Medicare Advantage plans often may come in the form of HMOs or PPOs, like traditional health insurance. UnitedHealthcare also offers standalone dental insurance plans that you can pair with other insurance plans. Members pay a monthly premium along with a deductible and copayments or coinsurance when utilizing the plan.

Full Answer

How much cheaper is Medicare Advantage compared to Medicare?

Jun 12, 2020 · Many Medicare Advantage (Part C) plans may include prescription drug, vision, hearing and dental coverage not offered by Original Medicare (Parts A & B). Additionally, each Medicare Advantage plan is required by law to have an annual maximum cap on out-of-pocket costs. This means that once that limit is reached you will pay nothing for ...

How much does United Healthcare Cost?

Jun 18, 2014 · Benefits and Costs of United Healthcare Medicare Most of the benefits for UHC coverage remain the same across different plans, but copays and coverage for prescription drugs change. Each plan includes services for Part A and Part B. However, United Healthcare does a great job of adding discounts for dental, hearing, vision and wellness.

How much does a Medicare Advantage plan really cost?

May 22, 2021 · For 2022 UnitedHealthcare Medicare Advantage plans with a premium, the monthly consolidated premium (including Part C and Part D) ranges from $9 to $199. For special needs plans, or SNPs, with a ...

Does Medicare Advantage cost less than traditional Medicare?

The good news is all UnitedHealthcare Medicare Advantage plans have a maximum out-of-pocket limit. Regardless of your health needs, you will never pay more than the out-of-pocket limit set by Medicare each year. In 2020, the limit is $6,700, although many UnitedHealthcare Medicare Advantage plans set the limit below what Medicare allows.

Does Medicare Advantage pay for everything?

Medicare Advantage Plans must cover all of the services that Original Medicare covers except hospice care. Original Medicare covers hospice care even if you're in a Medicare Advantage Plan. In all types of Medicare Advantage Plans, you're always covered for emergency and urgent care.

What is the deductible for UnitedHealthcare Medicare Advantage?

Annual deductible. Medicare limits the deductible for Part D plans to $435 per year in 2020.

Do Medicare Advantage plans pay 100 %?

Medicare Advantage plans must limit how much their members pay out-of-pocket for covered Medicare expenses. Medicare set the maximum but some plans voluntarily establish lower limits. After reaching the limit, Medicare Advantage plans pay 100% of eligible expenses.

Do Medicare Advantage plans pay the 20 %?

In Part B, you generally pay 20% of the cost for each Medicare-covered service. Out-of-pocket costs vary – plans may have different out-of-pocket costs for certain services.

Does Medicare Advantage pay for surgery?

Medicare Advantage Coverage for Surgery Medicare Advantage plans may require you to use hospitals and doctors within the plan's network for your surgery. Prior authorization is usually required. Medicare Advantage plans may also have different deductibles, coinsurance and copayments for surgery than Original Medicare.

What is the out of pocket maximum for UnitedHealthcare?

OOPM released for 2023 plan year represents 4.3% increase from OOPM for 2022 plan year. The 2023 out-of-pocket maximum (OOPM) for health plans is $9,100 for single coverage and $18,200 for family coverage.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

Do Medicare Advantage plans pay for hospitalization?

If you join a Medicare Advantage Plan, you'll still have Medicare but you'll get most of your Part A and Part B coverage from your Medicare Advantage Plan, not Original Medicare. Part A covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

What is the maximum out-of-pocket expense with Medicare?

Out-of-pocket limit. In 2021, the Medicare Advantage out-of-pocket limit is set at $7,550. This means plans can set limits below this amount but cannot ask you to pay more than that out of pocket.

How do you qualify to get 144 back from Medicare?

Even though you're paying less for the monthly premium, you don't technically get money back. Instead, you just pay the reduced amount and are saving the amount you'd normally pay. If your premium comes out of your Social Security check, your payment will reflect the lower amount.

Who is the largest Medicare Advantage provider?

UnitedHealthcareUnitedHealthcare is the largest provider of Medicare Advantage plans and offers plans in nearly three-quarters of U.S. counties.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.

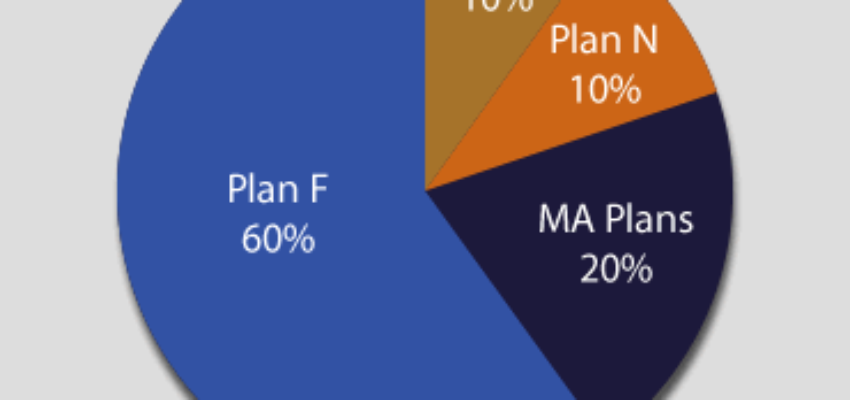

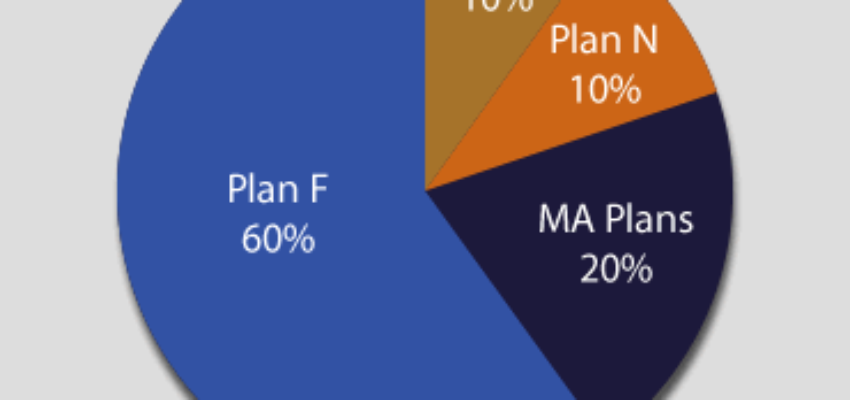

What are the other plans under United Health?

Other plans under United Health. United Healthcare also has two other types of plans: Medicare Supplemental Insurance and Medicare Special Needs Plans. Supplemental insurance is just for those who have a coverage gap and are using original Medicare.

What is the number to call for Medicare Advantage?

If you have any questions at all, don't hesitate to call and speak with one of our healthcare professionals. Available 24/7 at 1-800-810-1437 TTY 711.

How many people does AARP cover?

It has grown considerably over the last 40 years. The company provides coverage to 115 million individuals and is the company that provides AARP with their own Medicare Advantage Program. It’s also the company that provides AARP with its own Medicare Advantage Program.

Does United Healthcare offer Medicare Part C?

United Healthcare offers a few different types of Medicare Part C plans. The company has designated plans for budgets with minimal healthcare costs. It also offers plans that are being used consistently for inpatient visits. In addition, there are plans specifically for those who need lower deductibles on prescription drugs.

Does United Healthcare have copays?

Most of the benefits for UHC coverage remain the same across different plans, but copays and coverage for prescription drugs change. Each plan includes services for Part A and Part B. However, United Healthcare does a great job of adding discounts for dental, hearing, vision and wellness.

Does United Healthcare have a monthly premium?

You will still have to pay your monthly premium for Part B, but you won’t have to pay to get coverage through United Healthcare. You can pick Medicare Advantage plans, Medicare supplemental plans and Medicare prescription drug plans through an online marketplace on UnitedHealthSolutions.com. Because different plans are available in specific areas, you will need to enter your ZIP code to see what’s available.

Is a PPO plan the same as an HMO?

POS plans are similar to HMO plans except that you are able to see providers for certain services outside the plan’s network. However, out-of-network providers may cost more. You may also need to get a referral to a specialist. Your out-of-pocket costs are usually higher than with an HMO but lower than you’d expect with a PPO plan.

What does an A rating mean for UnitedHealthcare?

An A rating in this category indicates that AM Best believes UnitedHealthcare has an excellent ability to meet its ongoing insurance obligations.

How much is Medicare Advantage 2021?

Even as a Medicare Advantage user, you’ll still be responsible for paying your Medicare Part B premium, which is at least $148.50 in 2021.

How much is a copay for a doctor?

Copayments and/or coinsurance for each visit or service. For instance, there may be a $10 copay for seeing your primary doctor and a $45 copay for seeing a specialist .

How many stars does Medicare Advantage have?

The Centers for Medicare & Medicaid Services maintains its own database of star ratings on every Medicare Advantage and separate Medicare Part D plan, ranging from best (5 stars) to worst (1 star). The agency bases these ratings on plans’ quality of care and measurements of customer satisfaction, and ratings may change from year to year.

Which company has the largest Medicare Advantage network?

Largest network: UnitedHealthcare offers the largest Medicare Advantage network of all companies, with more than 850,000 network care providers [2].

What is an HMO point of service plan?

HMO point-of-service plans are HMO plans that allow members to get some out-of-network services, but you’ll pay more for those services.

Does UHC offer Medicare Advantage?

UHC also offers Medicare Advantage Patriot Plans, which are geared toward veterans and other people with existing drug coverage. Other plan offerings include the following types: HMO plans. A health maintenance organization, or HMO, generally requires that you use a specific network of doctors and hospitals.

What is coinsurance in Medicare?

Coinsurance is a percentage of the actual charge for the service. If you choose a PPO (Preferred Provider Organization) plan, for example, you might pay 30% coinsurance if you receive care outside your plan’s network. The good news is all UnitedHealthcare Medicare Advantage plans have a maximum out-of-pocket limit.

Does Medicare cover prescriptions?

Most plans include coverage for prescription drugs plus additional benefits not covered by Original Medicare, such as dental, vision, hearing, wellness programs and fitness memberships among other extra benefits and features. Your costs are based on the plan you choose. Most plans include some or all of the following expenses: Monthly premiums.

Do you pay a monthly premium for Medicare Advantage?

Monthly premium. If you get your Part D coverage for prescription drugs with your Medicare Advantage plan, you don’t pay a separate monthly premium for Part D. If you buy a stand-alone Part D plan to work with Original Medicare, you pay a monthly premium to UnitedHealthcare. Annual deductible. Medicare limits the deductible for Part D plans ...

Does Medicare Supplement cover out of pocket costs?

Medicare Supplement insurance plans can cover some of your out-of-pocket costs with Original Medicare. Some plans have more complete coverage: They may pay 100% of your Part A and Part B deductibles, coinsurance, and Part B excess charges. Others pay only some of your out-of-pocket costs. You pay a monthly premium to UnitedHealthcare ...

Do you pay Medicare Advantage monthly?

Monthly premiums. No matter which Medicare Advantage plan you enroll in, you continue to pay your regular Part B premium to Medicare every month. Some plans have an additional monthly premium you pay UnitedHealthcare, although there may be $0 premium plans available in your area.

Do prescription plans have copayments?

Most plans use a tiered copayment system. Medications in the lower tiers have a smaller copayment. The copayment is higher for more expensive medications in the upper tiers. Some plans may have no copayment for generic medications.

Is UnitedHealthcare a Medicare Advantage?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract. Enrollment in the plan depends on the plan’s contract renewal with Medicare.

How much does Medicare Part B pay?

The amount you may be required to pay as your share for the cost of a covered service. For example, Medicare Part B pays about 80% of the cost of a covered medical service and you would pay the rest.

What is a copayment in Medicare?

ON SCREEN TEXT: 3 Co-payments A fixed amount you pay when you receive a service covered by Medicare. Your plan pays the remaining amount.

What is Medicare Part B?

Medicare Part B has a monthly premium you pay directly to Medicare, and the amount you pay can vary based on your income level. Other costs you may pay with Medicare Part A and Part B include deductibles, coinsurance and copays. Learn more about the specific costs for Medicare Part A and Part B. What are my costs with Medicare Advantage, Medicare ...

What happens if you miss your Medicare enrollment?

Adopt healthy lifestyle behaviors. Medicare late enrollment penalties. Missing your Initial Enrollment Period can be costly. Medicare Part A, Part B and Part D may charge premium penalties if you miss your initial enrollment dates, unless you qualify for a Medicare Special Enrollment Period.

What is a 2 deductable?

ON SCREEN TEXT: 2 Deductibles A set amount you pay out of pocket for covered health services before your plan begins to pay.

Does Medicare pay for the rest of the cost?

You’ll also pay a share of the cost for your care, while your Medicare or Medigap coverage will pay the rest. There are three methods of cost sharing:

Does Medicare Advantage have deductibles?

Not all plans will have deductibles, copays or coinsurance, so check each plan’s cost-sharing rules carefully. Medicare Advantage plans also limit how much you'll pay out of pocket every year. This is called the out-of-pocket maximum, and each year the limit is set by Medicare.

Does Medicare cover syphilis?

Medicare covers STI screening for chlamydia, gonorrhea, syphilis or Hepatitis B when tests are ordered by a primary care provider for members who are pregnant or have an increased risk for an STI. These tests are covered once every year or at certain times during pregnancy.

Can a lab cost share be per day?

If the plan calls for a laboratory cost share, the cost share applies per day per provider, not per laboratory test. To prevent multiple lab cost shares for a single visit, all lab services must be billed by the same provider on the same date of service on a single claim.

Does Medicare Advantage cover physicals?

All of our Medicare Advantage plans cover an annual routine physical examination with no cost share. The exam includes a comprehensive physical exam and evaluates the status of chronic diseases.

What is Medicare Advantage?

Medicare Advantage plans are a different way to get Original Medicare coverage. Original Medicare has Part A and Part B. Part A covers your hospital costs while Part B covers your doctor visits and other outpatient services. UnitedHealthcare Medicare Advantage plans combine Part A and Part B coverage and may cover additional services as well. For example, some plans include routine vision, hearing, or dental care. Many plans also include Part D prescription drug coverage. Look for a plan that covers the services you need.

When do you sign up for Medicare Advantage?

The Initial Enrollment Period is the first time you can sign up for a Medicare Advantage plan. The window begins three months before the month you turn sixty-five. It includes your birthday month and goes on for three months after your birthday month.

When is Medicare open enrollment?

There is also a Medicare Advantage Open Enrollment Period. This time runs from January 1 to March 31 every year . If you have a Medicare Advantage plan, you can switch plans during this time.

When is the enrollment period for Medicare?

The Annual Enrollment Period is another time to sign up. This window runs from October 15 to December 7 every year. You can change from Original Medicare to a Medicare Advantage plan during this period. You can also switch from one Medicare Advantage plan to another.

Is there a medical deductible for a health insurance plan?

Deductible- Some plans have a medical deductible for certain services, which you pay each year before the plan begins to pay

Is UnitedHealthcare a Medicare Advantage?

Plans are insured through UnitedHealthcare Insurance Company or one of its affiliated companies, a Medicare Advantage organization with a Medicare contract. Enrollment in the plan depends on the plan’s contract renewal with Medicare.

Where is the provider service number on a health card?

For questions, please contact your local Network Management representative or call the Provider Services number on the back of the member’s health ID card.

What are the factors that affect reimbursement?

These factors may include, but are not limited to: legislative mandates, the physician or other provider contracts, and/or the member specific benefit plan documents**.

What is a medicaid supplement?

Medigap is a supplement program designed to help ‘fill in coverage gaps’ that may exist between United Healthcare and Medicare plans up their limitation amounts. Part A Plans with United Healthcare cover Medicare Part A co-insurance payments and hospital costs up to one year after Medicare Benefits are expended.

What is covered by home health insurance?

Those covered typically have access to home health care aides in addition to skilled medical care for in-home physical, speech or occupational therapy. Depending on need and whether a doctor prescribes them, certain medical supplies may also be covered under certain policies.

Is hospice coverage available through Medicare?

However, this care can be costly and a United Healthcare specialized hospice policy might be more effective should such care become necessary. Hospice coverage is also available on some level through Medicaid and Medicare with or without a United Healthcare policy.

Does Medicare cover nursing home care?

Medicare will only cover medically related expenses for a short period when prescribed by a doctor. However, seniors with a United Healthcare policy supplemented with Part C or Medicare Advantage will enjoy greater levels of coverage for skilled nursing care and nursing home living. Individuals who require regular medical care and support in a home like setting will want access to supplemental coverage through Medicare or a long term care insurance policy. To qualify, one must have a doctor deem this care necessary, and beneficiaries must use providers and facilities that are within the coverage plan and who are licensed by the state. Another option for skilled medical and nursing home care for United Healthcare policy holders may include the Medicare Advantage Special Needs Plan, which is available in certain states.

Does United Healthcare offer Medicare Supplement?

When it comes to senior care, United Healthcare offers Medicare Supplement Plans and Medicare Advantage Plans. Each of these help expand upon United Healthcare’s coverage options for senior care.

What is assisted living?

Assisted living facilities are primarily designed to allow individuals to live in a home setting where they have staff support and amenities on a daily basis. Typically, residents stay here long term and reside in an apartment, home or a dedicated suite where they carry about their lives in privacy.

Does United Healthcare cover senior care?

United Healthcare and Senior Care Coverage. As a major United States heath insurance provider, United Healthcare provides coverage for an array of conditions and does offer certain protections for senior care. However, they type of senior care costs that are covered will depend on the type of policy one has. When it comes to senior care, United ...

What is UHC insurance?

About hearing loss. Summary. UnitedHealthcare (UHC) are a private insurance company administering Medicare Advantage plans, most of which provide hearing coverage. Private insurance companies that administer Medicare Advantage plans often include benefits not available to those with an original Medicare plan.

What is a HMO POS?

Health Maintenance Organization Point-of-service (HMO-POS): A person has the same provider setup as the HMO plan outlined above, but they may also have a choice of out-of-network providers.

What is the Medicare Part B copayment?

For Medicare Part B, this comes to 20%. Copayment: This is a fixed dollar amount that an insured person pays when receiving certain treatments. For Medicare, this usually applies to prescription drugs.

How many types of Medicare Advantage Plans are there?

The company have four different types of Medicare Advantage plans, which include HMOs, HMO-POS plans, PPOs, and SNPs.

What is an HMO?

Health Maintenance Organization (HMO): A person with an HMO has the choice of in-network healthcare providers, but must choose a primary care physician (PCP) to coordinate care, and they require a referral to see a specialist.

What is the difference between coinsurance and deductible?

Coinsurance: This is a percentage of a treatment cost that a person will need to self-fund. For Medicare Part B, this comes to 20%.

What is conductive hearing loss?

Conductive hearing loss: Occurs when sound cannot pass through the ear canal. Doctors can sometimes treat this with prescription drugs or surgery.