What is box 12 on a medical billing form?

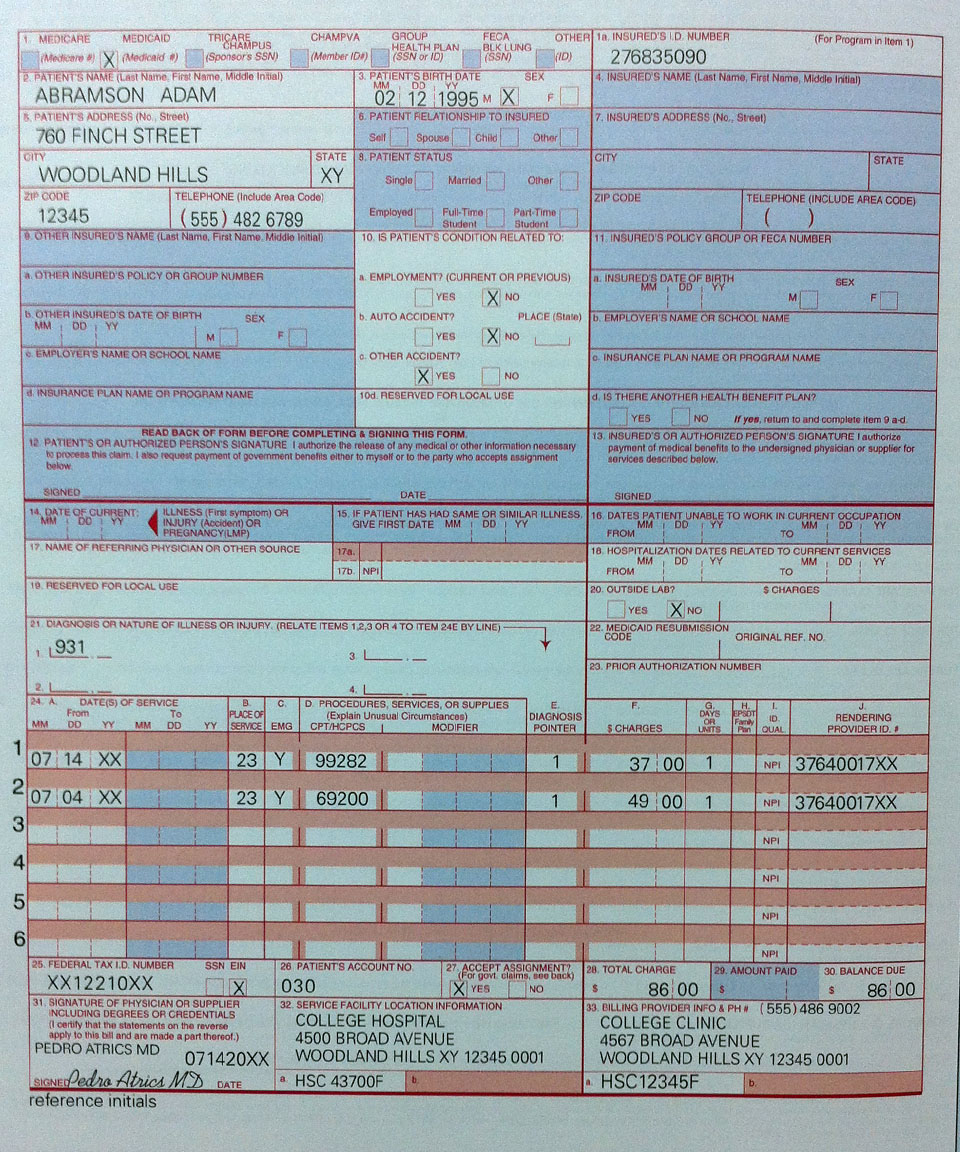

Learn about the pros and cons of in-house billing vs. outsourced medical billing. Click here. Box 12 is the “release of information” box. Many billers think that if you don’t have to release any information, you can just leave this blank.

What is a 12x or 13X claim?

This is an outpatient claim (Type of Bill 12X, 13X, or 14X) in which the Outpatient Prospective Payment System (OPPS) reimbursement is greater than the covered charges reported on the claim. Access the claim. The Remarks section will include the code (s) in question. Verify the code (s), unit (s), and charges are reported correctly.

What is place of service 12 in medical billing?

Place of Service 12 is also called as POS 12 in Medical billing. Place of Service 12 indicated when the patient receives the medical services in patients “Home”. POS 12 Description: POS 12 is a place other than a facility or hospital, where the patient receives health care services in a private residence.

What is Box 13 on a medical bill?

Box 13 is the “authorization of payment of medical benefits to the provider of service.” If this box is completed, the patient is indicating that they want any payments for the services being billed to be sent directly to the provider.

What is code 12 medical billing?

HomeDatabase (updated September 2021)Place of Service Code(s)Place of Service Name09Prison/ Correctional Facility10Telehealth Provided in Patient's Home11Office12Home54 more rows

What does place of service 12 on a CMS 1500 form represent?

If desired, local contractors are permitted to work with their medical directors to determine a new crosswalk such as from Homeless Shelter (code 04) to Home (code 12) or Custodial Care Facility (code 33) for DME provided in a homeless shelter setting.

What are the denial codes?

1 – Denial Code CO 11 – Diagnosis Inconsistent with Procedure. ... 2 – Denial Code CO 27 – Expenses Incurred After the Patient's Coverage was Terminated. ... 3 – Denial Code CO 22 – Coordination of Benefits. ... 4 – Denial Code CO 29 – The Time Limit for Filing Already Expired. ... 5 – Denial Code CO 167 – Diagnosis is Not Covered.

What are Medicare remark codes?

Remittance Advice Remark Codes (RARCs) are used in a remittance advice to further explain an adjustment or relay informational messages that cannot be expressed with a claim adjustment reason code. Remark codes are maintained by CMS, but may be used by any health plan when they apply.

When should you enter a signature on Block 12?

Box 12 indicates the client authorizes the release of any medical information needed to process and/or adjudicate the claim. This can be done by entering "Signature on File", "SOF", or by using an actual signature.

Which are examples of place of service?

A residence, with shared living areas, where clients receive supervision and other services such as social and/or behavioral services, custodial service, and minimal services (e.g., medication administration).

What is F2 denial?

F2. Finalized/Denial-The claim/line has been denied. Start: 01/01/1995. F3. Finalized/Revised - Adjudication information has been changed.

What are the top 10 denials in medical billing?

These are the most common healthcare denials your staff should watch out for:#1. Missing Information. You'll trigger a denial if just one required field is accidentally left blank. ... #2. Service Not Covered By Payer. ... #3. Duplicate Claim or Service. ... #4. Service Already Adjudicated. ... #5. Limit For Filing Has Expired.

What does denial code B11 mean?

B11 The claim/service has been transferred to the proper payer/processor for processing. Claim/service not covered by this payer/processor.

What are reason codes?

Reason codes, also called score factors or adverse action codes, are numerical or word-based codes that describe the reasons why a particular credit score is not higher. For example, a code might cite a high utilization rate of available credit as the main negative influence on a particular credit score.

What is a claim adjustment code?

Claim Adjustment Reason Codes (CARC) Every adjudicated claim submitted to ProviderOne that has been finalized will have a Claim Adjustment Reason Code (CARC) applied to the claim or to each claim line. The CARC may be an informational code or may be an encompassing denial code.

What is reason code in medical billing?

Reason codes appear on an explanation of benefits (EOB) to communicate why a claim has been adjusted. If there is no adjustment to a claim/line, then there is no adjustment reason code.

What is box 12 in a bill?

Box 12 is the “release of information” box . Many billers think that if you don’t have to release any information, you can just leave this blank. Others think you just stick “signature on file” there and you’re good. Well, neither is correct.

What is box 13 in a medical billing statement?

Box 13 is the “authorization of payment of medical benefits to the provider of service.”.

Can a carrier release payment if the box is empty?

Many carriers will not release payment if this box is empty. But just sticking “signature on file” in there is not correct either. You really need to know that the patient’s signature is on file. The patient should have signed a release of information statement when he or she first came in.

Can insurance send payment to patient if not in network?

For example, if the provider is not in-network, the insurance carrier may send payment directly to the patient – even if this box is completed. And, if the provider is in-network but this box is not completed, it is possible that payment could go to the patient. So again, if you have the patient’s authorization for the payment to be made to the provider, you should make sure this box is completed to help ensure that you receive payment for services from the payer.

What is an itemized bill?

The itemized bill from your doctor, supplier, or other health care provider. A letter explaining in detail your reason for submitting the claim, like your provider or supplier isn’t able to file the claim, your provider or supplier refuses to file the claim, and/or your provider or supplier isn’t enrolled in Medicare.

How to file a medical claim?

Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1 The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2 The itemized bill from your doctor, supplier, or other health care provider 3 A letter explaining in detail your reason for submitting the claim, like your provider or supplier isn’t able to file the claim, your provider or supplier refuses to file the claim, and/or your provider or supplier isn’t enrolled in Medicare 4 Any supporting documents related to your claim

How do I file a claim?

Fill out the claim form, called the Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB). You can also fill out the CMS-1490S claim form in Spanish.

What to call if you don't file a Medicare claim?

If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227) . TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got. If it's close to the end of the time limit and your doctor or supplier still hasn't filed the claim, you should file the claim.

How long does it take for Medicare to pay?

Medicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share. For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020.

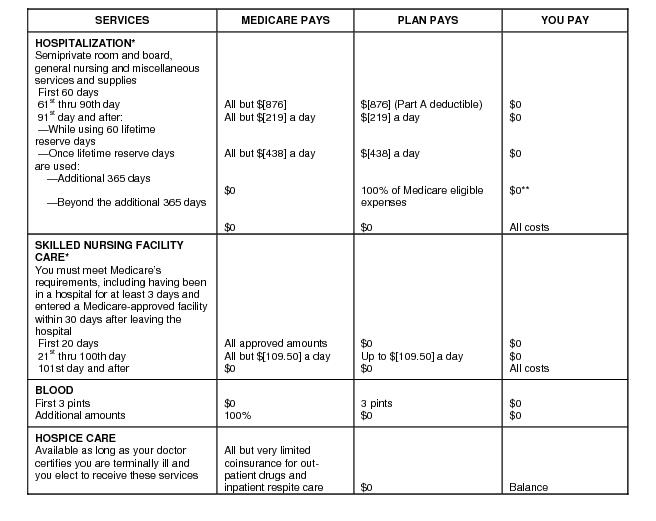

What happens after you pay a deductible?

After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). , the law requires doctors and suppliers to file Medicare. claim. A request for payment that you submit to Medicare or other health insurance when you get items and services that you think are covered.

When do you have to file Medicare claim for 2020?

For example, if you see your doctor on March 22, 2019, your doctor must file the Medicare claim for that visit no later than March 22, 2020. Check the "Medicare Summary Notice" (MSN) you get in the mail every 3 months, or log into your secure Medicare account to make sure claims are being filed in a timely way.

What is the meaning of 140.3.2?

140.3.2 - Anesthesia Time and Calculation of Anesthesia Time Units 140.3.3 - Billing Modifiers

What is 20.4.7?

20.4.7 - Technical Component Payment Reduction for X-Rays and Other Imaging Services

What is 100.1.8?

100.1.8 - Physician Billing in the Teaching Setting

What is IHS 90.6?

90.6 - Indian Health Services (IHS) Provider Payment to Non-IHS Physicians for Teleradiology Interpretations 90.7 - Bundling of Payments for Services Provided in Wholly Owned and Wholly Operated Entities (including Physician Practices and Clinics): 3-Day Payment Window

What is 90.4.11.5?

90.4.11.5 - Claims Processing and Payment 90.5 - Billing and Payment in a Physician Scarcity Area

When did CMS transition to resource based practice expense?

For the years 1999 through 2002, payments attributable to practice expenses transitioned from charge-based amounts to resource-based practice expense RVUs. The CMS used the following transition formula to calculate the practice expense RVUs.

Does Medicare bill for endoscopic surgery?

To bill Medicare for endoscopic procedures (excluding endoscopic surgery that follows the surgery policy in subsection A, above), the teaching physician must be present during the entire viewing. The entire viewing starts at the time of insertion of the endoscope and ends at the time of removal of the endoscope.

What is the frequency code of an adjusted claim?

An adjusted claim contains frequency code equal to a ‘7’, ‘Q’, or ‘8’, and there is no claim change reason code (condition code D0, D1, D2, D3, D4, D5, D6, D7, D8, D9, or E0.

How long does Medicare have to submit a claim?

The claim was not submitted timely. Medicare regulations require claims to be submitted within one year of the date of service (through ‘To’ date of service on the claim).

What is the NPI of a service line?

The service line contains a line level rendering physician NPI but the first digit of the NPI is not equal to 1 or the 10th digit of the NPI does not follow the check digit validation routine.

What is a XX7 bill?

The adjustment (XX7) or Cancel (XX8) bill contains an invalid cross reference DCN. The cross reference DCN should be the Document Control Number of the original processed claim that is either being adjusted or canceled.

What is non-covered revenue code?

A non-covered revenue code is shown on the claim with covered charges greater than $0.00.

What is missing in a CPT code?

A principal procedure code or a surgical CPT/HCPCS code is present, but the operating physician's National Provider Identifier (NPI), last name, and/or first initial is missing.

What is XX7 adjustment?

Provider submitted adjustment (XX7 or XXQ) is for 'Other' reasons not identifiable with specific claim change reason (condition code) which equals 'D9'.

What is W-2 box 12?

The W-2 form is one of the most common tax forms used by U.S. taxpayers. In fact, it’s a tax statement that reports your wages and the taxes withheld from your wages. If you’ve ever really looked at the form’s details, you may be overwhelmed as it has many boxes and codes on it.

What is the check box on 1040 for uncollected Medicare?

B — Uncollected Medicare tax on tips. Include this tax on Form 1040 Schedule 2, line 8, check box c and identify as “UT”.

What is a G in a 1040?

G — Elective deferrals and employer contributions (including non -elective deferrals) to a Section 457 (b) deferred compensation plan. You may be able to claim the Saver’s Credit, Form 1040 Schedule 3, line 4. See Form 1040 Instructions for details.

What is a J on a W-2?

J — Nontaxable sick pay (information only, not included in W-2 boxes 1, 3, or 5).

What is the place of service 12?

Answer: Place of Service 12 indicates the services rendered at patient home. So the practice address to be mentioned at the bottom of HCFA Claim form, because place of service is enough for insurance to direct to the patient’s home address (Which will be on top of the HCFA claim form).

What is POS 12?

POS 12 is a place other than a facility or hospital, where the patient receives health care services in a private residence.

When is the place of service 12 required for a sleep test?

Answer: If the Health Sleep Test device is shipped to the patient’s home, the place of service 12 needs to be reported.

What is the E/M code for home visit?

According to me home visit E/M code should be billed with either new patient code s (99341-99345) or established codes (99347-99350) along with place of service 12.

When Do I Need to File A Claim?

- You should only need to file a claim in very rare cases

Medicare claims must be filed no later than 12 months (or 1 full calendar year) after the date when the services were provided. If a claim isn't filed within this time limit, Medicare can't pay its share. For example, if you see your doctor on March 22, 2019, your doctor must file the Medicar… - If your claims aren't being filed in a timely way:

1. Contact your doctor or supplier, and ask them to file a claim. 2. If they don't file a claim, call us at 1-800-MEDICARE (1-800-633-4227). TTY: 1-877-486-2048. Ask for the exact time limit for filing a Medicare claim for the service or supply you got. If it's close to the end of the time limit and yo…

How Do I File A Claim?

- Fill out the claim form, called the Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB). You can also fill out the CMS-1490S claim form in Spanish.

What Do I Submit with The Claim?

- Follow the instructions for the type of claim you're filing (listed above under "How do I file a claim?"). Generally, you’ll need to submit these items: 1. The completed claim form (Patient Request for Medical Payment form (CMS-1490S) [PDF, 52KB]) 2. The itemized bill from your doctor, supplier, or other health care provider 3. A letter explaining in detail your reason for subm…

Where Do I Send The Claim?

- The address for where to send your claim can be found in 2 places: 1. On the second page of the instructions for the type of claim you’re filing (listed above under "How do I file a claim?"). 2. On your "Medicare Summary Notice" (MSN). You can also log into your Medicare accountto sign up to get your MSNs electronically and view or download them anytime. You need to fill out an "Author…