Medigap, or Medicare Supplement Medigap refers to various private health insurance plans sold to supplement Medicare in the United States. Medigap insurance provides coverage for many of the co-pays and some of the co-insurance related to Medicare-covered hospital, skilled nursing facility, home health care, ambulance, durable medical equipment, and doctor charges. Medigap's name is derived from the notion that it exists to …Medigap

Full Answer

What is the difference between Medicare and Medigap?

Medicare will pay its share of the Medicare-approved amount for covered health care costs. Then, your Medigap policy pays its share. A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits.

What is Medigap insurance and how does it work?

Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S. If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the Medicare-Approved Amount for covered health care costs. Then, your Medigap policy pays its share.

Can I Keep my Medigap plan if I have Original Medicare?

If you already have or were covered by Plan C or F (or the Plan F high deductible version) before January 1, 2020, you can keep your plan. Some Medigap policies also cover services that Original Medicare doesn't cover, like medical care when you travel outside the U.S.

What don't Medigap policies cover?

What don't Medigap policies cover? Most don't pay for long-term care, dental care, hearing aids, eye exams, or eyeglasses. Centers for Medicare and Medicaid Services: "What Medicare Covers," "What's not covered by Part A & Part B?"

Does Medicare Plan G pay for everything?

Plan G covers everything that Medicare Part A and B cover at 100% except for the Part B deductible. This means that you won't pay anything out-of-pocket for covered services and treatments after you pay the deductible.

What is not covered in Medigap plan A?

Medigap is extra health insurance that you buy from a private company to pay health care costs not covered by Original Medicare, such as co-payments, deductibles, and health care if you travel outside the U.S. Medigap policies don't cover long-term care, dental care, vision care, hearing aids, eyeglasses, and private- ...

Does Medigap only work with Original Medicare?

Medigaps may cover outstanding deductibles, coinsurance, and copayments. Medigaps may also cover health care costs that Medicare does not cover at all, like care received when travelling abroad. Remember, Medigaps only work with Original Medicare. If you have a Medicare Advantage Plan, you cannot buy a Medigap.

Does Medigap cover all costs?

Medigap plans cover all or some of the following costs, with a few exceptions: Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are exhausted. Medicare Part B coinsurance or copayment.

Does Medigap pay for Part B premium?

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium.

Does Medigap cover all out-of-pocket costs?

Medigap plans help cover original Medicare costs including deductibles, copayments, and coinsurance. The price you pay for a Medigap plan can depends on which plan you choose, where you live, your age, and more. Only two Medigap plans — Plan K and Plan L — have out-of-pocket limits.

What's the difference between Medigap and Advantage plans?

Medigap supplemental insurance plans are designed to fill Medicare Part A and Part B coverage gaps. Medicare Advantage, also referred to as Medicare Part C plans, often include benefits beyond Medicare Parts A and B. Private, Medicare-approved health insurance companies offer these plans.

Does Medigap pay Part A deductible?

Medigap, also known as Medicare Supplement plans, can help pay some of your out-of-pocket costs, including your Medicare Part A deductibles. These plans are sold through private insurers.

Can Medigap deny coverage for preexisting conditions?

Be aware that under federal law, Medigap policy insurers can refuse to cover your prior medical conditions for the first six months. A prior or pre-existing condition is a condition or illness you were diagnosed with or were treated for before new health care coverage began.

What plan G does not cover?

Medigap Plan G does not cover dental care, or other services excluded from Original Medicare coverage like cosmetic procedures or acupuncture. Some Medicare Advantage policies may cover these services. Like Medigap, Medicare Advantage is private insurance.

Is plan F better than plan G?

Although the plans have several similarities, there is one key difference between Plan F and Plan G: With Medicare Plan F, you're getting the plan with the most coverage available. In addition to the above coverage, Plan F also covers Medicare Part B deductible payments. Plan G does not.

What is the monthly premium for plan G?

How much does Medicare Plan G cost? Medicare Plan G costs between $120 and $364 per month in 2022 for a 65-year-old. You'll see a range of prices for Medicare supplement policies because each insurance company uses a different pricing method for plans.

What is the difference between Medigap and Medicare?

Generally, the only difference between Medigap policies sold by different insurance companies is the cost. You and your spouse must buy separate Medigap policies.Your Medigap policy won't cover any health care costs for your spouse. Some Medigap policies also cover other extra benefits that aren't covered by Medicare.

What is a medicaid supplement?

Medigap (Medicare Supplement Health Insurance) A Medigap policy is health insurance sold by private insurance companies to fill the “gaps” in Original Medicare Plan coverage. Medigap policies help pay some of the health care costs that the Original Medicare Plan doesn't cover.

Can insurance companies sell standardized insurance?

Insurance companies can only sell you a “standardized” Medigap policy. Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.”

Do you have to pay for Medigap?

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

Can I sell my Medicare insurance to someone under 65?

The bulletin below sets forth circumstances under which the Secretary has determined that issuers may sell individual market health insurance policies to certain Medicare beneficiaries under age 65 who lose state high risk pool coverage. As this bulletin explains, for sales to these individuals, HHS will not enforce the anti-duplication provisions of section 1882 (d) (3) (A) of the Social Security Act (the Act) from January 10, 2014 to December 31, 2015. Accompanying the bulletin are Frequently Asked Questions.

Who decides which Medigap policies to sell?

Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

Is Medigap standardized?

Medigap policies are standardized. Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance.". Insurance companies can sell you only a "standardized" policy identified in most states by letters. All policies offer the same basic.

What does Medigap not cover?

These are a few healthcare services and items that Medigap doesn’t cover: Prescription drug coverage. Dental. Vision. Long Term Care. Eye glasses. Private nursing.

How many hospitalization days does Medigap cover?

Medigap plans fill in the gaps of Original Medicare, however, each Medigap plan offers different coverage. Here is a list of what Medigap can cover: 365 additional hospitalization days. Nationwide network of doctors and hospitals. Covers Medicare Part A and Part B deductibles. First 3 pints of blood for a transfusion.

What is a Part B copay?

Part B copays and/or coinsurance. Part B excess charges. Foreign emergency healthcare coverage. All of the above, with the exception of foreign healthcare, are covered at 100%, therefore most clients find that they only pay their monthly premium and have no other out of pocket costs per year.

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Can you purchase prescription insurance separately?

Prescription Drug, Dental, Vision, and Long Term Care insurance can be purchased separately.

Does Medigap cover Medicare?

Medigap supplements Original Medicare’s healthcare costs. Medigap plans cover a lot of costs, however there are few things you may have thought Medicare and/or Medigap covers and they actually don’t.

What is Medicare Supplement (Medigap?)

Medicare Supplement, also called Medigap insurance, partners with Original Medicare (parts A and B) to cover gaps in Medicare coverage.

Get started now

Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.

What Is Medigap?

Medigap, or Medicare Supplement, is a private insurance policy purchased to help pay for what isn’t covered by Original Medicare (which includes Part A and Part B ). These secondary coverage plans only apply with Original Medicare—not other private insurance policies, standalone Medicare plans or Medicare Advantage plans.

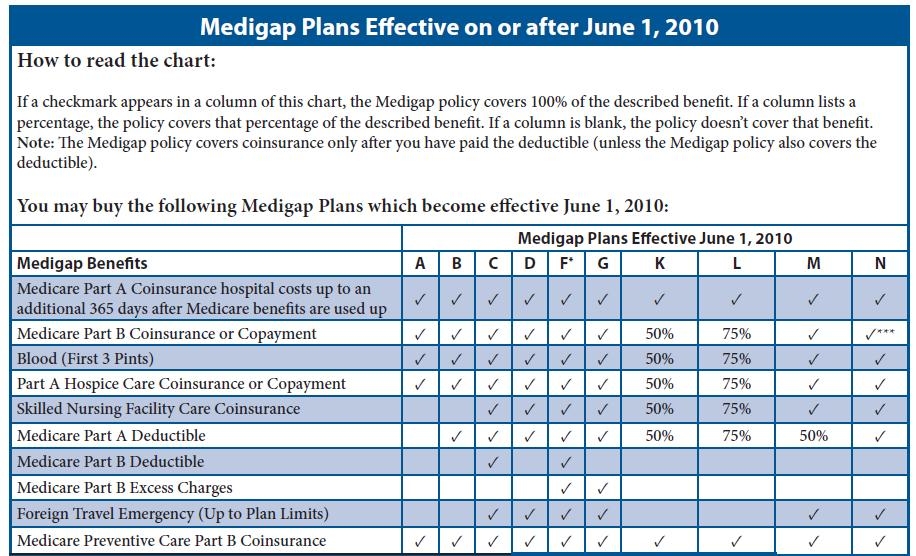

How many standardized Medigap plans are there?

There are 10 standardized Medigap plans with letter names A through N. Plans with the same letter must offer the same basic benefit regardless of the insurance company providing the plan. For example, all Medigap Plan A policies provide the same benefit, but health insurance company premiums vary based on the way they choose to set rates—community-rated, entry age-rated or attained-age-rated.

What are the requirements to be eligible for a Medigap plan?

To be eligible for a Medigap plan, you must be enrolled in Original Medicare Parts A and B, but not a Medicare Advantage plan. You must also be in one of the following categories:

How long does it take to get a Medigap policy?

To buy a Medigap policy, it’s best to enroll during your Medigap Open Enrollment period, which lasts six months. This period begins the first month you have Medicare Part B and are 65 or older. You can buy any Medigap policy sold in your state during this time, even if you have health problems.

How long can you delay Medicare coverage?

Companies could delay coverage up to six months for a pre-existing condition if you didn’t have creditable coverage (other health insurance) before enrolling in Medicare.

Is Medigap the same as Medicare Advantage?

Medigap plans aren’t the same as Medicare Part C, also known as Medicare Advantage. While a Medicare Advantage plan can serve as an alternative way to get Medicare Part A and Part B coverage, Medigap plans only cover what Part A and Part B do not.

Does Medigap cover prescriptions?

Medigap plans generally don’t cover prescriptions, so you may want to consider enrolling in Medicare Part D, which specifically covers prescription drugs, or a Medicare Advantage plan that includes drug coverage.

What is Medicare and Medigap?

Medicare and Medigap insurance comprise a sound financial plan for someone over age 65. Medicare works as the primary coverage, with the Medigap plan (sometimes called a Medicare Supplement) filling in the gaps in Medicare. But, how exactly do Medicare and Medigap work together?

How does Medicare work?

The way it works is that a doctor’s office files a claim to Medicare first, which pays that claim electronically. After Medicare pays, the Medigap plan pays as a secondary payer, after receiving the claim through the Medicare “crossover” system (see Fact #4 below)

How does the Medicare crossover work?

The way that the “crossover” system works is that Medicare sends claims information to the secondary payer (the Medigap company) and, essentially, coordinates the payment on behalf of the provider.

What happens if you go to a doctor who doesn't accept Medicare?

In other words, if you go to a doctor who does not accept Medicare, or file to Medicare, your Medigap plan (regardless of what company it is with) will be useless. The key, as a Medicare beneficiary, is seeing if your doctor/hospital, or any doctor/hospital you wish to use, accepts Medicare.

What is the Medicare Part B deductible for 2020?

Plan G which is the next step down, and usually is the best deal, pays all but the Medicare Part B deductible, which is $198/year (for 2020). NOTE: For people who were first eligible for Medicare after 1/1/2020, Plan F is no longer available.

Do Medicare and Medigap work together?

Medicare and Medigap plans work together seamlessly. One the major concerns that we address in people turning 65 is how the Federal government health program could possibly work well together with a private insurance company’s individual health insurance policy. Although we certainly recognize the root of this concern, ...

Does Medicare pay for claims?

Medicare does not pay any claims or provide any coverage if you have a Medicare Advantage plan. I’ve heard enough…. Email me the list of Medigap options with rates and ratings for my area. Get a List of Medigap Plans for Your Zip Code. Complete the form to receive the information via email. Name: