cover 100 percent?

Most medically necessary inpatient care is covered by Medicare Part A. If you have a covered hospital stay, hospice stay, or short-term stay in a skilled nursing facility, Medicare Part A pays 100% of allowable charges for the first 60 days after you meet your Part A deductible.

What is not covered by Medicare?

Medicare does not cover: medical exams required when applying for a job, life insurance, superannuation, memberships, or government bodies. most dental examinations and treatment. most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry, acupuncture and psychology services.Jun 24, 2021

What is not covered by Medicare Australia?

Medicare does not cover: most physiotherapy, occupational therapy, speech therapy, eye therapy, chiropractic services, podiatry or psychology services; acupuncture (unless part of a doctor's consultation); glasses and contact lenses; hearing aids and other appliances; and.

Does Medicare cover dental?

Dental services Medicare doesn't cover most dental care (including procedures and supplies like cleanings, fillings, tooth extractions, dentures, dental plates, or other dental devices). Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What parts of Medicare do I need?

There are four parts to Medicare: A, B, C, and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse.

Do I have to get Medicare Part B?

You need Part B before you can enroll in Medigap or a Medicare Advantage plan. Lastly Part B is not free unless you qualify for a Medicare Savings program due to low income. Though you must pay a premium for Part B, it provides a very significant 80% of all your outpatient expenses.Jan 2, 2021

Does Medicare Part A cover MRI?

Does Medicare Cover MRIs? Original Medicare — Medicare Part A and Part B — covers 80 percent of an MRI's cost if the health care providers involved accept Medicare. You'll be responsible for 20 percent of the cost and your deductible.

Does Medicare have a copay?

There are generally no copayments with Original Medicare — Medicare Part A and Part B — but you may have coinsurance costs. You may have a copayment if you have a Medicare Advantage plan or Medicare Part D prescription drug plan.

Which part of Medicare covers surgery?

Medicare Part BMedicare Part B covers outpatient surgery. Typically, you pay 20% of the Medicare-approved amount for your surgery, plus 20% of the cost for your doctor's services.

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is a type of health plan offered by private insurance companies that provides the benefits of Parts A and Part B and often Part D (prescription drug coverage) as well. These bundled plans may have additional coverage, such as vision, hearing and dental care.

How long do you have to sign up for Medicare Part B?

You can avoid the penalty if you had health insurance through your job or your spouse’s job when you first became eligible. You must sign up within eight months of when that coverage ends.

What is not covered by Medicare?

The biggest potential expense that’s not covered is long-term care, also known as custodial care. Medicaid, the federal health program for the poor, pays custodial costs but typically only for low-income people with little savings. Other common expenses that Medicare doesn’t cover include:

What are the most common medical expenses that are not covered by Medicaid?

The biggest potential expense that’s not covered is long-term care, also known as custodial care . Medicaid, the federal health program for the poor, pays custodial costs but typically only for low-income people with little savings. Hearing aids and exams for fitting them. Eye exams and eyeglasses.

Does Medicare cover eye exams?

Medicare also doesn’t cover eye exams for eyeglasses or contact lenses. Some Medicare Advantage Plans (Medicare Part C) offer additional benefits such as vision, dental and hearing coverage. To find plans with coverage in your area, visit Medicare’s Plan Finder.

Does Medicare Part A cover hospice?

Part A also helps pay for hospice care and some home health care. Medicare Part A has a deductible ($1,484 in 2021) and coinsurance, which means patients pay a portion of the bill. There is no coinsurance for the first 60 days of inpatient hospital care, for example, but patients typically pay $371 per day for the 61st through 90th day ...

Is Medicare the same as Medicaid?

No. Medicare is an insurance program, primarily serving people over 65 no matter their income level. Medicare is a federal program, and it’s the same everywhere in the United States. Medicaid is an assistance program, serving low-income people of all ages, and patient financial responsibility is typically small or nonexistent.

What type of insurance is used for Medicare Part A and B?

This type of insurance works alongside your Original Medicare coverage. Medicare Supplement insurance plans typically help pay for your Medicare Part A and Part B out-of-pocket costs, such as deductibles, coinsurance, and copayments.

How much does Medicare Supplement pay for hospital visits?

(Under Medicare Supplement Plan N, you might have to pay a copayment up to $20 for some office visits, and up to $50 for emergency room visits if they don’t result in hospital admission.)

What does Medicare cover?

Medicare coverage: what costs does Original Medicare cover? Here’s a look at the health-care costs that Original Medicare (Part A and Part B) may cover. If you’re an inpatient in the hospital: Part A (hospital insurance) typically covers health-care costs such as your care and medical services. You’ll usually need to pay a deductible ($1,484 per ...

How much is a deductible for 2021?

You’ll usually need to pay a deductible ($1,484 per benefit period* in 2021). You pay coinsurance or copayment amounts in some cases, especially if you’re an inpatient for more than 60 days in one benefit period. Your copayment for days 61-90 is $371 for each benefit period in 2021.

How much is coinsurance for 61-90?

Your copayment for days 61-90 is $371 for each benefit period in 2021. After you’ve spent more than 90 days in the hospital during a single benefit period, you’ll generally have to pay a coinsurance amount of $742 per day in 2021.

What does Part B cover?

Part B typically covers certain disease and cancer screenings for diseases. Part B may also help pay for certain medical equipment and supplies.

Does Medicare cover prescription drugs?

Medicare Part A and Part B don’ t cover health-care costs associated with prescription drugs except in specific situations. Part A may cover prescription drugs used to treat you when you’re an inpatient in a hospital. Part B may cover medications administered to you in an outpatient setting, such as a clinic.

How much is Medicare Part A deductible for 2021?

The Part A deductible is $1,484 per benefit period in 2021.

What is Medicare Part A?

Medicare Part A is hospital insurance. It covers some of your costs when you are admitted for inpatient care at a hospital, skilled nursing facility and some other types of inpatient facilities. Part A can include a number of costs, including premiums, a deductible and coinsurance.

How much is respite care in 2021?

You might also be charged a 5 percent coinsurance for inpatient respite care costs. Medicare Part A requires a coinsurance payment of $185.50 per day in 2021 for inpatient skilled nursing facility stays longer than 20 days. You are responsible for all costs after day 101 of an inpatient skilled nursing facility stay.

What is the average Medicare premium for 2021?

In 2021, the average monthly premium for Medicare Advantage plans with prescription drug coverage is $33.57 per month. 1. Depending on your location, $0 premium plans may be available in your area. Medicare Part C, also known as Medicare Advantage, is sold by private insurance companies.

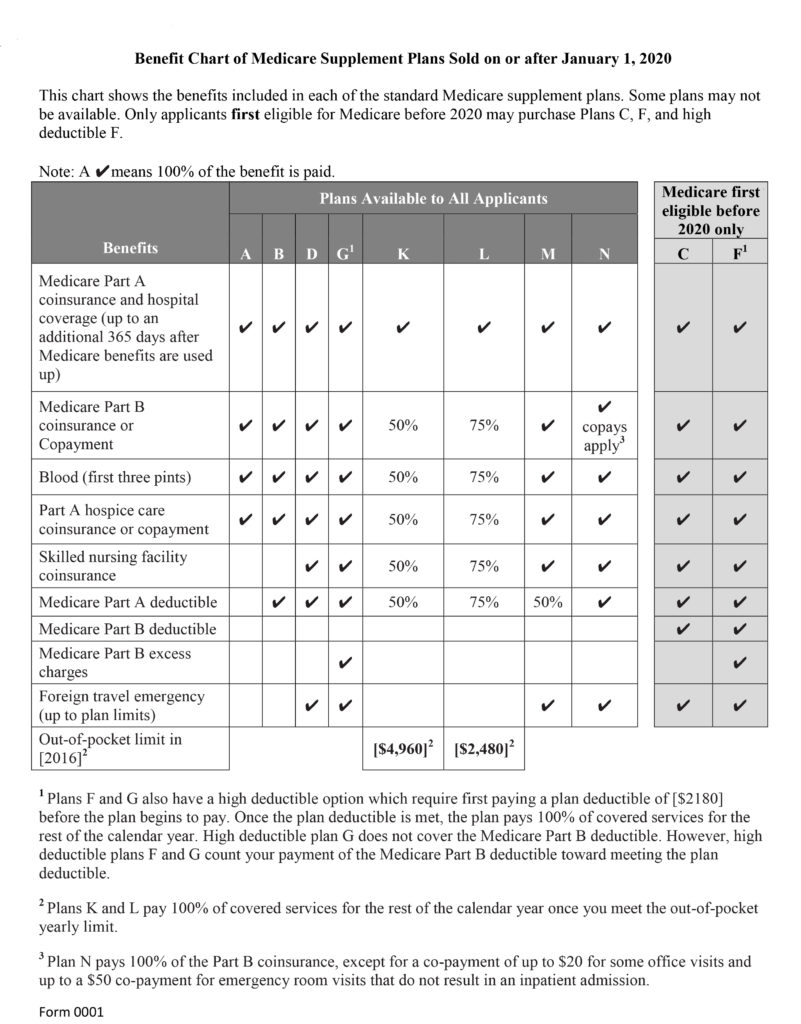

How many different Medigap plans are there?

There are 10 different Medigap plans available in most states. You can use the chart below to compare the costs that each type of Medigap plan may cover. Medigap plans and Medicare Advantage plans are not the same thing. You cannot have a Medigap plan and Medicare Advantage plan at the same time.

How long do you have to work to get Medicare in 2021?

To qualify for premium-free Part A, you or your spouse must have worked and paid Medicare taxes for the equivalent of 10 years (40 quarters).

What is the late enrollment penalty for Medicare?

The Part B late enrollment penalty is as much as 10 percent of the Part B premium for each 12-month period that you were eligible to enroll but did not.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Do you have to choose a primary care doctor for Medicare?

No, in Original Medicare you don't need to choose a. primary care doctor. The doctor you see first for most health problems. He or she makes sure you get the care you need to keep you healthy. He or she also may talk with other doctors and health care providers about your care and refer you to them.

Does Medicare cover assignment?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Is Medicare Advantage the same as Original Medicare?

What's covered? Note. If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain settings or for patients with certain conditions.

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.