Here are just a few popular services that are considered allowable expenses as a Medicare enrollee:

- Acupuncture

- Ambulance services

- Annual physical exam

- Artificial teeth

- Chiropractic services

- Contact lenses

- Dental services

- Eye exams & eyeglasses

- Guide dogs and other service animals

- Hearing aids

- Home care & nursing services

- Laboratory fees

- Long-term care

- Oxygen

- Therapy

- Vasectomy

- Weight-loss programs

- Wheelchairs

- X-ray services

Part A helps cover your inpatient care in hospitals. Part A also includes coverage in critical access hospitals and skilled nursing facilities (not custodial or long-term care). It also covers hospice care and home health care.

What qualifies as an eligible medical expense?

- “Morning-after” contraceptive pills

- Face masks (which include multiple layers of non-woven material and nose wire; examples include N95, KN95 and disposable face masks)

- Massage therapy

- Mastectomy-related special bras

- Mattresses

- Maxi pads

- Meals at a hospital or similar institution

- Medical abortion

- Medical alert bracelet or necklace

Which expenses are eligible?

- Room and board

- Insurance

- Medical expenses (including student health fees)

- Transportation

- Similar personal, living or family expenses

What medical expenses are tax deductible?

“I had not previously studied the federal tax treatment of marijuana, and I speculated that marijuana might ‘potentially’ be deductible as a medical expense in certain circumstances. After the program, I checked the law. To clarify, medical marijuana ...

What are my eligible expenses?

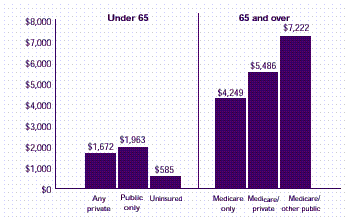

If you’re 65 or over or eligible for Medicare due to disability, developing a detailed list of what you have spent on your health care this past year — including hospital expenses and prescriptions — and what you need to have in your health plan next ...

What will Medicare not pay for?

In general, Original Medicare does not cover: Long-term care (such as extended nursing home stays or custodial care) Hearing aids. Most vision care, notably eyeglasses and contacts. Most dental care, notably dentures.

What expenses will Medicare Part B pay for?

Part B covers things like:Clinical research.Ambulance services.Durable medical equipment (DME)Mental health. Inpatient. Outpatient. Partial hospitalization.Limited outpatient prescription drugs.

What are qualifying medical expenses?

Qualified Medical Expenses are generally the same types of services and products that otherwise could be deducted as medical expenses on your yearly income tax return. Some Qualified Medical Expenses, like doctors' visits, lab tests, and hospital stays, are also Medicare-covered services.

What are the eligible expense categories for MSA?

You can use the money in your MSA account for non-medical expenses, such as groceries, rent, or utility bills. However, the amount you spend for non-medical purposes will not count toward your deductible and will be considered taxable income.

Does Medicare pay 100 of hospital bills?

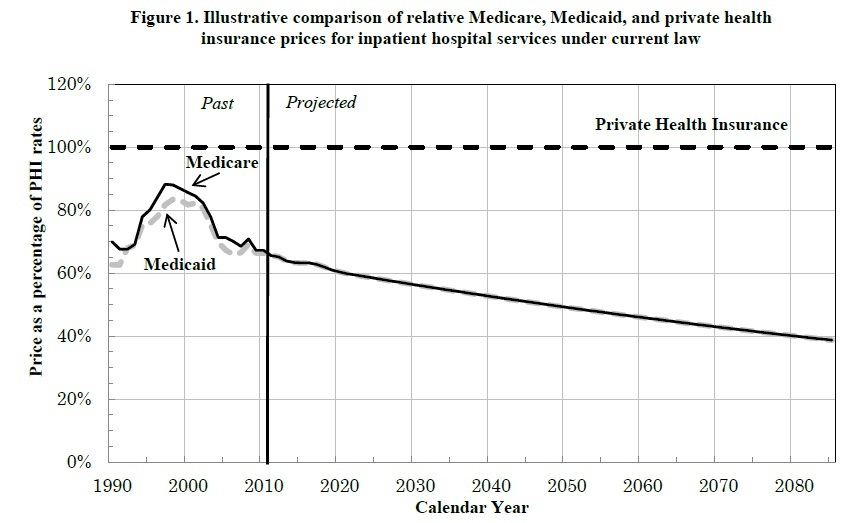

According to the Centers for Medicare and Medicaid Services (CMS), more than 60 million people are covered by Medicare. Although Medicare covers most medically necessary inpatient and outpatient health expenses, Medicare reimbursement sometimes does not pay 100% of your medical costs.

Does Medicare cover eye exams?

Medicare doesn't cover eye exams (sometimes called “eye refractions”) for eyeglasses or contact lenses. You pay 100% for eye exams for eyeglasses or contact lenses.

Are vitamins a qualified medical expense?

Per IRS: "You can't include in medical expenses the cost of nutritional supplements, vitamins, herbal supplements, “natural medicines,” etc. unless they are recommended by a medical practitioner as treatment for a specific medical condition diagnosed by a physician.

What medical expenses are deductible 2021?

7.5%You may deduct only the amount of your total medical expenses that exceed 7.5% of your adjusted gross income. You figure the amount you're allowed to deduct on Schedule A (Form 1040).

Are eyeglasses tax deductible in 2021?

You may be surprised to learn that the money you spend on reading or prescription eyeglasses are tax deductible. That's because glasses count as a “medical expense,” which can be claimed as an itemized deductible on form 104, Schedule A.

Is toothpaste FSA eligible?

Toothpaste: FSA Eligibility. Toothpaste is not eligible for reimbursement with a flexible spending account (FSA), health savings account (HSA), health reimbursement arrangement (HRA), limited-purpose flexible spending account (LPFSA) or a dependent care flexible spending account (DCFSA).

How do I know if I have a HSA or MSA?

Medicare savings accounts (MSAs) and health savings accounts (HSAs) both give consumers tax-advantaged ways to fund the costs of healthcare. MSAs are only for people enrolled in high-deductible Medicare plans. HSAs are restricted to people in high-deductible private insurance plans.

Can MSA be used for dental?

You can continue to use the carryover funds in the Limited-use MSA for dental and vision expenses incurred in 2020.

Examples of Medicare eligible expenses in a sentence

If you are enrolled in Medicare, Medicare will pay for Medicare eligible expenses, if any, not paid by the plan.If both you and your spouse are over age 65, you may elect to enroll in Original Medicare or a Medicare Advantage plan and/or a Medicare Part D prescription drug plan and disenroll completely from the plan.

More Definitions of Medicare eligible expenses

Medicare eligible expenses means expenses for health care of the kind covered by Medicare, to the extent recognized as reasonable by Medicare.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

How much is coinsurance for 61-90?

Days 61-90: $371 coinsurance per day of each benefit period. Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime) Beyond lifetime reserve days: all costs. Part B premium.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

Do you pay more for outpatient services in a hospital?

For services that can also be provided in a doctor’s office, you may pay more for outpatient services you get in a hospital than you’ll pay for the same care in a doctor’s office . However, the hospital outpatient Copayment for the service is capped at the inpatient deductible amount.

Does Medicare cover room and board?

Medicare doesn't cover room and board when you get hospice care in your home or another facility where you live (like a nursing home). $1,484 Deductible for each Benefit period . Days 1–60: $0 Coinsurance for each benefit period. Days 61–90: $371 coinsurance per day of each benefit period.

What does Medicare Part B cover?

Part B also covers durable medical equipment, home health care, and some preventive services.

Does Medicare cover tests?

Medicare coverage for many tests, items, and services depends on where you live . This list includes tests, items, and services (covered and non-covered) if coverage is the same no matter where you live.

Get help paying costs

Learn about programs that may help you save money on medical and drug costs.

Part A costs

Learn about Medicare Part A (hospital insurance) monthly premium and Part A late enrollment penalty.

Part B costs

How much Medicare Part B (medical insurance) costs, including Income Related Monthly Adjustment Amount (IRMAA) and late enrollment penalty.

Costs for Medicare health plans

Learn about what factors contribute to how much you pay out-of-pocket when you have a Medicare Advantage Plan (Part C).

Compare procedure costs

Compare national average prices for procedures done in both ambulatory surgical centers and hospital outpatient departments.

Ways to pay Part A & Part B premiums

Learn more about how you can pay for your Medicare Part A and/or Medicare Part B premiums. Find out what to do if your payment is late.

Costs at a glance

Medicare Part A, Part B, Part C, and Part D costs for monthly premiums, deductibles, penalties, copayments, and coinsurance.

What Medicare tax deductions can you take each year?

Medicare costs can be more than what you’ve budgeted for every month. Fortunately, you may be eligible to claim your Medicare expenses as deductions. These deductions give you a tax break, allowing you to lower your tax liability for the year.

How do income limits work for Medicare tax deductions?

The IRS establishes guidelines to determine if you are eligible to deduct your Medicare expenses. First, your qualified medical expenses must exceed 7.5% of your adjusted gross income (AGI). Tally up the costs of all unreimbursed Medicare and other health or dental expenses to determine if you’ve spent enough money to qualify for the deduction.

What expenses are not eligible for a Medicare tax deduction?

The IRS provides an exhaustive list of medical expenses that are considered tax deductible. However, you should be aware of costs that don't fit the bill. For example, Medicare expenses that are reimbursable are not eligible for a tax deduction.

Does having supplemental insurance affect which Medicare tax deductions you can make?

Medicare supplemental insurance — also known as Medigap — comes in handy when you have high out-of-pocket costs. This extra coverage can fill in the gaps of deductibles, coinsurance, and copays left by original Medicare (Parts A and B).

The bottom line

Deducting Medicare expenses on your tax return can help you save money. Make sure you keep track of your expenses and maintain your receipts throughout the year. This will help you determine if it makes sense to itemize deductions or take the standard deduction.

What are some expenses that do not count toward your deductible?

Expenses that do not count toward your deductible: Services that are not covered by Medicare Parts A or B, including dental care, vision care, and your Part D or other prescription drug coverage cost-sharing (premiums, deductibles, copayments, coinsurance ).

Can you use MSA money for medical expenses?

Register. It is generally a good idea to use the money in your Medical Savings Account (MSA) to pay for qualified medical expenses. This is because money you spend on qualified medical expenses will not be subject to income tax. If you use money from your MSA for anything else, you must pay income tax on that amount.

Is MSA tax deductible?

While all qualified medical expenses are tax-exempt, not all count toward your deductible. Keep in mind that you may have to pay more out of pocket before your plan provides coverage if you use your MSA for expenses that do not count toward your deductible.

What are qualified medical expenses?

Qualified Medical Expenses are generally the same types of services and products that otherwise could be deducted as medical expenses on your yearly income tax return. Some Qualified Medical Expenses, like doctors' visits, lab tests, and hospital stays, are also Medicare-covered services. Services like dental and vision care are Qualified Medical ...

Does Medicare MSA count towards deductible?

Qualified Medical Expenses could count toward your Medicare MSA Plan deductible only if the expenses are for Medicare-covered Part A and Part B services. Each year, you should get a 1099-SA form from your bank that includes all of the withdrawals from your account.

What is an Allowable Expense?

An allowable expense under the Provider Relief Fund (PRF) must be used to prevent, prepare for, and respond to coronavirus. PRF recipients must follow their basis of accounting (e.g., cash, accrual, or modified accrual) to determine expenses.

Use of Funds Guidance

The June 11 Notice of Reporting Requirements (PDF - 232 KB) states that PRF payments can be used by any provider of health care, services, and support in a medical setting, at home, or in the community towards health care-related expenses attributable to coronavirus that another source has not reimbursed and is not obligated to reimburse, which may include General and Administrative (G&A) or health care-related operating expenses.

Examples of Allowable Expenses for Provider Relief Fund Payments

This list is intended to clarify the intent and provide examples of allowable expenses for the use of PRF General and Targeted Distribution payments. This is not an exhaustive list of allowable expenses, but will help to inform and support providers as they categorize expenses for reporting on use of funds.