What percentage of the budget is Medicare?

Medicare spending was 15 percent of total federal spending in 2018, and is projected to rise to 18 percent by 2029. Based on the latest projections in the 2019 Medicare Trustees report, the...

What is Medicare annual budget?

Medicare consists of four "parts":

- Part A pays for hospital care;

- Part B provides medical insurance for doctor’s fees and other medical services;

- Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits;

- Part D covers prescription drugs.

What is Medicare SSA benefits?

The takeaway

- Medicare coverage is available for people with a disability who receive SSDI.

- You’ll automatically be enrolled in parts A and B after your 24th month of SSDI benefits.

- You can choose to decline Medicare Part B coverage if you have other options that work better for your budget.

What are the benefits of SSA?

Social Security's Disability Insurance Benefits are federally funded and administered by the U.S. Social Security Administration (SSA). Social Security pays disability benefits to you and certain members of your family if you have worked long enough... Social Security and Retirement.

What percent of US budget is Social Security and Medicare?

Major categories of FY 2017 spending included: Healthcare such as Medicare and Medicaid ($1,077B or 27% of spending), Social Security ($939B or 24%), non-defense discretionary spending used to run federal Departments and Agencies ($610B or 15%), Defense Department ($590B or 15%), and interest ($263B or 7%).

What percentage of the budget is Medicare?

12 percentKey Facts. Medicare is the second largest program in the federal budget: 2020 Medicare expenditures, net of offsetting receipts, totaled $776 billion — representing 12 percent of total federal spending.

What is the biggest part of the US budget?

Social Security takes up the largest portion of the mandatory spending dollars. In fact, Social Security demands $1.046 trillion of the total $2.739-trillion mandatory spending budget. It also includes programs like unemployment benefits and welfare.

How big is the Social Security budget?

The federal government spent nearly $910 billion on Social Security benefits in 2016. Together, Social Security's programs account for nearly one-quarter of all federal spending in 2016. Social Security is the largest among the three major entitlement programs.

What percentage of US budget goes to social programs?

In 2019, major entitlement programs—Social Security, Medicare, Medicaid, Obamacare, and other health care programs—consumed 51 percent of all federal spending, larger than the portion of spending for other national priorities (such as national defense) combined.

What percentage of the federal budget is health care?

In 2014, California's personal health care spending was highest in the nation ($295.0 billion), representing 11.5 percent of total U.S. personal health care spending.

What are the 3 largest categories of federal government spending?

The U.S. Treasury divides all federal spending into three groups: mandatory spending, discretionary spending and interest on debt. Together, mandatory and discretionary spending account for more than ninety percent of all federal spending, and pay for all of the government services and programs on which we rely.

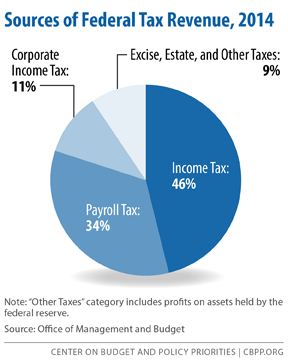

What is the largest source of income for the federal government?

individual income taxesThis is especially important as the economic recovery from the pandemic continues. In the United States, individual income taxes (federal, state, and local) were the primary source of tax revenue in 2020, at 41.1 percent of total tax revenue.

Where does most of the US budget go?

More than half of FY 2019 discretionary spending went for national defense, and most of the rest went for domestic programs, including transportation, education and training, veterans' benefits, income security, and health care (figure 4).

Which president took money from Social Security?

President Lyndon B. Johnson1.STATEMENT BY THE PRESIDENT UPON MAKING PUBLIC THE REPORT OF THE PRESIDENT'S COUNCIL ON AGING--FEBRUARY 9, 19648.LETTER TO THE NATION'S FIRST SOCIAL SECURITY BENEFICIARY INFORMING HER OF INCREASED BENEFITS--SEPTEMBER 6, 196515 more rows

How much money has the government borrowed from the Social Security fund?

The total amount borrowed was $17.5 billion.

How much does the US spend on Social Security 2020?

Mandatory spending by the federal government totaled $4.6 trillion in 2020, of which $1.9 trillion was for Social Security and Medicare.

Summary

According to the annual reports of the Social Security and Medicare trustees, the financial outlook for the two programs is not favorable.

Purpose of Trust Funds

Social Security and Medicare are programs created by federal laws and operated by agencies of the federal government. The taxes and premiums the public pays to support them and the benefits they provide to their recipients flow into and out of the U.S. Treasury.

Measures of Financial Soundness

The trustees of the two programs report annually on the financial status of their various trust funds. Although they use a number of measures, the media and general public typically place emphasis on trust fund exhaustion dates and long-range summary measures of financial status, such as the test of long-range close actuarial balance.

Budget Impact of the Programs

At times, the operations of trust funds are seen as measuring the effect that Social Security and Medicare have on the federal budget and the Treasury.

Resources Required to Pay for Social Security and Medicare

Trust fund assessments are intended to convey the adequacy of the financing arrangements established for the programs. In other words, the trustees reports evaluate whether and for how long the programs would be able to pay benefits with the spending authority Congress has given them.

Assessing the Economic Impacts

From an economic perspective, the gaps between what the government receives and spends for Social Security and Medicare can only be filled by increased borrowing, higher taxes, reduced spending, or some combination thereof. This total gap is composed of two parts.

Endnotes

1. Significant being defined here as having an average income shortfall of 5 percent or larger for the following 75 years.

What percentage of Medicare is from the federal government?

The federal government’s general fund has been playing a larger role in Medicare financing. In 2019, 43 percent of Medicare’s income came from the general fund, up from 25 percent in 1970. Looking forward, such revenues are projected to continue funding a major share of the Medicare program.

What is Medicare budget?

Budget Basics: Medicare. Medicare is an essential health insurance program serving millions of Americans and is a major part of the federal budget. The program was signed into law by President Lyndon B. Johnson in 1965 to provide health insurance to people age 65 and older. Since then, the program has been expanded to serve the blind and disabled.

What percentage of Medicare is home health?

Medicare is a major player in our nation's health system and is the bedrock of care for millions of Americans. The program pays for about one-fifth of all healthcare spending in the United States, including 32 percent of all prescription drug costs and 39 percent of home health spending in the United States — which includes in-home care by skilled nurses to support recovery and self-sufficiency in the wake of illness or injury. 4

How much of Medicare was financed by payroll taxes in 1970?

In 1970, payroll taxes financed 65 percent of Medicare spending.

How is Medicare self-financed?

One of the biggest misconceptions about Medicare is that it is self-financed by current beneficiaries through premiums and by future beneficiaries through payroll taxes. In fact, payroll taxes and premiums together only cover about half of the program’s cost.

What are the benefits of Medicare?

Medicare is a federal program that provides health insurance to people who are age 65 and older, blind, or disabled. Medicare consists of four "parts": 1 Part A pays for hospital care; 2 Part B provides medical insurance for doctor’s fees and other medical services; 3 Part C is Medicare Advantage, which allows beneficiaries to enroll in private health plans to receive Part A and Part B Medicare benefits; 4 Part D covers prescription drugs.

How is Medicare funded?

Medicare is financed by two trust funds: the Hospital Insurance (HI) trust fund and the Supplementary Medical Insurance (SMI) trust fund. The HI trust fund finances Medicare Part A and collects its income primarily through a payroll tax on U.S. workers and employers. The SMI trust fund, which supports both Part B and Part D, ...

Why is Medicare underfunded?

Medicare is already underfunded because taxes withheld for the program don't pay for all benefits. Congress must use tax dollars to pay for a portion of it. Medicaid is 100% funded by the general fund, also known as "America's Checkbook.".

How much is discretionary spending?

Discretionary spending, which pays for everything else, will be $1.688 trillion. The U.S. Congress appropriates this amount each year, using the president's budget as a starting point. Interest on the U.S. debt is estimated to be $305 billion.

What is the budget for 2022?

The discretionary budget for 2022 is $1.688 trillion. 1 Much of it goes toward military spending, including Homeland Security, the Department of Veterans Affairs, and other defense-related departments. The rest must pay for all other domestic programs.

How much is Biden's budget for 2022?

President Biden’s budget for FY 2022 totals $6.011 trillion, eclipsing all other previous budgets. Mandatory expenditures, such as Social Security, Medicare, and the Supplemental Nutrition Assistance Program account for about 65% of the budget. For FY 2022, budget expenditures exceed federal revenues by $1.873 trillion.

How long does it take for the President to respond to the budget?

The president submits it to Congress on or before the first Monday in February. Congress responds with spending appropriation bills that go to the president by June 30. The president has 10 days to reply.

Is Social Security covered by payroll taxes?

Social Security costs are currently 100% covered by payroll taxes and interest on investments. Until 2010, there was more coming into the Social Security Trust Fund than being paid out. Thanks to its investments, the Trust Fund is still running a surplus. Important.

What percentage of the federal budget is Social Security?

As the chart below shows, three major areas of spending make up the majority of the budget: Social Security: In 2019, 23 percent of the budget, or $1 trillion, paid for Social Security, which provided monthly retirement benefits averaging $1,503 to 45 million retired workers in December 2019. Social Security also provided benefits ...

How much of the federal budget is interest on debt?

In 2019, these interest payments claimed $375 billion, or about 8 percent of the budget.

How much did the federal government spend in 2019?

In fiscal year 2019, the federal government spent $4.4 trillion, amounting to 21 percent of the nation’s gross domestic product (GDP). Of that $4.4 trillion, over $3.5 trillion was financed by federal revenues. The remaining amount ($984 billion) was financed by borrowing. As the chart below shows, three major areas of spending make up ...

What is the Center on Budget and Policy Priorities?

The Center on Budget and Policy Priorities is a nonprofit, nonpartisan research organization and policy institute that conducts research and analysis on a range of government policies and programs. It is supported primarily by foundation grants.

What is the 601 income security?

The latter contains the Pension Benefit Guarantee Corporation and also covers programs that provide pension and disability benefits to certain small groups of private-sector workers.

What are the benefits of a retired federal employee?

These include providing health care and other benefits to veterans and retirement benefits to retired federal employees, ensuring safe food and drugs, protecting the environment, and investing in education, scientific and medical research, and basic infrastructure such as roads, bridges, and airports.

Why does the federal government collect taxes?

The federal government collects taxes to finance various public services. As policymakers and citizens weigh key decisions about revenues and expenditures, it is instructive to examine what the government does with the money it collects.

Contents

Summary

Purpose of Trust Funds

Measures of Financial Soundness

Budget Impact of The Programs

Resources Required to Pay For Social Security and Medicare

Assessing The Economic Impacts

Endnotes

- 1.Significant being defined here as having an average income shortfall of 5 percent or larger for the following 75 years. 2.It has been postulated that excess Social Security and Medicare receipts give the government more money than it otherwise would receive, and as such, they are a substitute for government borrowing from the public. There is, ho...