Will Medicare supplement pay if Medicare denies?

If you have a medical service that's not Medicare-approved, a Medicare Supplement insurance plan generally won't cover it. For example, Medicare Supplement plans generally cover Medicare Part A coinsurance/copayments for inpatient hospital stays.

Can Medigap insurance be denied?

The answer is yes, you can be denied Medigap coverage. But you can also be guaranteed Medigap coverage if you apply during your Medigap open enrollment period.

Does Medigap only work with Original Medicare?

You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

What if Medicare denies a claim?

An appeal is the action you can take if you disagree with a coverage or payment decision by Medicare or your Medicare plan. For example, you can appeal if Medicare or your plan denies: A request for a health care service, supply, item, or drug you think Medicare should cover.

Can you switch from Medicare Advantage to Medigap?

You may have chosen Medicare Advantage and later decided that you'd rather have the protections of a Medicare Supplement (Medigap) insurance plan that go along with Original Medicare. The good news is that you can switch from Medicare Advantage to Medigap, as long as you meet certain requirements.

Can Medicare supplement plans deny coverage for preexisting conditions?

A Medicare Supplement insurance plan may not deny coverage because of a pre-existing condition. However, a Medicare Supplement plan may deny you coverage for being under 65. A health problem you had diagnosed or treated before enrolling in a Medicare Supplement plan is a pre-existing condition.

Are Medigap and Medicare supplement the same?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

What is the downside to Medigap plans?

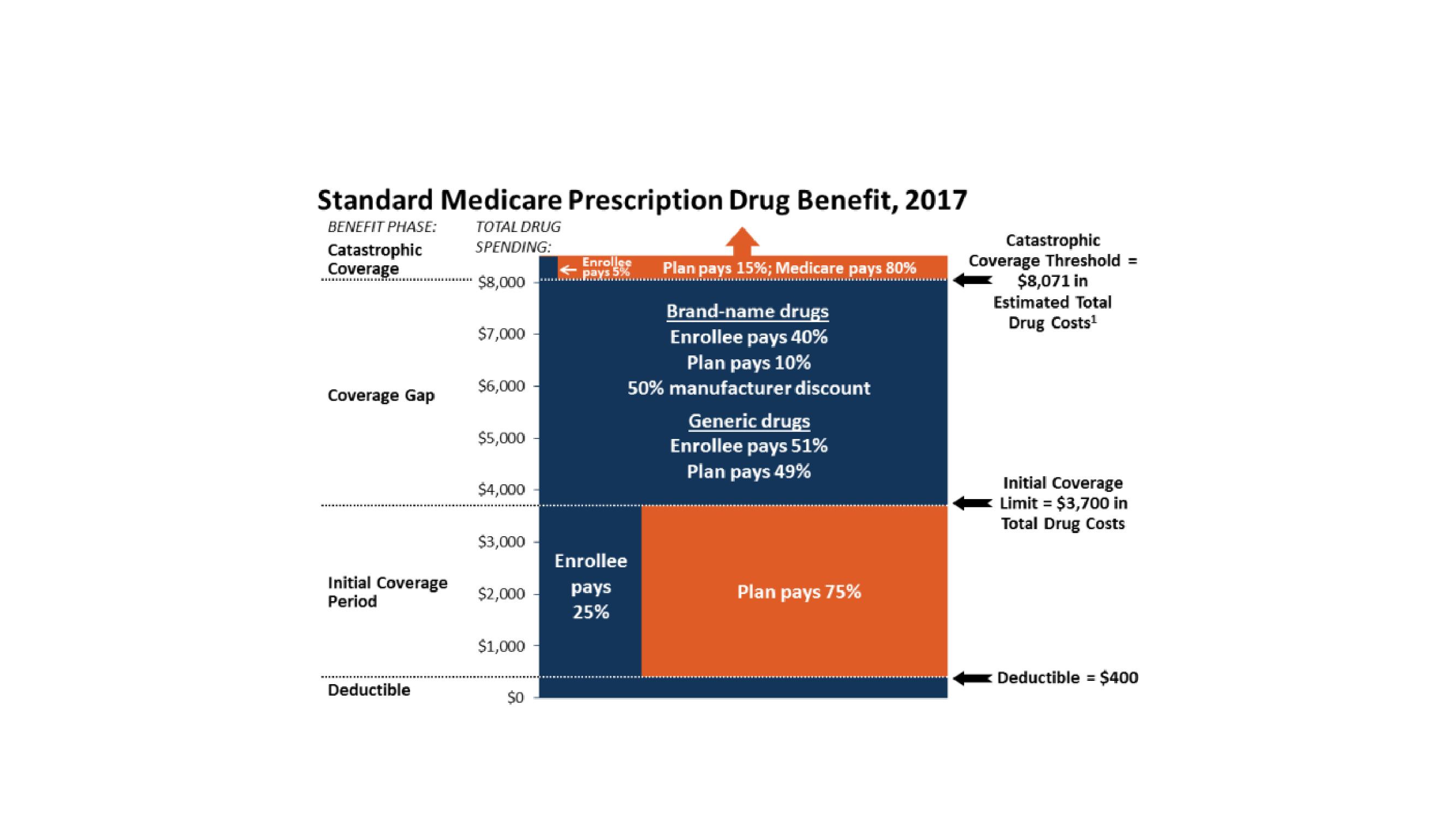

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

Can you have Medigap without Medicare?

Do I need to have Original Medicare to apply for Medigap? The short answer is yes. To have a Medigap policy, you must first have Medicare Part A and Part B. Your Medigap Open Enrollment Period begins on the first day of the month that you're both 65 or older and enrolled in Medicare Part B.

What actions should a patient pursue if Medicare denies payment when a claim is submitted?

for a medical service If Medicare denies payment of the claim, it must be in writing and state the reason for the denial. This notice is called the Medicare Summary Notice (MSN) and is usually issued quarterly.

What is a common reason for Medicare coverage to be denied?

Medicare's reasons for denial can include: Medicare does not deem the service medically necessary. A person has a Medicare Advantage plan, and they used a healthcare provider outside of the plan network. The Medicare Part D prescription drug plan's formulary does not include the medication.

When benefits in a Medicare policy are denied a patient has the right to appeal to quizlet?

Judicial Review. The final level of appeal for Medicare is to request a Judicial Review in Federal District Court. The threshold for review in federal district court in 2016 is $1,460.00 and is calculated each year and may change.

What is Medicare and Medigap?

Medicare and Medigap insurance comprise a sound financial plan for someone over age 65. Medicare works as the primary coverage, with the Medigap plan (sometimes called a Medicare Supplement) filling in the gaps in Medicare. But, how exactly do Medicare and Medigap work together?

What happens if you go to a doctor who doesn't accept Medicare?

In other words, if you go to a doctor who does not accept Medicare, or file to Medicare, your Medigap plan (regardless of what company it is with) will be useless. The key, as a Medicare beneficiary, is seeing if your doctor/hospital, or any doctor/hospital you wish to use, accepts Medicare.

What is Medicare crossover?

This system was created to simplify and streamline the claims payments process for Medicare and Medigap policies.

Does Bob Smiles file Medicare?

As you can see, the big thing that these steps have in common is Bob’s lack of involvement in them. Medicare and Medigap plans require no claims involvement from the beneficiary . They are designed to, and do, work together.

Does Medicare pay through crossover?

Simultaneously, Medicare coordinates a payment from the secondary payer, Medigap, through the Medicare “crossover” system. (Bob returns from the cruise and starts working on his vegetable garden daily in between reading, exercising and meals with friends)

Does the doctor give Medicare code for a visit?

The doctor’s office gives the visit a Medicare code and files the claim electronically to Medicare. (Bob heads out for a nice, relaxing dinner with his wife)

Do Medicare and Medigap work together?

Medicare and Medigap plans work together seamlessly. One the major concerns that we address in people turning 65 is how the Federal government health program could possibly work well together with a private insurance company’s individual health insurance policy. Although we certainly recognize the root of this concern, ...

Can you decline Medigap insurance?

You cannot be declined for Medigap insurance if you have a Guaranteed Issue right . In many cases, you have a Guaranteed Issue Right when you have other health insurance coverage that changes, such as, when you lose other health care coverage.

Can Medigap be denied?

Can Medigap be denied for pre-existing conditions? Yes, if you don’t qualify for a guaranteed issue or enrollment period. Each insurance company has their own unique set of health questions and underwriting guidelines. This benefits the consumer since each individual’s health is unique. For example, ABC insurance company may decline coverage if you have rheumatoid arthritis, while XYZ company will offer you a policy. In addition, some insurance companies look at a 5 year window for stroke while other companies only look back 2 years. These are just a couple examples of how medical underwriting can vary from one insurance company to the next.

How many states require Medicare to be part of a Medigap plan?

States can also create other rules about these plans. For example, 28 states require Medigap plans to offer coverage to Medicare beneficiaries whose employer makes changes to their retiree health coverage benefits.

How long does it take to get a Medigap plan?

Medigap plans are required to allow adults 65 and older, a one-time, 6-month open enrollment period to buy a Medigap plan, when they first enroll in Medicare Part B. After that open enrollment period, if you want to buy a Medigap plan, you can be denied coverage based on a pre-existing condition or face a pre-existing condition exclusion period.

Did the Medigap plan come out of the protections?

Yes, but Mediga p plans were specifically carved out of those protections.

Does Medicare cover co-pays?

One in four people with Medicare also have supplemental Medigap coverage to help cover their co-pays, deductibles, and other out-of-pocket costs. But that varies widely across states. For example, 51% of people with Medicare in Kansas have Medigap plans.

Does Medicare have a zip code?

Medicare’s website allows you to type in your zip code and it shows you the different Medigap policies available to you. Medicare also provides a chart comparing Medigap plans A-N and their different benefits.

What to do if you believe a federal law has been broken?

Call the Inspector General's hotline if you believe a federal law has been broken, like if someone tries to: Pressure you to buy a Medigap policy or lie to get you to switch to a new company or policy. Sell you a second Medigap policy when they know you already have one. (They can sell you a policy if you state, in writing, ...

What is a CMS?

Misuse the names, letters, or symbols of these: U.S. Department of Health & Human Services (HHS) Social Security. Centers for Medicare & Medicaid Services (CMS) Any of their programs, like Medicare. For example, they can't suggest the Medigap policy has been approved or recommended by the federal government.

Is Medicare Advantage the same as Original Medicare?

A Medicare Advantage Plan isn't the same as Original Medicare. If you enroll in a Medicare Advantage Plan, you'll be disenrolled from Original Medicare and can't use a Medigap policy.

Is Medicare Advantage a Medigap?

Medigap is private health insurance. Claim that a Medicare Advantage Plan is a Medigap policy. Sell you a Medigap policy that can't legally be sold in your state. Check with your State Insurance Department to make sure the policy you’re interested in can be sold in your state. Any of their programs, like Medicare.

Can you sell a Medicare Advantage plan?

Sell you a Medigap policy if they know you're in a Medicare Advantage (MA) Plan. (They can sell you a policy if your MA plan coverage will end before the Medigap policy's effective date.)

Can you sell a second medicaid policy?

Sell you a second Medigap policy when they know you already have one. (They can sell you a policy if you state, in writing, that you plan to cancel your existing policy.) Sell you a Medigap policy if they know you have Medicaid, except in certain situations.

What happens if a Medigap insurance company goes bankrupt?

Your Medigap insurance company goes bankrupt and you lose your coverage, or your Medigap policy coverage otherwise ends through no fault of your own.

How long after Medicare coverage ends can you start Medigap?

No later than 63 calendar days after your coverage ends. Medigap coverage can't start until your Medicare Advantage Plan coverage ends. You have Original Medicare and an employer group health plan (including retiree or COBRA coverage) or union coverage that pays after Medicare pays and that plan is ending.

How long does Medigap coverage last?

No later than 63 calendar days after your coverage ends. note: Your rights may last for an extra 12 months under certain circumstances. Your Medigap insurance company goes bankrupt and you lose your coverage, or your Medigap policy coverage otherwise ends through no fault of your own. You have the right to buy:

Can a company refuse to sell a Medigap policy?

You have a guaranteed issue right (which means an insurance company can’t refuse to sell you a Medigap policy) in these situations:

Can you charge more for Medigap?

Can't charge you more for a Medigap policy because of past or present health problems. In most cases, you have a guaranteed issue right when you have other health coverage that changes in some way, like when you lose the other health care coverage. In other cases, you have a "trial right" to try a.

Can you sell a Medigap policy after you leave?

The Medigap insurer can sell it to you as long as you’re leaving the plan. Ask that the new policy take effect no later than when your Medicare Advantage enrollment ends, so you’ll have continuous coverage. Note. The guaranteed issue rights in this section are from federal law.

How long do your rights last on Medicare?

Your rights may last for an extra 12 months under certain circumstances. You dropped a Medigap policy to join a Medicare Advantage Plan (or to switch to a Medicare SELECT policy) for the first time, you’ve been in the plan less than a year, and you want to switch back. (Trial Right) You have the right to buy:

How to end Medigap coverage?

Call the new insurance company and arrange to apply for your new Medigap policy. If your application is accepted, call your current insurance company, and ask for your coverage to end. The insurance company can tell you how to submit a request to end your coverage.

How to switch Medigap insurance?

How to switch Medigap policies. Call the new insurance company and arrange to apply for your new Medigap policy. If your application is accepted, call your current insurance company, and ask for your coverage to end. The insurance company can tell you how to submit a request to end your coverage.

How long is the free look period for Medigap?

Medigap free-look period. You have 30 days to decide if you want to keep the new Medigap policy. This is called your "free look period.". The 30- day free look period starts when you get your new Medigap policy. You'll need to pay both premiums for one month.

What happens if you buy a policy before 2010?

If you bought your policy before 2010, it may offer coverage that isn't available in a newer policy. If you bought your policy before 1992, your policy:

Do you have to switch Medigap policies?

If you have an older Medigap policy, you don't have to switch.

How long do you have to have a Medigap policy?

If you've had your Medicare SELECT policy for more than 6 months, you won't have to answer any medical questions.

Can I keep my Medigap policy if I move out of state?

I'm moving out of state. You can keep your current Medigap policy no matter where you live as long as you still have Original Medicare. If you want to switch to a different Medigap policy, you'll have to check with your current or new insurance company to see if they'll offer you a different policy. If you decide to switch, you may have ...

Can you drop Medigap coverage?

If you're losing Medigap coverage. In most cases, your Medigap insurance company can't drop you because the Medigap policy is a. guaranteed renewable policy. An insurance policy that can't be terminated by the insurance company unless you make untrue statements to the insurance company, commit fraud, or don't pay your premiums.

Can insurance drop you?

This means your insurance company can't drop you unless one of these happens: You stop paying your premiums. You weren't truthful on the Medigap policy application. The insurance company becomes bankrupt or insolvent. If you bought your Medigap policy before 1992, it might not be guaranteed renewable.

Can you renew a Medigap policy?

If you bought your Medigap policy before 1992, it might not be guaranteed renewable. This means the Medigap insurance company can refuse to renew the Medigap policy. But, the insurance company must get the state's approval to cancel your Medigap policy. If this happens, you have the right to buy another Medigap policy.