| Beneficiaries who file individual tax re ... | Beneficiaries who file joint tax returns ... | IRMAA Levels | IRMAA Levels |

| Beneficiaries who file individual tax re ... | Beneficiaries who file joint tax returns ... | 2018 | 2017 to 2011 |

| Less than or equal to $85,000 | Less than or equal to $170,000 | Level 1 | Level 1 |

| Greater than $85,000 and less than or eq ... | Greater than $170,000 and less than or e ... | Level 2 | Level 2 |

| Greater than $107,000 and less than or e ... | Greater than $214,000 and less than or e ... | Level 3 | Level 3 |

What is an irmaa in Medicare?

Medicare IRMAA: What Is It and When Does It Apply? What Is an IRMAA in Medicare? What is it? An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income.

What are the new Magi thresholds for irmaa for 2018?

New MAGI Thresholds For IRMAA Medicare Premium Surcharges In 2018. These amounts are in addition to the baseline Medicare Part B premium itself – $134/month in 2018 – plus the cost of the household’s chosen Medicare Part D premium (if applicable).

What is the irmaa surcharge on Medicare Part B and Part D?

For instance, a married couple that had higher income in 2016 and 2017, due to a series of substantial Roth conversions in retirement that put their household income (MAGI) over $170,000, would be subject to IRMAA surcharges on their Medicare Part B and Part D premiums in 2018 (and 2019).

Will the Medicare irmaa thresholds ever change?

Although the Medicare IRMAA thresholds have only been in place for barely a decade now, they have already experienced several changes – from the additional of the IRMAA premium charges to Medicare Part D in 2011, and the freezing of the MAGI threshold inflation adjustments. And under Section 402 of the Medicare Access And CHIP Reauthorization Ac...

What are the Irmaa brackets for 2018?

New 2018 Medicare SurchargesIRMAA TierIndividual MAGI (2017)Individual MAGI (2018)Tier 1Up to $107,000Up to $107,000Tier 2Up to $160,000Up to $133,500Tier 3Up to $214,000Up to $160,000Tier 4> $214,000> $160,0001 more row

What are the Irmaa brackets for Medicare?

C. IRMAA tables of Medicare Part B premium year for three previous yearsIRMAA Table2019More than $160,000 but less than $500,000 More than $500,000$433.40 $460.50Married filing jointlyMore than $170,000 but less than or equal to $214,000$189.60More than $214,000 but less than or equal to $267,000$270.909 more rows•Dec 6, 2021

What is the maximum Medicare premium for 2018?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018....What You'll Pay for Medicare in 2018.Income (adjusted gross income plus tax-exempt interest income):$133,501 to $160,000$267,001 to $320,000$348.305 more rows

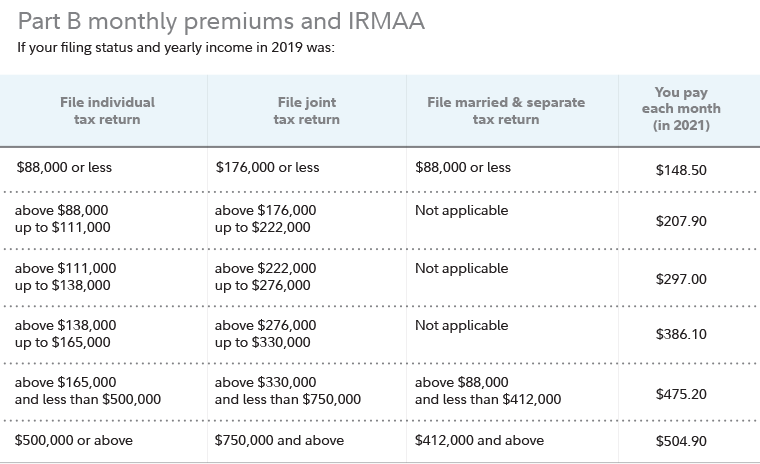

What are the maximum dollar amounts to avoid the Irmaa in 2021?

The IRMAA rises as adjusted gross income increases. The maximum IRMAA in 2021 will be $356.40, bringing the total monthly cost for Part B to $504.90 for those in that bracket. The top IRMAA bracket applies to married couples with adjusted gross incomes of $750,000 or more and singles with $500,000 or more of income.

What is the income threshold for Irmaa?

As noted above, only individuals who earn more than $88,000 and married couples filing jointly who earn more than $176,000 are required to pay IRMAA.

Is Irmaa adjusted annually?

IRMAA is determined by income from your income tax returns two years prior. This means that for your 2022 Medicare premiums, your 2020 income tax return is used. This amount is recalculated annually.

What are the Irmaa brackets for 2020?

IRMAA income brackets generally increased from $1,000 to $3,000 for individual tax filers, and between $2,000 and $6,000 for married couples filing jointly.

What are the Irmaa brackets for 2022?

What are the 2022 IRMAA Brackets2022 IRMAA BRACKETS FOR MEDICARE PART B & PART DFile Individual Tax ReturnFile Joint Tax ReturnPart B (Monthly Premium)$91,000 or less$182,000 or less$170.10Above $91,000 – $114,000Above $182,000 – $228,000$238.10Above $114,000 – $142,000Above $228,000 – $284,000$340.204 more rows•May 22, 2022

What will Irmaa be in 2023?

They expect to have $200,000 in income in 2022 and only $150,000 in income in 2023 when they spend the entire year retired. SSA would assign IRMAA based on their 2020 AGI of $250,000, and they would have to pay $340.20 each for Medicare Part B when they retire if they do not ask for an IRMAA reduction.

How do I reduce my Irmaa?

What are the best tips to avoid an IRMAA?Inform Medicare if you've had a life changing event that affected your income. ... Avoid certain income-boosting changes to your annual income. ... Utilize Medicare savings accounts. ... Consider a qualified charitable distribution. ... Explore tax-free income streams.

What are the magi limits for 2021?

If you file taxes as a single person, your Modified Adjusted Gross Income (MAGI) must be under $140,000 for the tax year 2021 and under $144,000 for the tax year 2022 to contribute to a Roth IRA, and if you're married and file jointly, your MAGI must be under $208,000 for the tax year 2021 and 214,000 for the tax year ...

How do I find my Irmaa?

If you need a replacement copy of your IRMAA letter you can obtain one from your local Social Security office, which can be located on the following website: www.socialsecurity.gov/onlineservices. This website can also be accessed to request a copy of the SSA-1099.

How does this affect me?

If you have higher income, you’ll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. They call the additional amount the income-related monthly adjustment amount (IRMAA). Here’s how it works:

How does Social Security determine if I must pay higher premiums?

The standard Part B premium amount in 2018 will be $134 (or higher depending on your income). However, some people who get Social Security benefits pay less than this amount ($130 on average). You’ll pay the standard premium amount (or higher) if:

Which tax return does Social Security use?

To determine your 2018 income-related monthly adjustment amounts (IRMAA), use your most recent federal tax return. Generally, this information is from a tax return filed in 2017 for tax year 2016. Sometimes, the IRS only provides information from a return filed in 2016 for tax year 2015.

What if my income has gone down?

If your income has gone down due to any of the following situations, and the change makes a difference in the income level we consider, contact us to explain that you have new information and may need a new decision about your income-related monthly adjustment amount:

Monthly Medicare premiums for 2018

The standard Part B premium for 2018 is $134.00. If you’re single and filed an individual tax return, or married and filed a joint tax return, the following chart applies to you:

What if I disagree?

If you disagree with the decision about your income-related monthly adjustment amount (IRMAA), you have the right to appeal. The fastest and easiest way to file an appeal of your decision is by visiting www.socialsecurity.gov/disability/appeal. You can file online and provide documents electronically to support your appeal.

How much is the Part B premium in 2018?

The 30 percent of all Part B enrollees who are not subject to the “hold harmless” provision will pay the full premium of $134 per month in 2018. Part B enrollees who were held harmless in 2016 ...

What is Medicare Part A?

Medicare Part A Premiums/Deductibles. Medicare Part A covers inpatient hospital, skilled nursing facility, and some home health care services. About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment. The Medicare Part A annual inpatient hospital deductible ...

What is the Medicare Part B premium?

Medicare Part B Premiums/Deductibles. Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and other items. The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017.

How much is Medicare Part A deductible?

The Medicare Part A annual inpatient hospital deductible that beneficiaries pay when admitted to the hospital will be $1,340 per benefit period in 2018, an increase of $24 from $1,316 in 2017. The Part A deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

When did Medicare Part A and B premiums come out?

2018 Medicare Parts A & B Premiums and Deductibles. On November 17, 2017 , the Centers for Medicare & Medicaid Services (CMS) released the 2018 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

How much will Social Security increase in 2018?

After several years of no or very small increases, Social Security benefits will increase by 2.0 percent in 2018 due to the Cost of Living adjustment.

What is the deductible for Medicare Part B?

The annual deductible for all Medicare Part B beneficiaries will be $183 in 2018, the same annual deductible in 2017. Premiums and deductibles for Medicare Advantage and Medicare Prescription Drug plans are already finalized and are unaffected by this announcement. Since 2007, beneficiaries with higher incomes have paid higher Medicare Part B ...

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

How much does Medicare Part B cost?

Medicare Part B covers medical care, including regular trips to the doctor and anything considered “medically necessary” for you. How much you pay for Part B coverage depends on different factors, such as when you enroll and your yearly income. The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

How much is Part D deductible for 2017?

In 2017, you can expect the following costs: The Part D deductible is $1,316 per benefit period. Once you meet the deductible, you’ll pay nothing out of pocket for the first 60 days of your stay. For days 61 to 90, you’ll pay $329 per day. For days 91 and beyond, you’ll pay $658 per day.

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

How long do you have to work to get medicare?

You are eligible to receive Medicare benefits as long as you have worked for at least 40 quarters in your lifetime – which translates to about 10 years of Social Security covered employment. Medicare benefits are typically divided into part A – which is paid for through your payroll deductions and Part B, C & D – which is paid through additional premiums. These premiums are deducted from your Social Security check every month. In this blog post, we are focusing on the excess premiums charged on Medicare Part B, strategies to limit this excess premium and finally why effectively planning for Medicare premiums can turn out to be a hard nut to crack.

What is Medicare Part B?

Medicare Part B covers physician’s expenses, outpatient services in hospitals, durable medical equipment and lab tests among other items. The standard premium amounts for this coverage is $134 a month. However, once an eligible individual starts to hit a particular income threshold, this premium amount starts drastically rising. For the past decade, this is how the surcharge has been calculated.

How much do the Simpsons have to pay for Medicare?

Simpson, file jointly, are both 75 years old, and together they have MAGI of $187,000. Their income consists of IRA withdrawals, huge capital gains, and Social Security income. They also receive part time employment income. Due to IRMAA, they will pay $1,280 in additional Medicare premiums. To lower their MAGI, assuming they have charitable inclinations, the Simpsons could have considered making a Qualified Charitable Distribution directly from the IRA. Another strategy would have been offsetting some of the capital gains by recognizing unrealized capital losses.

How to appeal an IRMAA?

If you want to appeal your IRMAA, you should visit the Social Security website for the form called Request for Reconsideration. The form will give you three options on how to appeal, with the easiest and most common way being a case review. Documentation is an essential thing in any appeal.

How does Social Security determine if you owe an IRMAA?

The Social Security Administration determines if you owe an IRMAA based on the income you reported on your IRS tax return two years prior. If you feel you’re higher Part B premium is incorrect, there are steps you can take to appeal IRMAA.

How to request a new initial determination for Medicare?

You can request a new initial determination by submitting a Medicare IRMAA Life-Changing Event form. You can also schedule an appointment with Social Security. Documentation will be required with either your correct income or of the life-changing event that caused your income to go down.

Can you appeal Medicare Part B?

You can appeal your Medicare Part B premium increase for outdated or incorrect information when you: Filed an amended tax return with the IRS. Have a more recent tax return that shows you are receiving a lower income than previously reported.

What is IRMAA Medicare?

What is IRMAA? For Medicare beneficiaries who earn over $88,000 a year – and who are enrolled in Medicare Part B and/or Medicare Part D – it’s important to understand the income-related monthly adjusted amount (IRMAA), which is a surcharge added to the Part B and Part D premiums.

What is IRMAA in Social Security?

The income used to determine IRMAA is a form of Modified Adjusted Gross Income (MAGI), but it’s specific to Medicare.

What is IRMAA Part D?

For Part D, the IRMAA amounts are added to the regular premium for the enrollee’s plan (Part D plans have varying prices, so the full amount, after the IRMAA surcharge, will depend on the plan).

What is the Medicare surcharge for 2021?

This means that for your 2021 Medicare premiums, your 2019 income tax return is used. This amount is recalculated annually. The IRMAA surcharge will be added to your 2021 premiums if your 2019 income was over $88,000 (or $176,000 if you’re married), but as discussed below, there’s an appeals process if your financial situation has changed.

How is IRMAA determined?

IRMAA is determined by income from your income tax returns two years prior. How IRMAA affects Part B premiums depends on your household income. IRMAA surcharges are added to you Part D premiums. You can appeal your IRMAA determination if you believe the calculation was erroneous. The SECURE Act of 2019 could further affect your premiums.

Can I appeal an IRMAA determination?

You can appeal the IRMAA determination – filing for a redetermination – if you believe that your calculation is erroneous. In addition, if you have had a life-changing event such as a loss of income or divorce, then you can refile or you can file for a redetermination using Form SSA-44.

Will MAGI income be adjusted for inflation in 2020?

The year 2020 was the first year that these MAGI income requirements were adjusted for inflation. Going forward, the Modified Adjusted Income requirements will continue to be adjusted by inflation (CPI). Back to top.

Who does IRMAA apply to?

IRMAA applies to Medicare beneficiaries who have higher incomes. Keep reading to learn more about IRMAA, how it works, and the parts of Medicare that it applies to.

How much is the IRMAA premium for 2021?

In 2021, the standard monthly premium for Part B is $148.50. Depending on your yearly income, you may have an additional IRMAA surcharge. This amount is calculated using your income tax information from 2 years ago. So, for 2021, your tax information from 2019 will be assessed.

How to contact Medicare directly?

SSA. To get information about IRMAA and the appeals process, the SSA can be contacted directly at 800-772-1213.

What is an IRMAA?

Takeaway. An IRMAA is a surcharge added to your monthly Medicare Part B and Part D premiums, based on your yearly income. The Social Security Administration (SSA) uses your income tax information from 2 years ago to determine if you owe an IRMAA in addition to your monthly premium. The surcharge amount you’ll pay depends on factors like your income ...

What is the state health insurance program?

The State Health Insurance Assistance Program (SHIP) provides free assistance with your Medicare questions. You can find out how to contact your state’s SHIP program here. Medicaid. Medicaid is a joint federal and state program that assists people who have a lower income or resources with their medical costs.

How many people will be covered by Medicare in 2027?

It’s made up of several parts. In 2019, Medicare covered about 61.5 million Americans and is predicted to increase to 75 million by 2027. Many parts of Medicare involve paying a monthly premium. In some cases, your monthly premium may be adjusted based on your income.

What is a Part D insurance plan?

Part D is prescription drug coverage. Like Part C plans, Part D plans are sold by private companies. Part D is affected by IRMAA. As with Part B, a surcharge can be added to your monthly premium, based on your yearly income. This is separate from the surcharge that can be added to Part B premiums.