How much does Medicare Part B cost in 2019?

Oct 12, 2018 · Medicare Part B Premiums/Deductibles. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A. The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, an increase of $1.50 from …

How much will Medicare Cost you in 2019?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. How it changed from 2018. The 2019 Part A premiums increased a …

How much does Medicare Part a cost?

Oct 12, 2018 · Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A. The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, a slight increase from $134 in 2018.

Do you have a Medicare Part a premium in 2019?

Oct 16, 2018 · How Much Will Medicare Cost in 2019? Part B. On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019. Part A

How much is Medicare Advantage 2019?

The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month. This represents a 6 percent decrease from the average Medicare Advantage plan premium in 2018.

What is the Medicare Part B premium?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

Is Medicare Part B optional?

Medicare Part B is optional. You will likely be automatically enrolled in Part B (with the option to drop it) if you are automatically enrolled in Medicare Part A.

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

What is the COLA for 2019?

The COLA in 2019 is 2.8 percent. An additional income bracket was added in 2019. In 2020, the IRMAA will be indexed to inflation for the first time since 2010. It’s expected that the income thresholds that determine when someone pays a Medicare IRMAA will rise slightly in 2020.

How much will Medicare pay in 2019?

An estimated 2 million Medicare beneficiaries (about 3.5 percent) will pay less than the full Part B standard monthly premium amount in 2019 due to the statutory hold harmless provision, which limits certain beneficiaries’ increase in their Part B premium to be no greater than the increase in their Social Security benefits.

What is the Medicare Part B premium?

The standard monthly premium for Medicare Part B enrollees will be $135.50 for 2019, a slight increase from $134 in 2018.

When does Medicare open enrollment end?

Ahead of Medicare Open Enrollment – which begins on October 15, 2018 and ends December 7, 2018 – CMS is making improvements the Medicare.gov website to help beneficiaries compare options and decide if Original Medicare or Medicare Advantage is right for them.

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

How much is Medicare Part A deductible?

The Medicare Part A inpatient deductible that beneficiaries will pay when admitted to the hospital is $1,364 in 2019, an increase of $24 from $1,340 in 2018.

How much will Medicare premiums decrease in 2019?

On average, Medicare Advantage premiums will decline while plan choices and new benefits increase. On average, Medicare Advantage premiums in 2019 are estimated to decrease by six percent to $28, from an average of $29.81 in 2018.

What is CMS eMedicare?

As announced earlier this month, CMS launched the eMedicare Initiative that aims to modernize the way beneficiaries get information about Medicare and create new ways to help them make the best decisions for themselves and their families.

How much is Medicare Part B premium?

On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

How much will Social Security increase in 2019?

A day before CMS’ announcement about 2019 Medicare costs, the SSA announced their plans to raise the COLA 2.8 percent in 2019. As a result, retired workers collecting Social Security can expect to see their checks rise by an average of about $39 per month next year. Retired couples will receive an average of about $67 in additional Social Security benefits in 2019.

How much does Medicare pay for Part B?

Medicare participants have to pay a monthly premium for Part B coverage. For 2019, the premium that most participants will pay is $135.50 per month. Only a small number of people will qualify for lower payments under what's known as the hold-harmless provision, because substantial increases to Social Security payments under cost-of-living adjustments have largely caught up with rising Medicare premiums.

How much is Medicare Part B deductible?

There are also deductibles and coinsurance amounts for Medicare Part B. In 2019, the Part B deductible is $185 per year. After you pay that amount out of pocket, Medicare starts providing coverage, and you'll only have to cover the 20% of your costs that Part B doesn't pay.

What is Medicare Part B?

Medicare Part B covers medically necessary outpatient services and treatments. Qualifying events include what's necessary to deal with a disease or medical condition, including diagnosis, cure, prevention, or detection. Doctor visits are covered under Medicare Part B, but you'll find a wide range of services that include diagnostic tests, ...

Is a doctor's visit covered by Medicare?

Doctor visits are covered under Medicare Part B, but you'll find a wide range of services that include diagnostic tests, ambulance services, clinical research, durable medical equipment, mental health services, and even second opinions about key issues like surgery. New Medicare participants get a one-time "Welcome to Medicare" preventive visit.

Does Medicare cover hearing aids?

In particular, dentures and most dental care aren't covered, nor are hearing-aid examinations. You typically can't get coverage for eye examinations related to prescribing glasses or contact lenses. It can be hard to know what's covered and what's not, but Medicare tries to make it easier.

Is Medicare Part B a financial protection plan?

For doctor visits and other outpatient care, Medicare Part B is an essential part of your financial protection plan. Given the high costs of healthcare, having Part B can be a lifesaver both healthwise and financially.

How much is Part B insurance?

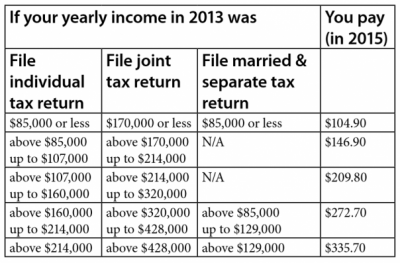

Depending on your income, premiums can be as much as $460.50 per month. For individuals with this income: Or joint filers with this income: Total monthly premium in 2019 will be: $85,000 to $107,000.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

Do you have to pay late enrollment penalty for Medicare?

In general, you'll have to pay this penalty for as long as you have a Medicare drug plan. The cost of the late enrollment penalty depends on how long you went without Part D or creditable prescription drug coverage. Learn more about the Part D late enrollment penalty.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

What is the Medicare deductible for 2019?

A deductible is the money you will pay before your benefits kick in. For 2019, the Medicare Part B deductible is $185. This is an amount you pay once per year. Some Medigap plans will cover the Part B (medical insurance) deductible, but if they don’t, you will have to pay this amount.

What is the maximum out of pocket limit for Medicare?

The maximum out-of-pocket limit is the dollar amount beyond which your plan will pay for 100% of healthcare costs. Copayments and coinsurance go toward this limit, but monthly premiums don’t. Here are the details on maximum out-of-pocket limits: 1 Original Medicare – no out-of-pocket limit. 2 Medigap plans – help to pay Part A and B deductibles and coinsurance so that your out-of-pocket costs don’t get too high. 3 Medicare Advantage plans – most have an out-of-pocket maximum of $6,700 (may differ by plan but can’t be higher than $6,700).

How much is coinsurance?

For Part A, coinsurance is a set dollar amount that you pay for covered days spent in the hospital. Here are the Part A coinsurance amounts: 1 Days 1-60 – $0 2 Days 61-90 – $341 per day 3 Day 91 on – $682 per day until you have used up your lifetime reserve days (you get 60 lifetime reserve days over the course of your life); after that you pay the full cost 4 Skilled nursing facility coinsurance – $170.50

Do you have to pay copays?

Usually you will not have to pay both a copay and coinsurance on a single service.

What is coinsurance in Medicare?

Coinsurance. Coinsurance is the percentage of your medical bill that you pay. For example, under Medicare Part B, after you meet your deductible you will pay 20% of each medical bill, and Medicare will pay 80%. For Part A, coinsurance is a set dollar amount that you pay for covered days spent in the hospital.

What is a Part D plan?

Part D plans have different tiers as part of the Part D formulary, in which different types of drugs incur lower or higher copays. These will differ according to your individual Part D plan. Copayments in Part D are when you pay a set cost (for example, $10) for all drugs in a certain tier.