What is the tax rate for self employment?

The self-employment tax rate is 15.3%. The rate consists of two parts: 12.4% for social security (old-age, survivors, and disability insurance) and 2.9% for Medicare (hospital insurance). For 2020, the first $137,700 of your combined wages, tips, and net earnings is subject to any combination of the Social Security part of self-employment tax, ...

What is self employment tax?

Self-employment tax is a tax consisting of Social Security and Medicare taxes primarily for individuals who work for themselves. It is similar to the Social Security and Medicare taxes withheld from the pay of most wage earners. You figure self-employment tax (SE tax) yourself using Schedule SE (Form 1040 or 1040-SR).

What is Schedule C for self employed?

If you are self-employed as a sole proprietor or independent contractor, you generally use Schedule C to figure net earnings from self-emplo yment. If you have earnings subject to self-employment tax, use Schedule SE to figure your net earnings from self-employment. Before you figure your net earnings, you generally need to figure your total ...

When do you have to use the maximum earnings limit?

If you use a tax year other than the calendar year, you must use the tax rate and maximum earnings limit in effect at the beginning of your tax year. Even if the tax rate or maximum earnings limit changes during your tax year, continue to use the same rate and limit throughout your tax year.

How much is Medicare tax?

As of 2019, the annual wage ceiling is $200,000 for taxpayers who are filing individually and $250,000 for spouses filing jointly. This component of Medicare taxes is set at a total of 2.9 percent of the employee’s wages up to the wage ceiling, which means that the employee pays 1.45 percent.

How much do self employed people pay in taxes?

This means that they must pay twice the amount of Social Security taxes, which will comprise 12.4 percent of their earnings up to the wage ceiling. They also must pay the full 2.9 percent in Medicare taxes for earnings up to the wage ceiling. Finally, they still must pay the 0.9 percent Medicare tax on earnings that exceed the wage ceiling. As a result, self-employed individuals face a Social Security and Medicare tax burden covering 15.3 percent of their earnings, and potentially more in some cases.

Do you have to pay taxes on Social Security?

The general rule is that you do not need to pay tax on Social Security benefits, but exceptions apply to taxpayers who earn a combined income above a certain threshold. Combined income is calculated by adding half of your total Social Security benefits during that year to any other income that you receive, including tax-exempt interest. If a taxpayer filing individually receives more than $25,000 in combined income, they will need to pay taxes on some of their Social Security benefits. Spouses who are filing jointly will need to pay taxes on some of their benefits if they receive more than $32,000 in combined income. Spouses who are filing separately will need to pay taxes on some of their benefits regardless of their combined income level, unless they did not live together at some point during the tax year. This allows each spouse to apply the $25,000 threshold, which can result in tax savings.

How to get a refund for Medicare and Social Security?

To claim a refund of Social Security and Medicare taxes, you will need to complete and submit IRS Form 843 . When you apply for a refund from the IRS, include either: A letter from your employer stating how much you were reimbursed. A cover letter attesting that your employer has refused or failed to reimburse you.

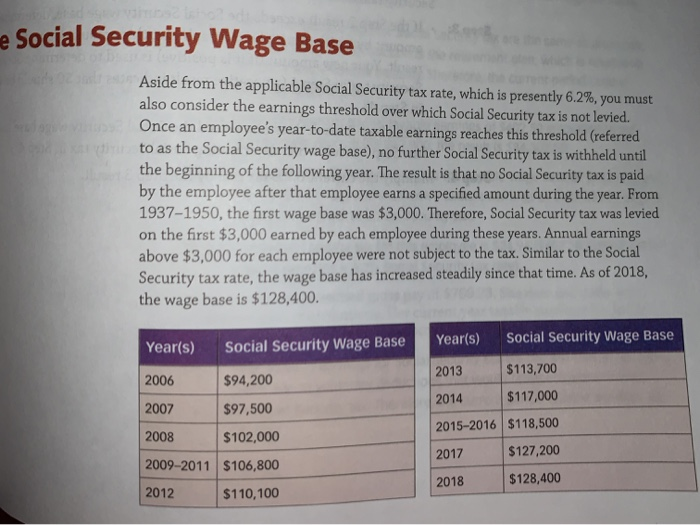

How much is Social Security taxed in 2020?

If you are an employee, FICA taxes are withheld from your paycheck along with income tax. The Social Security portion of the FICA tax is subject to a cap—$137,700 in 2020, and $142,800 in 2021. This is referred to as the " wage base .".

What are the taxes for self employment?

If you work for yourself rather than an employer, FICA taxes are your self-employment tax. You must make quarterly estimated payments to the IRS for your FICA taxes if you are: 1 Self-employed 2 An independent contractor 3 A sole proprietor 4 A member of a single-member LLC 5 A partner in a business that has elected to be treated as a partnership for tax purposes

What is the FICA tax for 2021?

The Social Security and Medicare taxes that are withheld from your paychecks are collectively referred to as the Federal Insurance Contributions Act tax, or "FICA tax.". You pay half of these taxes, and your employer pays half: 7.65% of your salary or wages each for a total of 15.3%. 1.

What is an independent contractor?

An independent contractor. A sole proprietor. A member of a single-member LLC. A partner in a business that has elected to be treated as a partnership for tax purposes. If you pay the self-employment tax, you must pay the full 15.3% to cover both the employee and the employer portions.

Who is Janet Berry Johnson?

Janet Berry-Johnson is a CPA with 10 years of experience in public accounting and writes about income taxes and small business accounting for companies such as Forbes and Credit Karma. Article Reviewed on June 28, 2021. Read The Balance's Financial Review Board.

Who is William Perez?

William Perez is a tax expert with 20 years of experience who has written hundreds of articles covering topics including filing taxes, solving tax issues, tax credits and deductions, tax planning, and taxable income. He previously worked for the IRS and holds an enrolled agent certification.

What is the Medicare tax rate for 2019?

In 2019, the tax rate for employees was 1.45% for Medicare and 6.2% for Social Security. High-income employees are charged an additional 0.9% Medicare surtax. Employers have the responsibility of withholding FICA taxes from their employees’ wages.

What happens if you don't pay Social Security taxes?

If an employee makes more than the set $132,900, Social Security tax should not be withheld from their pay for any earning made above this amount. If you do not follow Social Security, Medicare, or FICA instruction carefully, you may end up either not deducting enough or too much.

What is FICA tax?

FICA Tax. FICA is an acronym for Federal Insurance Contributions Act. This act was introduced in 1930 to cover Social Security. Both you and your employer will pay into this tax. Now, the tax is divided into Medicare and Social Security tax which is why you will probably see these two items on your paystub rather than just FICA.

Do self employed pay Social Security taxes?

Both employers and employees must pay Social Security Tax. As with Medicare tax, self-employed individuals will have to pay both the employee and employer portion of Social Security Tax. The rate for Social Security tax in 2019 was 6.2% of an employee’s gross wages below $132,900. The employer must match the amount paid by the employee.

Do employers have to pay FICA taxes?

In addition, employers must also pay their own employer FICA taxes and report both these and their employees’ portions to the IRS. FICA taxes are the most important tax to stay on top of and get correct. Not withhold or paying the correct amount of FICA taxes will result in serious consequences for the employer.

Do self employed people pay Medicare taxes?

If you are self-employed, you will pay self-employment tax, which is the equivalent of both employee and employer portions of the Medicare Tax. In 2019, the rate of Medicare tax was 1.45% of an employee’s gross earnings. The employer’s rate matches that rate. If you make more than the threshold set by the IRS, you will have to pay an additional ...

How to check if I have a Social Security card?

If you receive benefits or have Medicare, your my Social Security account is also the best way to: 1 Get your benefit verification letter; 2 Check your benefit and payment information; 3 Change your address and phone number; 4 Change your direct deposit information; 5 Request a replacement Medicare card; or 6 Report your wages if you work and receive Social Security disability insurance or Supplemental Security Income (SSI) benefits.

When was the last update for Social Security?

Last Updated: February 22, 2019. Tax season is approaching, and Social Security has made replacing your annual Benefit Statement even easier. The Benefit Statement is also known as the SSA-1099 or the SSA-1042S.

Can I get a copy of my SSA 1099?

The forms SSA-1099 and SSA-1042S are not available for people who receive Supplemental Security Income (SSI). With a personal my Social Security account, you can do much of your business with us online, on your time, like get a copy of your SSA-1099 form. Visit our website to find out more. See Comments.

Get a copy of your Social Security 1099 (SSA-1099) tax form online

Need a replacement copy of your SSA-1099 or SSA-1042S, also known as a Benefit Statement? You can instantly download a printable copy of the tax form by logging in to or creating a free my Social Security account.

What is a Social Security Benefit Statement?

A Social Security 1099 or 1042S Benefit Statement, also called an SSA-1099 or SSA-1042S, is a tax form that shows the total amount of benefits you received from Social Security in the previous year. It is mailed out each January to people who receive benefits and tells you how much Social Security income to report to the IRS on your tax return.

Still have questions?

If you have questions or need help understanding how to request your replacement SSA-1099 or SSA-1042S online, call our toll-free number at 1-800-772-1213 or visit your Social Security office. If you are deaf or hard of hearing, call our toll-free TTY number, 1-800-325-0778, between 8:00 a.m. and 5:30 p.m. Monday through Friday.