Before choosing a Medicare Advantage Plan, you may want to compare several plans by asking them these questions: What's my share of the costs for services and supplies? Does the plan have a Network of providers for some or all types of services?

Full Answer

What Medicare questions to ask?

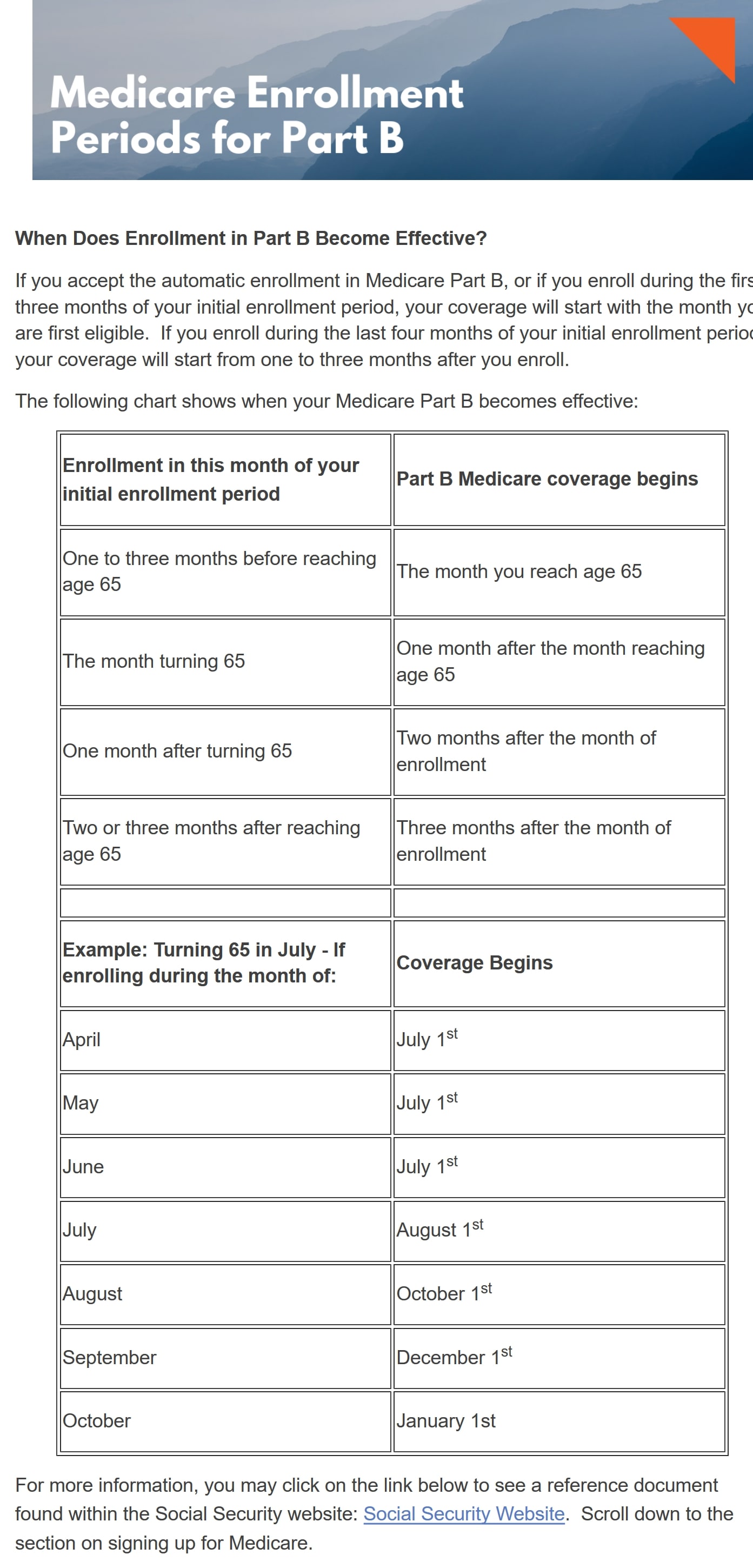

Most people get Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) when first eligible (usually when turning 65). Answer a few questions to check when and how to sign up based on your personal situation. Learn about Part A and Part B sign up periods and when coverage starts.

Where to get answeres to your Medicare questions.?

6 rows · • Enroll in Medicare Part A (Hospital Insurance) and/or Medicare Part B (Medical Insurance) ...

What information do I need to sign up for Medicare?

Jan 01, 2022 · Fill out Form CMS-40B (Application for Enrollment in Medicare Part B). Send the completed form to your local Social Security office by fax or mail. Call 1-800-772-1213. TTY users can call 1-800-325-0778. Contact your local Social Security office. If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

When to take Medicare question?

For most, Medicare Part A has no premium. You qualify for premium-free inpatient coverage when you pay Medicare taxes for 40 quarters (about ten years). Once you become eligible for Medicare and receive Social Security benefits, you must complete form CMS-1763 through your local Social Security office to sign up for Medicare Part A only. On this form, you must check the box to …

What questions are asked when signing up for Medicare?

- What are the basics? ...

- What are your coverage options? ...

- Should you enroll in Part D? ...

- Are you eligible for programs that help lower Medicare costs? ...

- What resources exist to help you navigate Medicare?

Do you get automatically enrolled in Medicare Part A?

What makes you eligible for Medicare Part A?

Is there a monthly fee for Medicare Part A?

How long before you turn 65 do you apply for Medicare?

It lasts for 7 months, starting 3 months before you turn 65, and ending 3 months after the month you turn 65. My birthday is on the first of the month.

Is Medicare Part A and B free?

Does Medicare come out of Social Security?

What is Medicare Part A and B?

What are the Medicare income limits for 2022?

| If your yearly income in 2020 (for what you pay in 2022) was | You pay each month (in 2022) | |

|---|---|---|

| File individual tax return | File joint tax return | |

| $91,000 or less | $182,000 or less | $170.10 |

| above $91,000 up to $114,000 | above $182,000 up to $228,000 | $238.10 |

| above $114,000 up to $142,000 | above $228,000 up to $284,000 | $340.20 |

What is Medicare Part A deductible for 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020.Nov 6, 2020

Does Medicare Part A cover emergency room visits?

Does Medicare Part A have a deductible?

How long before Medicare card is sent out?

We’ll mail you a welcome package with your Medicare card 3 months before your Medicare coverage starts.

How long after you sign up for Part A do you have to sign up for Part B?

You get Part A automatically. If you want Part B, you need to sign up for it. If you don’t sign up for Part B within 3 months after your Part A starts, you might have to wait to sign up and pay a monthly late enrollment penalty.

How long do you have to sign up for Part A?

You get Part A automatically. If you want Part B, you need to sign up for it. If you don’t sign up for Part B within 3 months of turning 65, you might have to wait to sign up and pay a monthly late enrollment penalty.

How to contact railroad retirement board?

If you or your spouse worked for a railroad, call the Railroad Retirement Board at 1-877-772-5772.

How long do you have to be on Social Security to qualify for Medicare?

Most people are eligible for Medicare at age 65. Those under 65 can qualify for Medicare when they collect Social Security Disability for at least 24 months.

Why do Medicare Supplements have a premium?

Medicare Supplements have a premium because they offer comprehensive benefits. If you’re hospitalized or in need of major treatment, Medigap will cover the costs that Medicare would leave you to pay.

What is Medicare Part C?

Medicare Part C is a Medicare Advantage plan. These plans sometimes have a $0 per month premiums, and many of them include Part D drug coverage. However, there are some pitfalls to Medicare Advantage plans that you need to know before signing up.

What is telemedicine in Medicare?

Telemedicine services can include telephone appointments and virtual appointments. In general, telemedicine is a remote clinical service . Medicare Part B will cover telehealth services.

What happens if you don't pay Medicare?

But, if you don’t pay the premium on a Medicare Advantage or Medigap plan, they can drop you. Also, if you don’t pay your Part D premium, the drug plan can drop you. Usually, they give multiple notices before the plan terminates your policy.

What is a medicaid supplement?

A Medigap plan is a supplemental option for Medicare. Medigap plans are also Medicare Supplement plans; these policies fill the gaps in Medicare. So, when Medicare would otherwise charge you 20% or a deductible, the Medicare Supplement could instead pick up the bill.

How many classes of drugs does Medicare cover?

There are many drugs covered under Medicare. Plus, every plan must cover the six protected classes. If you have medications that need coverage, use the Medicare plan finder tool to identify the policy that will cover your medications.

What is Medicare Part A?

Medicare Part A coverage includes: 1 A semi-private room 2 Hospital meals 3 Skilled nursing services 4 Care on special units such as intensive care 5 Drugs, medical supplies and medical equipment used during your inpatient stay 6 Lab tests, X-rays and medical equipment when you’re an inpatient 7 Operating room and recovery room services 8 Some blood transfusions (in a hospital or skilled nursing facility) 9 Rehab services such as physical therapy received through home health care 10 Skilled health care in your home if you’re homebound and only need part-time care 11 Hospice care

When do you have to retire to get Medicare?

Answer: If you retire or lose employer coverage before age 65, you’ll need other health coverage until you reach Medicare eligibility age and have your seven-month Initial Enrollment Period. If you are 65 or older when you retire or lose employer coverage, you may qualify for what is called a Special Enrollment Period (SEP).

What is Medicare Made Clear?

Medicare Made Clear is brought to you by UnitedHealthcare to help make understanding Medicare easier. Click here to take advantage of more helpful tools and resources from Medicare Made Clear including downloadable worksheets and guides.

What is the notice of creditable coverage for Medicare?

You’ll need a written notice of “creditable coverage” from the plan to qualify for a SEP and avoid late penalties. The notice certifies that the plan provides coverage at least as good as Medicare.

How long do you have to enroll in Part B?

Answer: When you’re over 65 and retiring soon, getting Part B is fairly simple. If you qualify for a Special Enrollment Period (see question 2 above), you’ll have up to eight months to enroll in Part B without penalty. If you don’t actually quality for an SEP, you will have a Part B late penalty. To get Part B, you will enroll directly with Social Security, which you can do online, in person or on the phone.

How long does Medicare last?

This period lasts seven months total, and includes the three months before the month you turn 65, the month in which you turn 65, and the three months after. If you are receiving Social Security or Railroad Retirement Board benefits when you first become eligible for Medicare, then you’ll be automatically enrolled in Part A and Part B ...

Does Medicare cover hospice care?

Hospice care. Medicare Part A does not cover custodial care such as help with bathing, dressing and eating, but due to new Medicare regulations, some Medicare Advantage plans (Part C) may begin offering some of these services in the home starting in 2019.

When do you have to enroll in Medicare?

Assuming you don’t qualify for automatic enrollment, the first opportunity you have to enroll in Original Medicare is typically during your seven-month Initial Enrollment Period, which generally begins three months before you turn 65, includes your birthday month, and ends three months after the month you turn 65. If you don’t enroll at this time, you may face a late-enrollment penalty.

When do you get Medicare if you are already on Social Security?

If you’re already receiving Social Security Administration (SSA) or Railroad Retirement Board (RRB) retirement benefits, you’ll typically get enrolled in Medicare when you turn 65.

What is Medicare prescription drug plan?

Medicare Prescription Drug Plans are available from private, Medicare-approved insurance companies. To qualify, you need to be enrolled in Medicare Part A and/or Part B and live in the plan’s service area. Plan availability, costs, and benefit details may vary. Read about enrollment periods for Medicare Prescription Drug Plans.

How to report Medicare fraud?

If you suspect Medicare fraud, waste, or abuse, you should immediately report fraud online. Alternatively, you can call the HHS Office of Inspector General at 1-800-447-8477 (TTY users 1-800-377-4950) or CMS at 1-800-633-4227 (TTY users 1-877-486-2048).

How to compare Medicare Advantage plans?

You can compare Medicare Advantage plans available where you live; just click Find Plans or Compare Plans on this page. Note that you need to continue paying your Medicare Part B premium, along with any premium the plan may charge.

How old do you have to be to get Medicare?

How to Complete Medicare Enrollment Forms. As you approach the age of 65, you’ll want to make sure you enroll in the Medicare insurance plan that may suit your needs. To do so, you need to know how to sign up for Medicare and which Medicare application forms to complete.

What is Medicare Advantage?

If you’d like, you may be able enroll in Medicare Advantage (Medicare Part C) as an alternative way to get your Original Medicare, Part A and Part B, benefits. Medicare Advantage plans are offered by private health insurance companies that contract with Medicare to deliver your Medicare Part A and Part B benefits – with the exception of hospice care, which is still covered under Part A. Many Medicare Advantage plans include benefits beyond Part A and Part B coverage as well; for example, some plans offer prescription drug coverage, routine vision care, and/or wellness programs. (Medicare Part A and Part B may cover prescription drugs in specific situations, but for the most part this coverage doesn’t extend to medications you take at home.)

How long can you join a health insurance plan?

You can join a plan anytime while you have job-based health insurance, and up to 2 months after you lose that insurance.

What is a Medicare leave period?

A period of time when you can join or leave a Medicare-approved plan.

What happens if you miss the 8 month special enrollment period?

If you miss this 8-month Special Enrollment Period, you’ll have to wait to sign up and go months without coverage. You might also pay a monthly penalty for as long as you have Part B. The penalty goes up the longer you wait to sign up.

When does the 8 month special enrollment period start?

Your 8-month Special Enrollment Period starts when you stop working, even if you choose COBRA or other coverage that’s not Medicare.

Does Cobra end with Medicare?

Your COBRA coverage will probably end when you sign up for Medicare. (If you get Medicare because you have End-Stage Renal Disease and your COBRA coverage continues, it will pay first.)

Do you have to tell Medicare if you have non-Medicare coverage?

Each year your plan must tell you if your non-Medicare drug coverage is creditable coverage. Keep this information — you may need it when you’re ready to join a Medicare drug plan. (Don’t send this information to Medicare.)