Can beneficiaries with Original Medicare purchase Medigap coverage?

The policies that help cover those extra costs are called Medicare Supplemental Insurance, but are often referred to as Medigap plans because they cover the “gaps” in Medicare coverage. Medigap’s purpose is to help Medicare beneficiaries pay the extra out of pocket costs for health services that are not covered under Medicare.

What do you need to know about Medicare Medigap insurance?

Most types of health coverage offer this “creditable coverage,” including employee or union group health insurance, retiree health insurance, Medicare Parts A and B and Medicaid (Title 19). For Medigap purposes, creditable coverage is conferred for the number of months an individual was covered by another Medigap policy or was enrolled in a Medicare HMO.

What is Medicare supplemental insurance (Medigap)?

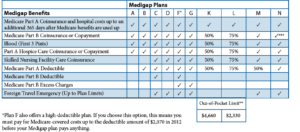

Compare Medigap plans side-by-side. The chart below shows basic information about the different benefits Medigap policies cover. Yes = the plan covers 100% of this benefit. No = the policy doesn't cover that benefit. % = the plan covers that percentage of this benefit. N/A = not applicable. The Medigap policy covers. coinsurance.

Are Medigap plans A and B the same as Medicare Parts a?

Medigap, also known as Medicare Supplemental Insurance, was designed to provide beneficiaries with coverage of expenses that are only partially, or not at all, covered under Medicare Part A and Part B coverage. Medigap plans exist to help individuals with Original Medicare coverage pay for premiums associated with Medicare Part B as well as copayments, …

Who is Medigap coverage offered by?

What is Medigap insurance Medigap insurance is provided by quizlet?

What relationship does Medigap insurance have to Medicare?

What is Medigap healthcare?

What is the purpose of Medigap insurance quizlet?

How many Medigap plans are available quizlet?

What is the difference between Medigap and Medicare?

Does Medigap cover Part D?

Is Medicare Part B the same as Medigap?

Does Medigap cover Part B premium?

Is Medigap and supplemental insurance the same?

What is Medigap plan G?

Does Medicare cover Medigap?

Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover. If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs.

What is the difference between Medigap and Medicare?

Generally, the only difference between Medigap policies sold by different insurance companies is the cost. You and your spouse must buy separate Medigap policies.Your Medigap policy won't cover any health care costs for your spouse. Some Medigap policies also cover other extra benefits that aren't covered by Medicare.

Can insurance companies sell standardized Medicare?

Insurance companies can only sell you a “standardized” Medigap policy. Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.”. It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that ...

Do you have to pay Medicare Part B?

You will have to pay the monthly Medica re Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year.

What is the next major consideration in selecting a Medigap policy?

The next major consideration in selecting a Medigap policy is cost. A person must be able to afford the particular policy he or she desires. There is a great deal of price difference from policy to policy.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance, also known as “Medigap” insurance, provides supplemental health insurance coverage for Medicare beneficiaries. Individuals in traditional Medicare may want to obtain Medicare Supplement (“Medigap”) insurance because Medicare often covers less than the total cost of the beneficiary’s health care.

What is Medicare Part B?

Medicare Part B Gaps. Medicare Part B (also known as Supplementary Medicare Insurance) provides coverage for a variety of outpatient and physician services. It also pays for durable medical equipment, prosthetic devices, supplies incident to physician’s services, and ambulance transportation.

What is QMB in Medicare?

People who do not qualify for Medicaid but are within 100% of the federal poverty level are eligible for coverage under a program known as the Qualified Medicare Beneficiary Program (QMB) . QMB program benefits include: Payment of Medicare premiums. Payment of Medicare annual deductibles.

How long is skilled nursing?

Skilled nursing facility services beyond 100 days per spell of illness; Home health aide services that are provided on more than a part-time or intermittent basis; Home health nursing and aide services when there is no longer a skilled care component;

How old do you have to be to get a Medigap policy?

This right only applies to Medicare beneficiaries who are 65 years of age or older. Insurance companies are not required by federal law to offer the same range of Medigap policies to Medicare beneficiaries with disabilities that they offer for sale to Medicare beneficiaries over age 65.

What is a pre-existing condition exclusion?

A pre-existing condition exclusion means that health insurance may not cover the costs incurred as a result of a medical condition a person had prior to obtaining the health insurance coverage. The ability of insurance companies to impose pre-existing condition exclusions has been severely constricted since the enactment of a federal law called “HIPAA.” Under HIPAA, if an individual had health insurance coverage for a period of at least 6 months prior to their initial open enrollment period for Medicare, no pre-existing condition exclusion may be imposed. Most types of health coverage offer this “creditable coverage,” including employee or union group health insurance, retiree health insurance, Medicare Parts A and B and Medicaid (Title 19).

Does Medigap cover Medicare Supplement?

Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance.". Insurance companies can sell you only a "standardized" policy identified in most states by letters. All policies offer the same basic. benefits.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

How many Medigap plans are there?

There are 12 Medigap plans, lettered A-N. Each lettered plan covers the core policy benefits. Depending on the letter plan you enroll in, you will have coverage for out-of-pocket medical costs such as deductible, copays, and coinsurance.

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare. You can also find her over on our Medicare Channel on YouTube as well as contributing to our Medicare Community on Facebook.

Key takeaways

Currently, no federal legislation guarantees enrollment in Medigap for under-65 beneficiaries.

Efforts to guarantee access to Medigap vary by state

States, meanwhile can create their own rules to ensure that disabled Medicare beneficiaries under age 65 are able to enroll in supplemental coverage, and the majority of the states have done so.

Four states have no provisions – and no plans – geared to the under-65 population

These states have not enacted any provisions to ensure access to supplemental coverage for Medicare beneficiaries who are under age 65, and there do not appear to be any guaranteed-issue plans available for this population:

13 states and DC have no coverage requirement for insurers, but some coverage is available

These states do not have regulations requiring Medigap insurers to offer plans to Medicare beneficiaries under the age of 65.

10 states require insurers to offer at least one Medigap plan to those under age 65

In these states, insurers are required to offer some – but not all – of their Medigap plans to people under 65. State regulations vary in terms of the specific plans that have to be offered and whether the insurer can charge higher premiums for under-65 enrollees:

11 states make all plans guaranteed-issue, but under-65 premiums can be much higher

These states require Medigap insurers to offer all of their plans to any newly-eligible Medicare beneficiary, regardless of age. But insurers are allowed to charge significantly higher premiums when an enrollee is under age 65:

12 states make all plans guaranteed-issue, include restrictions on premiums

In these states, Medigap insurers have to make all of their plans available to all newly-eligible Medicare beneficiaries, regardless of age. And there are rating restrictions that either prevent insurers from charging higher premiums for enrollees under age 65, or limit the additional premiums that can apply to this population: