Medicare has two parts, Part A (Hospital Insurance) and Part B (Medicare Insurance). You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if:

Who is eligible for Medicare in Illinois?

You may be eligible for Medicare in Illinois if you’re a U.S. citizen or a permanent legal resident who has lived in the U.S. for more than five years and one or more of the following applies to you: 3 You are age 65 or older. You are under 65, disabled, and receive disability benefits from Social Security or the Railroad Retirement Board.

How old do you have to be to receive Medicare?

Sep 16, 2018 · How to apply for Medicare in Illinois. To qualify for Medicare, you must be either a United States citizen or a legal permanent resident of at least five continuous years. The Medicare enrollment process is the same in all states. Illinois residents can be enrolled automatically when they turn 65, provided they are receiving retirement benefits through either the Social Security …

What is Medicare Part A in Illinois?

Jul 29, 2015 · Medicare Part A (Hospital Insurance): Part A coverage is a premium-free program for participants with enough earned credits based on their own work history or that of a spouse at least 62 years of age (when applicable) as determined by …

When can I enroll in a retirement plan in Illinois?

Feb 15, 2022 · You typically must be at least 65 years old to receive Medicare, even if you are receiving Social Security retirement benefits. There are some exceptions to this rule, however. Reaching age 62 can affect your spouse's Medicare premiums

Can I get Medicare at age 62?

Generally speaking, no. You can only enroll in Medicare at age 62 if you meet one of these criteria: You have been on Social Security Disability Insurance (SSDI) for at least two years. You are on SSDI because you suffer from amyotrophic lateral sclerosis, also known as ALS or Lou Gehrig's disease.

What is the earliest age you can get on Medicare?

age 65Remember, Medicare benefits can begin no earlier than age 65. If you are already receiving Social Security, you will automatically be enrolled in Medicare Parts A and B without an additional application. However, because you must pay a premium for Part B coverage, you have the option of turning it down.

How old do you have to be to get Medicare in Illinois?

65Medicare is available to everyone over the age of 65 and those under 65 with a disability or kidney failure. You will automatically be enrolled in Medicare Part A (hospital insurance) but you must take steps to enroll in Part B (medical insurance) as this is not automatic.Sep 8, 2021

Can you get Medicare at the age of 57?

You may apply for Medicare at any age if you meet one of the following criteria: your receive Social Security disability or Railroad Retirement Board (RRB) disability insurance.

Is Medicare age changing to 67?

3 The retirement age will remain 66 until 2017, when it will increase in 2-month increments to 67 in 2022. Several proposals have suggested raising both the normal retirement age and the Medicare eligibility age.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

Who qualifies for Illinois Medicare?

age 65 or olderMedicare is a federal health insurance program for the following: Participants age 65 or older. Participants under age 65 with certain disabilities. Participants of any age with End-Stage Renal Disease (ESRD)

Who qualifies for Medicare in Illinois?

When Can You Get Medicare in Illinois?You are age 65 or older.You are under 65, disabled, and receive disability benefits from Social Security or the Railroad Retirement Board.You have end-stage renal disease (ERSD).You have ALS (Amyotrophic Lateral Sclerosis), also known as Lou Gehrig's disease.

Can you be on Medicare at 45?

People under age 65 become eligible for Medicare if they have received SSDI payments for 24 months. ... People under age 65 who are diagnosed with end-stage renal disease (ESRD) or amyotrophic lateral sclerosis (ALS) automatically qualify for Medicare upon diagnosis without a waiting period.Aug 12, 2016

When can I get Medicare if I was born in 1961?

age 65If you are born from 1960 and later, you will reach full retirement age at 67. You will automatically receive Medicare benefits, if you receive Social Security Retirement benefits at age 65. Starting Social Security at age 62 will not get you Medicare until you reach 65.

Is Medicare Part A free?

Medicare Part A (Hospital Insurance) Most people get Part A for free, but some have to pay a premium for this coverage. To be eligible for premium-free Part A, an individual must be entitled to receive Medicare based on their own earnings or those of a spouse, parent, or child.Dec 1, 2021

Can you get Medicare at 60?

The Cost of Medicare at 60 Those who age in are eligible for Part A premium-free if they've paid in while working for at least 40 quarters (ten years). The tax money goes to the Hospital Insurance (HI) Trust Fund. This fund pays for Part A, which is why it is premium-free for most.Dec 7, 2021

About Medicare in Illinois

Medicare beneficiaries in Illinois can receive their coverage through Original Medicare, Part A and Part B, and add coverage in the form of a stand...

Types of Medicare Coverage in Illinois

Original Medicare, Part A and Part B, is available for beneficiaries in every state throughout the nation, including Illinois. Medicare Part A cove...

Local Resources For Medicare in Illinois

1. Medicare Savings Programs in Illinois: Illinois has programs to help beneficiaries who are unable to pay their out-of-pocket Medicare costs. Any...

How to Apply For Medicare in Illinois

To qualify for Medicare, you must be either a United States citizen or a legal permanent resident of at least five continuous years.The Medicare en...

What is Medicare Advantage Plan?

Medicare Advantage plans, also called Medicare Part C, are required to offer the same amount of coverage as Original Medicare (with the exception of hospice care), and some plans may include additional benefits, such as routine vision, dental, prescription drug coverage, and health wellness programs. Medicare Advantage plan details and costs are ...

Does Illinois have Medicare Advantage?

Medicare beneficiaries in Illinois can receive their coverage through Original Medicare, Part A and Part B, and add coverage in the form of a stand-alone Medicare Part D Prescription Drug Plan and/or a Medicare Supplement (Medigap) insurance plan. Beneficiaries may also enroll in a Medicare Advantage plan, which lets them get their Original Medicare, Part A and Part B, coverage (with the exception of hospice care) through a private insurance company that is approved by Medicare. These plans could also include routine vision, dental, and even prescription drug coverage.

What is Medicare Supplement?

Medicare Supplement insurance, also known as Medigap, is offered by private insurance companies. There are up to 10 standardized policy options in most states, each one marked with a letter. Plans of the same letter offer the same benefits no matter which insurance company offers the plan, but prices may vary.

Is Medicare Part D a stand alone plan?

Medicare Advantage plan details and costs are likely to vary by provider. Medicare Part D is optional prescription drug coverage. It must be purchased separately if you have Original Medicare. Illinois beneficiaries with Original Medicare can get this coverage through Medicare Prescription Drug Plans which are stand-alone plans available ...

Does Illinois have Medicare?

Medicare Savings Programs in Illinois: Illinois has programs to help beneficiaries who are unable to pay their out-of-pocket Medicare costs. Anyone can apply for these savings programs, but they are generally for Medicare beneficiaries whose income is below a government-set limit.

Can you get Medicare if you have Lou Gehrig's disease?

You may also qualify for automatic enrollment if you have amyotrophic lateral sclerosis (or Lou Gehrig’s disease); in this case, you’ll be automatically enrolled in Medicare starting the first month of disability benefits.

What is Medicare Part B?

Medicare Part B (Outpatient and Medical Insurance): Part B coverage requires a monthly premium contribution. With limited exception, enrollment is required for members who are retired or who have lost Current Employment Status and are eligible for Medicare.

What are the different types of Medicare?

Medicare has the following parts to help cover specific services: 1 Medicare Part A (Hospital Insurance): Part A coverage is a premium-free program for participants with enough earned credits based on their own work history or that of a spouse at least 62 years of age (when applicable) as determined by the Social Security Administration (SSA). 2 Medicare Part B (Outpatient and Medical Insurance): Part B coverage requires a monthly premium contribution. With limited exception, enrollment is required for members who are retired or who have lost Current Employment Status and are eligible for Medicare. 3 Medicare Part D (Prescription Drug Insurance): Part D coverage is not required for plan participants enrolled in any of the state programs (i.e., CIP, TRIP, LGHP or State). Medicare Part D coverage requires a monthly premium, unless the participant qualifies for extra-help assistance.

Is Medicare Part D required?

Medicare Part D (Prescription Drug Insurance): Part D coverage is not required for plan participants enrolled in any of the state programs (i.e., CIP, TRIP, LGHP or State). Medicare Part D coverage requires a monthly premium, unless the participant qualifies for extra-help assistance.

How old do you have to be to get Medicare?

Medicare eligibility at age 65. You must typically meet two requirements to receive Medicare benefits: You are at least 65 years old. You are a U.S. citizen or a legal resident for at least five years. In order to receive premium-free Part A of Medicare, you must meet both of the above requirements and qualify for full Social Security ...

What are the requirements for Medicare?

You must typically meet two requirements to receive Medicare benefits: 1 You are at least 65 years old 2 You are a U.S. citizen or a legal resident for at least five years

How much is Medicare Part A 2020?

In 2020, the Medicare Part A premium can be as high as $458 per month. Let’s say Gerald’s wife, Jessica, reaches age 62 and has worked for the required number of years to qualify for premium-free Part A once she turns 65. Because Jessica is now 62 years old and has met the working requirement, Gerald may now receive premium-free Part A.

Who can help you compare Medicare Advantage plans?

If you have further questions about Medicare eligibility, contact a licensed insurance agent today. A licensed agent can help answer your questions and help you compare Medicare Advantage plans (Medicare Part C) that are available where you live.

Is Medicaid based on income?

Yes. Medicaid qualification is based on income, not age. While Medicaid eligibility differs from one state to another, it is typically available to people of lower incomes and resources including pregnant women, the disabled, the elderly and children. Learn more about the difference between Medicare and Medicaid.

How long do you have to be a resident to qualify for Medicare?

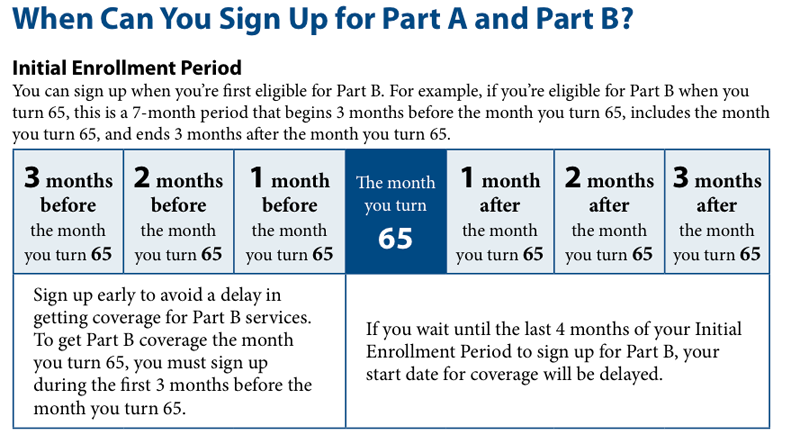

Medicare eligibility chart - by age. - Typically eligible for Medicare if you're a U.S. citizen or legal resident for at least 5 years. - If you won't be automatically enrolled when you turn 65, your Initial Enrollment Period begins 3 months before your 65th birthday.

Who is Christian Worstell?

Christian Worstell is a licensed insurance agent and a Senior Staff Writer for MedicareAdvantage.com. He is passionate about helping people navigate the complexities of Medicare and understand their coverage options. .. Read full bio

What is the Medicare-Medicaid Alignment Initiative?

The Medicare-Medicaid Alignment Initiative is one of Illinois' managed care programs. This program is for seniors and persons with disabilities who have full Medicaid and Medicare benefits.

Why is the Medicare-Medicaid Alignment Initiative important for me?

The Medicare-Medicaid Alignment Initiative brings together all of your Medicare, Medicaid, and prescription drug benefits into one health plan. In the Medicare-Medicaid Alignment Initiative, you choose a health plan that is best for you.

Can I enroll in the Medicare-Medicaid Alignment Initiative?

Getting full Medicaid and Medicare benefits (Medicare Parts A and B and Medicaid without a spenddown),

How do I know which health plan is the right plan for me?

To choose the best health plan for you, you should think about your answers to these questions:

How do I enroll in the Medicare-Medicaid Alignment Initiative?

You can enroll in the Medicare-Medicaid Alignment Initiative at any time. To enroll in this program, call Illinois Client Enrollment Services at 1-877-912-8880 (TTY 1-866-565-8576). Call Monday to Friday, 8 a.m. to 7 p.m. The call is free!

What happens after I enroll in the Medicare-Medicaid Alignment Initiative?

Once you enroll in a Medicare-Medicaid Alignment Initiative health plan, you will get a health plan member handbook and a member ID card. Look for them in the mail. You will work with your health plan care coordinator to get the health care services you need. To learn more, call your health plan member services number.

Key Takeaways

The standard age for Medicare eligibility#N#Some health plans require you to meet minimum requirements before you can enroll.#N#has been 65 for the entirety of the health insurance program, which debuted in 1965.

Medicare Eligibility Age Chart

Most older adults are familiar with Medicare and its eligibility age of 65. Medicare Part A and Medicare Part B are available based on age or, in some cases, health conditions, including:

Do I Automatically Get Medicare When I Turn 65?

Some people automatically get Medicare at age 65, but those numbers have declined as the Medicare and Social Security ages have continued to drift apart.

Is Medicare Free at Age 65?

While Medicare Part B has a standard monthly premium, 99 out of 100 people don’t have to pay a premium for Medicare Part A. Still, no part of Medicare can genuinely be called “free” because of associated costs you have to pay, like deductibles, coinsurance and copays.

Can You Get on Medicare at Age 62?

No, but while the standard age of eligibility remains 65, some call for lowering it. In a recent GoHealth survey, among respondents age 55 and older who weren’t on Medicare and had heard about proposals to lower the age of eligibility, 64% favored lowering the age.

Full Retirement Age by Year - What to Know

Full retirement age is the age you begin to receive full Social Security benefits. If you start to draw your Social Security benefits before reaching your full retirement age, the payment you receive will be less.

What is Medicaid in Illinois?

The program is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages. That being said, this page is focused on Medicaid eligibility, specifically for Illinois residents, aged 65 and over, and specifically for long term care, whether that be at home, in a nursing home or in assisted living.

What is institutional Medicaid?

1) Institutional / Nursing Home Medicaid – is an entitlement (anyone who is eligible will receive assistance) & is provided only in nursing homes. 2) Medicaid Waivers / Home and Community Based Services – Limited number of participants. Provided at home, adult day care or in assisted living.

Does the stimulus check count as income?

An exception exists for Covid-19 stimulus checks, which do not count as income, and therefore, have no impact on Medicaid eligibility. When only one spouse of a married couple is applying for institutional Medicaid or home and community based services via a Medicaid waiver, only the income of the applicant is counted.

What are countable assets?

Countable assets include cash, stocks, bonds, investments, IRAs, credit union, savings, and checking accounts, and real estate in which one does not reside. However, for Medicaid eligibility, there are many assets that are considered exempt (non-countable).

Can you spend down your income on medicaid?

Once an individual has paid his or her excess income down to the Medicaid eligibility limit for the month, he or she will qualify for Medicaid for the remainder of the month. Unfortunately, the Medically Needy Pathway does not assist one in “ spending down ” extra assets for Medicaid qualification.

Is Medicaid for Illinois seniors?

There are several different Medicaid long-term care programs for which Illinois seniors may be eligible. These programs have slightly different eligibility requirements and benefits. Further complicating eligibility are the facts that the criteria vary with marital status and that Illinois offers multiple pathways towards eligibility.

What is the eligibility age for Medicare?

What is the Medicare eligibility age? The eligibility age for Medicare is 65 years old for most people. This applies whether or not you’re still working at the time of your 65th birthday. The age when you retire does not factor into Medicare eligibility.

How long do you have to be on Medicare to get Social Security?

Social Security disability. If you’re under age 65 and have been receiving Social Security disability benefits for 24 months, you qualify for Medicare. You can enroll in your 22nd month of receiving these benefits, and your coverage will begin in your 25th month of receiving them. If you’re entitled to monthly benefits based on an occupational ...