Some of the costs of an urgent care visit that's covered by Medicare can be paid for by a Medicare Supplement

Medigap

Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …

Full Answer

Does Medicare supplement insurance cover emergency room costs?

If you're worried about a trip to the emergency room adding expensive and unpredictable costs to your health care budget, consider joining a Medicare Supplement Insurance (or Medigap) Plan. Medigap is private health insurance that Medicare beneficiaries can buy to cover costs that Medicare doesn't, including some copays.

How does Medicare supplement insurance work with Medicare?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people new to Medicare can no longer cover the Part B deductible.

What does a Medigap plan cover?

If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles). What Are the Costs for Medicare Supplement Plans?

Do Medicare Advantage plans cover emergency room visits?

Since Advantage plans are required to cover the same costs as Original Medicare, they also cover emergency room visits. The only difference between Advantage plans and Original Medicare is your out-of-pocket costs are different and less predictable.

Does Medicare Supplement cover emergency room visits?

Yes, Medicare covers emergency room visits for injuries, sudden illnesses or an illness that gets worse quickly. Specifically, Medicare Part B will cover ER visits.

What is the difference between Supplemental plan F and plan G?

The main difference between the two plans is how Plan G interacts with the Part B deductible. With Plan F, the Medicare Supplement plan pays for the Part B deductible. Under Plan G, you are responsible for the Part B deductible only. Otherwise, all Part A deductibles, copays, and coinsurance are covered.

What is the difference between plan G and plan G extra?

Medicare Supplement Plan G Extra offers all of Plan G's coverage with five additional benefits. Plan G Extra provides members with up to $100 off of CVS Health over-the-counter products each quarter. Eligible items include cold and allergy medicines, first-aid products, and pain relievers.

What is plan G coverage?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

Should I switch from Medicare F to G?

When it comes to coverage, Medicare Supplement Plan F will give you the most coverage since it's a first-dollar coverage plan and leaves you with zero out-of-pocket costs. However, when it comes to the monthly premium, if you think lower is better, then Medicare Supplement Plan G may be better for you.

Why was Medigap plan F discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the deductible for plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses. Medicare Supplement Insurance plans are sold by private insurance companies.

Does Medicare Plan G have a deductible?

However, Plan G does not have its own deductible separate from the Part B deductible. There is also a High Deductible Plan G which has a deductible of $2,490 in 2022.

What is plan F Medicare Supplement?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

What is the difference between plan G and plan N?

This is where the differences between Plan G and N start. Plan G covers 100% of all Medicare-covered expenses once your Part B deductible has been met for the year. Medicare Plan N coverage, on the other hand, has a few additional out-of-pocket expenses you will have to pay, which we'll cover next.

Is Medigap plan G the best plan?

Medicare Plan G is currently the most comprehensive Medicare Supplement plan in terms of the coverage it offers. If you desire stability and knowing what to expect from your health care costs (and if you can afford the premium), Medicare Plan G may be the best option for you.

What is Medicare Supplement?

Medicare Supplement insurance plans are private insurance plans that are offered to help bridge the gap between the coverage you need and what is offered through Medicare. While Medicare pays for a large percentage of the healthcare services and supplies you may need, it does not offer complete coverage, so Medicare Supplement insurance plans can ...

How does Medicare Supplement insurance work?

A Medicare Supplement insurance plan will have a monthly premium cost that you pay to the private insurance company that you purchased the plan through. You’ll pay your monthly Medigap policy premium separately of any Medicare premiums. Costs can vary widely for Medicare Supplement plans because they are offered through private insurance companies, ...

What happens when you buy a Medicare Supplement?

When you purchase a Medicare Supplement insurance plan, your Medigap policy will serve as a secondary source of insurance. That means that Medicare will be used first to pay for any Medicare-approved costs for any healthcare supplies and services. After Medicare has been applied, then your Medigap policy will be charged.

Why is Medicare Supplement Insurance called Medigap?

Medicare Supplement insurance plans are often referred to as Medigap policies, because they can help fill the gap between Medicare and healthcare needs. Many people use Medigap policies to help cover the costs of associated healthcare expenses, such as coinsurance payments, copays and deductibles.

How much does Medigap pay for emergency care?

Additionally, the Medigap policy will only pay 80% of the billed charges for eligible medically-necessary emergency care providing you pay your $250 year ly deductible. Additionally, the $250 deductible for foreign travel coverage is a separate deductible from any regular deductible that your plan stipulates.

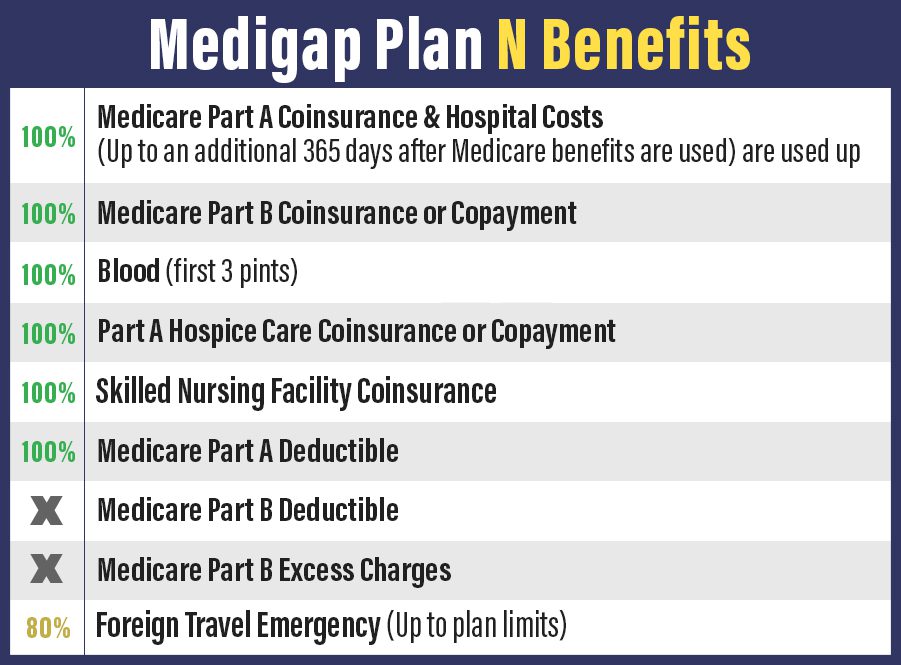

How long after Medicare benefits are used up can you get a coinsurance?

Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. Part B coinsurance or copayment. The first three pints of blood. Part A hospice care coinsurance or copayment. Skilled nursing facility care coinsurance. Part A deductible.

What states have Medigap?

Medigap policies differ if you live in Wisconsin, Massachusetts or Minnesota. These states standardize their Medigap policies in a different way than the other states, including policies on basic and extended care plans.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like: Note: Medigap plans sold to people who are newly eligible for Medicare aren’t allowed to cover the Part B deductible.

What does Part B cover?

Part B typically covers emergency services when you have an injury, a sudden illness, or illnesses that get significantly worse in a short period of time. This will also cover your physician follow-up appointments after receiving treatment from the emergency room or urgent care center.

Does Part A cover all expenses?

As stated above, Part A doesn’t cover all your costs in the emergency room. You’ll have to pay the deductible before your coverage kicks in. After you met the deductible, Part A will cover 100% of the costs for 60 days. After 60 days, you’ll have coinsurance to pay for each day you stay in the hospital.

Does Medicare Advantage cover emergency room visits?

Does Medicare Advantage Cover the Costs of an Emergency Room Visit? Since Advantage plans are required to cover the same costs as Original Medicare, they also cover emergency room visits. The only difference between Advantage plans and Original Medicare is your out of pocket costs are different and less predictable.

Do you have to pay for copay for emergency room?

Tip: If you happen to be admitted into the hospital within three days of your emergency room visit, your visit will be considered as part of your inpatient stay. You won’t have to pay the copayment for the emergency room.

Does Medigap cover coinsurance?

Medigap plans will cover any services that Original Medicare covers. Medigap plans cover the gaps in coverage with Medicare. Depending on the letter plan you choose, your Part A deductible and all cost-sharing could be covered at 100%. This includes coverage for any coinsurance for hospital stays after 60 days.

What is Medicare Advantage Plan?

Medicare Advantage Plan (Part C) A type of Medicare health plan offered by a private company that contracts with Medicare. Medicare Advantage Plans provide all of your Part A and Part B benefits, excluding hospice. Medicare Advantage Plans include: Health Maintenance Organizations. Preferred Provider Organizations.

What is the original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). (Part A and Part B) or a.

What happens if you don't get Medicare?

If you don't get Medicare drug coverage or Medigap when you're first eligible, you may have to pay more to get this coverage later. This could mean you’ll have a lifetime premium penalty for your Medicare drug coverage . Learn more about how Original Medicare works.

How much does Medicare pay for Part B?

For Part B-covered services, you usually pay 20% of the Medicare-approved amount after you meet your deductible. This is called your coinsurance. You pay a premium (monthly payment) for Part B. If you choose to join a Medicare drug plan (Part D), you’ll pay that premium separately.

Does Medicare Advantage cover prescriptions?

Most Medicare Advantage Plans offer prescription drug coverage. . Some people need to get additional coverage , like Medicare drug coverage or Medicare Supplement Insurance (Medigap). Use this information to help you compare your coverage options and decide what coverage is right for you.

What is the most popular Medicare Supplement?

Medigap Plan F is the most popular Medicare Supplement Insurance plan . 53 percent of all Medigap beneficiaries are enrolled in Plan F. 2. Plan F covers more standardized out-of-pocket Medicare costs than any other Medigap plan. In fact, Plan F covers all 9 of the standardized Medigap benefits a plan may offer.

How to compare Medicare Supplement Plans 2021?

How to Compare Medicare Supplement Plans. You can use the 2021 Medigap plan chart below to compare the benefits that are offered by each type of plan. Use the scroll bar at the bottom of the chart to view all plans and information. Click here to view enlarged chart. Scroll to the right to continue reading the chart. Scroll for more.

How much is the Medicare Part B deductible for 2021?

In 2021, the Part B deductible is $203 per year. Medicare Part B coinsurance or copayment. After you meet your Part B deductible, you are typically required to pay a coinsurance or copay of 20 percent of the Medicare-approved amount for your covered services.

What is the second most popular Medicare plan?

Medigap Plan G is the second most popular Medigap plan, and it is quickly growing in popularity. Plan G enrollment spiked 39 percent in recent years. 2. Medigap Plan G covers all of the same out-of-pocket Medicare costs than Plan F covers, except for the Medicare Part B deductible.

What are the benefits of Medigap?

Here are some key facts about Medicare Supplement Insurance: 1 Medigap insurance doesn't typically offer any additional benefits. Instead, it picks up the out-of-pocket costs associated with Medicare. 2 Medigap insurance is accepted by any doctor, hospital or health care provider who accepts Medicare. 3 If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

How much coinsurance is required for skilled nursing?

There is no coinsurance requirement for the first 20 days of inpatient skilled nursing facility care. However, a $185.50 per day coinsurance requirement begins on day 21 of your stay, and you are then responsible for all costs after day 101 of inpatient skilled nursing facility care (in 2021).

How much does Medicare Part A cover?

Medicare Part A helps cover your hospital costs if you are admitted to a hospital for inpatient treatment (after you reach your Medicare Part A deductible, which is $1,484 per benefit period in 2021). For the first 60 days of your hospital stay, you aren't required to pay any Part A coinsurance.

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What percentage of Medicare Part B is paid for doctor services?

In addition to these copays, you will pay a coinsurance for doctor services you receive in the ER. Medicare Part B typically pays 80 percent of the Medicare-approved amount for doctor services, and you are responsible for the remaining 20 percent of the cost. The Part B deductible also applies.

Do you pay copays for ER visits?

For example, you may pay copays or coinsurance for an ER visit and for services you receive while in the ER. Some plans also have deductibles. It’s important to check each plan’s details for information about coverage for ER visits.

Does Medicare Advantage cover out of network providers?

So, though Medicare Advantage plans typically have provider networks, they must cover emergency care from both network and out-of-network providers. In other words, Medicare Advantage plans cover ER visits anywhere in the U.S. Each Medicare Advantage plan sets its own cost terms for ER visits and other covered services.

Can ER copays change?

If an ER visit results in being you admitted to the hospital, then the visit is considered part of an inpatient stay and ER-related copays would not apply.

Does Medicare cover ER visits?

Yes, Medicare covers emergency room visits for injuries, sudden illnesses or an illness that gets worse quickly. Specifically, Medicare Part B will cover ER visits. And, since emergencies may occur anytime and anywhere, Medicare coverage for ER visits applies to any ER or hospital in the country. Note though, Medicare only covers emergency services ...