Here are other important 2018 benchmark numbers announced by CMS

Centers for Medicare and Medicaid Services

The Centers for Medicare & Medicaid Services, previously known as the Health Care Financing Administration, is a federal agency within the United States Department of Health and Human Services that administers the Medicare program and works in partnership with state government…

Full Answer

What is Medicare Part A in 2018?

· Beneficiaries should be happy to see a $50 increase in their initial coverage limit for Medicare Part D. The new limit for 2018 is $3750. The out-of-pocket threshold for Medicare in 2018 is $5,000,...

What changes are coming to Medicare in 2018?

Medicare Part D In 2018 Added to the Medicare lineup in 2003, Medicare Part D is the prescription drug coverage portion. These plans are sold separately from original Medicare and cover prescription drugs. Because seniors tend to need more drug coverage as they age, Part D is a popular portion.

What are the changes to Medicare Part B deductibles for 2018?

· Traditional Medicare doesn't offer these coverage options, and there is no maximum annual out-of-pocket expense. In 2018, MA providers will offer plenty of $0 monthly premium plans to act as a lure...

How much do Medicare Advantage plans cost in 2018?

· Here are other important 2018 benchmark numbers announced by CMS: The Part B annual deductible will be unchanged at $183. The Part A annual deductible will rise by $24 to $1,340 from $1,316. There...

What were 2018 Medicare premiums?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018.

Why did Medicare increase B?

This year's standard premium, which jumped to $170.10 from $148.50 in 2021, was partly based on the potential cost of covering Aduhelm, a drug to treat Alzheimer's disease.

What was the increase in Medicare from 2019 to 2020?

The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

What changes are coming to Social Security in 2022?

To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter. Maximum taxable wage base is $147,000. If you turn 62 in 2022, your full retirement age changes to 67. If you turn 62 in 2022 and claim benefits, your monthly benefit will be reduced by 30% of your full retirement age benefit.

Why did my Medicare premium increase for 2022?

CMS explained that the increase for 2022 was due in part to the potential costs associated with the new Alzheimer's drug, Aduhelm (aducanumab), manufactured by Biogen, which had an initial annual price tag of $56,000.

How much did Medicare go up in 2021?

2021 = $148.50 per month. 2020 = $144.60 per month. 2019 = $135.50 per month.

How much money is taken out of Social Security for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What is the 2021 Medicare premium?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

What is the Part D deductible for 2022?

$480Part D deductible: The deductible refers to the annual amount you must pay out of pocket before your plan begins to pay its portion of drug costs. CMS has capped the deductible at a maximum of $480 in 2022, up from $445 in 2021. Plans may charge a lower or even $0 deductible, but cannot exceed the maximum.

How do I get my $144 back from Medicare?

You can get your reduction in 2 ways:If you pay your Part B premium through Social Security, the Part B Giveback will be credited monthly to your Social Security check.If you don't pay your Part B premium through Social Security, you'll pay a reduced monthly amount directly to Medicare.

What is the Medicare Part B deductible for 2021?

$203 inThe annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020.

Rejoice! Part D Premiums Are Going Down

This past week, the Centers for Medicare and Medicaid Services released copious amounts of prescription drug pricing data via its annual landscape...

Medicare Advantage Members Have Fewer Low Out-Of-Pocket Plan Options

The aforementioned alternative to Medicare, known as Medicare Advantage (MA), has been an increasingly popular option for eligible enrollees. Betwe...

There Are New Part B Surcharge Income Brackets For The Wealthy

In April 2015, at seemingly the 11th hour, Congress passed legislation that introduced a new reimbursement schedule for physicians who accept Medic...

Surprise! Part B Premiums Aren't Changing (For Some People)

Lastly, it's worth pointing out what was brushed over above: Part B premiums aren't expected to increase in 2018. While that's great news for newly...

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

Is it necessary to sign up for Medicare Part B?

Signing up for Medicare Part B is optional, as is signing up for any portion of Medicare. But if you need medical coverage, then it’s an affordable option. Just remember to sign up when you first become eligible if you want medical coverage unless you have a better option elsewhere, such as a job-sponsored plan that costs less.

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

Does Medicare Part B have higher income?

Of course, higher-income enrollees are subject to even higher rates for Medicare Part B. If you earn above the standard income threshold, then you’ll be charged an “Income-Related Monthly Adjustment Amount” (IRMAA) along with the standard premium. When determining income, Medicare uses income information from the IRS, which dates two years back. In 2018, income determinations will be based on what you earned in 2016.

Why does Medicare go up each year?

Medicare premiums typically go up each year in line with the rising cost of healthcare . Yet 2018 is unusual, because some premiums that Medicare participants pay will stay the same.

How much does Medicare pay for hospital stays?

In 2018, Medicare participants will have to pay $335 per day as coinsurance for hospital stays that last longer than 60 days but are no more than 90 days. That's higher by $6 from 2017's numbers. Beyond the 90th day, Medicare participants can use up to 60 lifetime reserve days, but they'll need to pay $670 per day in coinsurance to do so, up $12 from 2017.

Does Medicare have a deductible?

Medicare also charges deductibles that participants have to pay before further coverage kicks in. Those amounts typically go up each year, but as with premiums, 2018 will be a bit unusual.

Is Medicare affected by the Affordable Care Act?

However, there are a few situations in which Medicare could be affected by what lawmakers are doing.

Did Avalere Health drop Part D?

Normally, this data would take a long time to pore over, but Avalere Health did the grunt work, thankfully. When all is said and done, Avalere's experts found that Part D (prescription drug plan) premiums are set to drop slightly in 2018 as a result of higher-than-predicted rebates.

Is Part D insurance falling?

However, just because Part D premiums are falling doesn't mean you should blindly remain enrolled in the same Part D plan as you had in 2017. Premiums and coverage commonly change from year to year on most plans, meaning what offered the best value in 2017 may not be the best value for you in 2018. You'll want to closely examine ...

Is there a maximum out of pocket for Medicare?

Traditional Medicare doesn't offer these coverage options, and there is no maximum annual out-of-pocket expense. In 2018, MA providers will offer plenty of $0 monthly premium plans to act as a lure to attract seniors, but the number of plans with out-of-pocket expenses capped at $4,000 or less will be significantly lower, according to Avalere.

Is Medicare Advantage a low out of pocket plan?

Medicare Advantage members have fewer low out-of-pocket plan options. The aforementioned alternative to Medicare, known as Medicare Advantage (MA), has been an increasingly popular option for eligible enrollees. Between 2005 and 2015, the number of eligible Medicare enrollees who chose an MA plan instead of traditional Medicare rose from 13% to 30%.

Will Part B premiums increase in 2018?

Lastly, it's worth pointing out what was brushed over above: Part B premiums aren't expected to increase in 2018. While that's great news for newly eligible enrollees, as well as those folks who haven't enrolled for Social Security as of yet, it's not necessarily great news for those protected by the hold harmless clause.

1. Some (but not all) Medicare premiums are on the rise

Medicare premiums typically go up each year in line with the rising cost of healthcare. Yet 2018 is unusual, because some premiums that Medicare participants pay will stay the same.

2. Some (but not all) Medicare deductibles will climb

Medicare also charges deductibles that participants have to pay before further coverage kicks in. Those amounts typically go up each year, but as with premiums, 2018 will be a bit unusual.

3. Coinsurance payments for hospital and skilled nursing stays will go up

Under Part A, participants typically get full coverage after covering their deductible for a certain length of time, but beyond that, they have to make contributions toward their care costs. In 2018, Medicare participants will have to pay $335 per day as coinsurance for hospital stays that last longer than 60 days but are no more than 90 days.

What is the Medicare premium for 2018?

Medicare announced its premiums for 2018. Here’s what you need to know. The Centers for Medicare and Medicaid Services (CMS) has announced that the 2018 premium for Part B of Medicare will remain at $134 a month . But even with no change, millions of Social Security recipients will pay sharply higher ...

How much is the deductible for a hospital stay in 2018?

The Part A annual deductible will rise by $24 to $1,340 from $1,316. There is a separate deductible for each hospital stay, usually defined as being separated by at least 60 days during a calendar year.

How much does Part A coinsurance cost?

The Part A coinsurance charge for hospitalizations lasting from 61 to 90 days will rise by $6 to $335 a day in a benefit period; for lifetime reserve days linked to longer stays, it will rise $12 to $670 a day.

Can Medicare premiums cause a decline in Social Security?

Increases in Medicare premiums can’t cause a person’s Social Security benefits to decline from one year to the next, according to Social Security’s “hold harmless” rule. About 30 percent of Medicare beneficiaries are not held harmless each year. This group includes people who have not yet begun receiving Social Security benefits, ...

Will Social Security pay higher Part B premiums?

But even with no change, millions of Social Security recipients will pay sharply higher Part B premiums that will eat up all or most of next year’s 2 percent cost of living adjustment (COLA) for Social Security. To explain why, let’s back up and explain some basic facts of Medicare. Part B covers insured expenses for doctors, ...

Will Social Security recipients receive a boost in their benefits next year?

One thing is clear: Many Social Security recipients will receive little if any boost in their benefits next year. And while most of these folks have been shielded by the hold-harmless rule from paying the full Part B premiums in recent years, I don’t expect any of them to send thanks for this to the folks at Social Security and Medicare who came up with this system for determining Medicare premiums.

What is the Medicare Part B deductible for 2018?

A The 2018 Medicare Part B deductible remains the same as it was: $183. The standard monthly premium also remains unchanged at $134.

What is the MACRA increase for 2018?

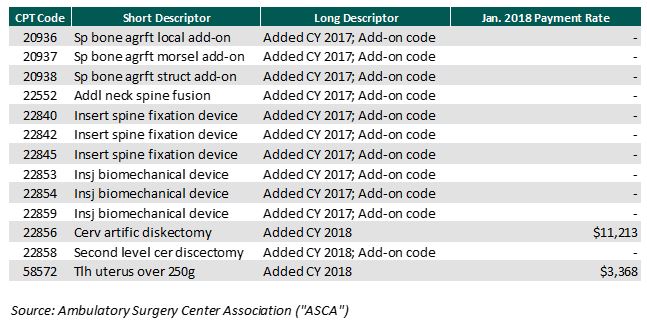

A In terms of the national published Fee Schedule for physicians, after the mandated 0.5-percent MACRA increase and some of the other budget-neutrality and misvalued-code adjustments, the 2018 conversion factor went up 0.28 percent to $35.9996. Ambulatory surgical centers got a fee-schedule conversion factor increase of 1.9 percent to $45.575 if they meet quality-reporting requirements. HOPD services in eye care showed an overall +1.35-percent change.

When does ICD-9 go into effect?

A As with ICD-9, these go into effect on October 1 each year. There are a few subtle changes, but the biggest relate to myopic degeneration (H44.2-) and low vision/blindness coding (H54.-), each of which gained much greater specificity. REVIEW

What is the Medicare code for Omidria?

A For Medicare, the existing code for Omidria, C9447 ( phenylephrine and ketorolac, injection) had its pass-through payment status changed. The payment indicator for this code changed from “K2” (paid separately) to “N1” (bundled). This means that on January 1, 2018, payment for C9447 is packaged in the reimbursement for the cataract procedure and is no longer separately identifiable for Part B Medicare.

What is a Category III code?

A Category III codes are released twice a year. Coverage and payment for these codes are at the discretion of the individual Medicare Administrative Contractors. None are significant for eye care on January 1, 2018, but those that are in place and effective since July 1, 2017 are: • 0469T—Retinal polarization scan, ...

What are MS-DRGs in FY 2018?

As a result of this review, no new MS-DRGs will be added to the list of MS-DRGs subject to the post-acute care transfer policy; however MS-DRGs 987, 988 and 989 (Non-Extensive O.R. Procedure Unrelated To Principal Diagnosis with major complication or comorbidity (MCC), with complication or comorbidity (CC), without CC/MCC, respectively) were added to the special payment policy list. See Table 5 of the FY 2018 IPPS/LTCH PPS Final Rule for a listing of all Post-acute and Special Post-acute MS-DRGs available on the FY 2018 Final Rule Tables webpage.

What is a PPS for Medicare?

The Social Security Amendments of 1983 (P.L. 98-21) provided for establishment of a PPS for Medicare payment of inpatient hospital services. In addition, the Medicare, Medicaid, and SCHIP Balanced Budget Refinement Act of 1999 (BBRA), as amended by the Medicare, Medicaid, and SCHIP Benefits Improvement and Protection Act of 2000 (BIPA), required that a budget neutral, per discharge PPS for LTCHs based on diagnosis-related groups (DRGs) be implemented for cost reporting periods beginning on or after October 1, 2002.

What is the readmission adjustment factor for 2018?

The readmissions payment adjustment factors for FY 2018 are in Table 15 of the FY 2018 IPPS/LTCH PPS final rule (which are available through the Internet on the FY 2018 IPPS Final Rule Tables webpage). Hospitals that are not subject to a reduction under the Hospital Readmissions Reduction Program in FY 2018 ( such as Maryland hospitals), have a readmission adjustment factor of 1.0000. For FY 2018, hospitals should only have a readmission adjustment factor between 1.0000 and 0.9700.

What is Medicare 505?

Section 505 of the Medicare Modernization Act of 2003 (MMA), also known as the “outmigration adjustment, is an adjustment that is based primarily on commuting patterns and is available to hospitals that are not reclassified by the Medicare Geographic Classification Review Board (MGCRB), reclassified as a rural hospital under § 412.103, or redesignated under section 1886(d)(8)(B) of the Act.

When did CMS change the labor market area?

Effective October 1, 2014, CMS revised the labor market areas used for the wage index based on the most recent labor market area delineations issued by the Office of Management and Budget (OMB) using 2010 Census data.

When did CR10273 become effective?

All items covered in CR10273 are effective for hospital discharges occurring on or after October 1, 2017, through September 30, 2018, unless otherwise noted.

When did the low volume hospital payment adjustment change?

The temporary changes to the low-volume hospital payment adjustment originally provided by the Affordable Care Act, and extended by subsequent legislation, which expanded the definition of a low-volume hospital and modified the methodology for determining the payment adjustment for hospitals meeting that definition, is currently effective through September 30, 2017 , as provided by section 204 of the Medicare Access and CHIP Reauthorization Act of 2015. Under current law, beginning in October 1, 2017, the low-volume hospital qualifying criteria and payment adjustment methodology will revert to that which was in effect prior to the amendments made by the Affordable Care Act and subsequent legislation (that is, the low-volume hospital payment adjustment policy in effect for FYs 2005 through 2010). The regulations implementing the hospital payment adjustment policy are at § 412.101.