What are the asset limits for Nevada Medicaid in 2019?

Nevada Medicaid Asset Limits 2019. Individuals in Nevada are allowed to keep $2,000 when they apply to Medicaid for long term care. If they are over this amount, they must spend down on care.

What are the asset limits for the Medicare savings program?

Medicare Savings Program income and asset limits. Burial funds up to $1,500 per person Life insurance with a cash value of less than $1,500 Some states may exclude other types of assets as well. For states with MSP asset limits, these limits must be at least as high as the asset limit for Extra Help.

What is the income limit for nursing home insurance in Nevada?

In Nevada, the income limit for Medicaid nursing home coverage is $2,349 a month if single and $4,698 a month if married (and both spouses are applying). The income limit for HCBS in Nevada is $2,349 a month if single and $4,698 a month if married (and both spouses are applying).

Does Nevada have Medicaid or Medicare?

Nevada Medicaid Definition In Nevada, Medicaid is administered by the Nevada Department of Health and Human Services. Medicaid is a wide-ranging, jointly funded state and federal health care program for low-income individuals of all ages.

How much assets can you have on Medicare?

You may have up to $130,000 in assets as an individual, up to $195,000 in assets as a couple, and an additional $65,000 for each family member. As of July 1, 2022 the asset limit for some Medi-Cal programs will go up to $130,000 for an individual and $195,000 for a couple.

Is Medicare based on assets or income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What assets are exempt from Medicare?

Other exempt assets include pre-paid burial and funeral expenses, an automobile, term life insurance, life insurance policies with a combined cash value limited to $1,500, household furnishings / appliances, and personal items, such as clothing and engagement / wedding rings.

Is Medicare eligibility based on assets?

Older People with Low Incomes Generally Have Few Assets In determining eligibility for Medicaid and the Medicare Savings Programs, countable assets include items such as money in checking or savings ac- counts, bonds, stocks, or mutual funds.

What are asset limits?

Asset limits serve as a barrier to economic security and mobility by actively discouraging families from attempting to save and build the resources they need to get ahead. They can also prevent middle-income families from accessing needed assistance in the event of an unexpected economic shock.

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.

Can I qualify for Medi-Cal If I have money in the bank?

To qualify for Medi-Cal, the applicant must demonstrate that they have limited resources available. California law allows the applicant to have up to $2,000 in countable assets. hand, uncashed checks and anything you might have in your safe deposit box that you could cash in to pay for care.

What is an exempt asset?

Exempt assets include those properties that a debtor is allowed to keep with him/her irrespective of the bankruptcy proceeding. Such property is free from claims of a creditor, who do not have a lien on the property.

Does owning a house affect Medi-Cal?

First, if you own a home, you can still qualify for Medi-Cal. California has one of the best health services in this regard because California does not ask that you sell your home and pay for your medical needs, but rather it will front all the medical bills for you while you are alive.

What is a Medi-Cal asset test?

“asset test” is to limit access to Medicaid to only. those who do not have access to sufficient resources. to pay for their own medical care. The idea is that if. people have substantial assets, they could use these.

What is the highest income to qualify for Medicaid?

Federal Poverty Level thresholds to qualify for Medicaid The Federal Poverty Level is determined by the size of a family for the lower 48 states and the District of Columbia. For example, in 2022 it is $13,590 for a single adult person, $27,750 for a family of four and $46,630 for a family of eight.

Does 401k affect Medi-Cal eligibility?

While an IRA or 401(k) may not count as an asset, an applicant needs to be aware that a retirement plan in payout status may push them over Medicaid's income limit. As a general rule of thumb, in 2022, most states have an income limit of $2,523 / month for an applicant.

Does Nevada help with my Medicare premiums?

Many Medicare beneficiaries who struggle to afford the cost of Medicare coverage are eligible for help through a Medicare Savings Program (MSP). In...

Who's eligible for Medicaid for the aged, blind and disabled in Nevada?

Medicare covers a great number services – including hospitalization, physician services, and prescription drugs – but Original Medicare doesn’t cov...

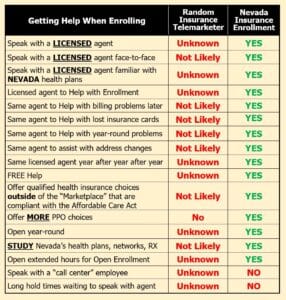

Where can Medicare beneficiaries get help in Nevada?

Nevada State Health and Insurance Assistance Program (SHIP) Free volunteer Medicare counseling is available by contacting the Nevada State Health a...

Where can I apply for Medicaid in Nevada?

The Medicaid program is administered by the Nevada Department of Welfare and Supportive Services (DWSS). Seniors and people with disabilities can a...

What is the income limit for Medicare in Nevada?

The income limit is $1,615 a month for individuals and $2,175 a month for married couples, and the asset limit is $14,610 ...

What is the maximum home equity for Medicaid in Nevada?

In 2020, states set this home equity level based on a federal minimum of $595,000 and maximum of $893,000. Nevada requires Medicaid LTSS applicants ...

How much equity do you need to have for Medicaid in Nevada?

Nevada requires applicants for Medicaid LTSS to have a home equity interest of $595,000 or less. Applicants for nursing home care or HCBS cannot transfer or give away assets for less than their value without incurring a penalty in Nevada.

How much does HCBS cost in Nevada?

The income limit for HCBS in Nevada is $2,349 a month if single and $4,698 a month if married (and both spouses are applying). Nevada does not have a Medicaid spend-down, but applicants with incomes too high for Medicaid nursing home care or HCBS can qualify for those services using a Miller Trust.

How to contact Medicare in Nevada?

Free volunteer Medicare counseling is available by contacting the Nevada State Health and Insurance Assistance Program (SHIP) at 1-800-307-4444. The SHIP can help beneficiaries enroll in Medicare, compare and change Medicare Advantage and Part D plans, and answer questions about state Medigap protections.

What is the income limit for HCBS?

Income limits: The income limit is $2,349 a month if single and $4,698 a month if married (and both spouses are applying). When only one spouse needs HCBS, the income limit for single applicants is used (and usually only the applicant’s income is counted).

Why do people give away assets to qualify for Medicaid?

Because long-term care is expensive, individuals often have an incentive to give away or transfer assets to qualify for Medicaid. To curb these asset transfers, federal law requires states to have a penalty period for Medicaid nursing home applicants who give away or transfer assets for less than their value.

What states do not have asset limits for MSPs?

* Alabama, Arizona, Connecticut, Delaware, Mississippi, New York, Oregon, Vermont, and the District of Columbia do not have asset limits for MSPs (as of January 2019).

What is extra help for Medicare?

Extra Help is the federal program that helps with Part D prescription drug costs if you meet the income and asset requirements. This change helps more people become eligible for MSPs and was a result of the Medicare Improvements for Patients and Providers Act (MIPPA). In 2021, the asset limits for full Extra Help are $9,470 for individuals ...

Why is the MSP limit lower than the extra help limit?

MSP limits appear lower than Extra Help limits because they do not automatically include burial funds. This means that the $1,500 disregard for MSP eligibility typically will not apply unless you prove that you have set aside these funds in a designated account or in a pre-paid burial fund.

How much can you keep on Medicaid in Nevada?

Nevada Medicaid Asset Limits 2019. Individuals in Nevada are allowed to keep $2,000 when they apply to Medicaid for long term care. If they are over this amount, they must spend down on care. It is important to note, that individuals are not allowed to give gifts of any amount for a period of 5 years (60 months) prior to applying to Medicaid.

How much does Medicaid pay for nursing homes in Nevada?

Medicaid pays for the cost of Nursing Home care in Nevada that meet certain financial and health criteria. The average cost of Skilled Nursing Care in Nevada is $95,268, so securing Medicaid coverage is essential. In Nevada there are 68 Nursing Homes, of which 87% accept Medicaid insurance as a form of payment.

What are countable assets?

Some examples of countable assets include savings accounts, bank accounts, retirement accounts and a second home. If you have multiple assets and are looking to access Medicaid, it may make sense to speak with a Medicaid Planner or Elder Law attorney in Nevada.

How much does a nursing home cost in Nevada?

The most expensive Nursing Home in Nevada is Marquis Plaza Regency Post Acute Rehab which costs $470 per day and the least expensive Nursing Home is Nevada State Veterans Home - Boulder City which costs $168 per day.

What is the penalty period for Medicaid in Nevada?

This penalty period in Nevada is called a look-back period and it can make an individual not eligible for Medicaid.

Does Medicaid match PQ?

As part of the Deficit Reduction Act (DRA) that was signed on February 8th, 2006, an individual may be eligible for a larger asset exclusion than the ones listed above. If the Long-term care policy purchased qualifies as a "Partnership Qualified" (PQ) policy, then Medicaid will match "dollar for dollar" in the form of exempt assets. This means that if a policy pays out $150,000, Medicaid will allow for an asset exclusion up to that amount. If you are moving states, aside from California, this policy

Can you get Medicaid if your home is not countable?

Despite the fact the home is not a countable asset, Medicaid, can look for repayment in probate court from the proceeds of a sale after it stops paying for care. It is important to understand if your home may be subject to the Medicaid repayment process.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

What is the income limit for QDWI?

You must meet the following income requirements to enroll in your state’s QDWI program: an individual monthly income of $4,339 or less. an individual resources limit of $4,000.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

What is Medicare Savings Program?

A Medicare Savings Program (MSP) can help pay deductibles, coinsurance, and other expenses that aren’t ordinarily covered by Medicare. We’re here to help you understand the different types of MSPs. Below, we explain who is eligible for these programs and how to get the assistance you need to pay for your Medicare.

Does Medicare savers have a penalty?

Also, those that qualify for a Medicare Savings Program may not be subject to a Part D or Part B penalty. Although, this depends on your level of extra help and the state you reside in. Call the number above today to get rate quotes for your area.

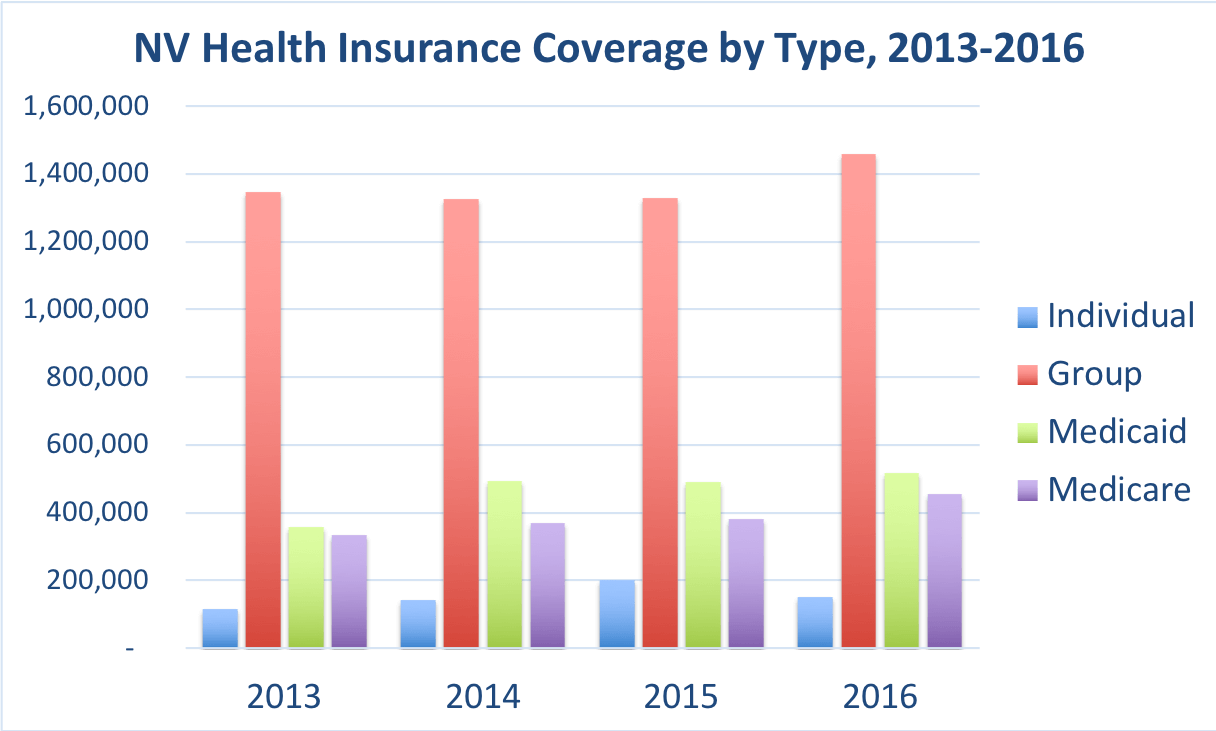

Medicaid Income Limits by State

See the Medicaid income limit for every state and learn more about qualifying for Medicaid health insurance where you live. While Medicaid is a federal program, eligibility requirements can be different in each state.

Learn More About Medicare

Join our email series to receive your free Medicare guide and the latest information about Medicare and Medicare Advantage.

What are the expenses that go away when you receive Medicaid at home?

When persons receive Medicaid services at home or “in the community” meaning not in a nursing home through a Medicaid waiver, they still have expenses that must be paid. Rent, mortgages, food and utilities are all expenses that go away when one is in a nursing home but persist when one receives Medicaid at home.

How long does it take to get a medicaid test?

A free, non-binding Medicaid eligibility test is available here. This test takes approximately 3 minutes to complete. Readers should be aware the maximum income limits change dependent on the marital status of the applicant, whether a spouse is also applying for Medicaid and the type of Medicaid for which they are applying.

Is income the only eligibility factor for Medicaid?

Medicaid Eligibility Income Chart by State – Updated Mar. 2021. The table below shows Medicaid’s monthly income limits by state for seniors. However, income is not the only eligibility factor for Medicaid long term care, there are asset limits and level of care requirements.

Healthcare

- There are several different Medicaid long-term care programs for which Nevada seniors may be eligible. These programs have slightly different financial and medical eligibility requirements, as well as varying benefits. Further complicating eligibility are the facts that the criteria vary with m…

Participants

- 2) Medicaid Waivers / Home and Community Based Services (HCBS) Waivers limit the number of participants. Therefore, wait lists may exist. Services are provided at home, adult day care, or in assisted living.

Types

- Countable (non-exempt) assets, also sometimes called liquid assets, include cash and most anything that can easily be converted to cash to be used to pay for the cost of long-term care. Other non-exempt assets include stocks, bonds, investments, credit union, savings, and checking accounts, and real estate in which one does not reside. However, for Medicaid eligibility purpose…

Qualification

- For Nevada elderly residents (65 and over) who do not meet the eligibility requirements in the table above, there are other ways to qualify for Medicaid.

Summary

- 1) Qualified Income Trusts (QITs) QITs, also referred to as Miller Trusts or Income Cap Trusts, are for Medicaid applicants who are over the income limit, but still cannot afford to pay for their long-term care. This type of trust offers a way for individuals over the Medicaid income limit to still qualify for long-term care Medicaid, as money deposited into a QIT does not count towards Med…

Issues

- Unfortunately, Income Cap Trusts are not helpful if one has assets over the Medicaid eligibility limit. Said another way, if one meets the income requirements for Medicaid eligibility, but not the asset requirement, the above option cannot assist one in reducing and meeting the asset limit. However, one can spend down assets by spending excess assets on non-countable assets, suc…

Programs

- 1) HCB Frail Elderly Waiver This home and community based waiver for frail seniors, abbreviated HCBW-FE, is a nursing home diversion program. Benefits to help promote independent living include adult day care, attendant care, housecleaning, preparation of meals, and respite care. 2) HCBW for Persons with Physical Disabilities (HCBW-PD) Also called the Physical Disability Waiv…