An existing Plan F recipient may not be able to switch to another Medigap plan if the plan denies them coverage due to a pre-existing condition. Recipients may also find they are charged a higher premium for attempting to switch plans past their initial enrollment period.

Full Answer

Is Medicare Plan F being phased out?

MEDICARE | December 27, 2018. If you sell Medicare supplements, you may have heard that Medigap plans C and F are being eliminated in 2020. Since that’s just over a year away, and because Medigap Plan F is the most popular Medicare supplement plan, you’ll probably start getting some questions from your Medicare-eligible (and near-eligible) clients. Here are a few …

Can I Change my Medicare plan to plan F in 2020?

Because of this, Plans C and F are no longer available to people new to Medicare on or after January 1, 2020. If you already have either of these 2 plans (or the high deductible version of Plan F) or are covered by one of these plans before January 1, 2020, you can keep your plan.

What is Medicare Plan F and how does it work?

· As of 2020, both Plan F and Plan C are no longer available the same way they used to be. People eligible for Medicare Part A prior to 2020 will continue to have options to enroll in Plans C and F later on. Every so often, Congress decides to change the landscape on Medicare Supplement plans. In 1990, they first standardized plan options.

Is Medigap plan F being discontinued?

However, Plan F will no longer be available for any newly eligible Medicare enrollees on or after January 1, 2020. Why is Medicare Plan F being discontinued? The decision to discontinue Medicare Plan F was made by Congress in 2015, which was part of the Medicare Access and CHIP Reauthorization Act.

Can you switch from plan F to plan G in 2021?

Can't I just move from a Medigap Plan F to a Plan G with the same insurance plan? Yes, you can.

Can I change from Medicare Plan F to plan G?

If you enrolled in Plan F before 2020, you can continue your plan or switch to another Medigap plan, such as Plan G, if you prefer. You may want to make the change to reduce the price of your health insurance. However, every state has different rules worth considering before making the switch.

What will replace plan F in 2020?

Fortunately, several other Medicare Supplement plans are available that cover a good portion of the expenses Plan F once covered. If you're looking for a plan comparable to Plan F, Medicare Supplement Plan G is the next best alternative. It includes the same benefits as Plan F.

Can I switch from plan F to plan G without underwriting?

During your Medigap Open Enrollment Period, you can sign up for or change Medigap plans without going through medical underwriting. This means that insurance companies cannot deny you coverage or charge you more for a policy based on your health or pre-existing conditions.

Should I switch from F to G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.

Is Plan G as good as Plan F?

Medigap Plan G is currently outselling most other Medigap plans because it offers the same broad coverage as Plan F except for the Part B deductible, which is $233 in 2022. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Otherwise, they function just the same.

Is Medicare Part F still available 2022?

Previously, anyone enrolled in original Medicare could purchase Medigap Plan F. However, this plan is now being phased out. As of January 1, 2020, Medigap Plan F is only available to those who were eligible for Medicare before 2020.

Why should I keep plan F?

PLAN F PROVIDES COMPREHENSIVE COVERAGE…AT A COST Because Plan F covers the annual Part B deductible, members of the plan are free to visit doctors, hospitals, and other healthcare providers as often as they'd like, with no out-of-pocket costs.

What is the most popular Medigap plan for 2021?

Medigap Plans F and G are the most popular Medicare Supplement plans in 2021.

Is Plan G cheaper than Plan F?

Even though it has similar coverage, Medigap Plan G's monthly premiums are typically much less expensive than those for Plan F. In some cases, the difference in premiums between the two plans may be so large that you could save money by choosing Plan G, even after the Part B deductible.

What is the deductible for Plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses.

What states allow you to change Medicare supplement plans without underwriting?

In some states, there are rules that allow you to change Medicare supplement plans without underwriting. This includes California, Washington, Oregon, Missouri and a couple others. Call us for details on when you can change your plan in that state to take advantage of the “no underwriting” rules.

When Is Plan F Going away?

Both Plan F and Plan C are going away in 2020. However, these Medicare changes in 2020 won’t affect everyone. Some people already on Medicare Plan...

Why Is Plan F Going away?

So what is happening with Plan F? Why is Medicare Plan F being phased out?Well, these changes to Medicare supplement plans are a result of the Medi...

Medicare Plan F 2020 Changes

So is Plan F going away? Yes, BUT only for new people starting in 2020. Here’s how it will go: 1. If you are are on Plan F already when 2020 rolls...

Will Plan F Rates Go Up Faster After 2020?

Some people are worried about this, and it’s certainly possible. Back in 2010, when Medicare discontinued Plans H, I and J, we did some price infla...

What Does 2020 Plan F Change Mean For You?

Here’s our advice about Medicare Plan F going away: 1. Make the best coverage decision for yourself right now. If Plan F feels best to you, it’s st...

Why Plan F Is Being Phased Out

This is not the first the Medicare Supplement plans have changed. From 1990 (when Congress first standardized plan options) to 2010 there are other parts that have been phased out by the legislative (those are Plans E, H, I, and J).

What Can Medicare Enrollees Do?

Most people who turn 65 before January 1, 2020 will still be able to purchase a Plan F after 2020, if they qualify medically. Those who will quality after that date can no longer buy the plan.

Can I switch policies?

In most cases, you won't have a right under federal law to switch Medigap policies, unless one of these applies:

How to switch Medigap policies

Call the new insurance company and arrange to apply for your new Medigap policy. If your application is accepted, call your current insurance company, and ask for your coverage to end. The insurance company can tell you how to submit a request to end your coverage.

When is Plan F Going Away?

As of 2020, both Plan F and Plan C are no longer available the same way they used to be. People eligible for Medicare Part A prior to 2020 will continue to have options to enroll in Plans C and F later on.

Why is Plan F Going Away?

So what is happening with Plan F? Why is Medicare Plan F being phased out?

Medicare Plan F 2020 Changes

So is Plan F going away? Yes, BUT only for new Medicare enrollees starting in 2020. People eligible for Medicare prior to 2020 will continue to have Plan C and F options in the future. Here’s some additional scenarios:

Will Plan F Rates Go Up Faster After 2020?

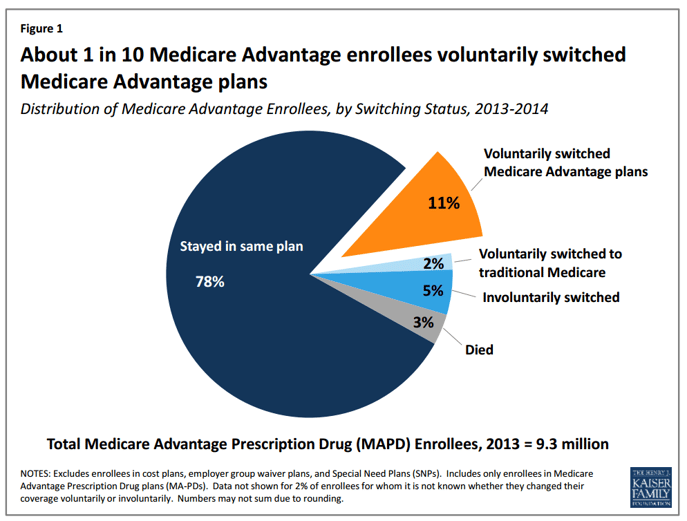

Some people are worried about this, and it’s certainly possible. Back in 2010, when Medicare discontinued Plans H, I and J, we did see some price inflation with some carriers, but not all carriers and not in all states.

Why is Medicare Plan F being discontinued?

The decision to discontinue Medicare Plan F was made by Congress in 2015, which was part of the Medicare Access and CHIP Reauthorization Act.

What if I have Plan F already?

If you already insured by a Medigap Plan F, the good news is that you can keep it. If you are a current Medicare beneficiary or you will become eligible for Medicare before January 1, 2020, you also can still enroll in Plan F.

What are my options if I want to change from my existing Plan F?

Some beneficiaries might choose to leave their Plan F and enroll in another plan that isn’t being discontinued, such as Plan G, that offers the same coverage as Plan F, except for the deductible. Specifically, in 2019, under a supplement Plan G, you assume the Part B deductible of $185.

How much does Plan G cost?

On average, a switch from Plan F to Plan G will financially benefit you as your savings with a lower premium will offset the Part B deductible. However, we strongly recommend that any Medicare soon-to-be enrollees review the cost and coverage options prior to picking a supplement plan.

Why Is Medicare Supplement Plan F being discontinued?

According to congress.gov, starting in 2020, Medicare Supplement plans that pay the Medicare Part B deductible will no longer be sold to those newly eligible. This change is part of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA).

Medicare Supplement Plan F: how much is the deductible in question?

The Medicare Part B deductible, which is the deductible amount involved in the MACRA legislation, can change every year. In 2019, it’s $185. That’s the amount you have to pay before Part B pays for covered services.

Why Is Plan F Disappearing?

As one of the most popular supplemental plans, it’s shocking that Plan F is suddenly going away.

Why did the federal government change the plan F?

Supplements are sold by private insurance companies, but the federal government sets the rules because the insurance kicks in where Medicare leaves off.

How much is the monthly premium for Plan G?

Nationally, monthly premiums for Plan G average about $150 compared with Plan F’s $186, according to Aon. The monthly savings in Plan G more than cover the annual $185 deductible that people usually finish paying out of pocket after the first or second visit to a doctor each year.

What is Plan G insurance?

After the change, Plan G will survive as the most comprehensive plan for newcomers.

Is Medicare being phased out?

Text size. The so-called Cadillac of Medicare-related insurance is being phased out at year’s end, shutting Medicare newcomers out of the plan that many retirees buy for peace of mind, and potentially boosting costs for those who remain or turn to another popular option. People who turn 65 after 2019 won’t be allowed to pick Medigap supplement Plan ...

Will insurance rates go up in 2020?

Prices aren’t expected to soar immediately. In fact, some insurance companies have been cutting premiums recently in both Plan F and Plan G to lure customers in advance of changes. But insurance experts warn retirees that as insurance companies adapt to government-imposed changes after 2020, people in both Plan F and Plan G could be shaken by rate increases.

Does Medicare cover everything?

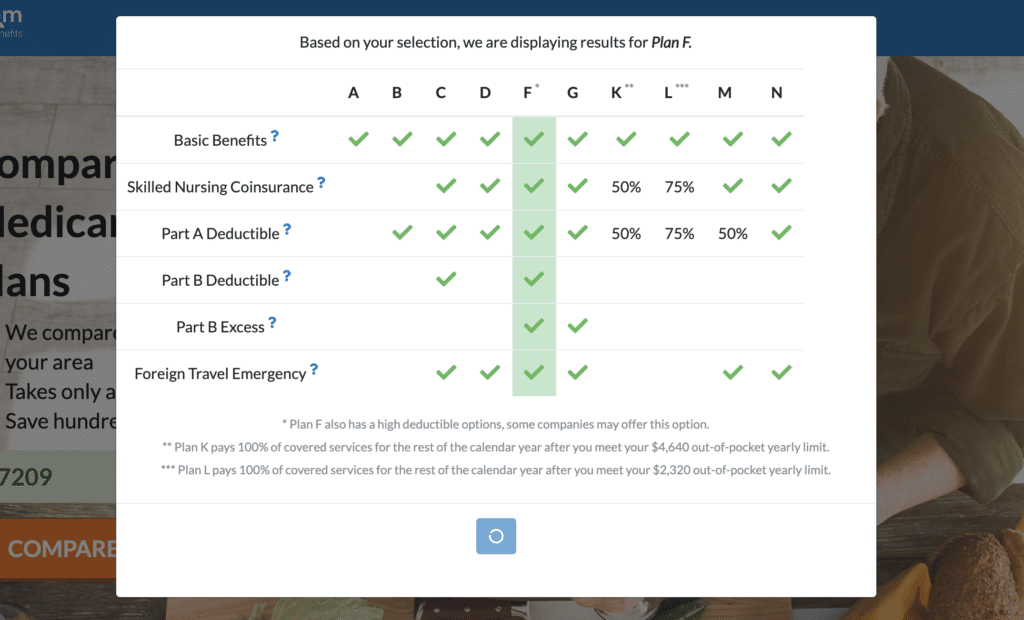

Medicare covers a lot, but not everything. Here’s what it covers and what you’ll owe out of pocket. because there are 10 different standard Medicare supplement choices with names of the alphabet from Plan A to Plan N—each with its own mixture of deductibles, copayments, and extra costs.

Will Plan G be more expensive in 2020?

As Plan G takes on more unhealthy retirees, insuring them will become more expensive, and insurance companies will probably start charging higher premiums, Strock says.

When will Medigap Plan F be discontinued?

Although Medigap Plan F is being discontinued at the beginning of 2020, this does not mean current enrollees in Plan F will lose their coverage with that plan. The change impacts newly eligible enrollees, which means anyone who turns 65 and first becomes eligible for Medicare in 2020.

What is Plan F for Medicare?

Like most Medigap plans, Plan F covers many of the out-of-pocket expenses associated with your Original Medicare benefits: 100% coverage of Part A coinsurance and costs while staying in the hospital, for up to 365-day once Medicare benefits are exhausted. 100% coverage of the first 3 pints of blood for a transfusion.

What is a plan F?

Like most Medigap plans, Plan F covers many of the out-of-pocket expenses associated with your Original Medicare benefits: 1 100% coverage of Part A coinsurance and costs while staying in the hospital, for up to 365-day once Medicare benefits are exhausted 2 100% coverage of Part B outpatient coinsurances and copayments 3 100% coverage of the first 3 pints of blood for a transfusion. 4 100% coverage of Part A’s coinsurance or copayment for hospice care. 5 100% coverage of the coinsurance at a skilled nursing facility. 6 100% coverage of the Part A deductible 7 100% coverage of the Part B deductible 8 100% coverage of excess charges with Part B 9 80% coverage of medical care during a foreign travel emergency

Does Medigap have a cap on out of pocket expenses?

Plan F does cap out-of-pocket expense limits like some other plans do. Medigap plans offered by private insurers may have a high-deductible version of Plan F alongside traditional Plan F coverage.

Can you switch Medigap plans?

Loss of coverage can open up penalty-free enrollment rules for other Medigap plans, but this does not apply to plans that are still being offered even though they have been discontinued for new enrollees. An existing Plan F recipient may not be able to switch to another Medigap plan if the plan denies them coverage due to a pre-existing condition. Recipients may also find they are charged a higher premium for attempting to switch plans past their initial enrollment period.

What is the difference between Medigap Plan G and Plan F?

Apart from the price of each plan there is only one difference in benefits: the Part B deductible. Medigap Plan F does cover the Part B deductible of $233, while Medigap Plan G does not. Other than that, they cover exactly the same benefits and access the exact same network.

When can I switch from Medigap Plan F to Plan G?

You can switch Medicare Supplement plan at any time. Many clients have to answer health questions (called Medical Underwriting) to switch plans but first check our Medigap Switching rules article to learn if you can skip the health questions section and be guaranteed to be approved.

How to switch from Plan F to Plan G

You can give us a call at 800-930-7956 and we can help you switch plans in minutes.

Stay in touch

Subscribe to be always on top of news on Medicare, Medigap, Medicare Advantage, Part D and more!