Most people get Medicare Part B (Medical Insurance) when they turn 65. If you didn't sign up for Part B then, now's the time to decide if you want to enroll. During Medicare's General Enrollment Period (January 1–March 31), you can enroll in Part B and your coverage will start July 1.

Full Answer

When should I sign up for Medicare Part B?

If you want Medicare coverage to start when your job-based health insurance ends, you need to sign up for Part B the month before you or your spouse plan to retire. Your coverage will start the month after Social Security (or the Railroad Retirement Board) gets your completed forms.

What is Medicare Part B and how does it work?

If you only have Medicare Part A (Hospital Insurance), adding Part B can help you get the most out of your Medicare coverage. Part B helps cover: Find out what else Part B covers. And, if you have Part B, you have more options to get additional coverage, like prescription drugs, vision, hearing, dental, and more.

Can I apply for Medigap before my Part B effective date?

If you have your Medicare card, we can submit your Medigap application before your Part B effective date. The carrier will process your application as if you’re already in your Medigap Open Enrollment Period, with no health questions. Once you apply for Medicare, there’s no need to wait to enroll in a supplement plan until you turn 65.

How long do you have to sign up for Medicare?

You also have 8 months to sign up after you or your spouse (or your family member if you’re disabled) stop working or you lose group health plan coverage (whichever happens first). Temporary coverage available in certain situations if you lose job-based coverage. or other coverage that’s not Medicare.

How long does Medicare Part B take to process?

approximately 30 daysYour Medicare Part A and B claims are submitted directly to Medicare by your providers (doctors, hospitals, labs, suppliers, etc.). Medicare takes approximately 30 days to process each claim.

Does Medicare Part B have to start on the first of the month?

Part B (Medical Insurance) Generally, you're first eligible to sign up for Part A and Part B starting 3 months before you turn 65 and ending 3 months after the month you turn 65. (You may be eligible for Medicare earlier, if you get disability benefits from Social Security or the Railroad Retirement Board.)

How long does Medicare take to activate?

When your coverage startsIf you sign up:Coverage starts:Before the month you turn 65The month you turn 65The month you turn 65The next month1 month after you turn 652 months after you sign up2 or 3 months after you turn 653 months after you sign up

Can you add Medicare Part B at any time?

You can sign up for Medicare Part B at any time that you have coverage through current or active employment. Or you can sign up for Medicare during the eight-month Special Enrollment Period that starts when your employer or union group coverage ends or you stop working (whichever happens first).

What day of the month does Medicare start when you turn 65?

You will have a Medicare initial enrollment period. If you sign up for Medicare Part A and Part B during the first three months of your initial enrollment period, your coverage will start on the first day of the month you turn 65. For example, say your birthday is August 31.

What day of the month does a Medicare Advantage plan take effect?

Coverage under a Medicare Advantage plan will begin the first day of the month after you enroll. Example: Judy's last day of work is July 1 and her group health plan ends July 31.

How do I know if my Medicare is active?

If you'd like to make sure you're enrolled in Original Medicare, you can call the program at 1-800-MEDICARE (1-800-633-4227) 24 hours a day, 7 days a week. TTY users call 1-877-486-2048. You can also check your Medicare enrollment online at Medicare.gov.

How do I check my Medicare Part B status?

How to Check Medicare Application StatusLogging into one's “My Social Security” account via the Social Security website.Visiting a local Social Security office. ... Contact Social Security Administration by calling 1-800-772-1213 (TTY 1-800-325-0778) anytime Monday through Friday, 7 a.m. to 7 p.m.More items...•

Does Medicare automatically send you a card?

You should automatically receive your Medicare card three months before your 65th birthday. You will automatically be enrolled in Medicare after 24 months and should receive your Medicare card in the 25th month.

Is Medicare Part B automatically deducted from Social Security?

Yes. In fact, if you are signed up for both Social Security and Medicare Part B — the portion of Medicare that provides standard health insurance — the Social Security Administration will automatically deduct the premium from your monthly benefit.

Do you have to enroll in Medicare Part B every year?

Do You Need to Renew Medicare Part B every year? As long as you pay the Medicare Part B medical insurance premiums, you'll continue to have the coverage. The premium is subtracted monthly from most people's Social Security payments. If you don't get Social Security, you'll get a bill.

Can you have Medicare and employer insurance at the same time?

Yes, you can have both Medicare and employer-provided health insurance. In most cases, you will become eligible for Medicare coverage when you turn 65, even if you are still working and enrolled in your employer's health plan.

Answer a few questions to find out

These questions don’t apply if you have End-Stage Renal Disease (ESRD).

Do you have health insurance now?

Are you or your spouse still working for the employer that provides your health insurance coverage?

When do you get Medicare Part B?

Most people get Medicare Part B (Medical Insurance) when they turn 65. If you didn't sign up for Part B then, now's the time to decide if you want to enroll. During Medicare's General Enrollment Period (January 1–March 31), you can enroll in Part B and your coverage will start July 1.

How to apply for Part B?

Signing up for Part B is easy—apply by March 31. Fill out a short form, and send it to your local Social Security office. Call Social Security at 1-800-772-1213. TTY users can call 1-800-325-0778. Contact your local Social Security office. If you get benefits from the Railroad Retirement Board, contact your local RRB office to sign up for Part B. ...

Is it important to enroll in Part B?

Deciding to enroll in Part B is an important decision. It depends on the type of coverage you have now. It’s also important to think about the Part B late enrollment penalty—this lifetime penalty gets added to your monthly Part B premium, and it goes up the longer you wait to sign up.

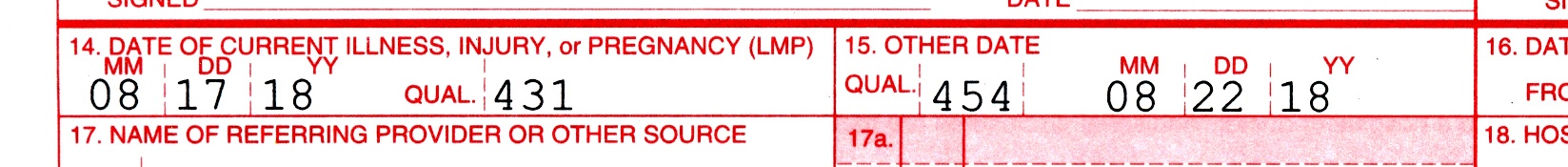

When is Medicare Part B effective?

That’s why this gentleman’s effective date for Medicare Part B was July 1, 2018. Additionally, late enrollees pay a 10 percent penalty for every year they were eligible for Part B but not enrolled, and that penalty continues for the rest of their lives.

How old was the client when he was not enrolled in Medicare?

One of the agents we work with received a call from a 68-year-old client who had not signed up for Medicare when he was first eligible. He was not yet receiving Social Security checks, so he was not automatically enrolled in Medicare Part A when he turned 65.

Why shouldn't Medicare agents guess?

If you get a question that you don’t know the answer to, it is far better for you and your client to contact an agent who works in the Medicare market than to guess at the answer.

When does Medicare Part A disqualify you from HSA?

Specifically, Medicare Part A disqualifies people from HSA eligibility, so if the client had made contributions to his Health Savings Account between July 1 and December 31, 2017 , he would need to contact the HSA administrator and back those funds out of the account to avoid paying taxes and an excess contribution penalty.

Is Medicare Part B free?

Medicare Part B. Medicare Part B is a different story. Unlike Medica re Part A, it’s not free when people start receiving it; instead , people pay for Medicare Part B through deductions from their Social Security check or by paying for it directly to the government.

When do you have to take Part B?

You have to take Part B once your or your spouse’s employment ends. Medicare becomes your primary insurer once you stop working, even if you’re still covered by the employer-based plan or COBRA. If you don’t enroll in Part B, your insurer will “claw back” the amount it paid for your care when it finds out.

What is a SEP for Medicare?

What is the Medicare Part B Special Enrollment Period (SEP)? The Medicare Part B SEP allows you to delay taking Part B if you have coverage through your own or a spouse’s current job. You usually have 8 months from when employment ends to enroll in Part B. Coverage that isn’t through a current job – such as COBRA benefits, ...

What is a Part B SEP?

The Part B SEP allows beneficiaries to delay enrollment if they have health coverage through their own or a spouse’s current employer. SEP eligibility depends on three factors. Beneficiaries must submit two forms to get approval for the SEP. Coverage an employer helps you buy on your own won’t qualify you for this SEP.

How long can you delay Part B?

You can delay your Part B effective date up to three months if you enroll while you still have employer-sponsored coverage or within one month after that coverage ends. Otherwise, your Part B coverage will begin the month after you enroll.

How does Medicare work with my job-based health insurance when I stop working?

Once you stop working, Medicare will pay first and any retiree coverage or supplemental coverage that works with Medicare will pay second.

When & how do I sign up for Medicare?

You can sign up anytime while you (or your spouse) are still working and you have health insurance through that employer. You also have 8 months after you (or your spouse) stop working to sign up.

Do I need to get Medicare drug coverage (Part D)?

Prescription drug coverage that provides the same value to Medicare Part D. It could include drug coverage from a current or former employer or union, TRICARE, Indian Health Service, VA, or individual health insurance coverage.

Why do people delay enrolling in Medicare Supplement?

For some; they choose to delay enrolling in Part B due to still working and having creditable coverage with their employer. When they do retire and enroll in Part B, they will initiate their Medicare Supplement Open Enrollment Period.

What is Medicare Supplement Open Enrollment Period?

What is Medicare Supplement Open Enrollment? Medicare Supplement Open Enrollment Period is a once in a lifetime window that allows you to enroll in any Medigap plan without answering health questions.

What happens if you miss your Medigap open enrollment period?

When you miss your Medigap Open Enrollment Period and are denied coverage, there are alternative options. If you have a serious health condition that causes a Medigap carrier not to accept you, you should be able to enroll in a Medicare Advantage plan.

How long does Medicare open enrollment last?

Applying outside your open enrollment window can result in higher premiums, as well as restrict your coverage options. This window only lasts for six months for each new beneficiary, unless you delay enrollment into Part B due to having other creditable coverage.

Does timing affect Medigap coverage?

Timing can affect how much you pay for coverage; how easy coverage is to obtain, and it can significantly determine the options available to you. The Megiap OEP is the only time you’ll ever get that allows you to enroll in any Medigap letter plan. You’ll be able to avoid having to answer any health questions.

Can you get insurance if you enroll in one time?

If they enroll as soon as their first eligible, during the one-time individual open enrollment window, these health problems will not prevent them from getting coverage.

Do you have to be 65 to get a Medigap plan?

Many states are not required to offer all supplement plans to those under 65. Most states only offer Plan A to those under 65. If they wait to enroll in a Medigap plan when they turn 65 during their second Medigap OEP, they’ll be able to choose from all the programs available to them in their state.