Medicare is intended primarily to provide coverage if when someone becomes ill or injured. This includes hospitalization, doctors' services, lab work, X-rays, hospice, and just about every kind of outpatient care, as well as some inpatient nursing facility and psychiatric care.

Full Answer

What is the Medicare process and how does it work?

How does Medicare work? With Medicare, you have options in how you get your coverage. Once you enroll, you’ll need to decide how you’ll get your Medicare coverage. There are 2 main ways: Original Medicare. Original Medicare includes Medicare Part A (Hospital Insurance) and Medicare Part B (Medical Insurance). You pay for services as you get them.

How does Medicare work and what it covers?

Medicare is a federal health insurance program that provides benefits to those 65 and older and to some younger individuals with disabilities. To understand how Medicare works, it helps to explore the different types of Medicare and the coverage they provide.

What is Medicare for all and how would it work?

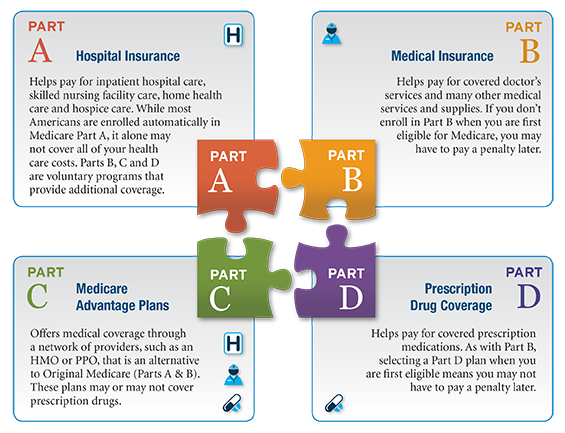

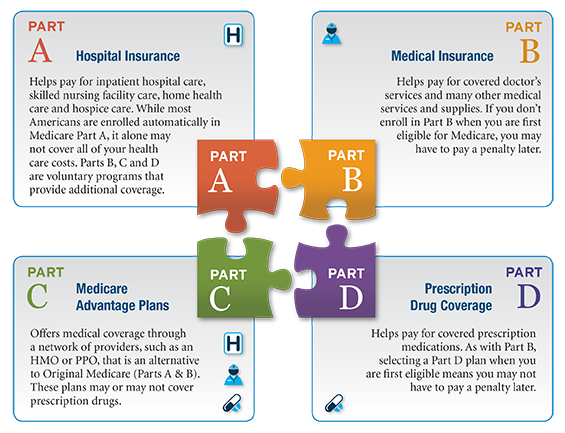

Medicare has four parts. Parts A and B are called Original Medicare. They're run by the federal government. Medicare Part C is called Medicare Advantage. You buy Medicare Advantage plans from private health insurance companies that contract with the government. They work with Original Medicare coverage. Part D covers prescription drugs.

What are facts about Medicare?

What else do I need to know about Original Medicare? You generally pay a set amount for your health care ( deductible [glossary] ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share ( coinsurance / copayment ) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket.

How does Medicare work in simple terms?

Medicare is our country's health insurance program for people age 65 or older and younger people receiving Social Security disability benefits. The program helps with the cost of health care, but it doesn't cover all medical expenses or the cost of most long-term care.Oct 24, 2019

What is Medicare and why do I pay for it?

What is Medicare? Medicare is health insurance that the United States government provides for people ages 65 and older. It also covers some people younger than 65 who have disabilities and people who have long-term (chronic) kidney failure who need dialysis or a transplant.

Do you have to pay back Medicare?

The payment is "conditional" because it must be repaid to Medicare if you get a settlement, judgment, award, or other payment later. You're responsible for making sure Medicare gets repaid from the settlement, judgment, award, or other payment.

How many years do you have to pay for Medicare?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

What are the 4 types of Medicare?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Can you have Medicare Part B without Part A?

While it is always advisable to have Part A, you can buy Medicare Part B (medical insurance) without having to buy Medicare Part A (hospital insurance) as long as you are: Age 65+ And, a U.S. citizen or a legal resident who has lived in the U.S. for at least five years.

Do I have to get Medicare Part B?

You need Part B before you can enroll in Medigap or a Medicare Advantage plan. Lastly Part B is not free unless you qualify for a Medicare Savings program due to low income. Though you must pay a premium for Part B, it provides a very significant 80% of all your outpatient expenses.Jan 2, 2021

What parts of Medicare are mandatory?

There are four parts to Medicare: A, B, C, and D. Part A is automatic and includes payments for treatment in a medical facility. Part B is automatic if you do not have other healthcare coverage, such as through an employer or spouse.

Do I automatically get Medicare when I turn 65?

You automatically get Medicare when you turn 65 Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

Is Medicare deducted from your Social Security check?

Yes. In fact, Medicare can automatically deduct your Part B premium directly from your Social Security check if you are both enrolled in Part B and collecting Social Security benefits. Most Part B beneficiaries have their premiums deducted directly from their Social Security benefits.Jan 14, 2022

Does Medicare Part A come out of your Social Security check?

Medicare Advantage and Part D premiums aren't automatically deducted from your Social Security benefits, so you'll typically receive a bill and pay the insurer directly.Feb 24, 2022

What Does Medicare Part A Cover?

Any inpatient care falls under Medicare Part A coverage . That includes:

What Does Medicare Part C Cover?

More Medicare coverage can mean more peace of mind. That's why many people choose Part C, called a Medicare Advantage plan, which you can select from private insurers like Anthem. Medicare Part C plans include Part A and Part B (Original Medicare).

What Does Medicare Part D Cover?

Original Medicare doesn't cover prescription medications. For that, you can either choose a Medicare Advantage plan that combines with Part D to include prescription drug coverage, or a standalone Part D plan that just covers prescription drugs.

Apply For The First Time: Medicare Initial Enrollment Period

Your Initial Enrollment Period is that seven-month window we just mentioned. It is your first chance to apply for Original Medicare. Try to sign up during this time to avoid penalties and delayed coverage.

Make Changes To Coverage: Medicare Annual Enrollment Period

If you already applied for Original Medicare but find you need to make changes, you can do that during the Annual Enrollment Period.

How To Apply For Medicare

Visit your local Social Security office to sign up for Medicare, or sign up with Social Security online in about 10 minutes. You may need the following documents:

What Is The Best Medicare Plan?

Choose the best Medicare plan for you by reviewing your coverage needs and budget. Compare plans to find the right fit.

How much does Medicare pay for coinsurance?

When you have Original Medicare, you pay 20 percent of the cost, or 20 percent coinsurance, for most medical services covered under Part B. Medicare Advantage plans use copays more than coinsurance. Which means you pay a fixed cost. You might have a $15 copay for doctor office visits, for example.

What is Medicare Advantage?

You buy Medicare Advantage plans from private health insurance companies that contract with the government. They work with Original Medicare coverage. Part D covers prescription drugs. Many Medicare Advantage plans combine Parts A, B and D in one plan. And each Medicare plan only covers one person.

What is Medicare Part D coverage?

Medicare Part D prescription coverage has something called the coverage gap , or donut hole. The coverage gap is a stage in which you pay much more out of pocket for your prescription drugs. It's not based on a time period.

What is the difference between Medicare Supplement and Medicare Advantage?

Medicare supplement, or Medigap, plans are another option. In a way, Medicare Advantage replaces Original Medicare and connects all the pieces together on one plan. Supplement plans don't replace Original Medicare. It's more like an extra you can add on top of Original Medicare.

Why are Medicare Advantage plans so popular?

Medicare Advantage plans are popular because of their convenience. Most plans combine medical and prescription coverage on one card. Some offer dental and vision coverage, too. And you're able to predict your out-of-pocket costs better than you can with Original Medicare.

Do Medicare supplement plans come with dental?

And supplement plans don't come with the extra benefits you often get with Medicare Advantage, like dental and vision coverage. The triangles to the right show how supplement plans sit on top of Medicare Parts A, B and D. You can get complete coverage, but you still have to coordinate all those pieces on your own.

Does Medicare have a cap?

That means once you spend a certain amount of money on health care each year, your plan pays 100 percent of the cost of services it covers. Original Medicare doesn't have this cap. So if you get really sick, you'll end up paying a lot.

What do I need to know about Medicare?

What else do I need to know about Original Medicare? 1 You generally pay a set amount for your health care (#N#deductible#N#The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay.#N#) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (#N#coinsurance#N#An amount you may be required to pay as your share of the cost for services after you pay any deductibles. Coinsurance is usually a percentage (for example, 20%).#N#/#N#copayment#N#An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage. For example, you might pay $10 or $20 for a doctor's visit or prescription drug.#N#) for covered services and supplies. There's no yearly limit for what you pay out-of-pocket. 2 You usually pay a monthly premium for Part B. 3 You generally don't need to file Medicare claims. The law requires providers and suppliers to file your claims for the covered services and supplies you get. Providers include doctors, hospitals, skilled nursing facilities, and home health agencies.

What is Medicare Advantage?

Medicare Advantage Plans may also offer prescription drug coverage that follows the same rules as Medicare drug plans. .

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. ) before Medicare pays its share. Then, Medicare pays its share, and you pay your share (. coinsurance.

What is a referral in health care?

referral. A written order from your primary care doctor for you to see a specialist or get certain medical services. In many Health Maintenance Organizations (HMOs), you need to get a referral before you can get medical care from anyone except your primary care doctor.

What is a coinsurance percentage?

Coinsurance is usually a percentage (for example, 20%). An amount you may be required to pay as your share of the cost for a medical service or supply, like a doctor's visit, hospital outpatient visit, or prescription drug. A copayment is usually a set amount, rather than a percentage.

Do you have to choose a primary care doctor for Medicare?

No, in Original Medicare you don't need to choose a. primary care doctor. The doctor you see first for most health problems. He or she makes sure you get the care you need to keep you healthy. He or she also may talk with other doctors and health care providers about your care and refer you to them.

Does Medicare cover assignment?

The type of health care you need and how often you need it. Whether you choose to get services or supplies Medicare doesn't cover. If you do, you pay all the costs unless you have other insurance that covers it.

What is Medicare Supplement Insurance?

If you decide to enroll in Original Medicare, consider buying a Medigap plan also known as Medicare Supplement Insurance. Private insurers offer these insurance plans and they are designed to cover costs that Medicare does not, such as copayments and deductibles.

What is Medicare Part D?

Medicare Part D helps cover the costs of prescription drugs. If you’re enrolled in Medicare Part A or Part B, you may enroll in Part D to supplement your coverage. These plans will help you pay for prescription medications not covered by Medicare Part A or Part B.

How much is Medicare Part B deductible in 2021?

The annual deductible for Medicare Part B is $203 in 2021. After reaching your deductible, you’ll pay 20% of the amount approved by Medicare for doctor services, outpatient therapy and durable medical equipment. Source: Medicare.gov.

How much does Medicare pay for a month?

If you paid between 30 and 39 quarters (9.75 years) of Medicare taxes, you’ll pay $259 per month. You’ll have a $1,484 deductible ...

How many people are covered by Medicare?

The program is administered by the Centers for Medicare & Medicaid Services and covers some 64 million people. Understanding how Medicare works is essential. Medicare is not to be confused with Medicaid, the medical coverage program for low-income Americans that’s run by ...

What happens if you are over 65 and have health insurance?

If you are over 65 and have qualifying health insurance through your job, you might have a bigger enrollment window. Talk to your employer’s benefits administrator to make sure you understand how your job coverage interacts with Medicare.

When is Medicare open enrollment?

Medicare’s open enrollment period runs every year between Oct. 15th and Dec. 7th. During this time, beneficiaries can pick a new Medicare Part D drug plan, a new Medicare Advantage plan, or switch from Original Medicare into a Medicare Advantage plan or vice versa.

How much is coinsurance for a hospital stay?

For example, Part A pays for the first 60 days of hospital care after you've fulfilled the deductible, but during days 61 to 90 of a hospital stay you'll have a $329 per day coinsurance in 2017 and $335 in 2018.

How much is deductible for hospital care?

For example, under Part A, hospital care has a deductible of $1,316 in 2017 for each "benefit period," which starts the day you're admitted to the hospital and ends when you haven't gotten any hospital care for 60 days in a row. That number will go up to $1,340 in 2018.

How many people need long term care?

Given that around 70% of Americans will need long-term care at some point, it just makes sense to prepare for these expenses. And if you've got both a long-term care insurance policy and Medicare covering your back, you should have a much easier time sleeping at night. The Motley Fool has a disclosure policy. Prev.

How many days does Part A cover?

Even then, Part A will only cover the first 100 days of your stay in a skilled nursing facility -- and you'll have coinsurance fees to pay for days 21 through 100.

Does Medicare have a deductible?

Original Medicare, which includes both Part A and Part B, has both deductibles and coinsurance charges. A deductible is the amount you must pay in qualified healthcare expenses before your insurance coverage will kick in and start paying for these expenses. Different types of healthcare expenses can have different deductible requirements.

Is Medicare Part A free?

Medicare Part A is free for nearly everyone who qualifies for Social Security benefits. You'll get Part A at no charge if you or your spouse has at least 40 calendar quarters of paying Medicare taxes on your work record. That will almost certainly be the case if you've paid the 40 quarters of Social Security taxes needed to qualify for Social Security benefits .

Is Medicare Part A the same as Original Medicare?

Medicare Part A is one of the two types of Original Medicare. Since nearly all retirees have this coverage, it's important to understand how it works. Wendy Connick. (imwconn) Nov 22, 2017 at 7:02AM. Once you turn 65, you're eligible for Medicare.

What percentage of Americans support Medicare for All?

A Kaiser Family Foundation tracking poll published in November 2019 shows public perception of Medicare for All shifts depending on what detail they hear. For instance 53 percent of adults overall support Medicare for All and 65 percent support a public option. Among Democrats, specifically, 88 percent support a public option while 77 percent want ...

What would happen if we eliminated all private insurance and gave everyone a Medicare card?

“If we literally eliminate all private insurance and give everyone a Medicare card, it would probably be implemented by age groups ,” Weil said.

What is single payer healthcare?

Single-payer is an umbrella term for multiple approaches.

What is the idea of Medicare for All?

Ask someone what they think about the idea of “Medicare for All” — that is, one national health insurance plan for all Americans — and you’ll likely hear one of two opinions: One , that it sounds great and could potentially fix the country’s broken healthcare system.

How many people in the US are without health insurance?

The number of Americans without health insurance also increased in 2018 to 27.5 million people, according to a report issued in September by the U.S. Census Bureau. This is the first increase in uninsured people since the ACA took effect in 2013.

Does Jayapal bill cover out of pocket costs?

The Jayapal bill fully prohibits all cost-sharing. The Sanders bill allows for very limited out-of-pocket costs of up to $200 per year for prescription drugs, but that doesn’t apply to individuals or families with an income under 200 percent of the federal poverty level.

Is Medicare for All funded by the government?

In Jayapal’s bill, for instance, Medicare for All would be funded by the federal government, using money that otherwise would go to Medicare, Medicaid, and other federal programs that pay for health services. But when you get right down to it, the funding for all the plans comes down to taxes.

How does Medicare work with insurance carriers?

Generally, a Medicare recipient’s health care providers and health insurance carriers work together to coordinate benefits and coverage rules with Medicare. However, it’s important to understand when Medicare acts as the secondary payer if there are choices made on your part that can change how this coordination happens.

What is secondary payer?

A secondary payer assumes coverage of whatever amount remains after the primary payer has satisfied its portion of the benefit, up to any limit established by the policies of the secondary payer coverage terms.

How old do you have to be to be covered by a group health plan?

Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization that shares a plan with other employers with more than 20 employees between them.

Does Medicare pay conditional payments?

In any situation where a primary payer does not pay the portion of the claim associated with that coverage, Medicare may make a conditional payment to cover the portion of a claim owed by the primary payer. Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment.

Is Medicare a secondary payer?

Medicare is the secondary payer if the recipient is: Over the age of 65 and covered by an employment-related group health plan as a current employee or the spouse of a current employee in an organization with more than 20 employees.

Who is responsible for making sure their primary payer reimburses Medicare?

Medicare recipients may be responsible for making sure their primary payer reimburses Medicare for that payment. Medicare recipients are also responsible for responding to any claims communications from Medicare in order to ensure their coordination of benefits proceeds seamlessly.

Is ESRD covered by COBRA?

Diagnosed with End-Stage Renal Disease (ESRD) and covered by a group health plan or COBRA plan; Medicare becomes the primary payer after a 30-day coordination period. Receiving coverage through a No-Fault or Liability Insurance plan for care related to the accident or circumstances involving that coverage claim.