What is the penalty for not signing up for Medicare Part B?

Your penalty has the potential to increase up to 10% for every year you were eligible but did not sign up. Let’s give another example. Say you were eligible for Part B for four years before you decided to sign up. In that scenario, the cost of your penalty would be 40% of your monthly premium.

Are there late enrollment penalties for Medicare supplement plans?

Thankfully, there are generally no late enrollment penalties for Medicare Supplement plans. Your enrollment period for a Medicare Supplement plan starts once you enroll in Part B and lasts for six months.

Should I delay Medicare Part B enrollment?

Cons of delaying Medicare Part B enrollment. Those who do not sign up for Medicare Part B when they’re first eligible and don’t qualify for a Special Enrollment Period may be subject to a late enrollment penalty. This could mean paying a 10% higher monthly premium for every 12-month period that you were eligible for Part B but didn’t enroll.

Do you have to pay a penalty for Medicare prescription drug coverage?

People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, if they decide to enroll in Medicare prescription drug coverage later. .

How do I avoid Medicare Part B penalty?

If you don't qualify to delay Part B, you'll need to enroll during your Initial Enrollment Period to avoid paying the penalty. You may refuse Part B without penalty if you have creditable coverage, but you have to do it before your coverage start date.

What happens if I don't sign up for Medicare Part B when I turn 65?

If you miss your 7-month Initial Enrollment Period, you may have to wait to sign up and pay a monthly late enrollment penalty for as long as you have Part B coverage. The penalty goes up the longer you wait. You may also have to pay a penalty if you have to pay a Part A premium, also called “Premium-Part A.”

How is the Part B penalty calculated?

Part B late penalties are calculated as an extra 10 percent for each full 12-month period when you should have had Part B but didn't. If you should have signed up at age 65, the penalty calculation is made on the time that elapsed between the end of your IEP and the end of the GEP in which you finally sign up.

Can I be charged extra if I don't enroll in Medicare?

Medicare Part A late-enrollment penalty If you don't enroll when you're first eligible for Medicare, you can be subject to a late-enrollment penalty, which is added to the Medicare Part A premium. The penalty is 10% of your monthly premium, and it applies regardless of the length of the delay.

How do I opt out of Medicare Part B online?

To disenroll, you're required to submit a form (CMS-1763) that must be completed either during a personal interview at a Social Security office or on the phone with a Social Security representative. For an interview, call the Social Security Administration at 1-800-772-1213, or your local office.

Is Medicare Part B required?

Medicare Part B isn't a legal requirement, and you don't need it in some situations. In general, if you're eligible for Medicare and have creditable coverage, you can postpone Part B penalty-free. Creditable coverage includes the insurance provided to you or your spouse through work.

What is the penalty for Medicare Part B?

For each 12-month period you delay enrollment in Medicare Part B, you will have to pay a 10% Part B premium penalty, unless you have insurance based on your or your spouse's current work (job-based insurance) or are eligible for a Medicare Savings Program (MSP).

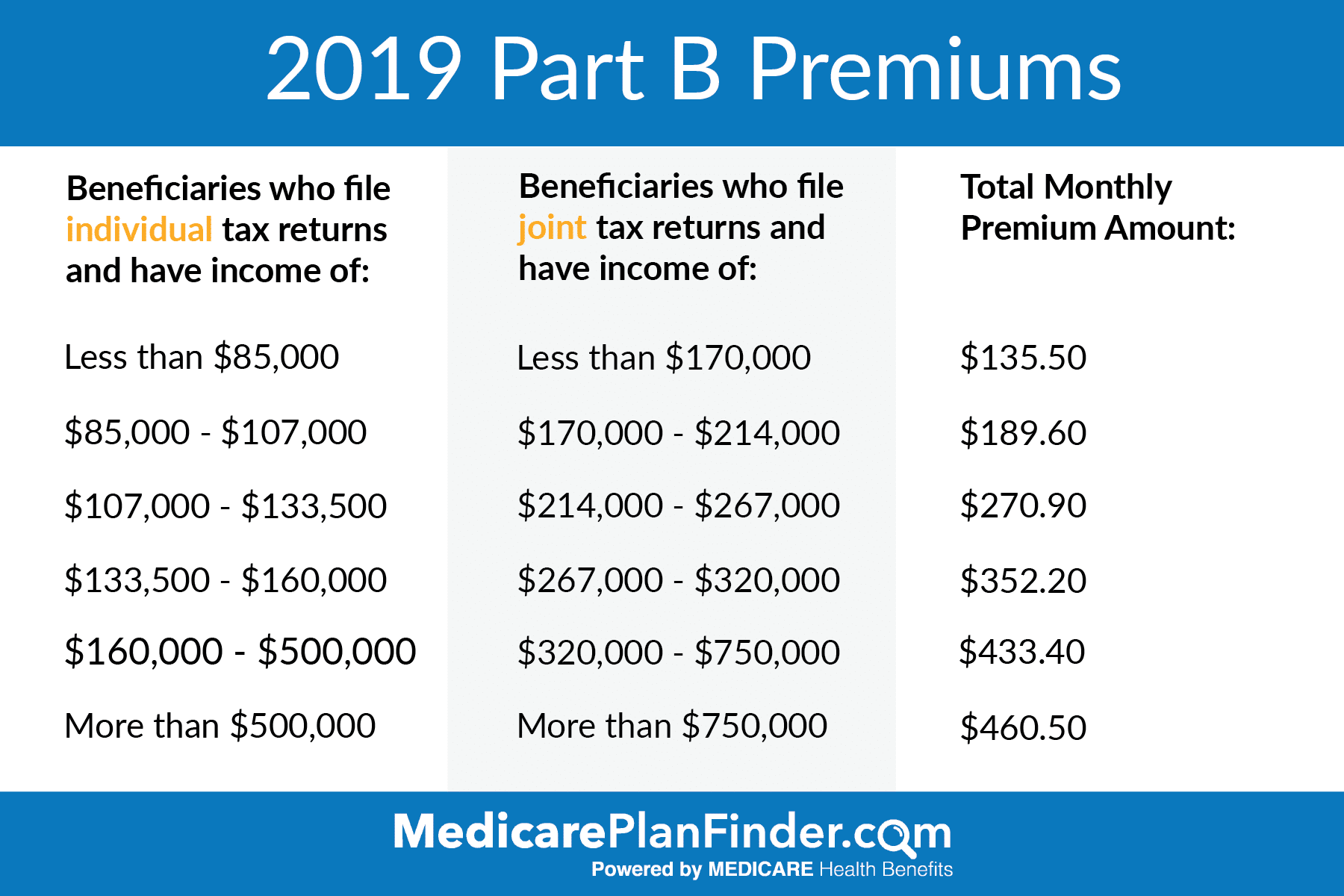

What is the Medicare Part B premium for 2022?

$170.10The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $170.10 in 2022, an increase of $21.60 from $148.50 in 2021.

Do most federal retirees enroll in Medicare Part B?

About 70% of federal retirees enroll in Part B, which means paying two premiums and in essence two duplicative insurance programs. A portion of the retirees that join Part B might do so as a hedge against the elimination of FEHB retiree benefits.

Can you drop Medicare Part B anytime?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.

Why is there a Medicare penalty?

Medicare charges several late-enrollment penalties. They're meant to discourage you from passing up coverage, then getting hit with costly medical bills. To avoid higher Medicare premiums, you need to know about these penalties and take steps to avoid them.

How do I defer Medicare Part B?

There are two ways to defer Part B: If you have already received your Medicare card, follow the instructions on how to send the card back. If you keep the card, you are keeping Part B and will pay Part B premiums. Call the Social Security Administration.

How long do you have to be on Medicare if you are not on Social Security?

If you wish to do so, contact the SSA . If you are not yet on Social Security, you have an initial window of seven months , sandwiched around your 65th birthday, to enroll in Medicare. Updated December 28, 2020.

How long can you delay Part B?

In this case, you can delay signing up for Part B until your employment ends. When that happens, you have eight months to sign up without incurring the penalty.

How much is Part B 2021?

If you’re carrying a one-year late fee, you’ll pay an extra $178.20 for Part B in 2021, and bigger surcharges in future years as premiums rise. Now for those exceptions. You can choose not to sign up for Part B at 65 without facing a late fee down the road if: You are still working and have group coverage through a company ...

What is the Medicare rate for 2021?

Medicare Part A, which covers hospitalization, comes at no cost for most recipients, but Part B carries premiums. The base rate in 2021 is $148.50 a month.

How to avoid Medicare Part B late enrollment penalty?

How to Avoid the Medicare Part B Late Enrollment Penalty. The best way to avoid Part B penalties is to plan ahead. You have several Medicare options to choose from, including Original Medicare plus a Medigap Plan. MedicareFAQ can help you through these decisions by answering your questions and helping you prepare for Medicare.

What happens if you don't sign up for Medicare Part B?

Medicare Part B Late Enrollment Penalty. If you’re new to Medicare and don’t sign up for Part B when you’re first eligible, you may end up having to pay the Part B late enrollment penalty. The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying ...

How long does Medicare Part B last?

Your IEP begins three months before your birth month and ends three months after your birth month.

What is the late enrollment penalty?

The late enrollment penalty is imposed on people who do not sign up for Part B when they’re first eligible. If you have to pay a penalty, you’ll continue paying it every month for as long as you have Part B.

How long do you have to wait to enroll in Part B?

If you then retire at age 67, you can avoid a penalty by signing up for Part B during your eight-month SEP. If you instead decide to wait until age 70 to enroll, you will pay a 30% penalty every month. 10% for every 12-month period you delayed.

How much is the Part B penalty?

The Part B penalty increases your monthly Part B premium by 10% for each full 12-month period you waited before signing up. The penalty is based on the standard Part B premium, regardless of the premium amount you actually pay.

When does Part B start?

General Enrollment runs from January 1st to March 31st each year. If you enroll at this time, your coverage will not start until July 1st. Meaning you may be without insurance if you have ...

What is the penalty for late enrollment in Medicare?

There are special circumstances that could exempt beneficiaries from a penalty. The Medicare Part A late enrollment penalty is 10 percent of the Part A premium, which must be paid for twice the number of years for which you were eligible for Part A but did not sign up. For example, if you were eligible for Part A for two years before finally ...

What happens if you don't sign up for Medicare?

If you don’t sign up for Medicare when you first become eligible, you may face a late enrollment penalty. Learn how much these penalties are and how you can avoid them.

How much does Medicare add to your premium if you owe a late fee?

If you owe the standard Medicare Part B premium but sign up for Part B a year after you were initially eligible, the late enrollment fee can add another $14.85 per month to your Part B premium.

How much is Medicare Part A 2021?

In 2021, Medicare Part A premiums are either $259 or $471 per month, depending on the amount of Medicare taxes you paid during your lifetime. The 2021 Part A late enrollment penalty can be as high as $26 or $47 per month, depending on your Medicare Part A premium cost.

How long does Medicare enrollment last?

When you first become eligible for Medicare, you have an Initial Enrollment Period. This is a seven-month period that begins three months before you turn 65 years old, includes the month of your birthday, and then continues for three more months thereafter.

What happens if you go 63 days without Medicare?

If you go 63 consecutive days without “creditable drug coverage” after your Initial Enrollment Period is over, you could face a Part D late enrollment penalty if you eventually choose to sign up for a plan. Creditable drug coverage can include: A Medicare Part D plan. A Medicare Advantage plan that offers drug coverage.

What happens if you wait too long to enroll in Medicare?

If you wait too long after your Initial Enrollment Period to sign up for Medicare Part A (hospital insurance), Part B (medical insurance) or Part D (Medicare prescription drug plans), you could be subject to a Medicare late enrollment penalty.

How much is the late enrollment penalty for Medicare Part D?

Take 1% of the current “national base beneficiary premium” ($33.06 in 2021) – that’s about 33 cents ($.33) . Round to the nearest $.10, and you get $.30. Multiply that by the number of months you were eligible for coverage under Medicare Part D, but didn’t have it. Just count the full months, so in the example above, count October 2019 as the first month and September 2021 as the last full uncovered month. That makes 24 months without coverage.

What is the penalty for Part B?

The Part B penalty is 10% added to your monthly premium. You generally pay this extra amount multiplied by the number of years (12-month periods) that you were eligible for Part B, but not enrolled.

What is Medicare Part D?

Medicare Part D is prescription drug coverage that you get from private, Medicare-approved insurance companies. It’s optional, yet there’s a late enrollment penalty if you don’t sign up when you’re first eligible for Medicare, and decide at some later date that you want this coverage.

How much does Medicare add to your premium?

Your Medicare prescription drug plan will add $7.20 to your premium, and you’ll pay the penalty as long as you have Medicare prescription drug coverage. Be aware that the Part D national base beneficiary premium can change from year to year, so your penalty amount might also change.

How long is the Medicare enrollment period?

It’s a seven-month period altogether. You could face a late enrollment penalty for Medicare Part A if both of these are true for you: You didn’t sign up for Part A during your IEP. You have to pay a Part A monthly premium.

How much is Part A premium 2021?

In this example, your Part A premium in 2021 would be $259 per month plus 10% of $259, which is about $26. So, the amount you’d pay per month may be $259 + 26 = $285. In this example, you’d pay the penalty for 4 years (you delayed enrollment by two years, and the penalty doubles that number of years: 2×2=4). Be aware that the Part A premium can change from year to year, so your penalty amount might also change.

What happens if you don't sign up for Medicare?

Penalties for not signing up for Medicare: automatic enrollment. If you’re already receiving Social Security benefits when you turn 65, you’re typically enrolled in Medicare automatically. That is – you’re enrolled in Original Medicare, Part A and Part B. If this is the case for you, you don’t have to worry about a late enrollment penalty ...

What happens if you don't apply for Medicare Part B?

Just like applying for Part A Medicare, Part B Medicare needs to be applied for. This is the case if you are not already receiving Social Security benefits. Enrollment initially happens during your Initial Enrollment Period. Part B Medicare coverage has a premium to it each month. The premium is based on the amount of income a person makes within the year. If you do not apply for Medicare Part B coverage during your Initial Enrollment Period, a penalty will be assessed. The penalty for Part B late enrollment is lifelong.

What is the penalty for late enrollment in Medicare?

The penalty for late enrollment in Medicare Part A can be hefty. People who have paid Medicare taxes through their place of employment, as well as people who have worked for at least ten years, premium-free Part A coverage plans are available. Those who meet any of these requirements are automatically eligible. This includes the vast majority of Medicare beneficiaries, coming in at 99% of people who sign up. People who do not have enough work credits will need to pay a premium for Medicare Part A.

How to determine Medicare Part D penalty?

This premium is determined by multiplying 1% of the national base premium by the number of uncovered months without coverage. In order to determine a person’s penalty, the monthly premium they have is multiplied times 1% as well as times the number of months that coverage is delayed.

How much is the penalty for not having creditable coverage?

The penalty for delaying this type of insurance is 10% for each year you do not have creditable coverage. If you, for example, delay getting Part B coverage through Medicare for five years, your premiums will go up 50% for as long as you have Part B insurance coverage. People can avoid paying these lifelong penalties by enrolling for Part B insurance coverage during their initial enrollment period.

Is it expensive to not sign up for Medicare?

Penalties for not signing up for Medicare coverage can be pricey, but fortunately, they are also easy to avoid. By understanding what the late enrollment penalties are for the various types of coverage, you will have a better understanding of how important it is to avoid them. Late enrollment penalties are in existence for Medicare Part A, Medicare Part B, and Medicare Part D.

What happens if you don't have Medicare Part B?

Going without Medicare Part B and not having other coverage might leave you paying high out-of-pocket costs for doctors’ visits, preventive care, and medical services. Health care needs tend to increase as people get older, and any potential savings from delaying enrollment in Part B could be offset if you get sick and don’t have medical coverage. If you wait to enroll and then contract an illness, you may not be able to sign up for Medicare Part B until the next General Enrollment Period. In the meantime, you may have to pay for all medical costs out-of-pocket.

What are the pros and cons of delaying Medicare Part B enrollment?

If you already have other coverage, the biggest advantage of delaying Part B enrollment is not paying an additional premium for benefits you may not need or use.

What is a special enrollment period?

A Special Enrollment Period occurs anytime you have a qualifying situation and lets you enroll in Medicare Part A and/or Part B outside of the annual enrollment periods. If you are an active-duty service member (or the spouse or dependent child of an active-duty member), you may delay Part B enrollment and keep your TRICARE coverage.

What type of coverage does not count as creditable?

The following types of coverage do not count as creditable coverage based on current employment and would not exempt you from paying the Part B penalty if you delay enrollment: COBRA. Retiree benefits. TRICARE (unless you, your spouse, or dependent child are an active-duty member)*. Veterans’ benefits.

How long do you have to work to get Medicare Part A?

Many individuals qualify for premium-free Medicare Part A (hospital insurance), provided that they have worked at least 10 years (or 40 quarters) and paid Medicare taxes during those time periods. For these individuals, it typically makes sense to keep Part A, since the coverage comes at no added cost. However, because Part B comes ...

Is it better to enroll in Part B or Part B?

For those who only spend part of the year living overseas, or those who foresee eventually moving back to the U.S., it may be safer to enroll in Part B when first eligible to avoid paying a large penalty later.

Do you have to pay for medical expenses out of pocket?

In the meantime, you may have to pay for all medical costs out-of-pocket. Those who do not sign up for Medicare Part B when they’re first eligible and don’t qualify for a Special Enrollment Period may be subject to a late enrollment penalty.

What is the late enrollment penalty for Medicare?

Part D late enrollment penalty. The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

What happens if Medicare decides the penalty is wrong?

What happens if Medicare's contractor decides the penalty is wrong? If Medicare’s contractor decides that all or part of your late enrollment penalty is wrong, the Medicare contractor will send you and your drug plan a letter explaining its decision. Your Medicare drug plan will remove or reduce your late enrollment penalty. ...

What happens if Medicare pays late enrollment?

If Medicare’s contractor decides that your late enrollment penalty is correct, the Medicare contractor will send you a letter explaining the decision, and you must pay the penalty.

How much is Medicare penalty in 2021?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.06 in 2021, $33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $.10 and added to your monthly Part D premium.

What is creditable prescription drug coverage?

creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage. People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, ...

What is Medicare program?

A Medicare program to help people with limited income and resources pay Medicare prescription drug program costs, like premiums, deductibles, and coinsurance.

How often does the national base beneficiary premium change?

The national base beneficiary premium may change each year, so your penalty amount may also change each year.

What happens if you don't sign up for Medicare Part A?

If not, you might be subject to the Medicare Part A late enrollment penalty. Unfortunately, this penalty may increase your monthly premium by up to 10%. In most cases, you might have to pay this increased premium for double the number of years you could have had Part A but did not sign up. Let’s give an example.

What happens if you wait too long to enroll in Medicare?

If you wait too long, you might have to pay the Medicare Part B late enrollment penalty. Unlike Part A, you’ll typically have to pay a Part B penalty for as long as you have Part B. Your penalty has the potential to increase up to 10% for every year you were eligible but did not sign up. Let’s give another example.

How long does Medicare Supplement last?

Your enrollment period for a Medicare Supplement plan starts once you enroll in Part B and lasts for six months. While you won’t have to pay a late enrollment penalty if you miss your Medicare Supplement open enrollment period, you’ll have to undergo medical underwriting when applying for your Medicare Supplement plans.

How long does open enrollment for Medicare last?

Your Open Enrollment Period lasts seven months: three months before, through the month of, and three months after your 65th birthday. You may be wondering: what if I don’t enroll in Medicare during this time period? ...

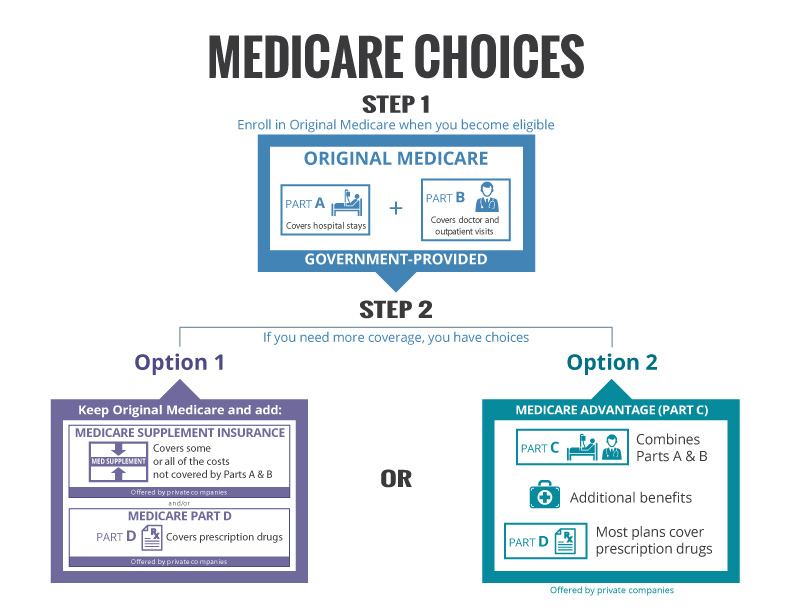

How many parts are there in Medicare?

As you’re doing your research, you’ll learn that there are four parts to Medicare: Medicare Part A, Part B (Original Medicare), Part C (Medicare Advantage), and Part D (Medicare Prescription Drug Coverage). There are different penalties for enrolling late into most of the different parts of Medicare. Let’s dive into the specific penalties ...

When do you have to enroll in Part D?

The enrollment period for Part D is the same as Parts A and B, which starts three months before your 65th birthday, through the month of your 65th birthday, and three months after your 65th birthday. For Part D, you may have to pay a late enrollment penalty if you don’t enroll during your initial enrollment period or for any continuous period ...

How many quarters do you have to work to get a premium free?

Well, you are automatically eligible for a premium-free Part A if you or your spouse worked at least 40 quarters (10 years) in the United States. There may be cases where you or your spouse might not meet the requirements to qualify for a premium-free Part A. If you find yourself in this position, don’t worry.