Is Medigap plan F being discontinued?

Although Medigap Plan F is being discontinued at the beginning of 2020, this does not mean current enrollees in Plan F will lose their coverage with that plan. The change impacts newly eligible enrollees, which means anyone who turns 65 and first becomes eligible for Medicare in 2020.

Is Medicare supplement plan F going away in 2020?

Certain Medicare Supplement plans, also known as Medigap, will no longer be offered to newly eligible enrollees after January 1, 2020. This change specifically impacts plans that pay for the Medicare Part B deductible, like Medicare Supplement Plan F. What Does Plan F Cover?

Who’s eligible for Medigap plan F?

Who’s Eligible for Medigap Plan F? Due to the MACRA Act, CMS has discontinued Plan F. Beneficiaries eligible for Medicare on or after January 1st, 2020 are not eligible for Plan F, Plan C, or High-Deductible Plan F. Those who were eligible prior, even if they didn’t have a Plan F before, you’re still eligible to enroll.

What are the benefits of Medigap plan F?

Plan F Benefits. Medigap Plan F pays for all of these co-insurance fees. Medicare Part B co-insurance and co-payment: Medicare Part B usually charges a co-insurance and copayments for doctor visits and other outpatient care. Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services,...

Is Medigap Plan F being discontinued?

Medigap Plan F and Medigap Plan C are no longer available to people who qualified for Medicare on or after January 1, 2020. If you've ever shopped for a Medicare Supplement plan, you've probably encountered Plan F.

Will Plan F be available in 2021?

Medicare Supplement Plan F is the most comprehensive of the standardized Medicare Supplement plans available in most states. These plans are being phased out, starting in 2021.

What is Medicare Plan F being replaced with?

Popular Plan F Replacements Include Medicare Supplement Plan G and Plan N. There are no explicit replacements for Plan F – you'll have to choose from a number of existing Medicare Supplement plans.

Is Medicare Plan F still available 2022?

Previously, anyone enrolled in original Medicare could purchase Medigap Plan F. However, this plan is now being phased out. As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020. If you were already enrolled in Medigap Plan F, you can keep the plan and the benefits.

What is the cost for Medicare Plan F in 2022?

The average premium for Medicare Supplement Insurance Plan F in 2022 is $172.75 per month, or $2,073 per year.

Can I switch from plan F to plan G?

Switching from Plan F to Plan G If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance.

Is plan G better than plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Which Medigap plans are no longer available?

The federal government standardizes all Medigap plans. Medicare Supplement Plan H, Plan I, and Plan J are no longer available. These plans were discontinued when the Medicare Modernization Act of 2003 became a law, introducing Medicare Part D.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

What is the plan F deductible for 2022?

Effective January 1, 2022, the annual deductible amount for these three plans is $2,490.

What is Medicare Part F 2021?

Plan F is the most comprehensive Medigap plan available for qualifying Medicare beneficiaries. Specifically, this plan covers 100% of your Medicare cost-sharing and leaves you with no out-of-pocket expenses for Medicare-covered services.

Can I go back to plan F?

Guaranteed renewability: Medicare Supplement plans (F included) are guaranteed renewable, regardless of any health problems you may have. As long as you pay your premiums on time, an insurance company cannot cancel your policy.

When will Medicare stop allowing you to buy Medigap?

If you became eligible for Medicare on or after January 1, 2020, a federal law will prevent you from purchasing Medigap Plan C and Plan F.

What is the first dollar Medicare Supplement?

First-Dollar Medicare Supplement Insurance plans. Plan F and Plan C are both referred to as “first-dollar” coverage plans because they cover the annual Medicare Part B deductible. This benefit allows policyholders to get non-emergency medical care without having to pay an annual deductible. The Part B deductible is $198 per year in 2020.

How many Medicare plans are there in 2020?

Unless new plans are added, most newly eligible Medicare beneficiaries in 2020 will only have 8 Medigap plan options to choose from: Plans A, B, D, G, K, L, M, and N. If you're a new Medicare beneficiary starting in 2020, you will not be able to enroll in Plan F or Plan C and will not have coverage for the Medicare Part B deductible benefit.

Can you keep Medigap Plan C?

Current Medigap policyholders. If you are currently enrolled in Medigap Plan C or Plan F, you can keep your plan. However, you may still want to explore your options. “Plan F holders may want to make sure Plan F is the right plan for them and make changes while they are healthy and still able to qualify for a new plan,” he said.

Does lower rated insurance increase premiums?

Lower-rated carriers or new insurance carriers may offer lower premiums at first, but they might increase premiums drastically from year to year, or after the introductory rates are over. “If you are uncertain about plan F or the future of Plan F, give us a call,” Esposito said.

Will Medicare Part B deductible increase in 2020?

If you use Medicare Part B services, you must pay the $198 annual deductible in 2020. The Part B deductible may increase in future years. Esposito thinks that it's possible that the Part B deductible will increase at a higher rate than we are used to seeing especially due to the recent increase.

When does Medicare stop covering F and C?

Plan F). Now, this does not take effect until 2020. But as of 1/1/2020, plans that cover “everything” Medicare does not cover, including Plans F and C, will be eliminated to NEW enrollees.

What does it mean when a Medigap plan ends?

Also, when a Medigap plan ends to new customers, it becomes a “closed” block of business. This just means that everyone that has that plan is aging with no “turning 65” new customers to offset that. An aging customer base means more claims, and most likely, higher/more frequent rate increases.

What is a plan F?

Plan F is the most common and comprehensive Medigap plan. It pays everything that Medicare Parts A & B do not cover at the doctor and hospital. It also accounts for almost half of the current enrollees in Medigap plans. In 2014, Congress passed legislation that included a prohibition against “first-dollar” Medigap coverage (i.e. Plan F).

Which is more cost effective, Plan G or Plan N?

Other plans like Plan G and Plan N, which require some cost-sharing, have proven to be both more cost-effective and rate-stable over time. Although those plans have some deductibles, co-pays and out of pocket costs, the premium savings (in most situations) more than offsets any out of pocket costs you would pay.

Will Medigap change again?

It’s likely that would occur again in 2020. However, those changes have not been finalized or announced.

Can I sign up for Medigap Plan F?

Actually, you can still sign up for Medigap Plan F now (and many people still are!). And, it is expected that you will be able to keep (“grandfathered in”) your Plan F after 1/1/2020. While you may be able to sign up for it now and may be able to keep your Plan F after 1/1/2020, it may not be wise to do so.

When will Medicare change to plan F?

The rules for who can enroll in Medigap plan F have changed starting January 1, 2020. If you're newly eligible for Medicare in 2020, skip ahead to find out how this update will affect you.

What is Medicare Supplement Plan F?

Licensed Insurance Agent and Medicare Expert Writer. July 29, 2020. Medicare Plan F covers more expenses than other supplement plans, and it's one of just two plans that pay for the Part B deductible. It also covers the Part B excess charge, a benefit that’s just as rare.

What is a plan F?

Plan F is one of two Medicare Supplement plans that covers Part B excess charges (what some doctors charge above what Medicare pays for a service). Plan C is the other. Like many other Medigap policies, Plan F also covers Part B copayments and the deductible.

How much does Plan F cost in 2020?

This plan covers everything a regular Plan F does, but in 2020, you’ll be responsible for paying the first $2,340 (up from $2,300 in 2019) of costs out of your own pocket before coverage kicks in. In return, you could pay lower premiums each month.

What is covered by Plan F?

Plan F also covers many Part A expenses, such as coinsurance for hospital stays, a skilled nursing facility, and hospice care. You’ll also have coverage for the first three pints of blood, should you ever need a transfusion. After that, Part A takes over to pay for additional blood.

Why did John choose Plan F?

He’s choosing Plan F because he needs regular kidney dialysis, as well as physical therapy for an old shoulder injury. He has a wife and helps care for two teenage grandchildren, so John needs fixed health care costs each month.

Is Plan F a good Medicare supplement?

As the most popular Medicare Supplement plan, Plan F could be a logical choice for many Medica re recipients. If it seems like the right choice, call a licensed insurance agent who can help you choose the right insurance company for your needs.

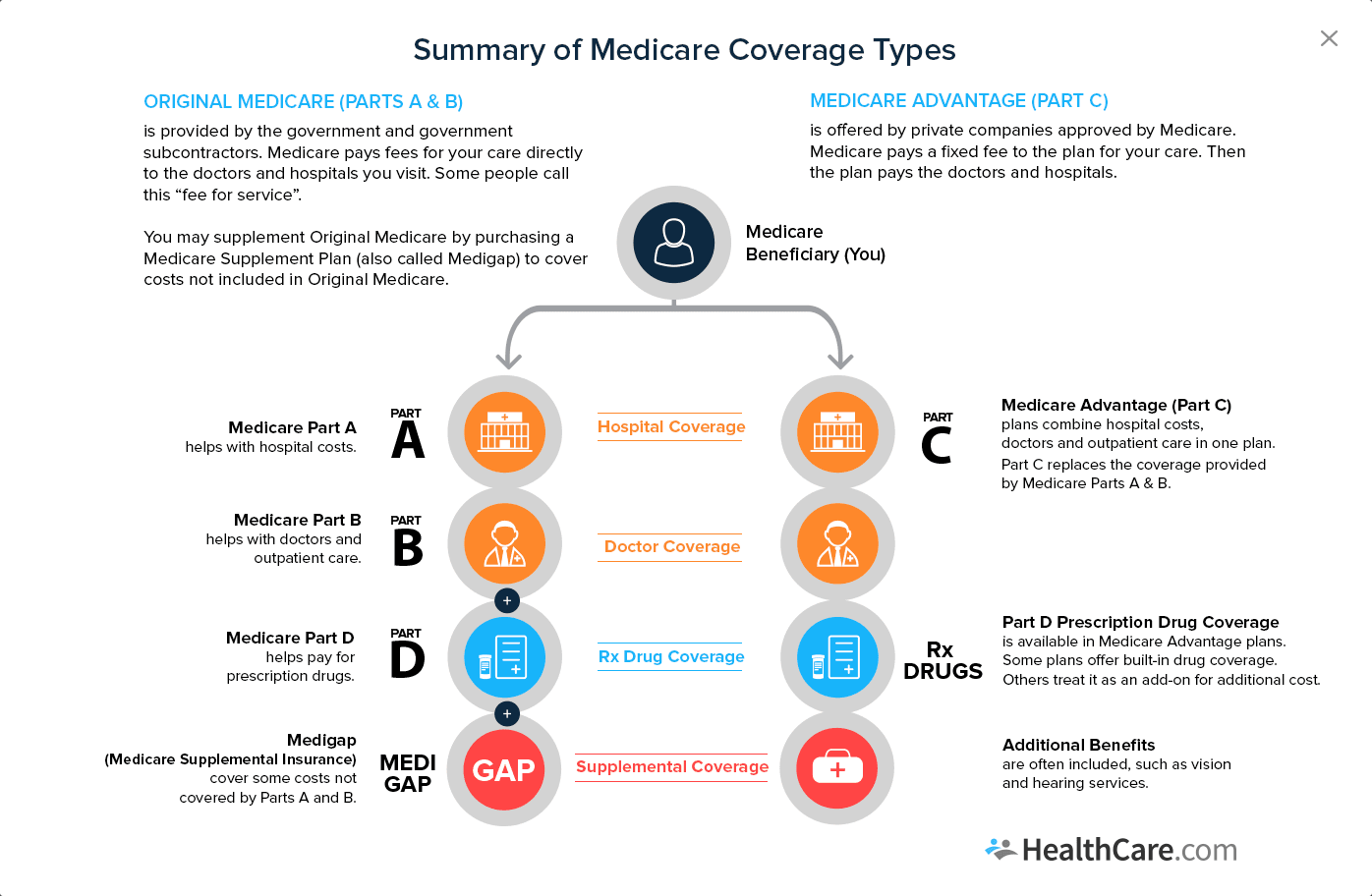

What is Plan F insurance?

Plan F is part of Medicare Supplement Insurance, also known as Medigap. This is insurance that’s sold by private companies and fills gaps in Original Medicare coverage, such as copayments, coinsurance and deductibles. How it works: Medicare pays its share of the approved amount for covered health care costs and services.

How does Medicare Advantage work?

How it works: Medicare pays its share of the approved amount for covered health care costs and services. Then, the Medigap policy pays its share. (You’ll pay a separate monthly premium for Medigap benefits.) » Learn about Medicare Advantage Plans.

How to contact Medigap insurance?

For questions about Medicare coverage, go to Medicare.gov or call 1-800-MEDICARE (1-800-633-4227).

Which states have Medigap plans?

Medigap plans are standard in every state except Massachusetts, Minnesota and Wisconsin, which have their own plans. Medigap Plan F, when it was fully available, was considered one of the most comprehensive Medigap policies on the market, since it covers all of the out-of-pocket costs of Original Medicare (Part A and Part B).

Can I keep my Medicare Part F plan?

If you already have or were covered by Part F before Jan. 1, 2020, you can keep your plan. And if you were eligible for Medicare before that date but haven't yet enrolled , you may be able to buy a Part F plan. Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up.

Can I buy a Medigap plan F after Jan 1 2020?

Here’s the catch for most new enrollees: If you’re newly eligible for Medicare after Jan. 1, 2020, you cannot purchase a Medigap Plan F policy. Why? After that date, new policies aren't allowed to pay a Medicare Part B deductible, one of the prime features of Plan F.

When will Medicare plan F be available?

Note: Plan F will not be available for sale to Medicare beneficiaries who become eligible for Medicare after January 1, 2020. If you fall in this category, you may want to consider Medigap Plan G instead. Learn more about the benefits, costs and coverage of Medicare Supplement Insurance Plan F.

What is Medicare Supplement Insurance Plan F?

Medicare Supplement Insurance Plan F. Medigap Plan F is one of the 10 standardized Medicare Supplement Insurance plan options sold in most states. Plan F covers the most standardized Medigap benefits and is the most popular Medigap plan. In fact, 55% of Medigap beneficiaries in 2017 were enrolled in Plan F. 1.

What is Medicare Part B coinsurance?

Medicare Part B Coinsurance and Copayment. Medicare Part B usually charges a coinsurance and copayments for doctor visits and other outpatient care . Medicare Part B typically pays for 80% of the Medicare-approved amount for covered services, leaving a 20% coinsurance in most cases.

What is Plan F?

Plan F covers the most benefits out of any of the standardized Medicare Supplement Insurance plan options. This popular plan may be suitable for you if you may need extensive medical coverage and don't want to worry about co-pays and deductibles. Although Plan F's premiums tend to be some of the highest, it offers coverage for all 9 standardized ...

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

How much is Medicare Part A deductible?

Medicare Part A Deductible. Medicare Part A comes with a deductible, which is $1,408 per benefit period in 2020. This means that you must pay $1,408 out of pocket before your Medicare Part A coverage kicks in. The Part A deductible is not annual.

How much is a high deductible plan F?

There is a regular Plan F and a high-deductible Plan F. If you choose the high-deductible Plan F, you must meet a yearly deductible of $2,340 (in 2020) before the plan covers anything. The high-deductible version of Plan F may have lower premiums than the regular Plan F, but it also comes with much higher out-of-pocket costs.

When will Medigap Plan F be discontinued?

Although Medigap Plan F is being discontinued at the beginning of 2020, this does not mean current enrollees in Plan F will lose their coverage with that plan. The change impacts newly eligible enrollees, which means anyone who turns 65 and first becomes eligible for Medicare in 2020.

What is Plan F for Medicare?

Like most Medigap plans, Plan F covers many of the out-of-pocket expenses associated with your Original Medicare benefits: 100% coverage of Part A coinsurance and costs while staying in the hospital, for up to 365-day once Medicare benefits are exhausted. 100% coverage of the first 3 pints of blood for a transfusion.

What is a plan F?

Like most Medigap plans, Plan F covers many of the out-of-pocket expenses associated with your Original Medicare benefits: 1 100% coverage of Part A coinsurance and costs while staying in the hospital, for up to 365-day once Medicare benefits are exhausted 2 100% coverage of Part B outpatient coinsurances and copayments 3 100% coverage of the first 3 pints of blood for a transfusion. 4 100% coverage of Part A’s coinsurance or copayment for hospice care. 5 100% coverage of the coinsurance at a skilled nursing facility. 6 100% coverage of the Part A deductible 7 100% coverage of the Part B deductible 8 100% coverage of excess charges with Part B 9 80% coverage of medical care during a foreign travel emergency

Can you switch Medigap plans after 6 months?

Recipients may also find they are charged a higher premium for attempting to switch plans past their initial enrollment period. If a recipient is still within their 6-month open enrollment period when they choose Plan F, they may switch to a different Medigap plan without these issues factoring in.

Is Plan N a lower premium than F and G?

You might consider Plan N as a possibility. While it has fewer benefits than F and G, it offers significantly lower premiums. Like G, an N enrollee must pay the Part B $198 deductible. Plan N enrollees also pay a $20 copayment per doctor visit and $50 copayment for hospital visits that end with the patient being formally admitted as an inpatient.

Can you still join Plan F?

If you are eligible for Part A hospital services today, you can still join Plan F or remain on it. You’ll even be able to switch between different Plan F carriers. Since Plan F is by far the most popular Medigap plan, insurance companies will continue to offer it well into the future. Indeed, there are still policyholders of other plans, such as Plan J that was discontinued a decade ago.

When is Medicare newly eligible?

People who are 65 years of age or became first eligible for Medicare because of age, disability or end-stage renal sickness on or after January 1, 2020 are considered “newly eligible”. If you already had Medicare Part A and B in 2019, then you are NOT considered “newly eligible” and the MACRA rules do not apply to you.

Is Medicare Supplement Plan G the best?

For most of our clients, Medicare Supplement Plan G is usually the best short and long-term fit but there are lots of variables when it comes to choosing a plan. You can get prices and enroll in Medigap Plan F and G here. If you want to discuss your specific situation, give us a call at 800-930-7956.

Why Plan F is Going Away?

In order to cut spending, Congress has marked the discontinuation of the plan for all new beneficiaries. The change comes as part of a 2015 Law that prohibits Medigap plans that cover the deductible for Part B from being sold to new Medicare enrollees starting in 2020.

What If You Are Currently Enrolled in Plan F or C?

Those who currently are enrolled in these plans don’t panic! Those enrolled in plans C or F as of 12/31/2019 will be “grandfathered” and able to continue with their plan as long as want. Those currently enrolled will also be able to switch between the plans from different companies, although underwriting will be required.

What Medigap Options Do You Have?

Those who decide to get off Plan F or C will be looking for a good replacement. The next best thing comparable to a Plan F would be a Plan G. The plan provides the same Medigap benefits besides the part B deductible. Don’t limit yourself! Get with your trusted insurance agent and talk about your available options with switching your Medigap plan.