Medicare is the federal health insurance program for:

- People who are 65 or older

- Certain younger people with disabilities

- People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Part A helps cover your inpatient care in hospitals. Part A also includes coverage in critical access hospitals and skilled nursing facilities (not custodial or long-term care). It also covers hospice care and home health care.

What medications are not covered by Medicare?

Some examples of medications that may not be covered by Medicare include: Weight loss or weight gain medications Medications used to treat cold or cough symptoms Fertility medications Vitamins and minerals (with the exception of prenatal vitamins or fluoride preparation products) Medications used ...

What items are covered by Medicare?

- Durable medical equipment (DME)

- Prosthetic devices

- Leg, arm, back and neck braces (orthoses) and artificial leg, arm and eyes, including replacement (prostheses)

- Home dialysis supplies and equipment

- Surgical dressings

- Immunosuppressive drugs

- Erythropoietin (EPO) for home dialysis patients

- Therapeutic shoes for diabetics

- Oral anticancer drugs

What services are covered by Medicare?

- When they had a medical problem but did not visit a doctor

- Skipped a needed test, treatment, or follow-up

- Did not fill a prescription for medicine

- Skipped medication doses

Who decides what Medicare or Medicaid covers?

What Medicare covers may be based on several factors, like: • Federal laws describing Medicare benefits, or state laws that tell what services a particular type of practitioner is licensed to provide. • National coverage decisions made by Medicare about whether a particular item or service is covered nationally under Medicare’s rules.

What are the four parts of Medicare what do they cover?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What three types of coverage are provided by Medicare?

The different parts of Medicare help cover specific services:Medicare Part A (Hospital Insurance) Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.Medicare Part B (Medical Insurance) ... Medicare Part D (prescription drug coverage)

What are two types of coverage provided by Medicare?

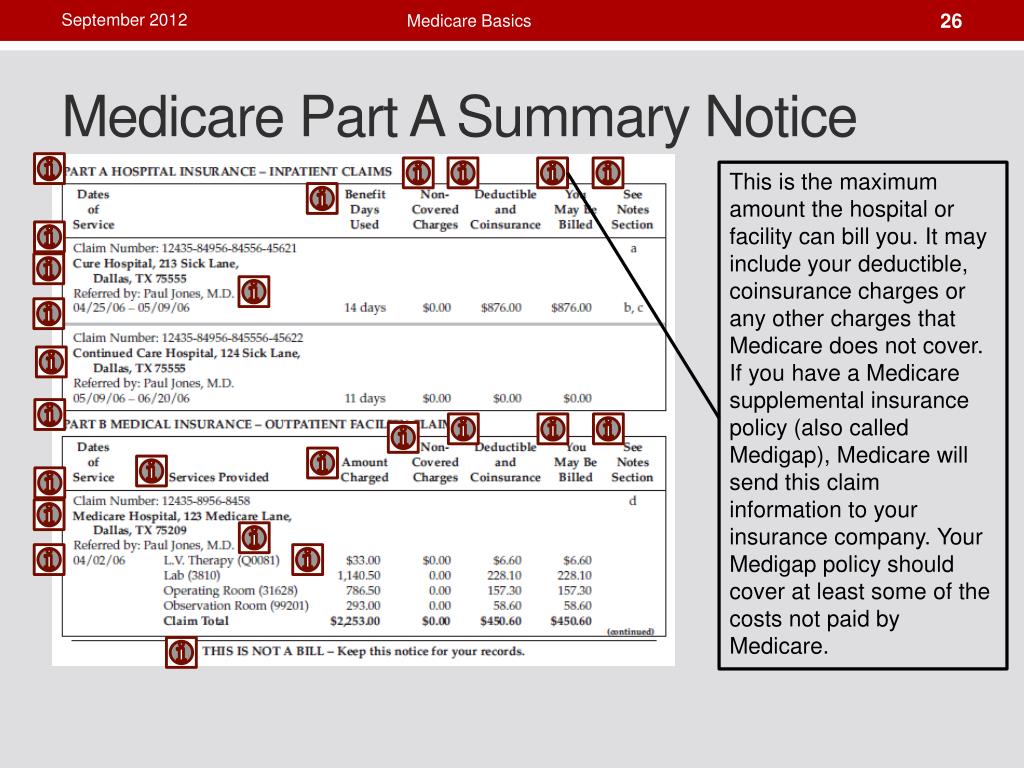

Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles).

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

Whats the difference between Medicare Part A and B?

Part A is hospital coverage, while Part B is more for doctor's visits and other aspects of outpatient medical care. These plans aren't competitors, but instead are intended to complement each other to provide health coverage at a doctor's office and hospital.

What is the difference between Medicare and Medicaid?

The difference between Medicaid and Medicare is that Medicaid is managed by states and is based on income. Medicare is managed by the federal government and is mainly based on age. But there are special circumstances, like certain disabilities, that may allow younger people to get Medicare.

How does Medicare work in simple terms?

Medicare is our country's health insurance program for people age 65 or older and younger people receiving Social Security disability benefits. The program helps with the cost of health care, but it doesn't cover all medical expenses or the cost of most long-term care.

Does Medicare Part B cover 100 percent?

Generally speaking, Medicare reimbursement under Part B is 80% of allowable charges for a covered service after you meet your Part B deductible. Unlike Part A, you pay your Part B deductible just once each calendar year. After that, you generally pay 20% of the Medicare-approved amount for your care.

Does Medicare cover eye exams?

Medicare doesn't cover eye exams (sometimes called “eye refractions”) for eyeglasses or contact lenses. You pay 100% for eye exams for eyeglasses or contact lenses.

Is there a Medicare plan that covers everything?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

Does Medicare pay for xrays?

Medicare Part B will usually pay for all the diagnostic and medically necessary testing your doctor orders, including X-rays. Medicare will cover your X-ray at most outpatient centers or as an outpatient service in a hospital.

Are shingle shots covered by Medicare?

Shingles shots cover the shingles shot. Medicare prescription drug plans (Part D) usually cover all commercially available vaccines needed to prevent illness, like the shingles shot.

Characteristics of People on Medicare

Many people on Medicare live with health problems, including multiple chronic conditions, cognitive impairments, and limitations in their activitie...

Benefit Gaps and Supplemental Coverage

Medicare provides protection against the costs of many health care services, but traditional Medicare has relatively high deductibles and cost-shar...

Medicare Beneficiaries’ Out-Of-Pocket Health Care Spending

In 2013, beneficiaries in traditional Medicare and enrolled in both Part A and Part B spent $6,150 out of their own pockets for health care spendin...

Medicare Spending Now and in The Future

In 2016, Medicare benefit payments totaled $675 billion; 21 percent was for hospital inpatient services, 14 percent for outpatient prescription dru...

Medicare Payment and Delivery System Reform

Policymakers, health care providers, insurers, and researchers continue to debate how best to introduce payment and delivery system reforms into th...

What is deductible in Medicare?

deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. at the start of each year, and you usually pay 20% of the cost of the Medicare-approved service, called coinsurance.

What is Medicare for people 65 and older?

Medicare is the federal health insurance program for: People who are 65 or older. Certain younger people with disabilities. People with End-Stage Renal Disease (permanent kidney failure requiring dialysis or a transplant, sometimes called ESRD)

Do you pay Medicare premiums if you are working?

You usually don't pay a monthly premium for Part A if you or your spouse paid Medicare taxes for a certain amount of time while working. This is sometimes called "premium-free Part A."

Does Medicare Advantage cover vision?

Most plans offer extra benefits that Original Medicare doesn’t cover — like vision, hearing, dental, and more. Medicare Advantage Plans have yearly contracts with Medicare and must follow Medicare’s coverage rules. The plan must notify you about any changes before the start of the next enrollment year.

Does Medicare cover all of the costs of health care?

Original Medicare pays for much, but not all, of the cost for covered health care services and supplies. A Medicare Supplement Insurance (Medigap) policy can help pay some of the remaining health care costs, like copayments, coinsurance, and deductibles.

Does Medicare cover prescription drugs?

Medicare drug coverage helps pay for prescription drugs you need. To get Medicare drug coverage, you must join a Medicare-approved plan that offers drug coverage (this includes Medicare drug plans and Medicare Advantage Plans with drug coverage).

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

Is Medicare Advantage the same as Original Medicare?

What's covered? Note. If you're in a Medicare Advantage Plan or other Medicare plan, your plan may have different rules. But, your plan must give you at least the same coverage as Original Medicare. Some services may only be covered in certain settings or for patients with certain conditions.

What are the characteristics of Medicare?

Characteristics of People on Medicare. Many people on Medicare live with health problems, including multiple chronic conditions and limitations in their activities of daily living, and many beneficiaries live on modest incomes. In 2016, nearly one third (32%) had a functional impairment; one quarter (25%) reported being in fair or poor health;

When did Medicare expand?

The program was expanded in 1972 to cover certain people under age 65 who have a long-term disability. Today, Medicare plays a key role in providing health and financial security to 60 million older people and younger people with disabilities. The program helps to pay for many medical care services, including hospitalizations, physician visits, ...

What is the deductible for Part B?

Part B covers physician visits, outpatient services, preventive services, and some home health visits. Many Part B benefits are subject to a deductible ($185 in 2019), and, typically, coinsurance of 20 percent.

What is Medicare payment and delivery system reform?

Policymakers, health care providers, insurers, and researchers continue to debate how best to introduce payment and delivery system reforms into the health care system to tackle rising costs, quality of care, and inefficient spending.

How much is the Part B premium?

Beneficiaries with incomes greater than $85,000 for individuals or $170,000 for married couples filing jointly pay a higher, income-related monthly Part B premium, ranging from 35% to 85% of Part B program costs, or $189.60 to $460.50 per person per month in 2019.

How long does it take to get Medicare?

People under age 65 who receive Social Security Disability Insurance (SSDI) payments generally become eligible for Medicare after a two-year waiting period, while those diagnosed with end-stage renal disease (ESRD) and amyotrophic lateral sclerosis (ALS) become eligible for Medicare with no waiting period.

Does Medicare have a deductible?

Medicare provides protection against the costs of many health care services, but traditional Medicare has relatively high deductibles and cost-sha ring requirements and places no limit on beneficiaries’ out-of-pocket spending for services covered under Parts A and B.

What are the factors that determine Medicare coverage?

Medicare coverage is based on 3 main factors 1 Federal and state laws. 2 National coverage decisions made by Medicare about whether something is covered. 3 Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is national coverage?

National coverage decisions made by Medicare about whether something is covered. Local coverage decisions made by companies in each state that process claims for Medicare. These companies decide whether something is medically necessary and should be covered in their area.

What is Part B?

Part B covers 2 types of services. Medically necessary services: Services or supplies that are needed to diagnose or treat your medical condition and that meet accepted standards of medical practice. Preventive services : Health care to prevent illness (like the flu) or detect it at an early stage, when treatment is most likely to work best.

What is the Medicare/Medicaid summary?

These Medicare/Medicaid summaries review the history and major provisions of Title XVIII and Title XIX of the Social Security Act, as well as the history of health spending in the U.S. and projected national health expenditures.

What are the highlights of the Medicare summary?

Highlights of the Medicare summary: Entitlement and coverage; Program financing, beneficiary payment liabilities, and payments to providers ; Medicare claims process ing; and. Administration of the Medicare program. Highlights of the Medicaid summary: Medicaid eligibility; Scope, amount, and duration of Medicaid services;

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

Does this apply to my plan?

Yes. You can get a Summary of Benefits and Coverage for all individual and job-based health plans, including grandfathered plans.

More answers

Where can I get an example of the Summary of Benefits and Coverage and the Uniform Glossary?