Full Answer

What are the Medicare and Social Security taxes on my paystub?

Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA. In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security.

What is the combination of Social Security and Medicare taxes?

(There is also a Medicare surtax for higher income taxpayers.) The combination of Social Security taxes and Medicare taxes is referred to as FICA. Often we refer to the FICA tax rate as 7.65% (6.2% Social Security + 1.45% Medicare) of each employee's first $128,400...

What is the FICA tax for Social Security and Medicare?

The payroll taxes required for the Federal Insurance Compensation Act (FICA) are to support both your Social Security and Medicare benefits programs. Your employer makes a matching contribution to the Medicare program. Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Does Medicare payroll tax apply to Social Security benefits?

The tax is collected from all employees regardless of their age. If you are currently working and receiving Social Security benefits, you will still have the Medicare payroll tax taken from your paycheck. Your employer automatically deducts your Medicare liability from your taxable income.

What is Social Security on pay stub?

It stands for the Federal Insurance Contributions Act and is deducted from each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self- employment. As you work and pay FICA taxes, you earn credits for Social Security benefits.

Why is box 1 and 3 different on my W-2?

Some pre-tax deductions reduce your taxable income (box 1) and your social security income (box 3). Other pre-tax deductions only reduce your taxable income (box 1). If you have a deduction that only reduces your taxable income then the amounts in box 1 and box 3 will be different.

Do tax brackets include Social Security and Medicare?

What is FICA tax? FICA tax includes a 6.2% Social Security tax and 1.45% Medicare tax on earnings. In 2021, only the first $142,800 of earnings are subject to the Social Security tax ($147,000 in 2022). A 0.9% Medicare tax may apply to earnings over $200,000 for single filers/$250,000 for joint filers.

Does employer match Social Security and Medicare?

Employers also are required to match paycheck withholding amounts for Social Security and Medicare. This “match” means your employer pays the same amount you do every pay period for Social Security and Medicare withholding.

Where do I find my health insurance premiums on my W-2?

Your health insurance premiums paid will be listed in box 12 of Form W2 with code DD.

Why was no federal income tax withheld from my paycheck 2021?

Reasons Why You Might Not Have Paid Federal Income Tax You Didn't Earn Enough. You Are Exempt from Federal Taxes. You Live and Work in Different States. There's No Income Tax in Your State.

Who pays for Medicare tax?

Medicare is paid for by taxpayer contributions to the Social Security Administration. Workers pay 1.45 percent of all earnings to the Federal Insurance Contributions Act (FICA). Employers pay another 1.45 percent, for a total of 2.9 percent of your total earnings.

Is Medicare a tax deduction?

Medicare expenses, including Medicare premiums, can be tax deductible. You can deduct all medical expenses that are more than 7.5 percent of your adjusted gross income.

Is Social Security taxes included in federal taxes?

If you're employed, you may notice a line on your pay stub for Social Security, FICA, or OASDI. These all relate to the same Social Security Tax you must pay and are separate from your federal income tax.

What is Medicare on my paycheck?

Medicare tax is deducted automatically from your paycheck to pay for Medicare Part A, which provides hospital insurance to seniors and people with disabilities. The total tax amount is split between employers and employees, each paying 1.45% of the employee's income.

Why do they take Medicare out of my paycheck?

The Social Security and Medicare programs are in place to help with your income and insurance needs once you reach retirement age. If you're on your employer's insurance plan, this deduction may come out of your paycheck to cover your medical, dental and life insurance premiums.

Why was Social Security not taken out of my paycheck?

Some workers are exempt from paying Social Security taxes if they, their employer, and the sect, order, or organization they belong to officially decline to accept Social Security benefits for retirement, disability, death, or medical care.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

Is there a wage base limit for Medicare?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

Who reviewed Medicare and Social Security?

Medically reviewed by Alana Biggers, M.D., MPH — Written by S. Behring on May 13, 2020. Medicare and Social Security are federally managed benefits that you’re entitled to based on your age, the number of years you have paid into the system, or if you have a qualifying disability. If you’re receiving Social Security benefits, ...

What is Medicare Part A?

Medicare Part A (hospital insurance). Part A covers services such as hospital stays, long-term care stays, and hospice care.

Who is eligible for Medicare?

You’ll need to be a United States citizen or have been a permanent legal resident for at least five years. In order to get full coverage, you or your spouse need to meet a work requirement. Meeting the work requirement verifies that you’ve paid into the system.

Who is eligible for SSI?

Social Security Disability Insurance is a type of Social Security benefit for those with disabilities or health conditions that prevent them from working.

How long do you have to wait to get Medicare?

Waiting period. You can also qualify for full Medicare coverage if you have a chronic disability. You’ll need to qualify for Social Security disability benefits and have been receiving them for two years. You’ll be automatically enrolled in Medicare after you’ve received 24 months of benefits.

How much does Medicare cost in 2020?

In 2020, the standard premium amount is $144.60. This amount will be higher if you have a large income.

When will I get Medicare if I am already on Social Security?

You’ll get Medicare automatically if you’re already receiving Social Security retirement or SSDI benefits. For example, if you took retirement benefits starting at age 62, you’ll be enrolled in Medicare three months before your 65th birthday. You’ll also be automatically enrolled once you’ve been receiving SSDI for 24 months.

How much is Medicare payroll tax?

Medicare Payroll Tax. The Medicare payroll tax is 1.45% and is based on each employee's earnings without limit. The Medicare tax is withheld from each employee's earnings and is also matched by the employer. This makes the total Medicare tax equal to 2.9% on every dollar of earnings.

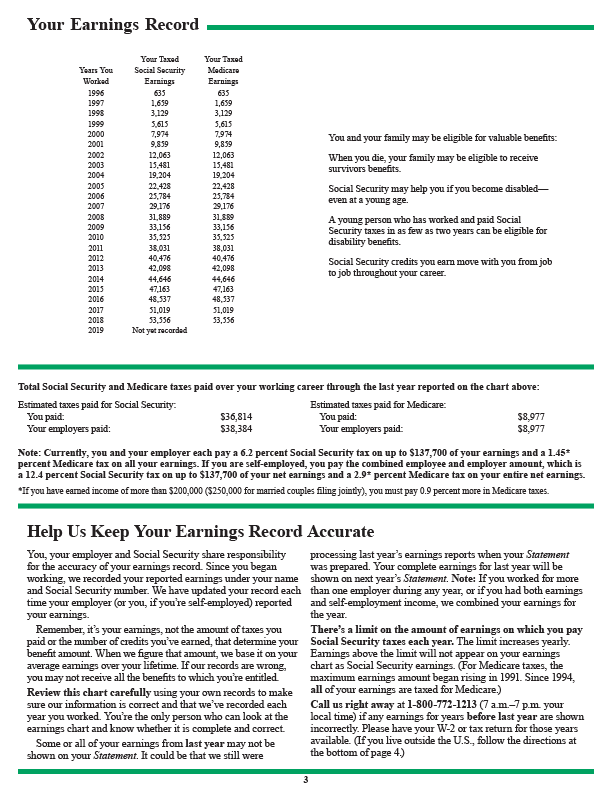

What is the Social Security payroll tax rate for 2020?

In the calendar year 2020, the Social Security payroll tax rate of 6.2% is applied to each employee's earnings up to the maximum of $137,700. The 6.2% that is withheld from the employee is also matched by the employer. As a result, the total Social Security tax in 2020 for an employee is equal to 12.4% of each employee's annual earnings up to a maximum earnings amount of $137,700.

What is the FICA rate?

FICA Payroll Tax. The combination of Social Security taxes and Medicare taxes is referred to as FICA. We often refer to the FICA tax rate as 7.65% (6.2% Social Security + 1.45% Medicare) of each employee's first $137,700 of annual earnings in 2020 and the first $142,800 of annual earnings in 2021. Each employee's earnings in excess ...

How does Social Security determine if you will pay a higher premium?

Social Security determines whether you will pay a higher premium based on income information it receives from the Internal Revenue Service.

What does the SSA do?

In this role, the Social Security Administration (SSA) works with the Centers for Medicare & Medicaid Services (CMS) to inform older Americans about their Medicare sign-up options, process their applications and collect premiums.

When do you get Medicare?

For most people, Medicare eligibility starts at age 65. If you're receiving Social Security retirement benefits, SSA will send you a "Welcome to Medicare" package at the start of your initial enrollment period, which begins three months before the month you turn 65. For example, if your 65th birthday is July 15, 2021, this period begins April 1.

How much is Part B insurance in 2021?

In 2021, the Part B premium starts at $148.50 a month and rises with the beneficiary's income. Part B premiums go up in steps for individuals with incomes greater than $88,000 or married couples with joint incomes of more than $176,000.

When do you have to apply for Medicare if you have not filed for Social Security?

If you have not yet filed for Social Security benefits, you will need to apply for Medicare yourself. You can do so any time during the initial enrollment period, which lasts seven months (so, for that July 15 birthday, the sign-up window runs from April 1 through Oct. 31).

When will Social Security start in 2021?

For example, if your 65th birthday is July 15, 2021, this period begins April 1. On your 65th birthday, you'll automatically be enrolled in parts A and B. You have the right to opt out of Part B, but you might incur a penalty, in the form of permanently higher premiums, if you sign up for it later. If you have not yet filed for Social Security ...

Do you get Medicare if you don't get Social Security?

If you're not getting benefits, you'll receive bills from CMS. (Almost all Medicare beneficiaries pay no premiums for Part A because they worked, and paid Medicare taxes, long enough to qualify for the program.)

What Is Medicare Tax?

Medicare tax supports the Medicare program. This program ensures all Americans older than 65 years have access to federal health insurance. Employees and employers must pay their Medicare tax. In addition, self-employed people pay both self-employment tax, which means they pay both the employee and employer portions of the Medicare tax.

What is the difference between FICA and Medicare?

The only difference is that, as with FICA, the employee’s portion is deducted from their wages while the employer pays their share directly. Some employees have to pay an Additional Medicare Tax at 0.9% This tax applies to employees who make more than a set threshold amount each calendar year.

What happens if you don't follow Social Security?

Remember that if you don’t follow Social Security, Medicare or FICA instructions carefully, you may deduct too much Social Security tax from an employee. This could be the case if you kept on deducting above the Social Security maximum by mistake.

What does FICA mean for employers?

What this means as an employer is that you’ll have to periodically deposit both your employer’s taxes and the taxes you’ve withheld from your employee’s paychecks. Keep in mind that FICA taxes are calculated based on an individual’s gross annual wages.

What is the Medicare tax rate for 2019?

Both employers and employees pay FICA and these days, the tax is divided into Medicare tax and Social Security tax. The tax rates for employees in 2019 are 1.45% for Medicare and 6.2% for Social Security. In addition, highly paid employees are charged a 0.9% Medicare surtax.

Do you have to pay Social Security taxes on wages above $132,900?

If your employees’ wages exceed $132,900, you should no longer withhold social security taxes from their pay. In addition, you also don’t have to pay any employment taxes on wages above that amount.

Do self employed people pay Social Security tax?

The Social Security tax pays for federal disability and retirement benefits that support a huge portion of the American population. Employees and employers must both pay Social Security tax. Along with this, as with Medicare, self-employed people pay both employer and employee portions.

What is the Social Security tax rate?

The Social Security rate is 6.2 percent, up to an income limit of $137,000 and the Medicare rate is 1.45 percent, regardless of the amount of income earned. Your employer pays a matching FICA tax. This means that the total FICA paid on your earnings is 12.4 percent for Social Security, up to the earnings limit of $137,000 ...

What percentage of your income is taxable for Medicare?

The current tax rate for Medicare, which is subject to change, is 1.45 percent of your gross taxable income.

What is the FICA tax?

Currently, the FICA tax is 7.65 percent of your gross taxable income for both the employee and the employer.

Is Medicare payroll tax deductible?

If you are retired and still working part-time, the Medicare payroll tax will still be deducted from your gross pay. Unlike the Social Security tax which currently stops being a deduction after a person earns $137,000, there is no income limit for the Medicare payroll tax.