Medicare Part A Premium and Part A Deductible

| Year | Premium | Deductible |

| 2017 | $413 | $1,316 |

| 2016 | $411 | $1,288 |

| 2015 | $407 | $1,260 |

| 2014 | $426 | $1,216 |

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

What determines your Medicare Part B premium?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employer’s pension plan.

How much does Medicare Part B costs?

and Part B which covers doctor’s visits and other medical services, and costs $170.10 per month for most enrollees in 2021. Everyone is eligible for Medicare at age 65, even if your full Social ...

How high will the Medicare Part B deductible get?

The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

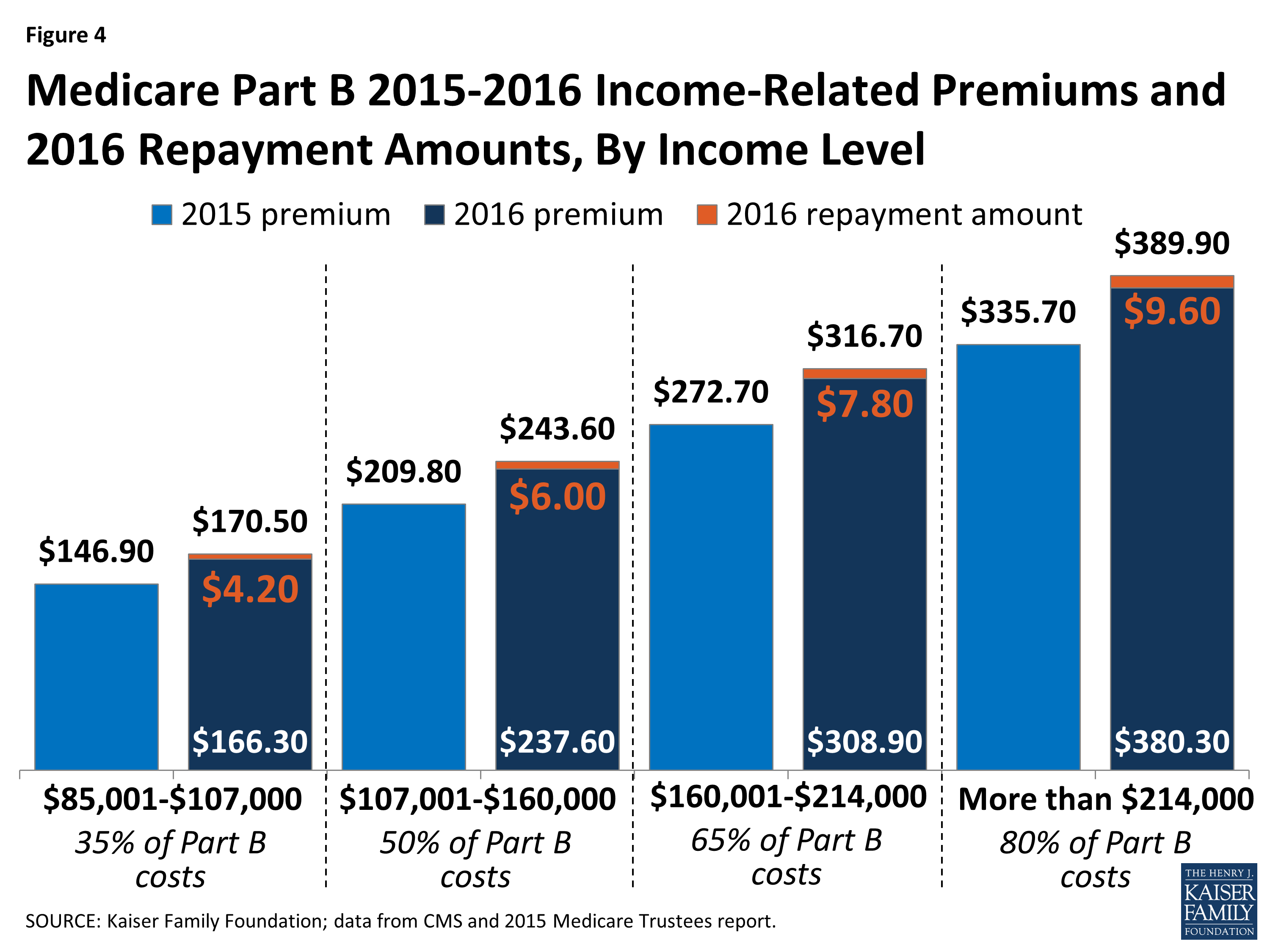

What were Medicare premiums in 2016?

Some people already signed up for Part B could see a hike in premiums.How Much You'll Pay for Medicare Part B in 2016Single Filer IncomeJoint Filer Income2016 Monthly PremiumUp to $85,000Up to $170,000$121.80 or $104.90*$85,001 - $107,000$170,001 - $214,000$170.50$107,001 - $160,000$214,001 - $320,000$243.602 more rows

What was the Medicare Part B premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

What is the Irmaa for 2017?

If Your Yearly Income Is2017 Medicare Part B IRMAA$85,000 or below$170,000 or below$0.00$85,001 - $107,000$170,000 - $214,000$53.50$107,001 - $160,000$214,000 - $320,000$133.90$160,001 - $214,000$320,000 - $428,000$214.303 more rows•Jul 31, 2016

Are Medicare Part B premiums adjusted each year?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

What were Medicare premiums in 2017?

Medicare Part B (Medical Insurance) Monthly premium: The standard Part B premium amount in 2017 is $134 (or higher depending on your income). However, most people who get Social Security benefits pay less than this amount.

What is the Medicare Part B deductible for 2017?

$183 in 2017CMS also announced that the annual deductible for all Medicare Part B beneficiaries will be $183 in 2017 (compared to $166 in 2016).

How do I calculate my Irmaa?

How Is IRMAA Calculated? The government determines whether you qualify for IRMAA by finding your modified adjusted gross income (MAGI). Your monthly IRMAA payment for each year is determined by your MAGI from two years prior. Your MAGI is your adjusted gross income (AGI) with certain costs added back to it.

How do I find my Irmaa?

If you need a replacement copy of your IRMAA letter you can obtain one from your local Social Security office, which can be located on the following website: www.socialsecurity.gov/onlineservices. This website can also be accessed to request a copy of the SSA-1099.

How do you calculate modified adjusted gross income for Irmaa?

MAGI is calculated as Adjusted Gross Income (line 11 of IRS Form 1040) plus tax-exempt interest income (line 2a of IRS Form 1040).

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Does Social Security count as income for Medicare premiums?

(Most enrollees don't pay for Medicare Part A, which covers hospitalization.) Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the current Medicare Part B premium?

$170.10The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What Medicare Part B Covers

In a nutshell, Medicare Part B, or "medical insurance," is the part of Medicare that covers most medical services and supplies other than hospital...

What Medicare Part B Costs in 2017

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There ar...

Is Medicare in Financial Trouble?

You may have seen headlines about Medicare's financial troubles, so let's set the record straight. First of all, those headlines are referring to t...

How much is the Part B premium for 2017?

The standard Part B premium amount in 2017 will be $134 (or higher depending on your income). However, most people who get Social Security benefits will pay less than this amount. This is because the Part B premium increased more than the cost-of-living increase for 2017 Social Security benefits. If you pay your Part B premium through your monthly Social Security benefit, you’ll pay less ($109 on average). Social Security will tell you the exact amount you will pay for Part B in 2017. You’ll pay the standard premium amount if:

How much does Medicare pay for Part B?

Over 90% of eligible Medicare beneficiaries enroll in Part B and over 70% use Part B services during a year. Part B generally pays 80% of the approved amount for covered services in excess of the annual deductible ($166 in 2016 and $183 in 2017). The beneficiary is liable for the remaining 20%. Many beneficiaries purchase a Medicare Supplement (Medigap) policy to cover that exposed 20%.

What is Medicare for seniors?

Medicare is the federal health insurance program that covers people 65 and older and some younger adults with permanent disabilities and certain medical conditions. When Medicare was established in 1965 about half of American seniors had no health insurance. Today, virtually all Americans over age 65 have at least some health coverage through Medicare.

What is covered by Part B?

Part B covers physician services, outpatient hospital care, and some home health visits. It also covers laboratory and diagnostic tests, such as X-rays and blood work; durable medical equipment, such as wheelchairs and walkers; certain preventive services and screening tests, such as mammograms and prostate cancer screenings; outpatient physical, speech and occupational therapy; outpatient mental health care ; and ambulance services.

Does Medicare cover all medical services?

Medicare does not cover all health care services. For example, Medicare generally does not pay for long-term care services, regular eye exams and eyeglasses, hearing aids, or routine dental care.

How much does Medicare Part B cost?

The short answer is that the standard Medicare Part B premium is $134 per month. However, that's not what most beneficiaries actually pay. There are essentially three categories of beneficiaries, each with different premiums. About 70% of Medicare beneficiaries pay their premiums directly through their Social Security benefits.

What is Medicare Part B?

Medicare Part B is also known as "medical insurance," and it covers most medical services and supplies other than hospital stays. Here's a more detailed explanation of what Medicare Part B covers and what it will cost in 2017. Image source: Getty Images.

What are the preventative services covered by Medicare Part B?

Preventative services covered by Medicare Part B include services like lab tests; screenings for conditions such as diabetes, heart disease, and cancer; and services intended to prevent diseases (such as your annual flu shot).

Is Medicare Part A funded by premiums?

First of all, those headlines are referring to the part of Medicare that's funded by tax revenue -- Part A, or hospital insurance -- not Part B, which is funded mostly by premiums. Also, Medicare Part A is in decent financial shape -- for now.

When will Medicare be privatized?

This change may come in the form of a tax increase, benefit reductions, or privatization. If Republican leaders get their way, Medicare will be privatized by 2024 (which would definitely affect Part B).

When will the hospital insurance fund run out?

After that, however, deficits are projected, and the Hospital Insurance trust fund is expected to run out in 2028. So it's fair to assume that something will need to change in the coming years.

Does Medicare cover a wheelchair?

This is the part of Medicare you would use when you see your doctor or have surgery. It also covers supplies that are deemed medically necessary, such as a wheelchair or a walker. Medicare Part B also covers ambulance services, but only if other transportation could endanger your health. For instance, if you're having a heart attack, Medicare Part B would cover ambulance transportation.

How much is Medicare Part B?

Starting January 1, most people with Medicare will see a small increase in their Part B premium, from $104.90 to an average of $109.00 per month. But about 30 percent of people covered by Medicare will see a minimum Part B premium ...

How much is Medicare Part B deductible?

In addition to the updated premium amounts, CMS announced an increase in the Medicare Part B annual deductible, from $166 in 2016 to $183 in 2017.

What is the hold harmless provision in Medicare?

This difference in premium amounts is due to a federal law which is commonly called the “hold harmless” provision. This provision prevents about 70 percent of beneficiaries from seeing major increases in Medicare Part B premiums when Social Security cost of living adjustments (COLAs) are nonexistent or very small.

Can you see a Part B premium increase?

Those who are held harmless will not see their Part B premium increase by an amount that is greater than the dollar amount of their COLA increase. Because the COLA is a percentage of a person’s Social Security benefits, the exact dollar amount of the increase, and the premium, will vary.

What is the Medicare premium for 2017?

The monthly premium for Medicare Part B was $134 for tax years 2017 and 2018. This rate was for single or married individuals who filed separately with MAGIs of $85,000 or less and for married taxpayers who filed jointly with MAGIs of $170,000 or less. 4 The 2017 premium rate was an increase of 10% over the 2016 rate that was not based on the Social Security Administration's cost-of-living adjustments (COLA).

How much is Medicare Part B 2021?

Medicare Part B premiums for 2021 increased by $3.90 from the premium for 2020. The 2021 premium rate starts at $148.50 per month and increases based on your income to up to $504.90 for the 2021 tax year. Your premium depends on your modified adjusted gross income (MAGI) from your tax return two years before the current year (in this case, 2019). 2.

What happens if you increase your Medicare premium?

2 This means that, generally, if you increase your earnings over certain limits and the cost of living continues to increase, you'll keep seeing increases in Medicare Part B premiums.

When do you get Medicare if you don't have Social Security?

If you're not receiving Social Security, though, be sure to contact the Social Security Administration about three months prior to your 65th birthday in order to receive Medicare .

Is Medicare Part B indexed for inflation?

Updated July 07, 2021. Medicare Part B premiums are indexed for inflation — they're adjusted periodically to keep pace with the falling value of the dollar. What you pay this year may not be what you pay next year. 1 Premiums are also means-tested, which means they're somewhat dependent upon your income. The more income you have, the higher your ...

Does Medicare have a hold harmless?

Medicare has a "hold harmless" provision for seniors. This provision prevents Medicare from raising the premiums more than the cost of living increases. 4 While this keeps seniors from paying more than they should, you'll have to pay the increased premiums if your COLA is higher than the increase.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

What is the standard Part B premium for 2021?

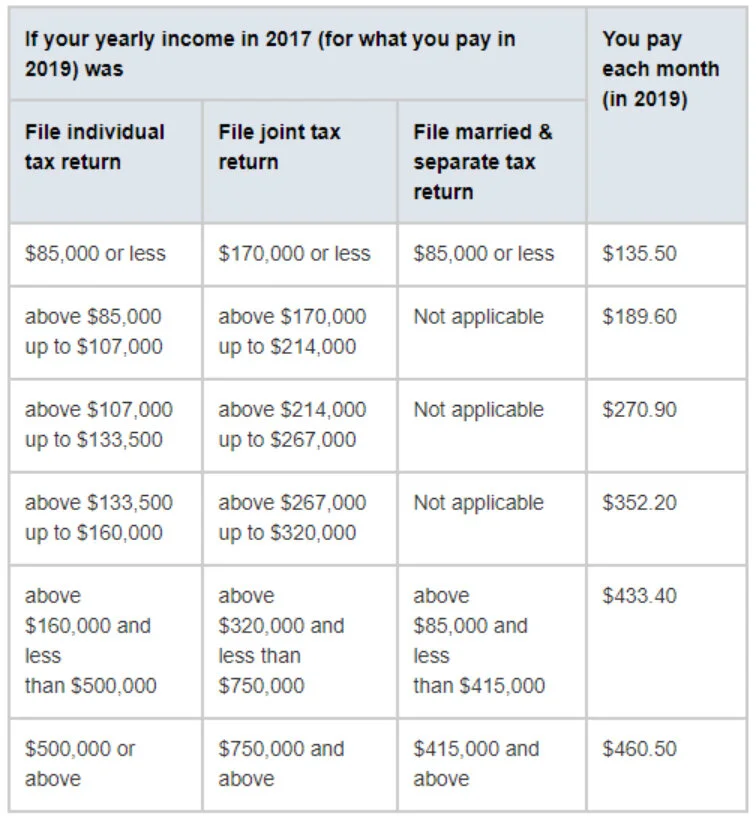

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't sign up for Part B?

If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.