Every Medicare Advantage plan must provide at least the same minimum benefits as Original Medicare, but they may include additional benefits not covered by Medicare Part A or Part B, such as:

- Prescription drug coverage

- Dental coverage

- Vision coverage

- Health and wellness programs

What benefits are covered by Medicare?

Sep 15, 2018 · Your Medicare Advantage benefits may include discounted gym memberships, yoga classes, weight management counseling, and other routine wellness services not covered under Original Medicare. Keep in mind that there may be annual limits and restrictions on these additional Medicare Advantage benefits, and that you may need to pay a deductible, …

Do Medicare Advantage plans have extra benefits?

Medicare covers an additional 8 sessions if you show improvement. If your doctor decides your chronic low back pain isn’t improving or is getting worse, Medicare won’t cover your additional treatments. You can get a maximum of 20 acupuncture treatments in a 12-month period. Medicare doesn’t cover acupuncture (including dry needling) for any

What are the benefits of traditional Medicare?

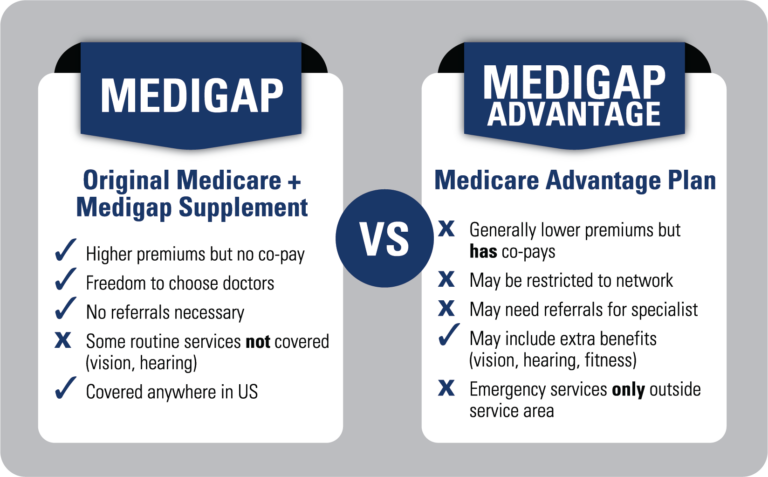

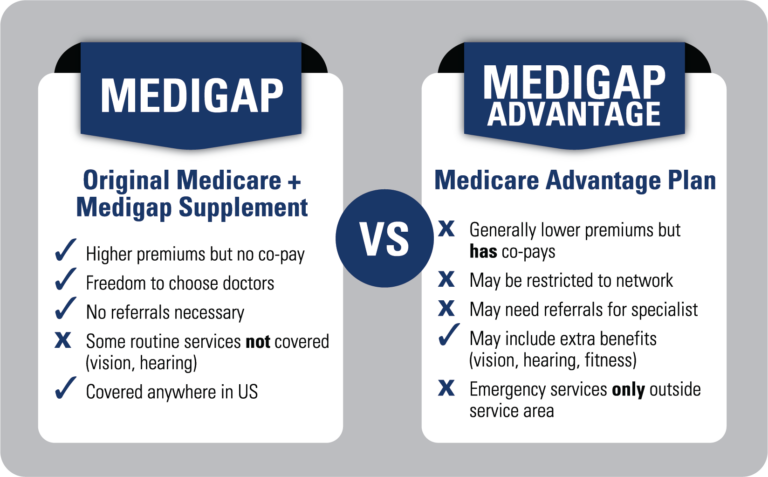

Supplemental (Medigap) policies help pay Medicare out-of-pocket copayments, coinsurance, and deductible expenses. Medicare Advantage Plan (previously known as Part C) includes all benefits and services covered under Part A and Part B — prescription drugs and additional benefits such as vision, hearing, and dental — bundled together in one plan.

Do you qualify for more Medicare benefits?

Nov 04, 2021 · Transportation benefits: 38%; Acupuncture: 36%; In-home support services: 10%; Bathroom safety devices: 8%; Telemonitoring services: 3%; …

What are the disadvantages of a Medicare Advantage plan?

Cons of Medicare AdvantageRestrictive plans can limit covered services and medical providers.May have higher copays, deductibles and other out-of-pocket costs.Beneficiaries required to pay the Part B deductible.Costs of health care are not always apparent up front.Type of plan availability varies by region.More items...•Dec 9, 2021

What are 4 types of Medicare Advantage plans?

Medicare Advantage PlansHealth Maintenance Organization (HMO) Plans.Preferred Provider Organization (PPO) Plans.Private Fee-for-Service (PFFS) Plans.Special Needs Plans (SNPs)

What is the difference between Medicare Part B and Medicare Advantage?

Original Medicare covers inpatient hospital and skilled nursing services – Part A - and doctor visits, outpatient services and some preventative care – Part B. Medicare Advantage plans cover all the above (Part A and Part B), and most plans also cover prescription drugs (Part D).

What does secondary Medicare pay for?

Usually, secondary insurance pays some or all of the costs left after the primary insurer has paid (e.g., deductibles, copayments, coinsurances). For example, if Original Medicare is your primary insurance, your secondary insurance may pay for some or all of the 20% coinsurance for Part B-covered services.

What is the most popular Medicare Advantage plan?

AARP/UnitedHealthcare is the most popular Medicare Advantage provider with many enrollees valuing its combination of good ratings, affordable premiums and add-on benefits. For many people, AARP/UnitedHealthcare Medicare Advantage plans fall into the sweet spot for having good benefits at an affordable price.Feb 16, 2022

What is the highest rated Medicare Advantage plan?

The Aetna Medicare Advantage plans are number one on our list. Aetna is one of the largest health insurance carriers in the world. They have earned the title of an AM Best A Rated Company. These plans have options- HMO or PPO, zero or low premiums, and added benefits.

Can you switch back and forth between Medicare and Medicare Advantage?

If you currently have Medicare, you can switch to Medicare Advantage (Part C) from Original Medicare (Parts A & B), or vice versa, during the Medicare Annual Enrollment Period. If you want to make a switch though, it may also require some additional decisions.

What is the biggest difference between Medicare and Medicare Advantage?

With Original Medicare, you can go to any doctor or facility that accepts Medicare. Medicare Advantage plans have fixed networks of doctors and hospitals. Your plan will have rules about whether or not you can get care outside your network. But with any plan, you'll pay more for care you get outside your network.Oct 1, 2020

Is Medicare Advantage more expensive than Medicare?

Clearly, the average total premium for Medicare Advantage (including prescription coverage and Part B) is less than the average total premium for Original Medicare plus Medigap plus Part D, although this has to be considered in conjunction with the fact that an enrollee with Original Medicare + Medigap will generally ...Nov 13, 2021

How do you know if Medicare is primary or secondary?

Medicare pays first and your group health plan (retiree) coverage pays second . If the employer has 100 or more employees, then the large group health plan pays first, and Medicare pays second .

Is Medicare Part B primary or secondary?

Your group insurance plan is the secondary insurer, so you should enroll in Medicare Part B before your group plan will pay its portion of the claim.

How do you determine which insurance is primary and which is secondary?

The insurance that pays first is called the primary payer. The primary payer pays up to the limits of its coverage. The insurance that pays second is called the secondary payer. The secondary payer only pays if there are costs the primary insurer didn't cover.Dec 1, 2021

What is Medicare Advantage?

Medicare Advantage, also known as Medicare Part C, is simply an alternate way of getting your benefits under Original Medicare (Part A and Part B). There are many different Medicare Advantage benefits available depending on the plan you choose.

What is a personal emergency response system?

Personal emergency response system to notify emergency personnel in the event of fall or other medical event. Telemedicine or other remote health services, including a nursing hotline; in some cases, you may also qualify for remote monitoring devices.

Does Medicare cover chiropractic care?

In some cases , you may be able to enroll in a Medicare Advantage plan that covers alternative therapies such as chiropractic care and even acupuncture. In addition, your plan may include other comprehensive benefits such as:

Does Medicare Advantage cover prescription drugs?

Most Medicare Advantage plans include Part D prescription drug coverage, but be sure to read your plan documents to understand what medications are covered, if any, and your financial responsibility for covered medications, since this can vary greatly from plan to plan.

Does Medicare cover eye exams?

Original Medicare does not cover routine eye exams or prescription eye glasses except in certain limited situations. However, depending on where you live, you may have Medicare Advantage benefits for routine vision care, prescription eyewear, and contact lenses. Dental care.

How much does Medicare pay for outpatient care?

You pay 20% of the Medicare-approved amount for doctor or other health care provider services. You generally pay a copayment for each service you get in a hospital outpatient setting. In most cases, the copayment can’t be more than the Part A hospital stay deductible for each service you get. The Part B deductible applies, and you pay all costs for items or services that Medicare doesn’t cover.

What is the limiting charge for Medicare?

Although the Medicare-approved amount is lower for doctors who don’t accept assignment, they can charge you 15% over that Medicare-approved amount. This is called the “limiting charge.” The limiting charge applies only to certain services and doesn’t apply to some supplies and durable medical equipment (DME). When getting certain supplies and DME, Medicare will only pay for them from suppliers enrolled in Medicare, no matter who submits the claim (you or your supplier).

How to contact Medicare supplier?

You can also call 1-800-MEDICARE (1-800-633-4227) . TTY users can call 1-877-486-2048.

How long does Medicare cover knee replacement?

If you have knee replacement surgery, Medicare covers CPM devices for up to 21 days for use in your home.

Do you pay for chemotherapy in a hospital?

You pay a copayment for chemotherapy covered under Part B in a hospital outpatient setting. For chemotherapy given in a doctor’s oce or freestanding clinic, you pay 20% of the Medicare-approved amount, and the Part B deductible applies.

How much does Medicare pay for diagnostic tests?

You pay 20% of the Medicare-approved amount of covered diagnostic non-laboratory tests done in your doctor’s oce or in an independent testing facility, and the Part B deductible applies. You pay a copayment for diagnostic non-laboratory tests done in a hospital outpatient setting.

Does Medicare cover Part B deductible?

If you have supplemental insurance, or have both Medicare and Medicaid, it may help cover the monthly fee.