When should you enroll in Medicare Part D?

You’re eligible to enroll in a Part D plan if you receive Medicare upon turning 65. You’re also able to enroll if you sign up for Medicare due to a disability. If you delay getting Part D coverage for a while because you already had a group health plan that covered prescription drugs, you can apply for Part D when your existing coverage ends.

What drugs are excluded from Part D plans?

What drugs are excluded from Part D plans? There are many drugs that no Medicare plans will cover under the Part D benefit, based on national Medicare guidelines. Drugs for anorexia, weight loss, or weight gain (i.e., Xenical®, Meridia, phentermine HCl, etc.) Drugs that promote fertility (i.e., Clomid, Gonal-f, Ovidrel®, Follistim®, etc.)

What is covered by Medicare Part D?

QUINCY (WGEM) - For those of you with a Medicare D plan, a list of vaccines is now covered for you in Adams County. Starting on Monday, the Adams County Health Department will begin offering vaccines for Shingles, Tetanus, Hepatitis A and B, and more.

What is the average cost of Medicare Part D?

So how much does Medicare Part D cost? According to the Centers for Medicare & Medicaid Services (CMS), the average cost of a Medicare Part D plan in 2022 will be approximately $33 per month. That represents a 4.9% increase from the 2021 average of $31.47 per month.

When should I sign up for Part D coverage?

If you don't have creditable prescription drug coverage, the best time to sign up for a Part D plan is during the seven-month initial enrollment period surrounding your 65th birthday — even if you don't take any daily prescriptions now.

Do you automatically get Part D with Medicare?

Enrollment in Medicare Part D plans is voluntary, except for beneficiaries who are eligible for both Medicare and Medicaid and certain other low-income beneficiaries who are automatically enrolled in a PDP if they do not choose a plan on their own.

Is it too late to add Part D to Medicare?

You must do this within 60 days from the date on the letter telling you that you owe a late enrollment penalty. Also send any proof that supports your case, like a copy of your notice of creditable prescription drug coverage from an employer or union plan.

Can you enroll in Medicare Part D at any time?

Keep in mind, you can enroll only during certain times: Initial enrollment period, the seven-month period that begins on the first day of the month three months before the month you turn 65 and lasts for three months after the birthday month.

What happens if I don't have Medicare Part D?

If you don't sign up for a Part D plan when you are first eligible to do so, and you decide later you want to sign up, you will be required to pay a late enrollment penalty equal to 1% of the national average premium amount for every month you didn't have coverage as good as the standard Part D benefit.

What is the deductible for Medicare Part D in 2022?

$480The initial deductible will increase by $35 to $480 in 2022. After you meet the deductible, you pay 25% of covered costs up to the initial coverage limit. Some plans may offer a $0 deductible for lower cost (Tier 1 and Tier 2) drugs.

Does Part D penalty go away when you turn 65?

In most cases, you will have to pay that penalty every month for as long as you have Medicare. If you are enrolled in Medicare because of a disability and currently pay a premium penalty, once you turn 65 you will no longer have to pay the penalty.

Is Medicare Part D deducted from Social Security?

If you are getting Medicare Part C (additional health coverage through a private insurer) or Part D (prescriptions), you have the option to have the premium deducted from your Social Security benefit or to pay the plan provider directly.

How do I avoid Part D Penalty?

3 ways to avoid the Part D late enrollment penaltyEnroll in Medicare drug coverage when you're first eligible. ... Enroll in Medicare drug coverage if you lose other creditable coverage. ... Keep records showing when you had other creditable drug coverage, and tell your plan when they ask about it.

Do I need Part B for Part D?

Part D is the outpatient prescription drug benefit for anyone with Medicare. You must have either Part A or Part B to be eligible for Part D. Part D is only available through private companies.

How long does it take to enroll in Part D?

This includes three months prior to your 65th birthday, the month of your birthday and then three months after your 65th birthday. Failing to enroll within this time period, also known as the initial enrollment period, means that you may face a late enrollment penalty if you choose to add Part D coverage at a later date.

Why is Medicare important?

Enrolling in Medicare is an important step for many people in protecting their health and their finances as they age. The Medicare program assists millions of seniors and certain individuals with qualifying disabilities, and without Medicare, some Americans would struggle to afford the cost of healthcare and related expenses.

When is the best time to sign up for Part D?

If you don’t have creditable drug coverage or health insurance from a current employer, the best time to sign up for Part D is during your 7-month initial enrollment period (IEP) to avoid penalties. Under your IEP, you have a 7-month window that opens 3 months before you turn 65 and closes at the end of the 3rd month following your birthday month.

What do you need to know before enrolling in a Part D plan?

The most important preparation you can do before finding a Part D plan is recording information about your medications.

How long does an open enrollment period last?

Typically a SEP lasts for 63 days.

How does dosage affect Part D?

Your dosage can affect your final cost or enact certain plan restrictions depending on the Part D plan. The frequency of the medication. The number of pills you take also affects the cost, so double check how often you take your medication and write it down. Once you have these recorded, you’ll be able to compare plans, apples-to-apples.

Is Medicare Part D a good program?

Although Medicare is not without its faults, one thing is clear: Medicare Part D has been a successful program. With nearly 70% of all beneficiaries enrolled in Part D, this optional add-on to Original Medicare is a popular way to lower drug costs. 1. But before diving into the deep end of Part D plans, you’ll want to perform due diligence ...

When does Part D start?

Your IEP runs from February 1 to August 31. The date when your Part D coverage begins depends on when you sign up: Enrolling during the first three months of the IEP means coverage begins the first day of the fourth month.

What happens if you turn 65 and have Medicare?

Are eligible for Extra Help. Note: If you are enrolled in Medicare because of a disability and currently pay a premium penalty, once you turn 65 you will no longer have to pay the penalty.

How long does an IEP last?

Your Part D IEP is usually the same as your Medicare IEP: the seven-month period that includes the three months before, the month of , and the three months following your 65th birthday. For example, let’s say you turn 65 in May. Your IEP runs from February 1 to August 31.

How Do I Sign up for Medicare Part D?

Medicare Part D plans are sold by private insurance companies, and plan availability and benefits can vary based on where you live.

When Can I Sign Up for Medicare Part D?

There are three times during which you may be able to sign up for a Medicare Part D plan .

Who Is Eligible for Medicare Part D?

Before enrolling in a Medicare Part D plan, you should check to make sure you are eligible.

How Much Does It Cost for Medicare Part D?

According to data from the Centers for Medicare & Medicaid Services (CMS), the average premium for a standalone Medicare Part D plan (PDP) in 2022 is $48 per month. 1

How do I Apply for Medicare Extra Help?

Some beneficiaries with limited financial resources may qualify for the Medicare Extra Help program. This program helps PDP enrollees pay for their plan premiums, coinsurance, deductibles and prescription costs.

How Else Can You Get Drug Coverage Through Medicare?

A Part D plan is not the only way to secure Medicare coverage for prescription drugs.

Can I Sign Up for Medicare Part D and a Medicare Supplement Plan?

You can have both a Medicare Part D prescription drug plan and a Medicare Supplement Insurance (Medigap) plan at the same time.

Medicare Part D: The Basics

Medicare eligibility begins at 65. Most older adults approaching 65 feel overwhelmed when it comes to signing up for Medicare coverage. Learning about enrollment periods, the parts of Medicare, and plan options can be stressful.

What is Medicare Part D?

Before we discuss when to enroll in Medicare Part D, it’s important to first understand what Medicare Part D is. Medicare Part D is the part of Medicare that helps Medicare beneficiaries pay for some or all of their prescription drug costs. Part D plans are offered by private insurance companies as stand-alone prescription drug plans.

Who can Enroll in Medicare Part D?

A Medicare Part D plan is available to anyone who is eligible for Medicare. However, you must be enrolled in Original Medicare (Part A and Part B) or a Medicare Advantage plan to enroll in a Part D prescription drug plan. It is important to note, enrolling in Original Medicare does not automatically enroll you in a prescription drug plan.

Medicare Part D Enrollment Periods

There are a few specific enrollment periods to be aware of when signing up for a Medicare Part D plan:

How to Enroll in Medicare Part D

Enrolling in Medicare Part D is simple. However, before you begin the enrollment process it’s important to shop and compare plans to ensure you receive the right coverage for your needs. Here are some questions to consider before enrolling in a Part D plan

Appealing a Late Enrollment Penalty

Medicare Part D enrollees have the right to appeal a decision they believe to be wrong about a late enrollment penalty. Common reasons individuals appeal a decision include

Medicare Part D Enrollment FAQs

Should I enroll in Medicare Part D if I don’t currently take any medications?

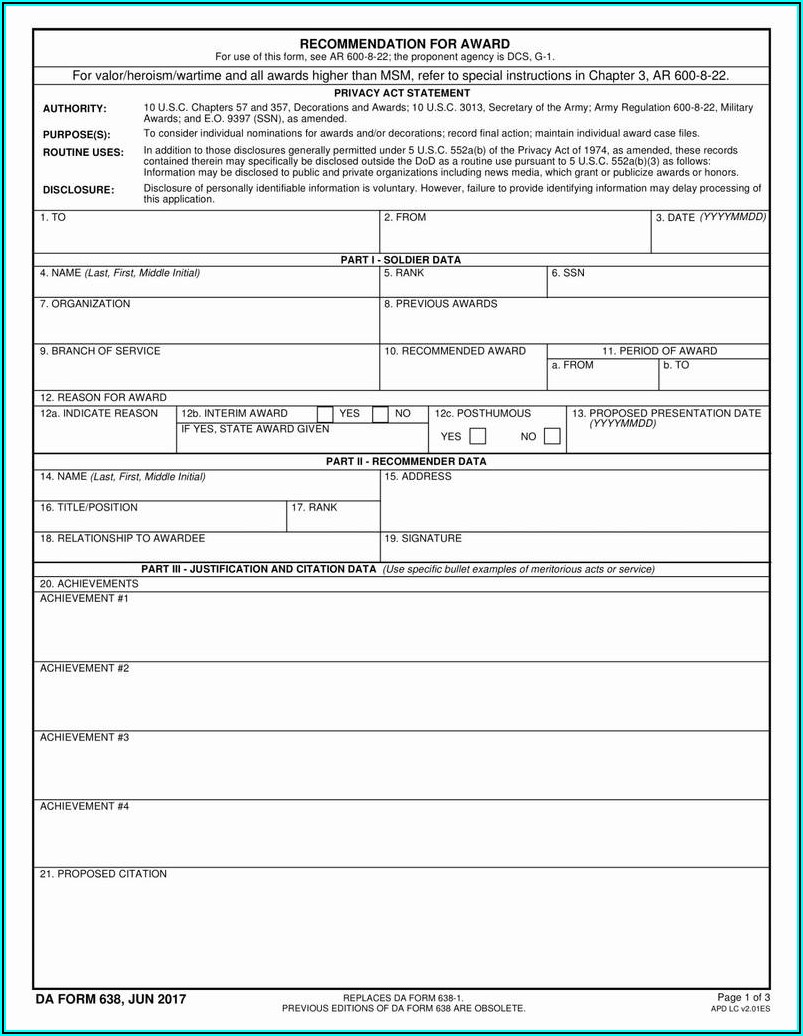

How to enroll in Medicare?

Enroll on the Medicare Plan Finder or on the plan's website. Complete a paper enrollment form. Call the plan. Call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. When you join a Medicare drug plan, you'll give your Medicare Number and the date your Part A and/or Part B coverage started.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What are the different types of Medicare plans?

You can only join a separate Medicare drug plan without losing your current health coverage when you’re in a: 1 Private Fee-for-Service Plan 2 Medical Savings Account Plan 3 Cost Plan 4 Certain employer-sponsored Medicare health plans

What happens if you don't get prescription drug coverage?

If you decide not to get it when you’re first eligible, and you don’t have other creditable prescription drug coverage (like drug coverage from an employer or union) or get Extra Help, you’ll likely pay a late enrollment penalty if you join a plan later.

What is a PACE plan?

Programs of All-inclusive Care for the Elderly (PACE) organizations are special types of Medicare health plans. PACE plans can be offered by public or private companies and provide Part D and other benefits in addition to Part A and Part B benefits. with drug coverage.

Is Medicare paid for by Original Medicare?

Medicare services aren’t paid for by Original Medicare. Most Medicare Advantage Plans offer prescription drug coverage. or other. Medicare Health Plan. Generally, a plan offered by a private company that contracts with Medicare to provide Part A and Part B benefits to people with Medicare who enroll in the plan.

Do you have to have Part A and Part B to get Medicare?

You get all of your Part A, Part B, and drug coverage, through these plans. Remember, you must have Part A and Part B to join a Medicare Advantage Plan , and not all of these plans offer drug coverage. Visit Medicare.gov/plan-compare to get specific Medicare drug plan and Medicare Advantage Plan costs, and call the plans you’re interested in ...

Check when to sign up

Answer a few questions to find out when you can sign up for Part A and Part B based on your situation.

When coverage starts

The date your Part A and Part B coverage will start depends on when you sign up.