What is the maximum premium for Medicare Part B?

The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What determines your part B Medicare premium?

In most cases, this information is your income two years prior to the year for which you must pay an income-related premium. If information is not yet available for the two years prior, Social Security will temporarily use information from the tax year three years prior. You may request Social Security to use the tax information from a more recent tax year under certain …

How much are Medicare Part B premiums?

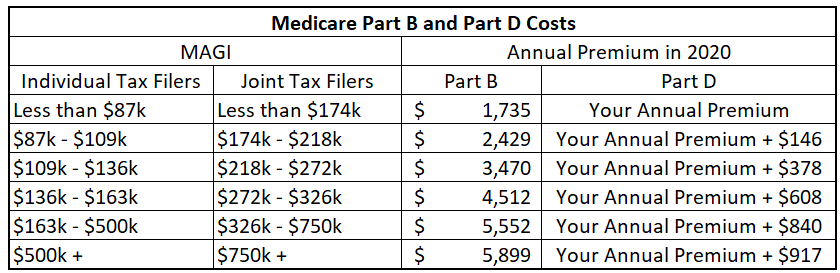

May 04, 2022 · The tables below show Part B premiums for 2022 by filing status and income level. The IRMAA is based on your reported adjusted gross income from two years ago. For 2022, your Part B premium may be as low as $170.10 or as high as $578.30.

How are Medicare Part B premiums calculated?

Dec 13, 2021 · 2022 Medicare Part B Premiums . Medicare Part B premiums for 2022 will increase by $21.60 from the premium for 2021. The 2022 premium rate starts at $170.10 per month and increases based on your income, up to to $578.30 for the 2022 tax year.

What tax year is used to determine Medicare Part B premiums?

What year is Medicare premium based on?

Is the Medicare Part B deductible calendar year?

Is Medicare Part B premium based on taxable income?

Is Medicare Part B premium adjusted annually?

The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

What is the Medicare Part B premium for 2021?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.Nov 12, 2021

What is the difference between calendar year and benefit year?

What is the Irmaa for 2021?

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

What is the Irmaa for 2022?

| Table 1. Part B – 2022 IRMAA | ||

|---|---|---|

| Individual | Joint | Monthly Premium |

| $91,000 or less | $182,000 or less | $170.10 |

| > $91,000 – $114,000 | > $182,000 – $228,000 | $238.10 |

| > $114,000 – $142,000 | > $228,000 -$284,000 | $340.20 |

Is Medicare Part B premium automatically deducted from Social Security?

How do you calculate your Magi?

- Add up your gross income from all sources.

- Check the list of “adjustments” to your gross income and subtract those for which you qualify from your gross income. ...

- The resulting number is your AGI.