Is Medicare tax withheld deductible?

Taxes. Like many other healthcare-related premiums, Medicare premiums are tax deductible. However, they are not typically considered pretax, so they’re taken out of your paycheck based on the amount you make before the money is taxed. For example, let’s say your employer-sponsored health insurance costs $250 each month and you earn $4,500 ...

Why do I pay Medicare tax?

Who Doesn't Have to Pay Social Security?

- High Earners. As mentioned above, workers making the big bucks pay for only a portion of their income. ...

- Members of Some Religious Groups. The group must have been in existence since 1950. ...

- Certain Foreign Visitors. ...

- Some American College Students. ...

- Pre-1984 Federal Employees. ...

- Certain State and Local Government Workers. ...

What is Medicare withholding tax?

What Are Medicare Taxes?

- Medicare Taxes: The Basics. Like Social Security benefits, Medicare’s Hospital Insurance program is funded largely by employment taxes.

- Medicare Taxes and the Affordable Care Act. The Affordable Care Act (ACA) added an extra Medicare tax for high earners. ...

- The Takeaway. ...

- Healthcare Tips. ...

What is SSA withholding?

What Is Social Security Withholding? The Social Security tax is a federal tax imposed on employers, employees, and self-employed individuals. It is used to pay the cost of benefits for elderly recipients, survivors of recipients, and disabled individuals ( OASDI, or Old Age, Survivors and Disability Insurance ).

Is Medicare tax withheld reported on W-2?

However, don't include any amounts reported on Form W-2, box 12, codes B and N, for uncollected RRTA Medicare tax. Note. Both Medicare tax and Additional Medicare Tax withholding are reported together on Form W-2, box 6.

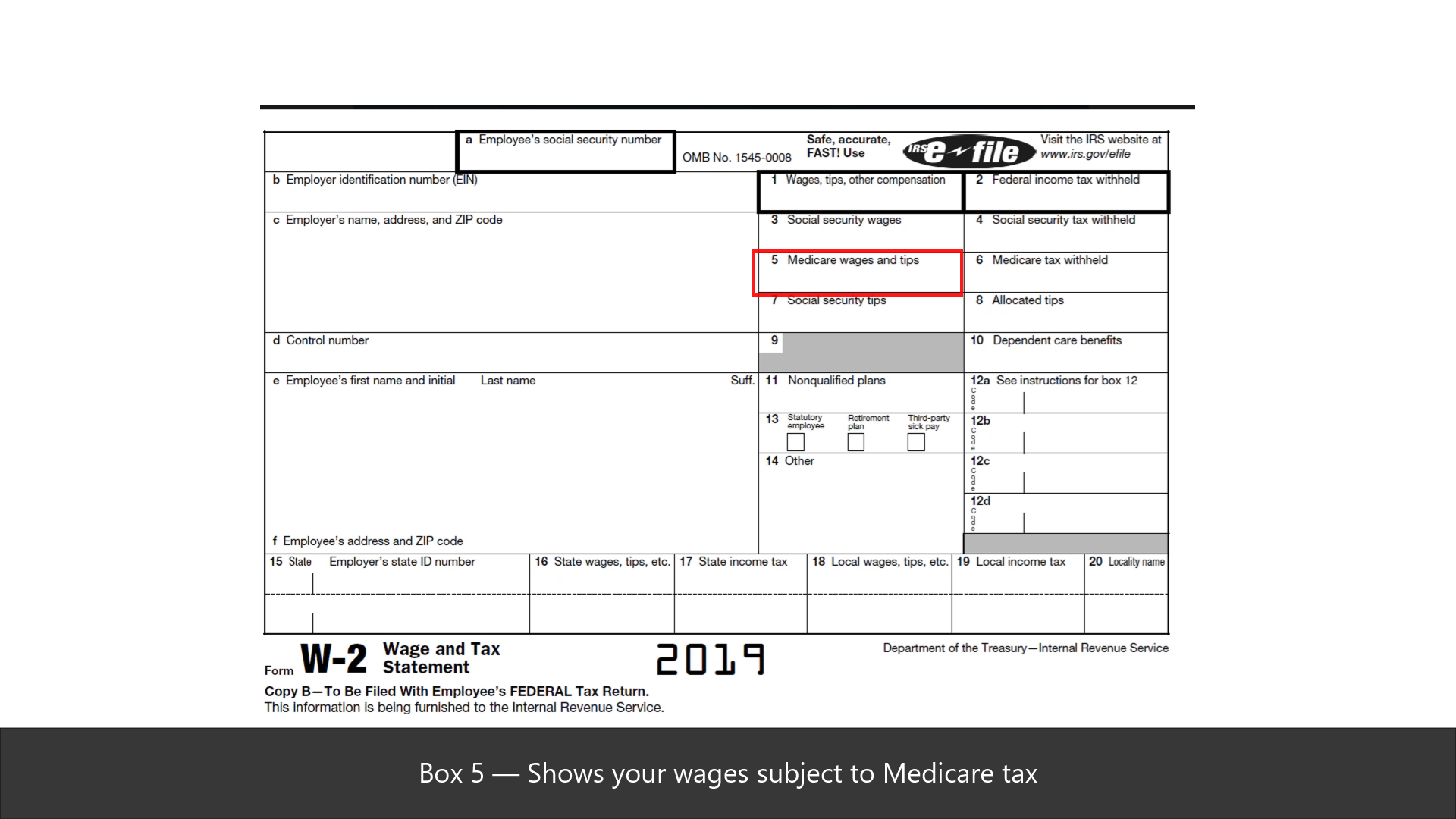

What box is Medicare on W-2?

Box 5 "Medicare wages and tips": This is total wages and tips subject to the Medicare component of social security taxes. Box 6 "Medicare tax withheld": This is Medicare tax withheld from your pay for the Medicare component of social security taxes. The rate is 1.45% of the Medicare wage base.

Where on W-2 does it show withholding?

Box 2Box 2 reports the total amount of federal income taxes withheld from your pay during the year.

What is V in box 14 on W-2?

Code "V" in Box 14 refers to contributions you made to "Non-Taxable Health Benefits".

What is Box 12 dd on W-2?

Employers. The Affordable Care Act requires employers to report the cost of coverage under an employer-sponsored group health plan on an employee's Form W-2, Wage and Tax Statement, in Box 12, using Code DD.

What makes up Medicare wages on W-2?

It should also be 6.2% of the amount in Box 3 on your W-2. Total wages in Box 5 are the wages subject to Medicare (Medic) tax. These wages are taxed at 1.45% and there is no limit on the taxable amount of wages.

What are boxes 12a and 12b on W-2?

The W-2 box 12 codes are: A – Uncollected Social Security tax or Railroad Retirement Tax Act (RRTA) tax on tips. Include this tax on Form 1040 Schedule 2, line 13. B – Uncollected Medicare tax on tips.

What is K in Box 14 of W-2?

K = Pre-tax dental and vision deductions. P = Parking Fringe Benefits/Employer Provided Vehicle (Included in Box 1) R = Retirement Deductions (Civilian employees who have wages earned in Puerto Rico)

Why is Box 1 and Box 5 different on W-2?

The amount in Box 1 is also going to be subject to Social Security and Medicare taxes, which means it will be included in Boxes 3 and 5. Box 5 includes income subject to federal income tax (Box 1) as well as income that is not subject to federal income tax. This is the amount subject to Medicare tax.

What does V mean on W-2?

Code V. Code V in box 12 of the W-2 indicates income from the exercise of non-statutory stock options. Per IRS General Instructions for Forms W-2 and W-3: "Code V—Income from the exercise of nonstatutory stock option(s).

What is D and DD in box 12?

Code DD is only information to you to tell you how much your employer spend for health coverage - you do nothing with it. Code D is the amount of salary deferrals to a 401(k) plan. You do nothing with than either other than enter it on the W-2 screen in box 12 just like it is on the paper W-2.

Where are uncollected taxes reported on W-2?

Uncollected taxes are not reported in boxes 4 and 6 of Form W-2. Unlike the uncollected portion of the regular (1.45%) Medicare tax, the uncollected Additional Medicare Tax is not reported in box 12 of Form W-2 with code B. The employee may need to make estimated tax payments to cover any shortage.

What is Medicare tax?

The Additional Medicare Tax applies to wages, railroad retirement (RRTA) compensation, and self-employment income over certain thresholds. Employers are responsible for withholding the tax on wages and RRTA compensation in certain circumstances.

What happens if an employee does not receive enough wages for the employer to withhold all taxes?

If the employee does not receive enough wages for the employer to withhold all the taxes that the employee owes, including Additional Medicare Tax, the employee may give the employer money to pay the rest of the taxes.

How to calculate Medicare tax?

Step 1. Calculate Additional Medicare Tax on any wages in excess of the applicable threshold for the filing status, without regard to whether any tax was withheld. Step 2. Reduce the applicable threshold for the filing status by the total amount of Medicare wages received, but not below zero.

How much did M receive in 2013?

M received $180,000 in wages through Nov. 30, 2013. On Dec. 1, 2013, M’s employer paid her a bonus of $50,000. M’s employer is required to withhold Additional Medicare Tax on $30,000 of the $50,000 bonus and may not withhold Additional Medicare Tax on the other $20,000.

How much is F liable for Medicare?

F is liable to pay Additional Medicare Tax on $50,000 of his wages ($175,000 minus the $125,000 threshold for married persons who file separate).

What is the income of A and B?

A and B live in a community property state and are married filing separate. A has $200,000 in wages and B has $100,000 in self employment income. A is liable for Additional Medicare Tax on $75,000, the amount by which A’s wages exceed the $125,000 threshold for married filing separate.

What is the purpose of a W-2?

What is the purpose of the Form W-2? Form W-2 is a wage tax form used to report the gross wages paid to employees and the taxes (social security, income, and Medicare) withheld from these employees to the SSA (Social Security Administration). 2. Line by Line Instructions to complete your Form W2.

When do I have to file W-2 2021?

Updated on January 20, 2021 - 10:30am by, TaxBandits. If you operate a business and pay your employees, you are required to file Form W2 with SSA. You must also send a copy of Form W2 to each employee before January 31 annually. You may have to file Form W-2 with the state depending upon your state requirements.

How much is Medicare tax for 2020?

for Medicare taxes. If you’re reporting for Household Employees for the tax year 2020, the sum of Medicare Wages and Tips must be equal to or greater than $2,200.00. If this sum is less than $2,200.00, enter zeros in the Medicare Wages & Tips boxes.

What is box 1 in 401(k)?

Box 1 - Wages, tips, other compensation. Enter the total taxable wages, tips, prizes, bonuses, and other compensation that you paid to your employee for the year. Box 1 does not include any tax benefits such as savings contributions to a 401 (k) plan, 403 (b) plan, or health insurance.

What is a third party sick pay?

Check the Third-party sick pay box if you are a third-party sick payer filing a Form W-2 for an insured employee or an employer reporting sick pay payments made by a third party .

What is the maximum Social Security wage base for 2020?

Enter the total wages paid subject to the employee Social Security tax. For the 2020 tax year, the maximum social security wage base is $137, 700. The sum of boxes 3 and 7 should#N#not exceed $137,700.

Is it important to complete W-2 correctly?

Completing your W-2 accurately is as important as paying the taxes. Incomplete or incorrect information in your W-2s may attract penalties. To stay away from unnecessary penalties, complete your W2s free of errors. To help you with this, we will explain each box of Form W2 and the information to be entered in it.

What is Box 2 in Social Security?

Box 2 shows how much federal income tax you withheld from Box 1 wages throughout the year. The numbers in Box 1 and Box 2 help determine an employee’s tax refund or liability. Most benefits that are exempt from federal income tax are not exempt from Social Security tax.

What is box 1 in the IRS?

Box 1—wages, tips, other compensation—contains an employee’s total wages subject to federal income tax. Do not include pre-tax benefits in Box 1. Per the IRS, list the following taxable wages, tips, and other compensation in Box 1: Total wages, bonuses, prizes, and awards you paid an employee. Noncash payments.

What box do you report taxable wages in 2020?

Let’s say you pay an employee $150,000 in taxable wages in 2020. You would enter “$150,000” in Box 1 and “$137,700” in Box 3. Because there is no Medicare wage base, you must also report “$150,000” in Box 5.

What are the boxes for retirement contributions?

Other states tax contributions at the state level. If retirement contributions are exempt from state income tax, Boxes 1 and 16 may be the same. If contributions are subject to state income tax, Box 16 may be higher than Box 1.

Why are boxes 1 and 3 different?

Because some benefits are not subject to federal income tax, Boxes 1 and 3 (as well as Box 5) can have different values. Likewise, you may see W-2 Box 1 and Box 16 differ. And, the values in Box 1 and Box 18 may also vary.

Do you report earnings above SS tax?

After an employee earns above the Social Security wage base, they no longer need to pay Social Security tax. Because earnings above the Social Security wage base aren’t subject to SS tax, don’t report them in Box 3.

Is Box 16 higher than Box 1?

If contributions are subject to state income tax, Box 16 may be higher than Box 1. For example, Pennsylvania requires employees to pay state income tax on retirement contributions. On the other hand, Ohio aligns itself with federal requirements and exempts retirement contributions from state income tax.

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers are responsible for withholding the 0.9% Additional Medicare Tax on an individual's wages paid in excess of $200,000 in a calendar year, without regard to filing status.

Wage Base Limits

Only the social security tax has a wage base limit. The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2022, this base is $147,000. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers.