Choosing a Medicare Supplement Plan When you consider Medicare Supplement Plans, it is best if you have the help of a local Medicare insurance broker who can help you find the best options and best rates available. You will want to choose a plan that has the coverage you are looking for and then find the best rate possible.

Full Answer

What is the best Medicare plan?

They are here to talk about their 5 star medicare plans available to switch your current plan or during the election periods throughout the year. As independent agents, Deb and Jerry represent most of the supplement plan and drug -plan carriers and all Medicare advantage plan carriers.

How to pick the best Medicare supplement plan?

- Do your important physicians participate in any Medicare Advantage plans or do they only accept Original Medicare?

- What insurance is accepted by your preferred hospitals?

- Do you travel out of the area frequently? ...

- What is your risk tolerance? ...

- How about peace of mind? ...

Who qualifies for free Medicare?

- You’re eligible for or receive monthly benefits under Social Security or the railroad retirement system.

- You’ve worked long enough in a Medicare-covered government job.

- You’re the child or spouse (including a divorced spouse) of a worker (living or deceased) who has worked long enough under Social Security or in a Medicare-covered government job.

How to compare Medicare Advantage plans?

What You Should Know

- In 2022, there are more than 3,800 Medicare Advantage Plans for Americans to choose from — more than any previous year.

- Choosing the right plan requires a careful comparison of costs and how often you expect to need the benefits.

- All Medicare Advantage Plans are required to have an annual limit on out-of-pocket costs. ...

How do I choose the right Medicare plan?

To compare Medicare plans, use the Medicare Plan Finder at www.medicare.gov/find-a-plan, on the official U.S. government site for people with Medicare, which allows you to compare plans by cost, by quality and by other features that may be of importance to you.

What is the most widely accepted Medicare plan?

Plan F has the most comprehensive coverage you can buy. If you choose Plan F, you essentially pay nothing out-of-pocket for Medicare-covered services. Plan F pays 100 percent of your Part A and Part B deductibles, coinsurance amounts, and excess charges.

What are the 3 types of Medicare and what do they provide?

There are four parts of Medicare: Part A, Part B, Part C, and Part D.Part A provides inpatient/hospital coverage.Part B provides outpatient/medical coverage.Part C offers an alternate way to receive your Medicare benefits (see below for more information).Part D provides prescription drug coverage.

What is the best resource to understand Medicare?

The best resource is Medicare's Plan Finder, a comprehensive list of the Part D and Medicare Advantage plans (called “Medicare Health Plans”) available in your area.

What are the top 3 Medicare Advantage plans?

The Best Medicare Advantage Provider by State Local plans can be high-quality and reasonably priced. Blue Cross Blue Shield, Humana and United Healthcare earn the highest rankings among the national carriers in many states.

What are the top 3 most popular Medicare Supplement plans in 2021?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

Which is better PPO or HMO?

HMO plans typically have lower monthly premiums. You can also expect to pay less out of pocket. PPOs tend to have higher monthly premiums in exchange for the flexibility to use providers both in and out of network without a referral. Out-of-pocket medical costs can also run higher with a PPO plan.

Why do I need Medicare Part C?

Medicare Part C provides more coverage for everyday healthcare including prescription drug coverage with some plans when combined with Part D. A Medicare Advantage prescription drug (MAPD) plan is when a Part C and Part D plan are combined. Medicare Part D only covers prescription drugs.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Why are Medicare plans so confusing?

Medicare can seem confusing because they have tried to develop a system to accomodate a variety of lifestyles and financial situations across the country. In addition, they work to give Medicare beneficiaries as many options as possible when they move or if their health or financial conditions change.

Which company has the best Medicare Advantage plan?

List of Medicare Advantage plansCategoryCompanyRatingBest overallKaiser Permanente5.0Most popularAARP/UnitedHealthcare4.2Largest networkBlue Cross Blue Shield4.1Hassle-free prescriptionsHumana4.01 more row•Jun 22, 2022

Is it necessary to have supplemental insurance with Medicare?

For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

How does Medigap work with Medicare?

How it works with Original Medicare: A Medigap plan works in conjunction with Original Medicare and helps to pay for some of Medicare’s out-of-pocket costs. You might consider this type of Medicare plan if: You wish to have less uncertainty with your out-of-pocket health care costs.

What is the difference between Medicare Part A and Part B?

Step 1: Determine which Medicare plan coverage option you want. Medicare beneficiaries could potentially only be enrolled in Medicare Part A (hospital insurance). Medicare Part B (medical insurance) is optional, as are several other types of Medicare coverage .

What is a Medigap plan?

Medigap plans can help provide coverage for some of the out-of-pocket expenses that are tied to Original Medicare. These can include Medicare deductibles, coinsurance, copayments and more. There are 10 different types of standardized Medigap plans available in most states, and each type of plan offers its own combination of benefits.

What is a Part D plan?

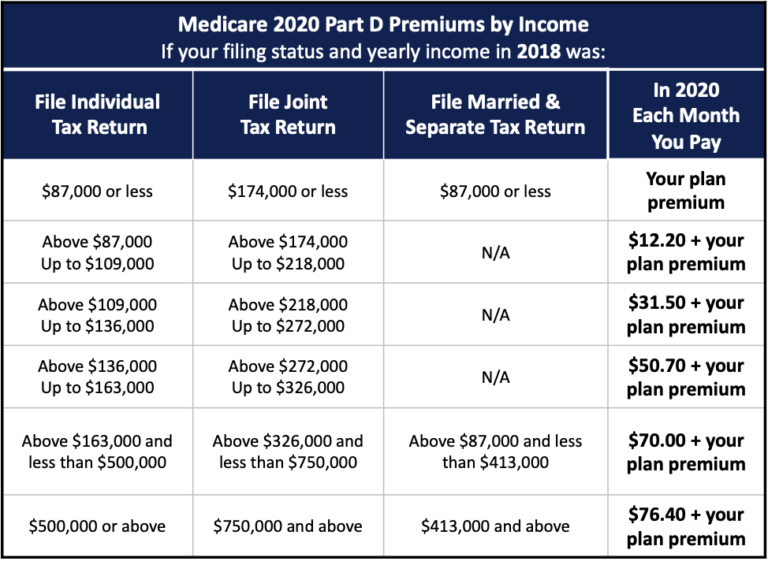

The Part D plan provides the prescription drug coverage that Original Medicare and some Medicare Advantage plans do not. You might consider this type of Medicare plan if: You want to have some help paying for your prescription drug costs. You can compare Part D plans available where you live and enroll in a Medicare prescription drug plan online ...

What is Medicare Part D?

Medicare Part D. Medicare Part D plans provide coverage for many prescription drugs. There are many different types of Medicare Part D plans, and each one offers its own formulary, which is the list of drugs covered by the plan. How it works with Original Medicare: Part D plans are used alongside Original Medicare or a Medicare Advantage plan ...

What are the benefits of Medicare Advantage?

Some of these additional benefits can include coverage for prescription drugs, dental, hearing, vision and more.

What are the different types of Medicare Advantage plans?

There are several different types of Medicare Advantage plans. These plan types include Medicare HMO plans, Medicare PPO plans and others. Learn more about the different types of Medicare Advantage plans to help you decide which one might be the best fit for you. Medicare Part D plans can also come in different types of formats, ...

When Can I Enroll In Medicare?

Remember, you are automatically eligible to receive Medicare the day you turn 65. If you are already receiving Social Security benefits and enrolled in Medicare before you hit 65, you will automatically be enrolled in Part A of Medicare.

Can I Add, Drop, And Change Coverage?

You can’t add, drop, and change coverage as you please. There are certain times and dates when you can do this. There can also be some confusion as to whether or not there will be fees or penalties for adding certain coverage or dropping it from your plan.

Choosing the right plan

Asking the right questions will help you choose the Medicare plan that best fits your needs. Here are some questions to help you get started.

Understanding Original Medicare

Learn about Original Medicare, what it covers, and how to choose the right option for additional coverage that best matches your health needs.

Understanding Medicare Part D

Learn what you need to know about Medicare prescription drug plans (Part D) before you choose the coverage that’s right for you.

Is Medicare Advantage right for you?

Medicare Advantage plans offer 3 advantages: cost, coverage and convenience. Learn more about Medicare Advantage plans and see if they are right for you.

What do the parts of Medicare cover?

In order to get the most out of Medicare, you need to understand the relationship among its parts. Check out our coverage comparison chart to learn how the parts of Medicare can be combined to give you the coverage that best fits your health needs.

Medicare Star Ratings: 5 things to know

When it comes to choosing a Medicare Advantage or prescription drug plan, it may seem like you have an abundance of options. The Medicare Star Ratings system is a useful tool to help you decide the best plan to fit your needs.

Research Medicare benefits

A satisfied Medicare member shares advice on what to focus on when researching plans.

Medicare Advantage or Medigap?

The main difference between the two types of plans is that Medigap (also called Medicare Supplemental Plans) works with Medicare to provide your coverage while Medicare Advantage provides your coverage instead of Medicare.

Choosing a Medicare Supplement Plan

When you consider Medicare Supplement Plans, it is best if you have the help of a local Medicare insurance broker who can help you find the best options and best rates available. You will want to choose a plan that has the coverage you are looking for and then find the best rate possible.

Choosing a Medicare Advantage Plan

When it comes to choosing a Medicare Advantage plan, there are many options available as well. Some options include:

What is Better, Medicare Advantage or Medicare Supplement?

Your circumstances will determine what’s best for you. If money is no issue, the freedom and simplicity of a Medicare Supplement plan make for a great experience. More often than not, money is a consideration since many seniors are on a fixed income (only 20% choose to enroll into a Medicare Supplement plan).

What if I Still Have Private Health Insurance?

If you're turning 65 but will still have private insurance through your or your spouse's job, you might be thinking about waiving Medicare Part A hospital coverage and Part B medical coverage for now. In this case, you've still got some research to do.

Important Facts About Medicare

Medicare can be a big help for people, so learn more about this program, including when you can sign up, what’s included, and what you can add.

Tips for Plan-Shopping

These tactics may help you once you plunge into the sea of Medicare plans:

Should You Get Help?

Many people decide they can handle Medicare decisions on their own. But you may feel more comfortable with one-on-one expert help. You might start by calling 800-MEDICARE (800-633-4227) or with a live help chat on the Medicare.gov site.

What to consider before picking a Medicare plan?

Here are six things to consider before picking a Medicare plan: 1. Coverage options. First, take a look at your current coverage .

How many Medicare plans are there in the US?

Today, people age 65 and older have more choices in Medicare coverage than previous generations. Most Americans have more than 25 plans to choose from, each with different premiums, copays, and alliances with medical providers and pharmacies.

What happens if you don't get Medicare?

If you don’t get these benefit payments, you’ll get a bill. If you choose to get the Medicare Plan D coverage for prescription drugs, you’ll also pay a monthly premium. The actual cost of this coverage depends on plans available in your area.

What is PPO Advantage?

A PPO Advantage Plan gives you a little more freedom and doesn’t require that you use the plan’s approved in-network physicians. However, you’ll pay higher out-of-pocket fees if that’s the case. 4. Prescription drug coverage. Traditional Medicare parts A and B don’t cover prescription drug costs.

Does Medicare Part A cover hospital care?

For most people, Medicare Part A, which covers hospital care, will be provided to you at no charge. Part B, which covers medical care, is an elected plan that involves a monthly premium.

Does Healthline Media offer insurance?

Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S. jurisdiction. Healthline Media does not recommend or endorse any third parties that may transact the business of insurance. Last medically reviewed on March 1, 2019.

What are the two types of Medicare?

There are two types of Medicare plans: Original Medicare and Medicare Advantage. According to Medicare.gov, Original Medicare is a government-provided, fee-for-service plan that is made up of two parts: Part A is hospital insurance and Part B is medical insurance.

What is Medicare Advantage?

Medicare Advantage is a plan offered by a private insurance company that contracts with Medicare. These plans include Part A and Part B coverage, and may be set up as an HMO, PPO, fee-for-service or other type of plan. They typically include prescription drug coverage and may offer vision, dental and other services. [.

When is the best time to switch Medicare?

For those already enrolled, the annual open enrollment period, which runs from Oct. 15 until Dec. 7 each year , is the best time to consider switching plans or adding coverage. 2. Learn about your options. There are two types of Medicare plans: Original Medicare and Medicare Advantage.

Can you enroll in health insurance after your 65th birthday?

Patients may be responsible for late penalties and lapses in coverage if they don't qualify for a Special Enrollment Period, which allows you to enroll outside your 65th birthday window or during annual open enrollment, for unplanned events like losing a job and associated health insurance coverage.

Can an employer group health plan be the primary carrier over Medicare?

That is true except with people still covered by an employer plan," Omdahl says. Federal law says that an employer group health plan (sponsored by a company with 20 or more employees) can be the primary carrier over Medicare. "People working at 65 or past 65, that population makes the most of the mistakes with enrollment," she says.

Does Medicare change if you work with a different insurance company?

The premiums are set by Medicare or the insurance company if you select a Medicare Advantage or Medigap plan. Medicare premiums do not change regardless of who you work with, but the other plans vary among companies based on the state they are licensed to do business in.

What is an HMO plan?

Health Maintenance Organization (HMO) plan is a type of Medicare Advantage Plan that generally provides health care coverage from doctors, other health care providers, or hospitals in the plan’s network (except emergency care, out-of-area urgent care, or out-of-area dialysis). A network is a group of doctors, hospitals, and medical facilities that contract with a plan to provide services. Most HMOs also require you to get a referral from your primary care doctor for specialist care, so that your care is coordinated.

What is a special needs plan?

Special Needs Plan (SNP) provides benefits and services to people with specific diseases, certain health care needs, or limited incomes. SNPs tailor their benefits, provider choices, and list of covered drugs (formularies) to best meet the specific needs of the groups they serve.

What happens if you get a health care provider out of network?

If you get health care outside the plan’s network, you may have to pay the full cost. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed. In most cases, you need to choose a primary care doctor. Certain services, like yearly screening mammograms, don’t require a referral. If your doctor or other health care provider leaves the plan’s network, your plan will notify you. You may choose another doctor in the plan’s network. HMO Point-of-Service (HMOPOS) plans are HMO plans that may allow you to get some services out-of-network for a higher copayment or coinsurance. It’s important that you follow the plan’s rules, like getting prior approval for a certain service when needed.

Do providers have to follow the terms and conditions of a health insurance plan?

The provider must follow the plan’s terms and conditions for payment, and bill the plan for the services they provide for you. However, the provider can decide at every visit whether to accept the plan and agree to treat you.

Can a provider bill you for PFFS?

The provider shouldn’t provide services to you except in emergencies, and you’ll need to find another provider that will accept the PFFS plan .However, if the provider chooses to treat you, then they can only bill you for plan-allowed cost sharing. They must bill the plan for your covered services. You’re only required to pay the copayment or coinsurance the plan allows for the types of services you get at the time of the service. You may have to pay an additional amount (up to 15% more) if the plan allows providers to “balance bill” (when a provider bills you for the difference between the provider’s charge and the allowed amount).