Wages paid for certain types of services are exempt from Social Security/Medicare taxes. Examples of exempt services include: Compensation paid to a duly ordained, commissioned, or licensed minister of a church in the exercise of his ministry.

What wages are subject to Medicare tax?

What wages are taxable for Medicare?

- Medicare is funded by a payroll tax of 1.45% on the first $200,000 of an employee’s wages.

- Employers also pay 1.45%.

- The Medicare tax for self-employed individuals is 2.9% to cover both the employee’s and employer’s portions.

Are all wages subject to Medicare tax?

There's no wage base limit for Medicare tax. All covered wages are subject to Medicare tax.

Does everyone pay FICA?

Who pays FICA taxes? Pretty much everyone pays FICA taxes. Individuals are responsible for paying it whether they’re full time or part time, salaried or hourly, a resident or nonresident. Yet, there are a few exceptions you should be aware of. Groups that don’t have to contribute FICA taxes include:

What deductions are exempt from Medicare?

Pretax deductions are often not subject to Social Security and Medicare taxes, which are governed by the Federal Insurance Contributions Act, or FICA. Qualified benefits offered under a cafeteria or Section 125 plan are exempt from FICA.

What income is exempt from Medicare?

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000.

What wages are considered Medicare wages?

It is calculated the same way as Social Security taxable wages, except there is no wage limit. Medicare taxable wage refers to the employee wages on which Medicare tax is paid. It is calculated as the employee's gross earnings less the non-taxable items, without any maximum on gross wages.

Are any wages not subject to Medicare tax?

There is no wage base limit for Medicare tax. All your covered wages for the year are subject to Medicare tax. Only the Social Security tax has a wage base limit — $147,000 for 2022.

How do you calculate Medicare taxable wages?

These wages are taxed at 1.45% and there is no limit on the taxable amount of wages. The amount of taxable Medicare wages is determined by subtracting the following from the year-to-date (YTD) gross wages on your last pay statement. Health – subtract the YTD employee health insurance deduction.

What are Medicare wages on W-2?

What Are Medicare Wages and Tips on a W-2? The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding. The number included in this box will usually be identical to the “wages, tips, other compensation” section on the W-2 form.

Who is exempt from Social Security and Medicare withholding?

The Code grants an exemption from Social Security and Medicare taxes to nonimmigrant scholars, teachers, researchers, and trainees (including medical interns), physicians, au pairs, summer camp workers, and other non-students temporarily present in the United States in J-1, Q-1 or Q-2 status.

What is included in Medicare wages and Tips?

Medicare wages and tips: The total wages, tips and other compensation that are subject to Medicare taxes. There is no limit on the amount of wages that are subject to Medicare taxes. Medicare tax withheld: The amount of Medicare tax withheld from your Medicare taxable wages, tips and other compensation.

Is 401k included in Medicare wages?

Contributions to a 401k are subject to social security and medicare tax, but not to ordinary income tax.

Why are my Medicare wages higher than my regular wages?

Medicare wages include any deferred compensation, retirement contributions, or other fringe benefits that are normally excluded from the regular income tax. In other words, the amount in Box 5 typically represents your entire compensation from your job.

What is the difference between Medicare wages and Social Security wages?

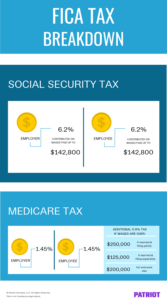

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

What are considered taxable wages?

Taxable wages are employee earnings that are subject to taxation. Types of compensation that are subject to taxation include salaries or hourly wages, tips, bonuses, commissions, and accrued time off payouts.

Is Medicare calculated on gross income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Topic Number: 751 - Social Security and Medicare Withholding Rates

Taxes under the Federal Insurance Contributions Act (FICA) are composed of the old-age, survivors, and disability insurance taxes, also known as so...

Social Security and Medicare Withholding Rates

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45%...

Additional Medicare Tax Withholding Rate

Additional Medicare Tax applies to an individual's Medicare wages that exceed a threshold amount based on the taxpayer's filing status. Employers a...

What is the tax rate for Social Security?

The current tax rate for social security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total. Refer to Publication 15, (Circular E), Employer's Tax Guide for more information; or Publication 51, (Circular A), Agricultural Employer’s Tax Guide for agricultural employers. Refer to Notice 2020-65 PDF and Notice 2021-11 PDF for information allowing employers to defer withholding and payment of the employee's share of Social Security taxes of certain employees.

What is the wage base limit for 2021?

The wage base limit is the maximum wage that's subject to the tax for that year. For earnings in 2021, this base is $142,800. Refer to "What's New" in Publication 15 for the current wage limit for social security wages; or Publication 51 for agricultural employers. There's no wage base limit for Medicare tax.

What is Medicare tax?

Medicare taxes go toward the Medicare program—a federal health insurance program for Americans who are older than 65 or have certain disabilities and diseases. The funds taken from Medicare taxes cover three areas.

How much do employers have to match for Medicare?

An employer is also required to match 1.45% of an employee’s withholding for Medicare wages and tips. For example, if an employee makes $2,000 during their pay period, that employee would have $29 withheld from their paycheck, and their employer would match that contribution with an additional $29 paid toward Medicare.

What is Medicare tips on W-2?

What Are Medicare Wages and Tips on a W-2? The Medicare wages and tips section on a W-2 form states the amount of your earnings that are subject to Medicare tax withholding.

What is the Medicare tax rate for 2020?

If you are self-employed, the 2020 Medicare tax rate is 2.9% on the first $137,700 of your yearly earnings.

Is Medicare taxed on wages?

Almost all wages earned by an employee in the United States are subject to the Medicare tax. How much an individual is taxed will depend on their yearly earnings. However, certain pretax deductions are exempt from the FICA tax, which includes Social Security and Medicare taxes.

What is Medicare tax?

The Medicare Program. The Medicare tax deducted from employee wages goes towards the Medicare program provided to Americans over 65 years of age. A line item in an employee pay stub, Medicare tax is implemented under FICA (Federal Insurance Contributions Act) and calculated on the employee’s Medicare taxable wage.

What is the Medicare tax rate on W-2?

Employers are required to withhold Medicare tax on employees’ Medicare wages. This is a flat rate of 1.45%, with employers contributing a matching amount. Medicare tax is reported in Box 5 of the W-2 ...

When was Medicare enacted?

In 1965 , Medicare was enacted into law, with Medicare coverage intending to be an important source of post-retirement health care. Medicare is divided into four parts: Part A, Hospital Insurance: This helps pay for hospice care, in-patient hospital care, and nursing care.

What are the gross earnings?

Gross earnings are made up of the following: Regular earnings . Overtime earnings. Paid time-off earnings. Payouts of time-off earnings (Sick, holiday, and vacation payouts) Non-work time for paid administrative leave, military leave, bereavement, and jury duty. Bonus pay.

What is Medicare tax?

Medicare tax by definition goes to fund the federal insurance program for elderly and disabled people. It's deducted from your paychecks along with Social Security tax, which pays for that federal program, as well as ordinary federal and state income tax.

How much is pretax for Medicare?

Also, amounts you receive for educational assistance under your employer’s program earn you a pretax deduction; up to $5,250 annually is exempt from Medicare tax. If a pretax deduction is excluded from Medicare tax, subtract it from your gross wages before subtracting the tax. For example, if you earn $2,000 semi-monthly ...

What is the Social Security tax rate?

The Social Security tax rate is 6.2 percent payable by the employee and 6.2 percent payable by the employer. Self-employed people must pay what is called self-employment tax, which includes the employee and employer portions of Social Security and Medicare taxes, so they pay a 15.3 percent tax rate.

Where is Medicare tax withheld on W-2?

Your employer puts your annual Medicare wages in Box 5 of your W-2 and Medicare tax withheld for the year in Box 6. The amount shown in Box 5 does not include pretax deductions which are exempt from Medicare tax. Your last pay stub for the year may show a different year-to-date amount for Medicare wages than your W-2.

What is a pretax benefit?

Pretax benefits include those offered under a cafeteria – or Section 125 – plan, such as medical, dental, vision, life, accident and disability insurance; and flexible spending accounts such as dependent care, and health savings and adoption assistance reimbursement accounts.

Is Medicare tax exempt from Social Security?

Pretax deductions that are excluded from Medicare tax are typically exempt from Social Security tax as well. Your Medicare wages are usually the same as your Social Security wages except that Social Security tax has an annual wage limit and Medicare tax has none. If you have multiple jobs that collectively put you over the wage limit, you may get a refund for over-withheld Social Security tax

Is transportation expense pretax?

Also, qualified retirement contributions, transportation expenses and educational assistance may be pretax deductions. Most of these benefits are exempt from Medicare tax, except for adoption assistance, retirement contributions, and life insurance premiums on coverage that exceeds $50,000. Also, amounts you receive for educational assistance ...

How much Medicare tax is paid if there is no pretax deduction?

If the employee has no pretax deductions, her entire gross pay is also her Medicare wages. Calculate Medicare tax at 1.45 percent of the employee’s Medicare wages to arrive at the amount of tax to withhold. Notably, the employer pays an equal portion of Medicare tax.

How to determine Medicare tax amount?

To determine the amount of Medicare tax an employee should pay, you must first figure the wages. Determine whether the employee has voluntary pretax deductions. These are deductions the employer offers and the employee accepts.

What is pretax deduction?

Pretax deductions are those that meet the requirements of IRS Section 125 code, such as a traditional 401k plan, a Section 125 medical or dental plan or a flexible spending account. Subtract applicable pretax deductions from the employee’s gross pay – earnings before deductions – to arrive at Medicare wages.

Is Medicare based on wages?

Unlike federal income tax, which depends on varying factors such as the employee’s filing status and allowances, Medicare tax is based on a flat percentage of wages. Furthermore, unlike Social Security tax, which has an annual wage limit, Medicare has none.

Can an employer withhold Medicare from employee wages?

An employer is legally required to withhold Medicare tax from employee wages. The employee is exempt from withholding only if an exception applies, such as if she works for a university at which she is also a student.

What is Medicare Part B?

Medicare Part B. This is medical insurance and covers visits to doctors and specialists, as well as ambulance rides, vaccines, medical supplies, and other necessities.

How many types of Medicare savings programs are there?

Medicare savings programs. There are four types of Medicare savings programs, which are discussed in more detail in the following sections. As of November 9, 2020, Medicare has not announced the new income and resource thresholds to qualify for the following Medicare savings programs.

What is the Medicare Part D premium for 2021?

Part D plans have their own separate premiums. The national base beneficiary premium amount for Medicare Part D in 2021 is $33.06, but costs vary. Your Part D Premium will depend on the plan you choose.

How much is Medicare Part B 2021?

For Part B coverage, you’ll pay a premium each year. Most people will pay the standard premium amount. In 2021, the standard premium is $148.50. However, if you make more than the preset income limits, you’ll pay more for your premium.

How does Social Security determine IRMAA?

The Social Security Administration (SSA) determines your IRMAA based on the gross income on your tax return. Medicare uses your tax return from 2 years ago. For example, when you apply for Medicare coverage for 2021, the IRS will provide Medicare with your income from your 2019 tax return. You may pay more depending on your income.

How much do you need to make to qualify for SLMB?

If you make less than $1,296 a month and have less than $7,860 in resources, you can qualify for SLMB. Married couples need to make less than $1,744 and have less than $11,800 in resources to qualify. This program covers your Part B premiums.

Does Medicare change if you make a higher income?

If you make a higher income, you’ll pay more for your premiums, even though your Medicare benefits won’t change.

What is FICA payroll?

FICA stands for Federal Insurance Contributions Act. FICA consists of two separate payroll taxes: Social Security (6.2% of pay) and Medicare (1.45% of pay), for a total of 7.65%. This is paid equally by workers and their employers, for a total of 15.3% of pay (7.65% x 2). In the case of self-employed workers and independent contractors, ...

Do self employed workers pay FICA taxes?

Almost all employed and self-employed workers are covered by Social Security and are expected to pay FICA tax or self-employment taxes. The major exceptions are most civilian ...