Disadvantages of Medicare Advantage Plans

- Your options may be limited. Depending on where you live, your Medicare Advantage plan options may be limited, or you...

- You can’t use Medigap with Medicare Advantage plans. If you have a Medigap policy to cover your Medicare deductibles or...

- If you have end-stage renal disease (ESRD), you don’t qualify. While people with...

What are the weaknesses of Medicare Advantage plans?

Oct 11, 2021 · Medicare Advantage is completely different. The people who have chosen to go into Medicare Advantage, Medicare no longer pays doctors on your behalf. Medicare no longer pays the hospitals on your behalf. Instead, Medicare pays an insurance company, a Medicare Advantage insurance company, Humana, Blue Cross.

Why Advantage plans are bad?

Jan 22, 2021 · Through a Medicare Advantage plan, premiums are lower, and sometimes free, and will also likely include benefits for vision and dental, something original Medicare doesn't …

How do I choose the best Medicare Advantage plan?

Some Medicare Advantage plans may offer fewer options when it comes to doctors and hospitals, as they may have smaller plan networks than Original Medicare. And if you sign up …

Why are Medicare Advantage plans are bad?

Dec 12, 2021 · The Top 7 Disadvantages of Medicare Advantage Plans Reason 1: Free Plans Are Not Really Free This is true. The real issue here is people’s misunderstanding of how Medicare …

Why do people dislike Medicare Advantage plans?

Are Medicare Advantage plans too good to be true?

Does getting a Medicare Advantage plan make you lose original Medicare?

Can I switch from a Medicare Advantage plan back to Original Medicare?

Who is the largest Medicare Advantage provider?

Who Has the Best Medicare Advantage plan for 2022?

What are 4 types of Medicare Advantage plans?

- Health Maintenance Organization (HMO) Plans.

- Preferred Provider Organization (PPO) Plans.

- Private Fee-for-Service (PFFS) Plans.

- Special Needs Plans (SNPs)

Why does zip code affect Medicare?

Can you switch from a Medicare Advantage plan to a supplement plan?

Can you be denied a Medicare supplement plan?

Does Medicare Advantage include prescription drug coverage?

What is the difference between Medicare Supplement and Medicare Advantage plans?

What are the problems with Medicare Advantage?

In 2012, Dr. Brent Schillinger, former president of the Palm Beach County Medical Society, pointed out a host of potential problems he encountered with Medicare Advantage Plans as a physician. Here's how he describes them: 1 Care can actually end up costing more, to the patient and the federal budget, than it would under original Medicare, particularly if one suffers from a very serious medical problem. 2 Some private plans are not financially stable and may suddenly cease coverage. This happened in Florida in 2014 when a popular MA plan called Physicians United Plan was declared insolvent, and doctors canceled appointments. 3 3 One may have difficulty getting emergency or urgent care due to rationing. 4 The plans only cover certain doctors, and often drop providers without cause, breaking the continuity of care. 5 Members have to follow plan rules to get covered care. 6 There are always restrictions when choosing doctors, hospitals, and other providers, which is another form of rationing that keeps profits up for the insurance company but limits patient choice. 7 It can be difficult to get care away from home. 8 The extra benefits offered can turn out to be less than promised. 9 Plans that include coverage for Part D prescription drug costs may ration certain high-cost medications. 4

Does Medicare automatically apply to Social Security?

It doesn't happen automatically. However, if you already get Social Security benefits, you'll get Medicare Part A and Part B automatically when you first become eligible (you don't need to sign up). 4. There are two main ways to get Medicare coverage: Original Medicare. A Medicare Advantage Plan.

What is Medicare Supplement?

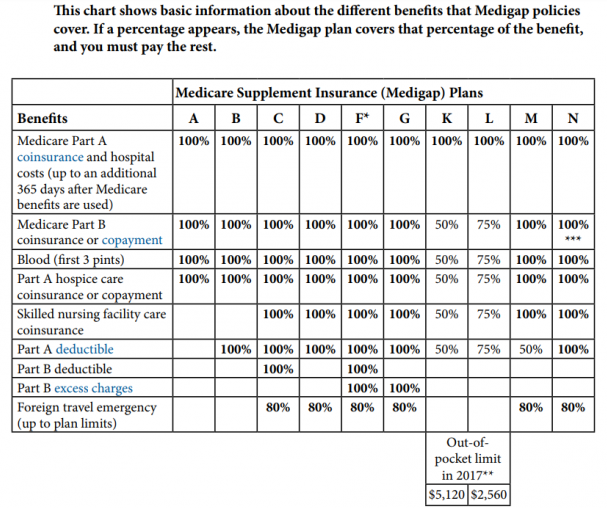

Original Medicare includes Part A (hospital insurance) and Part B (medical insurance). To help pay for things that aren't covered by Medicare, you can opt to buy supplemental insurance known as Medigap (or Medicare Supplement Insurance). These policies are offered by private insurers and cover things that Medicare doesn't, such as copayments, deductibles, and healthcare when you travel abroad.

What is Medicare Advantage Plan?

A Medicare Advantage Plan is intended to be an all-in-one alternative to Original Medicare. These plans are offered by private insurance companies that contract with Medicare to provide Part A and Part B benefits, and sometimes Part D (prescriptions). Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, ...

Does Medicare cover dental?

Most plans cover benefits that Original Medicare doesn't offer, such as vision, hearing, and dental. You have to sign up for Medicare Part A and Part B before you can enroll in Medicare ...

Does Medicare Advantage cover dental?

Through a Medicare Advantage plan, premiums are lower, and sometimes free, and will also likely include benefits for vision and dental, something original Medicare doesn't offer. "In America nothing is free, you pay now or pay later," Goldberg said. "It's wonderful until there is a large bill.".

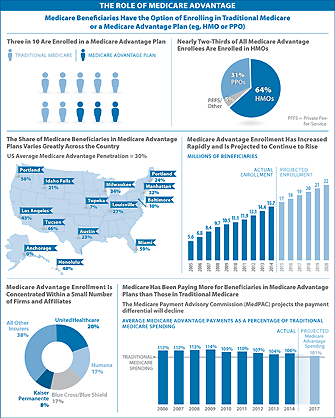

Which insurance company has the largest Medicare Advantage enrollment?

UnitedHealthcare, the nation's largest insurer, is among those payers which have the largest Medicare Advantage enrollment. Steve Warner, senior vice president of Medicare Advantage for UnitedHealthcare Medicare and Retirement, was asked to comment about Goldberg's claims that MA will be more costly for most seniors in the long run.

Is CDPHP a non profit?

For example, CDPHP, a regional, not-for-profit health plan in upstate New York, is working with Mom's Meals to offer home-delivered, fully-prepared meals at no cost to Medicare Advantage members returning home from the hospital. Premiums declined for 2021 offerings, adding to the growing popularity of MA plans.

What Does a Medicare Advantage Plan Cover?

Medicare Advantage plans are sold by private insurance companies and are required by law to provide all of the same coverage included in Original Medicare ( Medicare Part A and Medicare Part B ).

Is a Medicare Advantage Plan Worth It?

A Medicare Advantage plan may be worth it to some beneficiaries and perhaps not worth it to others. A Medicare Advantage plan may be worth it if:

How Do You Choose a Medicare Advantage Plan?

One way to shop for a Medicare Advantage plan is to work with a licensed insurance agent. This is also a great way to learn more about the advantages and disadvantages of these plans and determine if one may be worth it for you. You can also compare plans online for free to get a better idea of the advantages and disadvantages of each plan.

Is Medicare Advantage a good plan?

Medicare Advantage plans are most beneficial if you are healthy and/or receive assistance paying shared costs. Where available, Medicare Advantage Special Needs Plans are affordable for those who qualify for both Medicare and Medicaid.

What is Medicare Advantage?

Medicare Advantage (MA), also known as Medicare Part C, are health plans from private insurance companies that are available to people eligible for Original Medicare ( Medicare Part A and Medicare Part B).... bad?

What is Medicare Part B rebate?

ALSO: Some zero-dollar premium Advantage health plans can rebate all or a portion of your Medicare Part B. Medicare Part B is medical coverage for people with Original Medicare. It covers doctor visits, specialists, lab tests and diagnostics, and durable medical equipment. Part A is for hospital inpatient care....

What is Medicare premium?

A premium is an amount that an insurance policyholder must pay for coverage. Premiums are typically paid on a monthly basis. In the federal Medicare program, there are four different types of premiums. ... , but pay virtually nothing when you use healthcare services once the annual Part B premium is paid.

Do all Medicare Advantage plans require prior authorization?

According to the Kaiser Family Foundation, nearly all Medicare Advantage plan enrollees are in plans that require prior authorization for some services. Health plans are in the business of making money and this is one of the primary ways they have to control costs.

What is the CMS?

This is true. Under the rules set out by the Centers for Medicare and Medicaid Services. The Centers for Medicare & Medicaid Services (CMS) is the U.S. Federal agency that runs the Medicare, Medicaid, and Children’s Health Insurance Programs.... (CMS), insurers may change the benefits and costs in their plans.

What is CMS in health insurance?

The Centers for Medicare & Medicaid Services ( CMS) is the U.S. Federal agency that runs the Medicare, Medicaid, and Children’s Health Insurance Programs.... (CMS), insurers may change the benefits and costs in their plans. They are also allowed to change their provider networks.

What are the benefits of Medicare Advantage?

Benefits of Medicare Advantage Plans 1 You may get extra coverage. Medicare Advantage plans typically include coverage that Original Medicare doesn’t. Your plan may include additional benefits like dental, vision, hearing, and prescription drug coverage. 2 Health equipment may be covered. Your plan may also offer discounts or coverage for health and fitness equipment and services, such as gym memberships, meal subscriptions, and telehealth access. 3 You may pay less out of pocket. Your out-of-pocket costs — how much you pay on your own for health and prescription expenses because they aren’t covered by health insurance — may be less with a Medicare Advantage plan, helping you save money. 4 You have simplified care. If you have Original Medicare, you may have to add on Medigap coverage and Medicare Part D coverage to pay for all your health expenses. With a Medicare Advantage plan, you’ll have just one insurer for all of your health coverage instead of several, streamlining your healthcare. 5 Your care can be coordinated. With a Medicare Advantage plan, you can have coordinated care. With in-network providers, all your healthcare providers can work together and collaborate on your care, minimizing unnecessary tests and lab work.

Is Medicare Advantage for everyone?

Medicare Advantage plans are popular, but they’re not for everyone. Everyday Health. If you’re approaching 65, qualifying for Medicare can give you much-needed coverage for your healthcare needs. But dealing with the different aspects of Medicare — including Medicare Part A, Part B, stand-alone prescription drug coverage, ...

How does Medicare pay for a plan?

Medicare pays a set amount toward your Medicare Advantage plan each month. But you may have to pay a fee for your plan, depending on the options you choose. There are typically four types to choose from: 1 Health maintenance organization (HMO) When you’re in an HMO plan, you usually have to stay in network, meaning you can only go to doctors and healthcare providers who have agreements with your insurance company. The only exceptions are if you’re facing a serious emergency, need out-of-area urgent care, or out-of-area dialysis. If you need to see a specialist, you’ll need to get a referral for one from your primary care doctor. 2 Preferred provider organization (PPO) With a PPO, you pay less if you see doctors and healthcare providers that are within your network. You can opt to see doctors outside of your network, but insurance will cover less of the cost. In most cases, you don’t need a referral before you see a specialist. 3 Private fee-for-service (PFFS) Under a PFFS, you can go to a healthcare provider who has agreed to accept the plan’s payment terms and treat you. Some PFFS plans have in-network providers, but you can also choose to see out-of-network providers. 4 Special needs plans (SNPs) SNPs are plans for people with specific diseases or characteristics. You can usually get care only from healthcare providers within the plan network, except for emergency situations.

What are the benefits of a health insurance plan?

Your plan may include additional benefits like dental, vision, hearing, and prescription drug coverage. Health equipment may be covered. Your plan may also offer discounts or coverage for health and fitness equipment and services, such as gym memberships, meal subscriptions, and telehealth access.

Can you get Medicare if you have end stage renal disease?

If you have end-stage renal disease (ESRD), you don’t qualify. While people with preexisting conditions can qualify for Medicare Advantage plans, that’s not the case if you have ESRD. If you have ESRD, you have to enroll in Original Medicare. You may not be able to see a provider of your choice.

Does Medicare Advantage cover prescriptions?

Many Medicare Advantage plans also include prescription drug coverage, as well, so you can use your policy to get access to branded and generic medications. Medicare pays a set amount toward your Medicare Advantage plan each month. But you may have to pay a fee for your plan, depending on the options you choose.

Can you cancel a Medigap plan?

You’ll have to cancel your Medigap policy, or return to Original Medicare. If you have end-stage renal disease (ESRD), you don’t qualify. While people with preexisting conditions can qualify for Medicare Advantage plans, that’s not the case if you have ESRD. If you have ESRD, you have to enroll in Original Medicare.