In 2019, there will be an extra surcharge tier for people with the highest income. If your income is between $160,001 and $499,999 ($320,001 to $749,999 for joint filers), you’ll pay $433.40 per month. Single filers with income of $500,000 or more ($750,000 or more for joint filers) will pay $460.50 per month.

| Income (adjusted gross income plus tax-exempt interest income): | |

|---|---|

| Single tax return | Married filing jointly |

| $85,000 or less | $170,000 or less |

| $85,001 to $107,000 | $170,001 to $214,000 |

| $107,001 to $133,500 | $214,001 to $267,000 |

How much will my Medicare premium be in 2019?

If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. The 2019 Part A premiums increased a little over 3 percent from 2018. Medicare Part B provides coverage for doctor’s office visits and other types of outpatient care, along with durable medical equipment (DME).

Are Medicare Part B and Part D premiums based on 2019 income?

This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019. In this guide, we break down the costs of Medicare by income level, including costs for Medicare Part A, Part B, Part C, Part D and Medicare Supplement Insurance plans.

How much does Medicare Part a cost a month?

Medicare Part A (Hospital Insurance) Costs. Part A Monthly Premium. Most people don’t pay a Part A premium because they paid Medicare taxes while working. If you don’t get premium-free Part A, you pay up to $437 each month.

What is the Medicare Part a deductible for 2019?

Medicare Part A Premiums/Deductibles. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,364 in 2019, an increase of $24 from $1,340 in 2018.

What was Medicare MAGI for 2019?

The base Medicare premium for 2019 is $135.50 per month. Surcharges are imposed on beneficiaries with higher income: single taxpayers with modified adjusted gross income (MAGI) in excess of $85,000 and married couples with MAGI greater than $170,000.

What are the Irmaa brackets for 2019?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2019More than $160,000 but less than $500,000 More than $500,000$433.40 $460.50Married filing jointlyMore than $170,000 but less than or equal to $214,000$189.60More than $214,000 but less than or equal to $267,000$270.909 more rows•Dec 6, 2021

What are the income levels that determine Medicare premiums?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What is the maximum Medicare premium for 2019?

On October 12, CMS announced it will raise the monthly Medicare Part B premiums from $134 in 2018 to $135.50 in 2019. It will also tack on an additional $2 to the annual Part B deductible, making it $185 in 2019.

What are the income brackets for Irmaa Part D and Part B?

What are the income brackets for IRMAA Part D and Part B?SingleMarried Filing JointlyPart D IRMAA$88,000 or less$176,000 or less$0 + your plan premium$165,001 and under $500,000$330,001 and under $750,000$70.70 + your plan premium$500,000 or above$750,000 and above$77.10 + your plan premium3 more rows

What is the income threshold for Irmaa?

The IRMAA surcharge will be added to your 2022 premiums if your 2020 income was over $91,000 (or $182,000 if you're married), but as discussed below, there's an appeals process if your financial situation has changed.

Do Medicare premiums change each year based on income?

Remember, Part B Costs Can Change Every Year The Part B premium is calculated every year. You may see a change in the amount of your Social Security checks or in the premium bills you receive from Medicare. Check the amount you're being charged and follow up with Medicare or the IRS if you have questions.

Does Social Security count as income for Medicare?

All types of Social Security income, whether taxable or not, received by a tax filer counts toward household income for eligibility purposes for both Medicaid and Marketplace financial assistance.

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

What is modified adjusted gross income for Medicare?

Your MAGI is your total adjusted gross income and tax-exempt interest income. If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage.

What are the Irmaa brackets for 2020?

IRMAA income brackets generally increased from $1,000 to $3,000 for individual tax filers, and between $2,000 and $6,000 for married couples filing jointly.

How does income affect Medicare?

If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the income-related monthly adjustment amount.

How much does Medicare pay for Social Security?

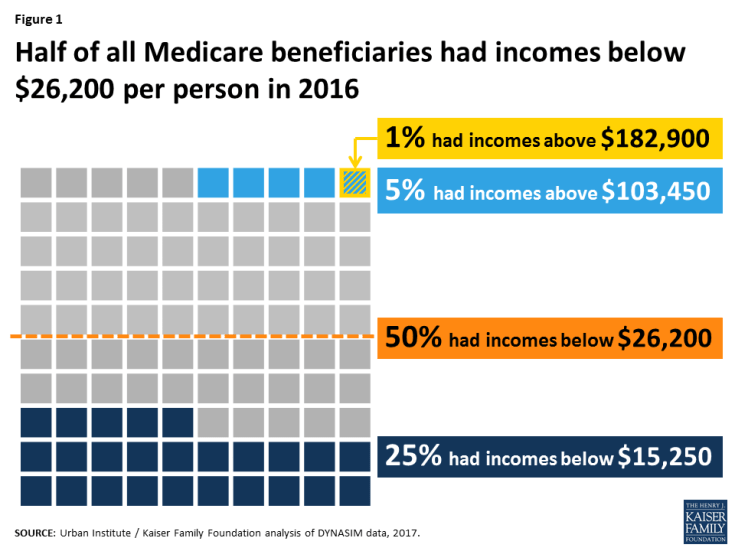

In 2019, most of Medicare’s 60 million beneficiaries will pay the standard Part B premium of $135.50 per month , up slightly from this year’s premium of $134 per month. But about 3 million high-income retirees will pay ...

How much is Medicare surcharge per month?

Those same high-income retirees are also subject to monthly surcharges on their Medicare prescription drug plans, ranging from an extra $13 per month to an extra $74.80 per month per person on top of their monthly premium. Medicare drug plans are run by private insurers.

How much is Medicare Part B surcharge?

But about 3 million high-income retirees will pay additional monthly surcharges ranging from $54.10 to $325 per month per person for Medicare Part B next year. The surcharges for each of the income tiers are a few dollars higher than last year. IRMAA surcharges for 2019 are based on 2017 federal income tax returns filed in 2018.

What is MAGI for Medicare?

MAGI includes adjusted gross income plus any tax-free interest from municipal bonds. For example, a married couple in the new top income bracket who are both are enrolled in Medicare would pay more than $11,000 for Part B premiums and surcharges in 2019, plus more than $2,600 for prescription drug coverage.

How much does Medicare D cost?

Costs of Medicare D plans vary widely, but the average premium is expected to be about $32.50 per month in 2019, down slightly from this year, according to the Centers for Medicare and Medicaid Services. Starting in 2019, a new top surcharge tier was added for very high-income beneficiaries, defined as individuals with modified adjusted gross ...

What are the life changing events that affect Social Security?

Social Security considers any of the following situations to be life-changing events: the death of a spouse; marriage, divorce or annulment; retirement or reduced work hours for one or both spouses; loss of income-producing property due to natural disaster; or loss of a pension.

How much is Medicare premium for 2019?

If you paid Medicare taxes for only 30-39 quarters, your 2019 Part A premium will be $240 per month. If you paid Medicare taxes for fewer than 30 quarters, your premium will be $437 per month. The 2019 Part A premiums increased ...

What is Medicare Part A?

2019 Medicare Part A premium. Medicare Part A (hospital insurance) helps provide coverage for inpatient care costs at hospitals and other types of inpatient facilities.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) provides coverage for some of the out-of-pocket costs that Medicare Part A and Part B don't cover. This can include costs such as Medicare deductibles, copayments, coinsurance and more. Medigap plans are sold by private insurance companies so there is no standard premium.

How much is Medicare Part C?

Plan premiums will vary by provider, plan and location. The Centers for Medicare and Medicaid Services (CMS) reports that the average Medicare Advantage plan premium in 2019 will be $28.00 per month.

What is the Medicare Part B premium?

The standard monthly Medicare Part B premium is $135.50 in 2019. While most people pay only the standard premium, higher income earners will be charged a higher premium.

Is Medicare Part B optional?

Medicare Part B is optional. You will likely be automatically enrolled in Part B (with the option to drop it) if you are automatically enrolled in Medicare Part A.

Will Medicare IRMAA increase in 2020?

It’s expected that the income thresholds that determine when someone pays a Medicare IRMAA will rise slightly in 2020. This means that fewer people may have to pay the IRMAA, and the adjustment will delay when other beneficiaries are required to pay more for their 2020 Part B premiums.

When will Medicare Part B and Part D be based on income?

If you have Part B and/or Part D benefits (which are optional), your premiums will be based in part on your reported income level from two years prior. This means that your Medicare Part B and Part D premiums in 2021 may be based on your reported income in 2019.

How much is the 2021 Medicare Part B deductible?

The 2021 Part B deductible is $203 per year. After you meet your deductible, you typically pay 20 percent of the Medicare-approved amount for qualified Medicare Part B services and devices. Medicare typically pays the other 80 percent of the cost, no matter what your income level may be.

What is Medicare Part B based on?

Medicare Part B (medical insurance) premiums are based on your reported income from two years prior. The higher premiums based on income level are known as the Medicare Income-Related Monthly Adjustment Amount (IRMAA).

Does Medicare Part D cover copayments?

There are some assistance programs that can help qualified lower-income beneficiaries afford their Medicare Part D prescription drug coverage. Part D plans are sold by private insurance companies, so additional costs such as copayment amounts and deductibles can vary from plan to plan.

Does income affect Medicare Part A?

Medicare Part A costs are not affected by your income level. Your income level has no bearing on the amount you will pay for Medicare Part A (hospital insurance). Part A premiums (if you are required to pay them) are based on how long you worked and paid Medicare taxes.

Does Medicare Part B and D have to be higher?

Learn more about what you may pay for Medicare, depending on your income. Medicare Part B and Part D require higher income earners to pay higher premiums for their plan.

Does Medicare Advantage have a monthly premium?

Some of these additional benefits – such as prescription drug coverage or dental benefits – can help you save some costs on your health care, no matter what your income level may be. Some Medicare Advantage plans even feature $0 monthly premiums, though $0 premium plans may not be available in all locations.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

How much will Medicare premiums be in 2021?

There are six income tiers for Medicare premiums in 2021. As stated earlier, the standard Part B premium amount that most people are expected to pay is $148.50 month. But, if your MAGI exceeds an income bracket — even by just $1 — you are moved to the next tier and will have to pay the higher premium.

How much of Medicare Part B is paid?

But the remaining 25% of Medicare Part B expenses are paid through your premium, which is determined by your income level. Medicare prices are quoted under the assumption you have an average income. If your income level exceeds a certain threshold, you will have to pay more.

Why did Medicare Part B premiums increase in 2021?

That’s because 2021 Medicare Part B premiums increased across the board due to rising healthcare costs. Exactly how much your premiums increased though, isn’t based on your current health or Medicare plan or your income. Rather, it’s the soaring prices of overall healthcare.

What is Medicare Advantage?

Essentially: Medicare Advantage – Private plans that replace your Parts A, B, and in most cases, D. Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A.

Why are Social Security beneficiaries paying less than the full amount?

In 2016, 2017, and 2018, the Social Security COLA amount for most beneficiaries wasn’t enough to cover the full cost of the Part B premium increases, so most enrollees were paying less than the full amount, because they were protected by the hold harmless rule.

How much is Part B 2021?

So most beneficiaries are paying the standard $148.50/month for Part B in 2021. The hold harmless provision does NOT protect you if you are new to Medicare and/or Social Security, not receiving Social Security benefits, or are in a high-income bracket.

Is Medicare Part D tax deductible?

Also known as Part C. Medicare Part D – Prescription drug coverage plans, introduced in 2006. Generally, if you’re on Medicare, you aren’t charged a premium for Part A. However, you are charged monthly premiums for Part B and Part D, and can also be charged for Part C, depending on the plan you select. These premiums are tax-deductible but very few ...

How much does Medicare cover?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%. Medicare imposes surcharges on higher-income beneficiaries. The theory is that higher-income beneficiaries can afford to pay more for their healthcare. Instead of doing a 25:75 split with ...

How much does Medicare premium jump?

If your income crosses over to the next bracket by $1, all of a sudden your Medicare premiums can jump by over $1,000/year. If you are married and both of you are on Medicare, $1 more in income can make the Medicare premiums jump by over $1,000/year for each of you.

How long does it take to pay Medicare premiums if income is higher than 2 years ago?

If your income two years ago was higher and you don’t have a life-changing event that makes you qualify for an appeal, you will pay the higher Medicare premiums for one year. IRMAA is re-evaluated every year as your income changes.

What percentage of Medicare premiums do Medicare beneficiaries pay?

The premiums paid by Medicare beneficiaries cover about 25% of the program costs for Part B and Part D. The government pays the other 75%.

How many income brackets are there for IRMAA?

As if it’s not complicated enough for not moving the needle much, IRMAA is divided into five income brackets. Depending on the income, higher-income beneficiaries pay 35%, 50%, 65%, 80%, or 85% of the program costs instead of 25%. The lines drawn for each bracket can cause a sudden jump in the premiums you pay.

When will IRMAA income brackets be adjusted for inflation?

The IRMAA income brackets (except the very last one) started adjusting for inflation in 2020. Here are the IRMAA income brackets for 2021 coverage and the projected brackets for 2022 coverage. Before the government publishes the official numbers, I’m able to make projections based on the inflation numbers to date.

How much is Medicare Part B 2021?

The standard Medicare Part B premium is $148.50/month in 2021. A 40% surcharge on the Medicare Part B premium is about $700/year per person or about $1,400/year for a married couple both on Medicare. In the grand scheme, when a couple on Medicare has over $176k in income, they are probably already paying a large amount in taxes.