How are irmaa income limits calculated?

Part B IRMAA is calculated by multiplying the average expenditure (which is the standard premium multiplied by 4) by the subsidy percentage assigned to a particular income bracket. The subsidy amounts can be found in table 2. The resulting answer is the total amount you will pay (standard premium plus IRMAA).

Is irmaa taxable?

Yes, IRMAA is allowed as a medical deduction on Schedule A, which could come off against your adjusted gross income (AGI). Put the amount in Medicare D Premiums Deducted From Your Benefit. See the below screenshot. These are the amounts your itemized deductions must be higher than to start making a difference in your taxes:

What does Irma stand for in Medicare?

- You married,

- You divorced, or your marriage was annulled,

- You became a widow or widower,

- You or your spouse stopped working or reduced work hours,

- You or your spouse lost income-producing property due to a disaster or other event beyond your control,

Will I avoid irmaa surcharges on Medicare Part B?

Unfortunately, even if you enroll in a Medicare Advantage plan, you are still subject to the Medicare Part B premium plus any IRMAA surcharges. You might find an Advantage program in your area that...

At what income does Irmaa kick in?

Who Pays IRMAA? As noted above, only individuals who earn more than $88,000 and married couples filing jointly who earn more than $176,000 are required to pay IRMAA.

How does Medicare Irmaa work?

An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium.

How do I know if I have to pay Irmaa?

SSA determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior, meaning two years before the year that you start paying IRMAA. The income that counts is the adjusted gross income you reported plus other forms of tax-exempt income.

How do I avoid Medicare Irmaa?

To avoid getting issued an IRMAA, you can proactively tell the SSA of any changes your income has seen in the past two years using a “Medicare Income-Related Monthly Adjustment Amount – Life-Changing Event” form or by scheduling an interview with your local Social Security office (1-800-772-1213).

How long does the Irmaa last?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

Is Social Security included in Irmaa?

Essentially, IRMAA is a way of increasing the Medicare Part B and now Part D payments drawn from your monthly Social Security checks. Currently, most individuals pay about 25 percent of their Medicare costs at a standard rate of $144.60 a month, social security paying the remaining 75 percent.

What are the Irmaa income brackets for 2021?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2021More than $111,000 but less than or equal to $138,000$297.00More than $138,000 but less than or equal to $165,000$386.10More than $165,000 but less than $500,000$475.20More than $500,000$504.9012 more rows•Dec 6, 2021

How much Social Security will I get if I make $75000 a year?

about $28,300 annuallyIf you earn $75,000 per year, you can expect to receive $2,358 per month -- or about $28,300 annually -- from Social Security.

Is Irmaa tax deductible?

Yes, IRMAA is allowed as a medical deduction on Schedule A, which could come off against your adjusted gross income (AGI).

What percentage of Medicare beneficiaries pay Irmaa?

IRMAA affects less than 5% of people with Medicare, but those it does affect are often surprised or unclear about how it works.

What income level triggers higher Medicare premiums?

In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there. You'll receive an IRMAA letter in the mail from SSA if it is determined you need to pay a higher premium.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

What is IRMAA?

For Medicare beneficiaries who earn over $91,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to unders...

How is my income used in my IRMAA determination?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax r...

Can I appeal the IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have...

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

What is IRMAA Part D?

For Part D, the IRMAA amounts are added to the regular premium for the enrollee’s plan (Part D plans have varying prices, so the full amount, after the IRMAA surcharge, will depend on the plan).

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

What age can you contribute to an IRA?

The SECURE Act has a number of different features – such as allowing IRA contributions after age 70½ if you’re still earning an income – and it extends the minimum age that one must receive RMDs (Required Minimum Distributions) from 70½ to 72. Note that those who are already at least 70½ must continue to receive RMDs.

Can I appeal an IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44.

Will MAGI income be adjusted for inflation in 2020?

The year 2020 was the first year that these MAGI income requirements were adjusted for inflation. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation (CPI). Back to top.

How to appeal an IRMAA?

If you want to appeal your IRMAA, you should visit the Social Security website for the form called Request for Reconsideration. The form will give you three options on how to appeal, with the easiest and most common way being a case review. Documentation is an essential thing in any appeal.

How does Social Security determine if you owe an IRMAA?

The Social Security Administration determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior. If you feel you’re higher Part B premium is incorrect, there are steps you can take to appeal IRMAA.

How to request a new initial determination for Medicare?

You can request a new initial determination by submitting a Medicare IRMAA Life-Changing Event form. You can also schedule an appointment with Social Security. Documentation will be required with either your correct income or of the life-changing event that caused your income to go down.

What is modified adjusted gross income?

Your Modified Adjusted Gross Income amount is made up of your total adjusted gross income in addition to any tax-exempt interest income. On your IRS Form 1040, these are line items 37 and 8b; if you are unsure of your MAGI, you can quickly figure it out by looking at your tax return records. Income examples that you may have reported on your tax return would include wages, dividends, alimony received, rental income, investment income, capital gains, farm income, and SSA benefits.

Can you appeal Medicare Part B?

You can appeal your Medicare Part B premium increase for outdated or incorrect information when you: Filed an amended tax return with the IRS. Have a more recent tax return that shows you are receiving a lower income than previously reported.

How is Medicare Part B Premium Figure?

Most people have a $0 premium for their Medicare Part A hospital insurance. But as you probably know there is a monthly premium assigned for your Medicare Part B . The standard Medicare Part B premium in 2021 is $148.50 per month. That is for individuals making less than $88,000 a year and joint earners making less than $176,000 a year.

What Is Medicare IRMAA?

Here is a web page from Medicare’s website on IRMAA. You can see here under the “What Is It Heading.” It states, You’ll get this notice if you have Medicare Part B and/or Medicare Part D and social security determines that any Income Related Monthly Adjustment Amounts (IRMAA) apply to you.

What Aspects of Medicare are Affected by IRMAA?

Medicare is an essential public service for the elderly here in America, which helps cover medical expenses in various terms. Some people will be more affected by these changes than others due to their specific needs when it comes down to coverage.

How Much is Medicare Part B Premium 2021?

The cost for Medicare Part B premium in 2021 is $148.50 per month, and an additional IRMAA surcharge may apply depending on your income. This surcharge amount varies based on how you filed taxes two years ago (IRS tax return information).

How much will IRMAA Charge Me for Medicare Part D?

It can be a little challenging to figure out the monthly premium for Medicare Part D plans. The company offering the policy will determine its price, and since there’s no standard, it could range from one program to another. But that’s not all! You also have to add surcharges into your calculations depending on how you filed taxes two years ago.

Important YouTube Channel Details

I appreciate you looking through my article. If it is interesting to you, please subscribe to my YouTube channel.

Who calculates IRMAA?

The Centers for Medicare & Medicaid Services ( CMS) calculate IRMAA and publish this amount yearly in the Federal Register. Once the IRMAA calculations are complete, CMS inform the Social Security Administration (SSA). The SSA determine whether a person must pay more than the standard premium.

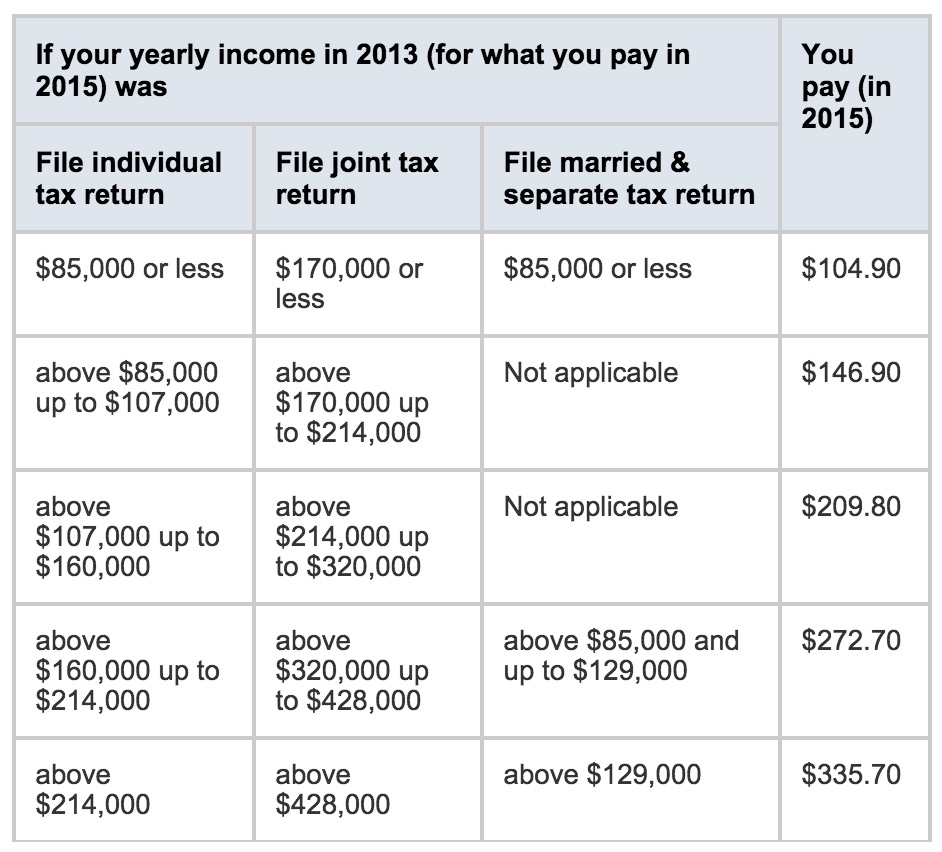

How many income levels are there in IRMAA?

The calculation for IRMAA covers five income levels. There are also three tax filing status levels. The charts below show the five different IRMAA levels for each of the three tax filing status levels for 2021. The examples use the tax year 2019.

What is the Medicare premium for 2021?

In 2021, the standard premium for Part B is $148.50. Medicare Part D premiums vary depending on the plan a person chooses. The amount of an individual’s Part B premium, Part D premium, or both, may change based on their modified adjusted gross income (MAGI), which their Internal Revenue Service (IRS) tax return will report.

What is Medicare Part B?

Medicare Part B pays outpatient doctor visits, provider services, durable medical equipment, and some home health care. Medicare Part C, also called Medicare Advantage. This policy combines the benefits of Medicare Part A and Part B. People pay a premium for Medicare Part B and for Medicare Advantage.

How often does Medicare add to your income?

The amounts are based on a person’s adjusted gross income, and Medicare adds them every month. This amount can change each year based on a person’s income. If a person believes that there is a mistake with the assessment, they can go through an appeal process.

How to get extra help for Medicare?

Extra Help is a program to help pay some of the out-of-pocket costs of Medicare Part D premiums. To get Extra Help, a person must: 1 have Medicare Part A, Part B, or both 2 live in the United States 3 have income and assets below specified limits

Does IRMAA change?

IRMAA may change each year, depending on a person’s income. Medicare is a federal insurance plan for people aged 65 and over. Younger people may be eligible if they have a disability or end stage renal disease (ESRD). Medicare parts include:

What is IRMAA in Medicare?

What is IRMAA? IRMAA is an acronym for Medicare’s income-related monthly adjustment amount (IRMAA). This is a higher premium charged by Medicare Part B and Medicare Part D to individuals with higher incomes.

How much does IRMAA affect Medicare?

IRMAA affects less than 5% of people with Medicare, but those it does affect are often surprised or unclear about how it works. For the part of the population that does not pay the higher premium amounts, Medicare pays approximately 75% of the cost of the Medicare Part B premium. The beneficiary is left with approximately 25% ...

What is the IRMAA determination for Social Security?

This means that the IRMAA determination ends up being based on a tax return from a couple of years ago. For example, the 2020 IRMAA determination is based on 2018 tax return.

What is the Medicare monthly adjustment number?

If you want information about this, have questions about the Medicare income-related monthly adjustment amount, or anything else related to your transition to Medicare, feel free to contact us here or call 877.506.3378.

How much is Medicare premium 2020?

The beneficiary is left with approximately 25% of the premium – $144.60/month in 2020. For people with higher incomes, you pay a higher percentage of the total – 35, 50, 65 or 80 percent – based on where you fall on Medicare’s income-related monthly adjustment amount scale (see below).

Do I pay higher Medicare premiums?

Likewise, you pay a higher Medicare Part D IRMAA premium if you fall into one of the higher income categories. The higher premium amount is applied regardless of which company you choose for your Part D plan. The IRMAA is applied on top of the premium that you would normally be paying for Part D.

How much of Medicare is paid by the government?

To provide some background, approximately 75% of the costs of Medicare Part B (Medical Insurance) and Part D (Prescription Drug) are paid directly from the General Revenue of the Federal Government, with the remaining 25% covered through monthly premiums paid by Medicare enrollees.

How long does Medicare look back for 2021?

Medicare premiums and any surcharges are based on your filing status and Modified Adjusted Gross Income (MAGI) with a two-year lookback (or three years if you haven’t filed taxes more recently). That means your 2021 premiums and IRMAA determinations are calculated based on MAGI from your 2019 federal tax return.

Who wrote the book Medicare for Retirement?

Co-written with Jeffrey Barnett. The first question on many retirees’ minds is how to pay for expensive healthcare costs and health insurance when you’re no longer covered by the employer plan you relied on throughout your career. Medicare is the U.S. government’s answer for supporting healthcare costs throughout retirement.

Introduction

Did you know that high-income earners may pay more on their Medicare Part B (Medical) and Part D (Prescription Drug) premiums? These surcharges are called income-related monthly adjustment amounts, also called IRMAA.

What is the Income Related Monthly Adjustment Amount (IRMAA)?

IRMAA is a Medicare high income premium added to the standard Parts B and D Medicare premiums. IRMAA does not impact other Medicare costs like Part A, Part C (without a prescription drug plan), and out-of-pocket costs.

How do you pay for IRMAA?

Your Part B and Part D Medicare extra premium (IRMAA) is automatically added to your monthly Medicare premiums.

How can you appeal an IRMAA determination?

There are two valid reasons to appeal IRMAA – a life-changing event or a miscalculation due to erroneous tax information.

Are there other factors that could impact your IRMAA?

Since IRMAA is a Medicare high income premium, your income determines your eligibility.

Summary of Medicare Advantage Open Enrollment Period

Since IRMAA surcharges can be substantial, it is critical to consider the various factors that can impact your IRMAA. Finally, appealing an IRMAA determination is essential if your income falls because of significant life changes.