Medical Supplemental Insurance is sold by private insurance companies, such as Aetna, UnitedHealthcare, Cigna, and Humana. They cover, among other items, the coinsurance and deductibles for hospitalization, hospice care, or skilled nursing services that Medicare does not cover.

Full Answer

What is plan F Medicare supplement?

Plan F is one of the most comprehensive Medicare Supplement plans available. As well as the Part B deductible, it also covers: Medicare Part A deductible. Medicare Part B excess charges. Part A hospital and coinsurance costs up to an additional 356 days after Medicare benefits are exhausted.

Which companies offer the best Medicare supplement plans?

Top-Rated Medicare Supplement Companies Manhattan Life Medicare Supplement Plans Continental Life Insurance Medicare Supplement Plans Humana Medicare Supplement Plans Blue Cross Blue Shield Medicare Supplement Plans Anthem Medicare Supplement Plans Mutual of Omaha Medicare Supplement Plans Aetna Medicare Supplement Plans

Which states do not offer Medicare supplement plan F?

Massachusetts, Minnesota, and Wisconsin have state-specific policies and do not offer Medicare Supplement Plan F. Although Medicare has an annual Open Enrollment Period, there is only one Medigap Open Enrollment Period.

Will Medicare supplement plan F leave the market in 2020?

Medicare Supplement Plan F may leave the market in 2020 – but not for everyone. If you have been shopping for a Medicare Supplement (also known as Medigap) plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

Who is Plan F available to?

Medicare Plan F is a supplemental (Medigap) health insurance plan that is offered to individuals who are disabled or over the age of 65.

What has replaced Plan F?

For those people who became eligible for Medicare on or after Jan. 1, 2020, Plans D or G may be available. Plan D and Plan G have replaced Plan C and Plan F. The difference between Plans C and D, and Plans F and G, is the coverage of the Part B deductible.

Why is Medigap Plan F being discontinued?

The reason Plan F (and Plan C) is going away is due to new legislation that no longer allows Medicare Supplement insurance plans to cover Medicare Part B deductibles. Since Plan F and Plan C pay this deductible, private insurance companies can no longer offer these plans to new Medicare enrollees.

What is Medicare Plan F supplement?

Medigap Plan F is a Medicare Supplement Insurance plan that's offered by private companies. It covers "gaps" in Original Medicare coverage, such as copayments, coinsurance and deductibles. Plan F offers the most coverage of any Medigap plan, but unless you were eligible for Medicare by Dec.

Is supplement F still available?

As of 2015, Medicare Supplement Plan F is no longer available to anyone who became eligible for Medicare after January 1st, 2020.

Is plan F still available in 2022?

However, as of January 1, 2020, Plan F was phased out, making it ineligible for new enrollees unless you were eligible for Medicare before January 1, 2020. The only real difference between Plan F and Plan G is that Plan F covers the deductible for Part B, which is $170.10 in 2022.

Can I switch back to plan F?

You pay for Medicare-covered costs up to the $2,490 deductible (as of 2022) before the plan begins to pay for anything. If you currently have Medicare Supplement Plan F, you can switch to high-deductible Plan F by contacting your insurance provider.

How much does AARP plan F Cost?

Below are the average AARP Medicare Supplement costs in each of these three categories....1. AARP Medigap costs in states where age doesn't affect the price.Plan nameAverage monthly cost for AARP MedigapPlan B$242Plan C$288Plan F$2567 more rows•Jan 24, 2022

Is plan F better than plan G?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

What is the difference between Medigap plan C and F?

Of the 10 Medigap plans, C and F currently pay that deductible, which is $233 for 2022. The difference between plans C and F is that C does not cover the 15 percent in excess charges that doctors who don't participate in Medicare are allowed to charge their patients; Plan F does.

Does Medicare Plan F cover prescriptions?

Medicare Supplement Plan F does not cover prescription drugs. By law, Medicare Supplement plans do not cover prescription drug costs. Medicare beneficiaries who want prescription drug coverage typically have two options: Enroll in a Medicare Advantage (Medicare Part C) plan that includes prescription drug coverage.

What is the difference between Plan F and Plan F high deductible?

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium. As a reminder, your...

Does Plan F cover dental?

Original Medicare doesn’t cover routine dental care, like cleanings or extractions, and there are no supplement plans that fill the gap. If you wan...

Is there an alternative to Plan F?

Since Plan F has been phased out for newer members, the best alternative is Plan G. Medicare Plan G covers all the same things that Plan F covers,...

How to enroll in Medicare Plan F?

The first step to enrolling in Medicare Plan F is to en roll in Original Medicare. Then, if you became eligible for Medicare before January 1, 2020, you can still apply for Plan F. If you became eligible after January 1, 2020, though, you are ineligible to apply for Plan F because the Medicare Access and CHIP Reauthorization Act (also known as MACRA) went into effect, phasing out Plan F for new enrollees. However, if you already have Plan F, you are able to keep your coverage.

How much is Plan F deductible?

The High Deductible Plan F has a deductible of $2,340 but because you have to pay more out-of-pocket, the premiums for this plan tend to be significantly lower.

Which Medicare Supplement Plan is the least expensive?

Medicare Supplement Plan F is far and away the least expensive Medicare Supplement Plan that offers the most coverage. This means it is—or was—the most popular supplement for Original Medicare, especially because Plan F covers the Part B deductible. However, as of January 1, 2020, Plan F is being phased out, making it ineligible for new enrollees ...

Does a high deductible plan work?

With a high-deductible Plan F, the coverage doesn’t activate until the deductible amount is met, but in exchange, you can expect much lower monthly payments than the regular Plan F, which works the same as other Plans, with lower deductibles and higher monthly payments.

Which is the best company to sign up for Medicare Supplement Plan F?

Mutual of Omaha is the best company to go with for a quick and painless experience signing up for Medicare Supplement Plan F. It takes hardly any time or effort to get an array of estimates for Plan F and other Medicare Supplement plans that are offered.

Does Humana have a plan F?

In addition to covering everything included in Medicare Parts A, B, and C at a low cost, Humana’s Plan F offers extensive extra benefits. These include a SilverSneakers fitness plan, a nurse advice line that's staffed 24/7, and even household discounts if more than one person in your household has a Medicare Supplement Plan with Humana.

Does Cigna pay for Medicare Supplement Plan F?

And, in most cases, you don't pay anything. For example, for hospitalization up through the first 60 days, Medicare covers everything except $1,408. Plan F then covers that $1,408, so you pay nothing. Cigna makes it easy to see exactly which gaps Plan F pays for.

What is a Medigap Plan F?

Medigap Plan F is a Medicare supplement insurance plan that helps you pay for out-of-pocket expenses associated with Medicare. It’s only available for people who have Original Medicare. Medicare Supplement Plans don’t work with Medicare Advantage.

What does Medicare Supplement Insurance Plan F cover?

Medicare Supplement Plan F covers costs that Medicare doesn’t cover, says Laura Decker, co-founder and president of the Employee Benefits Division at SSGI, a Maryland-based employee benefits insurance agency.

What doesn't Medicare Supplement Plan F cover?

Medicare Plan F won't cover any services not covered under Original Medicare.

How much does Medicare Part F cost?

The cost of Medicare Plan F depends on a few factors, including your age.

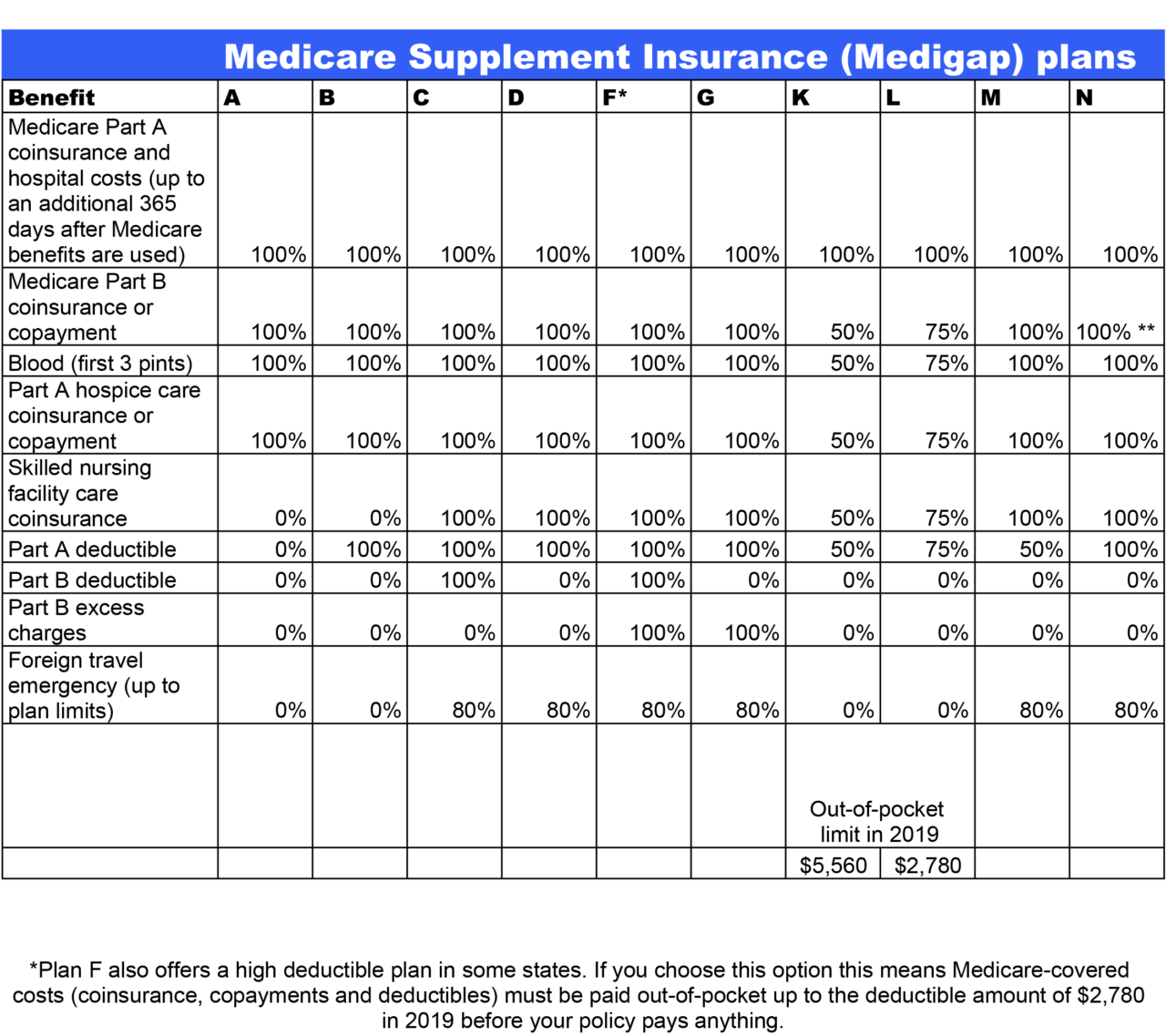

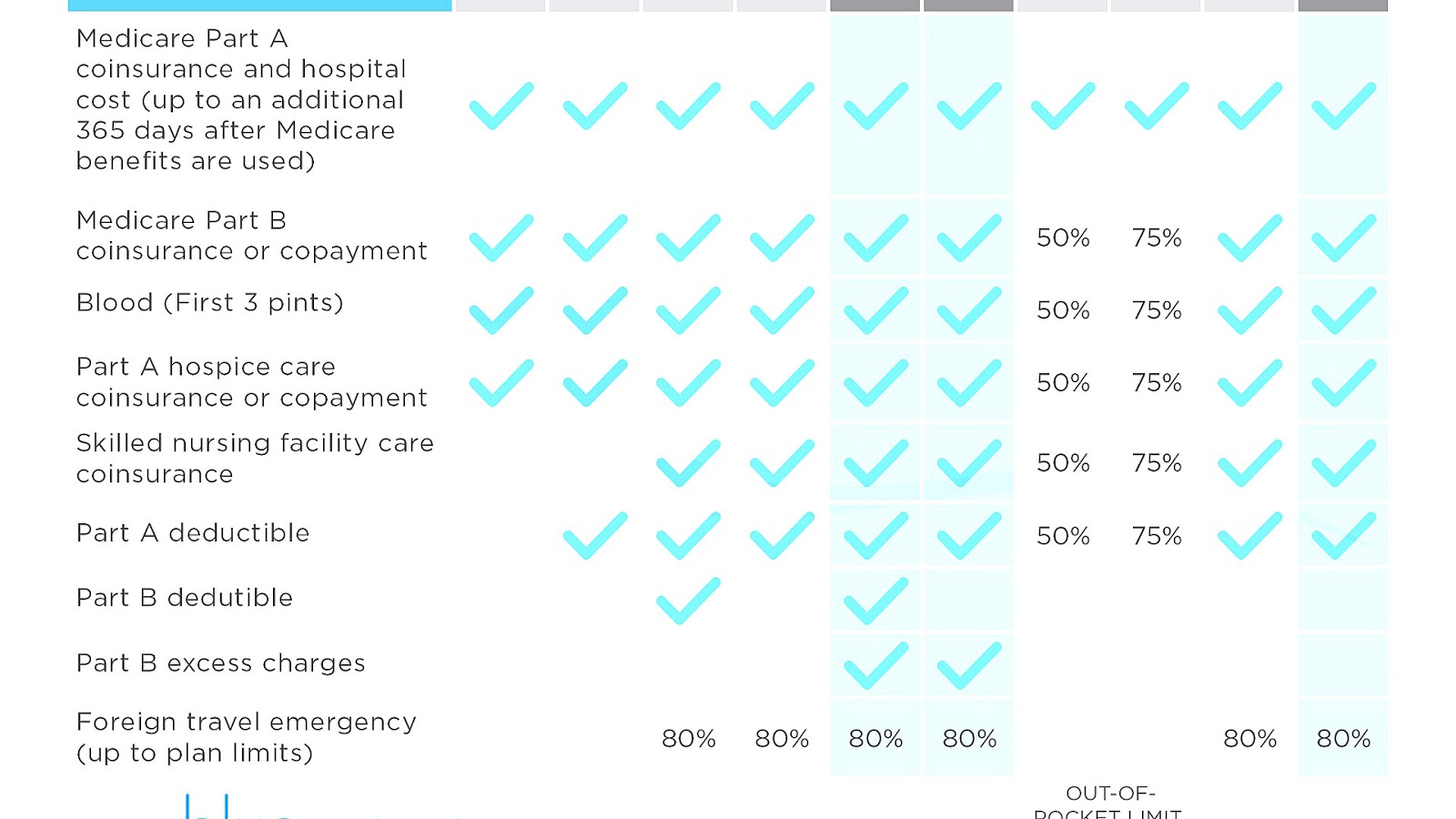

Medicare supplement plans comparison

Medicare Plan F is no longer available for purchase. However, several other Medigap supplement plans can help cover the out-of-pocket costs associated with Original Medicare.

Frequently Asked Questions

Standard Plan F has a much lower deductible than high-deductible Plan F. A high-deductible Plan F has a lower monthly premium.

What is the most comprehensive Medicare Supplement?

In most states, the most comprehensive Medicare Supplement insurance plan available will be Plan G. Plan G is similar to Medicare Supplement Plan F, except Plan G does not cover the Part B deductible. (In 2021, the Part B deductible is $203 per year.)

What is the Medicare Access and CHIP Reauthorization Act?

In 2015, Congress passed the Medicare Access and CHIP Reauthorization Act. The act was meant to improve provider payments for covered Medicare services. At the same time, however, Congress knew there’s an increasing strain on the Medicare Trust Fund budget, as more and more people age into Medicare.

When will Medicare Supplement Plan F leave the market?

Medicare Supplement Plan F may eventually leave the market, starting in 2020 – but not for everyone. If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

Is Medicare Supplement Plan F a plan option?

Obviously if you weren’t eligible for Medicare prior to January 1, 2020, Medicare Supplement Plan F won’t be a plan option. Still, you may have choices in Medicare Supplement insurance plans. Make the best coverage decision for yourself. If you have a Medicare Supplement Plan F, you don’t have to take any action because your coverage is still ...

Does Medicare Supplement cover Part A?

Some Medicare Supplement insurance plans can still cover the Medicare Part A deductible, but not the Part B deductible. This only applies to people who became eligible for Medicare January 1, 2020 and later.

Does Medicare Supplement Plan F cover out-of-pocket costs?

If you have been shopping for a Medicare Supplement (also known as Medigap) insurance plan, you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs. It’s the most comprehensive Medicare Supplement insurance plan among the 10 standardized plans available in most states.

Does Medicare Supplement Plan F have a high deductible?

Plan F has a high-deductible version. A Medicare Supplement high-deductible Plan G may now be available in some states.

What factors affect Medicare premiums?

In the case of Medicare Supplement plans, many factors affect what you’ll pay each month. Demographic information – such as age , location, and tobacco use – affect Medigap premium prices. Indeed, the carrier offering the plan also influences rates across the board. Each of the top 10 Medicare Supplement carriers on the list above is ...

What is INA insurance?

The Insurance Company of North America (INA) began in 1792 as the first Marine insurer of the United States. INA would eventually become the company we know today as Cigna, one of the most renowned health insurance carriers offering Medicare Supplement policies. Both AM Best and S&P rate Cigna at an A.

What is United American insurance?

United American: A Medigap Carrier with High Ratings. United American Insurance Company was founded in 1947. The company maintains an A+ rating from AM Best and has done so for over 40 years. S&P’s rating for United American is AA-.

Does Cigna have the same coverage as Plan G?

So, Plan G with Mutual of Omaha offers the same coverage as Plan G with Medico. Plan N with Cigna has the same coverage as Plan N with UnitedHealthcare. Additionally, all Medicare Supplement plans allow you to go to any doctor accepting Medicare assignment – which is the majority of doctors, coast-to-coast.

When was Aetna founded?

One of the most established insurance companies, Aetna was founded in 1853. Over 39 million customers rely on Aetna for health care, including Medicare. Aetna has excellent ratings all around; an A from AM Best and an A+ from S&P underscore the reasons for this company’s longevity.

Is Medicare competitive in 2021?

While every top carrier is competitive, it makes sense to pay more for superior customer service and financial stability. There are many top-rated medicare supplement companies to choose from in 2021, and when you use our agents, you get your cake and eat it too! When you enroll in a policy through us, you get the benefits ...

Who is Lindsay Malzone?

Lindsay Malzone is the Medicare expert for MedicareFAQ. She has been working in the Medicare industry since 2017. She is featured in many publications as well as writes regularly for other expert columns regarding Medicare.

What is Medicare Plan F?

Medicare Plan F covers all of the gaps in Original Medicare. It is considered to be the “Cadillac” coverage among the available Medicare supplements today. Plan F gives you first-dollar coverage for all Medicare-approved services. Whether you have a hospital stay, or a diagnostic exam or a doctor’s visit, you will simply present your Medicare card ...

What are the important imaging exams for Medicare?

Important imaging exams like colonoscopies and mammograms. Screenings for diabetes, cardiovascular conditions, bone density and other conditions. Medicare dictates which preventive screenings are allowed – your primary care doctor will know which screenings to provide to you that will be covered.

How much is Plan F for 2021?

Here’s a list view of your Plan F coverage at the hospital: Hospital deductible ($1,484 in 2021) and coinsurance. 365 days of additional hospital coverage after Medicare’s coverage is exhausted. Hospice care at any hospice facility. Blood (if needed in a transfusion)

Does Medicare pay for Plan F?

The way that Medigap plans, including Plan F, work is that they cover only after Medicare first pays its share. So naturally, if Medicare denies a claim, your Medigap plan cannot pay anything toward it either.

Does Plan F pay for deductible?

Then your Plan F supplement pays your deductible and the other 20%. Some doctors charge a 15% excess charge beyond what Medicare pays. Plan F covers that for you. Plan F also pays the 20% for a long list of other Part B services.

Does Medicare pay for eyeglasses after cataract surgery?

The answer is no if the matter is routine. Medicare will, however, pay for one pair of very basic eyeglasses after a cataract surgery. One exception is that Medicare supplement Plan F will cover up to $50,000 in foreign travel emergency benefits. Since this care occurs outside the U.S., Medicare obviously does not cover that.

Does Medicare cover outpatient prescriptions?

If Medicare pays its 80% share on such a drug, your Plan F will cover the rest of it. However, neither Original Medicare nor Plan F cover outpatient prescriptions.

What Is Medicare Supplement Insurance?

Medicare supplement plans are private health insurance plans that supplement Original Medicare.

What Is Medicare Supplement Plan F?

First, the bad news, Plan F has been phased out for new enrollees as of 2020. This is due to new legislation that no longer allows Medicare Supplement Insurance plans to cover your Part B deductible ($203 in 2021).

Frequently Asked Questions

Medicare Plan F (also referred to as Medigap Plan F) is the most comprehensive Medicare supplement plan. This plan covers Medicare deductibles and all copays and coinsurance (including Part B deductibles), which means you pay nothing out of pocket throughout the year.

Conclusion

We hope you found this overview helpful! If you have a question we did not cover, however, don’t hesitate to leave a comment or send us an email at [email protected]. We’ll be sure to get back to you within 24 hours.

What is Medico insurance?

Medico Insurance Company. Medico sells Medicare Supplement Insurance in 25 states and offers several popular Medigap plans, such as Plan A, Plan F, Plan G and Plan N. Medico offers a number of plan discounts for things like automatic premium withdrawal, being a non-smoker or living with another person over the age of 18.

What is the number 13 Cigna?

Cigna. Cigna is ranked number 13 on the Fortune 500 list. 2. Depending on your location, the Medicare Supplement Insurance plans you may be able to apply for from Cigna* may include: Plan G. Plan N.

What states have Medigap plans?

Their costs and the availability of the types of plans, however, may vary. Medigap plans in Massachusetts, Minnesota and Wisconsin are standardized differently than they are in every other state. Learn more about Medigap plans in your state.

What is a BCBS?

Blue Cross Blue Shield (BCBS) is among the leading health insurance carriers in the U.S., and BCBS companies were the very first to work in conjunction with Medicare. There are now 36 different locally operated BCBS companies administering coverage in all 50 states.

Does Aetna offer Medigap?

Aetna offers a diverse portfolio of insurance products that includes Medigap plans. Over 1 million people trust Aetna for their Medicare Supplement Insurance. 3. Aetna offers several different types of Medigap plans. Plan availability may vary based on your location.

Who sells Medicare Supplement Insurance?

Medicare Supplement Insurance plans (also called Medigap) are sold by dozens of private insurance companies all over the U.S. When shopping for coverage, it’s important to find the right plan for your unique needs and also to find the right insurance company. Different companies may sell Medigap plans that have different prices and terms, ...

Is Wellcare the same as Medigap?

It’s important to keep in mind that although each company’s plan selection and pricing may differ, the coverage included in each type of Medigap plan remains the same, no matter where you purchase it.