Can you switch from a Medigap plan to a Medicare Advantage plan?

Can you switch from Medicare Supplement (Medigap) to Medicare Advantage? Yes. There can be good reasons to consider switching your Medigap plan. Maybe you're paying too much for benefits you don't need, or your health needs have changed and now you need more benefits.Jun 24, 2021

Can I switch from Medigap to Medicare Advantage without underwriting?

If you leave that Medicare Advantage plan in the first 12 months, you can return to your Medigap plan without underwriting. In that first year ONLY, you will be guaranteed to reinstate your former Medigap plan. Be aware of this window if you try Medicare Advantage and decide you don't like it.Oct 4, 2016

Can I change my Medicare Supplement plan at any time during the year?

You can change your Medicare Supplement Plan anytime, just be aware that you might have to answer medical questions if your outside your Open Enrollment Period.

When a consumer enrolls in a Medicare Supplement insurance plan they are automatically disenrolled from their MA plan?

To switch to a new Medicare Advantage Plan, simply join the plan you choose during one of the enrollment periods. You'll be disenrolled automatically from your old plan when your new plan's coverage begins. To switch to Original Medicare, contact your current plan, or call us at 1-800-MEDICARE.

When can I change from Medigap to Medicare Advantage?

The best (and often only time) to switch from Medigap to Medicare Advantage is during the Open Enrollment Annual Election Period which runs from Oct 15th to Dec 7th. To switch during this time, you would enroll in a MA plan which can only start on Jan 1st of the following year.Jul 8, 2015

Can you switch from Plan N to Plan G without underwriting?

You can change Medigap carriers, while keeping the same level of coverage, during the months surrounding your Medigap anniversary. For example, you can switch from a Plan G to a Plan G without underwriting, but not from a Plan G to a Plan N.Jan 30, 2021

Can I change from one Medigap plan to another?

If you want to switch to a different Medigap policy, you'll have to check with your current or new insurance company to see if they'll offer you a different policy. If you decide to switch, you may have to pay more for your new Medigap policy.

What states allow you to change Medicare Supplement plans without underwriting?

In some states, there are rules that allow you to change Medicare supplement plans without underwriting. This includes California, Washington, Oregon, Missouri and a couple others. Call us for details on when you can change your plan in that state to take advantage of the “no underwriting” rules.

When can I change Medicare Supplement plans in California?

When Can You Switch Your Medigap Policy? The first time during which you can switch your Medigap policy without worrying about being rejected for coverage is during the Medigap Open Enrollment Period, a six-month period when you are 65 or older and have just enrolled in Medicare Part B.

Can I change my Medicare Advantage plan in February?

You can make changes to your plan at any time during the Medicare Advantage open enrollment period from January 1 through March 31 every year. This is also the Medicare general enrollment period. The changes you make will take effect on the first day of the month following the month you make a change.

Who pays for Medigap?

You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

Can you switch from an Advantage plan to a supplemental plan?

You may have chosen Medicare Advantage and later decided that you'd rather have the protections of a Medicare Supplement (Medigap) insurance plan that go along with Original Medicare. The good news is that you can switch from Medicare Advantage to Medigap, as long as you meet certain requirements.

How long is the free look period for Medigap?

Medigap free-look period. You have 30 days to decide if you want to keep the new Medigap policy. This is called your "free look period.". The 30- day free look period starts when you get your new Medigap policy. You'll need to pay both premiums for one month.

How long do you have to wait to get a Medigap policy?

The Medigap insurance company may be able to make you wait up to 6 months for coverage of pre-existing conditions. The number of months you've had your current Medigap policy must be subtracted from the time you must wait before your new Medigap policy covers your pre-existing condition.

Does Medicare cover Part B?

As of January 1, 2020, Medigap plans sold to new people with Medicare aren't allowed to cover the Part B deductible. Because of this, Plans C and F are not available to people new to Medicare starting on January 1, 2020.

How long does it take to switch to another Medicare Advantage plan?

If you permanently move out of your Medicare Advantage plan’s coverage area or move to an area with more available plans, you may switch to another Medicare Advantage plan beginning the month before your move and lasting for two months.

How often can you change your Medicare Advantage plan?

If you move into, out of, or currently reside in a facility of special care such as a skilled nursing home or long-term care hospital, you may enroll in, disenroll from, or change a Medicare Advantage plan one time per month.

What is a special enrollment period?

A Special Enrollment Period (SEP) is an enrollment period that takes place outside of the annual Medicare enrollment periods, such as the annual Open Enrollment Period. They are granted to people who were prevented from enrolling in Medicare during the regular enrollment period for a number of specific reasons.

When is the open enrollment period for Medicare?

Learn more and use this guide to help you sign up for Medicare. Open Enrollment: The fall Medicare Open Enrollment Period has officially begun and lasts from October 15 to December 7, 2020. You may be able to enroll in ...

Can you get TRICARE if you are 65?

TRICARE beneficiaries who are under 65 and qualify for Medicare because of a disability, ALS (Lou Gehrig’s Disease) or End-Stage Renal Disease (ESRD) may be eligible for a Special Enrollment Period if they didn’t sign up for Medica re Part B when they first became eligible.

What happens if you don't enroll in Medicare at 65?

If you did not enroll in Medicare when you turned 65 because you were still employed and were covered by your employer’s health insurance plan, you will be granted a Special Enrollment Period.

How long do you have to disenroll from Medicare Advantage?

If you enrolled in a Medicare Advantage plan when you first became eligible for Medicare, you have 12 months to disenroll from the plan and transition back to Original Medicare.

How to change Medicare Advantage plan?

During a Medicare Special Enrollment Period, you can typically: 1 Switch from one Medicare Advantage plan to another MA plan 2 Switch from a Medicare Advantage plan back to Original Medicare 3 Add or drop a Medicare Prescription Drug Plan (Medicare Part D)

How to change address on Medicare?

You can update your contact information online by visiting the Social Security Administration website, by phone via 1-800-772-1213 (TTY 1-800-325-0778) or by visiting your local Social Security office.

What happens if a doctor doesn't accept Medicare?

If you go to a doctor that does not accept your Medicare Advantage plan, you could be responsible for 100 percent of the costs. Be sure your new doctor accepts your Medicare Advantage plan before scheduling your first visit.

When does Medicare open enrollment end?

Typically, you are only able to make changes to your Medicare coverage during Medicare’s fall Open Enrollment Period, which runs from October 15 to December 7 each year. But certain life events, such as moving, may qualify you for a Medicare Special Enrollment Period (SEP).

How to speak to a licensed insurance agent about Medicare Advantage?

Some other situations include: To learn more about your Medicare Advantage options, including how to enroll in a new plan during your Special Enrollment Period, speak with a licensed insurance agent at 1-800-557-6059,TTY: 711. [1] According to Medicare.gov “Special circumstances (Special Enrollment Periods), Published May 18, 2018.

Is Medicare Advantage available in every region?

1. Medicare Advantage plan availability varies by location. Not all Medicare Advantage plans are available in every region. If you’re planning to move or have recently moved, we recommend speaking with a licensed insurance agent who can help you find Medicare Advantage plans in your area.

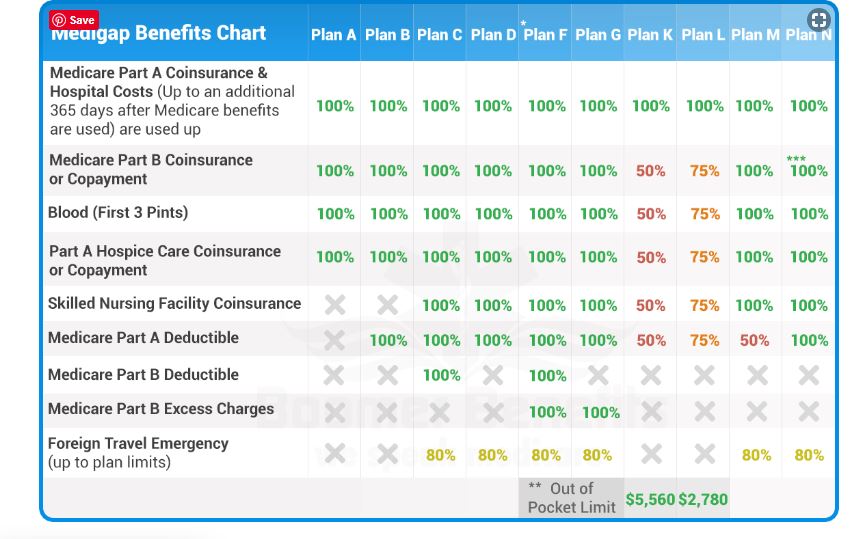

How many Medigap plans are there?

In most states, there are 10 Medigap plans — Plan A through Plan N (some plans, such as Plan E, are no longer sold).

When to sign up for Medicare Supplement Plan?

The best time for you to sign up for a Medicare Supplement plan, also called Medigap, is when you turn 65 and are covered under Medicare Part B. This six-month period, known as your Medigap Open Enrollment Period, typically starts on your 65th birthday if you’re already enrolled in Part B. During this period, you’re guaranteed acceptance into any Medicare Supplement plan available in your area without submitting to a complete medical review or being denied coverage because of pre-existing conditions. If you choose not to get Medicare Part B right away, then your Medigap Open Enrollment Period may also be delayed and will start automatically once you’re at least 65 and have Part B.

How long do you have to wait to get Medicare Supplement?

If you’re not turned down because of your health, you may have to wait up to six months to be covered ...

How many states have Medigap?

In most states, there are 10 Medigap plans — Plan A through Plan N (some plans, such as Plan E, are no longer sold). Massachusetts, Minnesota, and Wisconsin have their own versions of Medigap.

Does Medigap cover out of pocket costs?

Medigap only covers out-of-pocket costs associated with Original Medicare, Part A and Part B. To learn about Medicare plans you may be eligible for, you can: Contact the Medicare plan directly. Call 1-800-MEDICARE (1-800-633-4227), TTY users 1-877-486-2048; 24 hours a day, 7 days a week. Contact a licensed insurance agency such as Medicare Consumer ...

What is the phone number for Medicare?

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans.

Does California have a birthday rule?

California and Oregon have the Medigap Birthday Rule. If you are currently enrolled in a Medigap plan, you can change each year during around the time of your birth month with no medical questions asked. Learn more about the Birthday Rule here. Compare CA Medigap prices here.

Can I switch from Medigap to another?

These states below have laws that will allow you to switch from one Medigap plan to another without answering medical questions. Even if you move to a new insurance company, you will be approved without medical review. California and Oregon have the Medigap Birthday Rule.

Can I switch to a different Medigap plan?

Learn your Medigap choices before switching your plan. If you currently have a Medigap plan and want to switch to a different plan, you can do so at any time, but you might have to reapply and answer medical questions before being approved on your new plan. This is called medical underwriting.

How to get a Medigap policy?

For people with preexisting health conditions, Medigap Open Enrollment is the optimal time to get a policy. However, there are other special circumstances when you are granted guaranteed issue rights outside of your Medigap Open Enrollment Period: 1 You’re enrolled in Medicare Advantage and you move outside your plan's coverage area. 2 You’re enrolled in a Medicare Advantage plan that’s being discontinued by your insurance company. 3 You joined a Medicare Advantage plan when you became eligible for Medicare—but you want to switch back to Original Medicare less than a year after enrolling in Medicare Advantage. This is called a “trial right.” 4 You dropped your Medicare Supplement plan to join a Medicare Advantage plan but decided to switch back less than a year after enrollment. This is also called a “trial right.” 5 You have Medicare SELECT and move outside your SELECT plan network area. 6 You’re enrolled in Original Medicare and have health insurance through COBRA, your employer, retiree benefits, or a union that pays secondary to Medicare, and your secondary coverage is ending. 7 The insurance company that provides your Medicare Supplement plan goes out of business and you lose your coverage (or any other situation for which you're not at fault but you lose your coverage). 8 You end your Medigap policy or your Medicare Advantage plan because the insurance company deceived you or broke Medicare’s rules.

How long does a Medigap policy last?

Keep in mind that the Medigap protections don't last as long as they did during your Medigap Open Enrollment—you have only 63 days to find a new guaranteed issue policy.

How many Medicare Supplement Plans are there?

There are 10 Medicare Supplement plans. The availability of each plan depends on your location and (for Plan F and C) when you were eligible for Medicare. Premiums will vary by company and plan but, in general, the more benefits a Medigap plan covers, the higher its premiums will be. You can purchase a Medicare Supplement plan only ...

Is Medigap open enrollment?

For people with preexisting health conditions, Medigap Open Enrollment is the optimal time to get a policy. However, there are other special circumstances when you are granted guaranteed issue rights outside of your Medigap Open Enrollment Period:

How long do you have to cancel a new insurance policy?

Once you’re sure the new policy is the best choice for you, then you can cancel your old one. If the new policy doesn’t suit you, you can cancel it before 30 days is up without penalty.

Does Cadillac make sense?

Sometimes, the Cadillac plan doesn’t make sense if you’re not using all the benefits, and downsizing to a simpler plan can lower your costs. 3. Your Medigap premiums are too high. Insurance companies don’t lock your Medicare Supplement premiums, so sometimes the costs can become prohibitively high. Switching plans or companies could save you money.

How to enroll in Medigap?

In a few limited situations, you may be able to enroll in a Medigap plan with guaranteed issue. For example: 1 Your Medigap insurance company went bankrupt. 2 Your Medigap insurance company misled you or committed fraud. 3 You lose your Medigap coverage through no fault of your own. 4 You’re enrolled in Original Medicare and have an employer- or union-sponsored group plan that pays after Medicare has paid its share, and that group health plan is ending. 5 You’re enrolled in a Medicare Advantage plan and your plan is leaving the Medicare program, or you move out of the plan’s service area. 6 You’re enrolled in a Medicare SELECT policy (a type of Medigap plan that uses provider networks), and you move out of the Medicare SELECT plan’s service area. 7 You enrolled in a Medicare Advantage plan, or in a “Programs of All-Inclusive Care for the Elderly” (PACE) program, when you were first eligible for Medicare Part A at age 65, and you change your mind within the first year and want to return to Original Medicare. 8 You drop your Medigap plan to enroll in a Medicare Advantage plan for the first time, change your mind in the first year, and want to switch back to Original Medicare and your Medigap plan.

How long do you have to cancel Medigap?

After 30 days , you can cancel your first Medigap plan if you decide to keep your new policy. If you don’t like your new Medigap plan and are still in your free-look period, you can cancel the second policy and keep your first plan. Contact your insurance company for details on canceling your Medigap coverage.

Does Medicare cover copayments?

Also known as Medigap, these plans may help with certain out-of-pocket costs that Original Medicare doesn’t cover, including copayments, coinsurance, and deductibles. Sometimes, as your health and financial needs change, you may realize that your current Medigap coverage is no longer a good fit for you. There can be good reasons to consider ...