Monthly Medicare Premiums for 2022

| Modified Adjusted Gross Income (MAGI) | Part B monthly premium amount | Prescription drug coverage monthly premi ... |

| Individuals with a MAGI of less than or ... | 2022 standard premium = $170.10 | Your plan premium |

| Individuals with a MAGI above $91,000 up ... | Standard premium + $68.00 | Your plan premium + $12.40 |

| Individuals with a MAGI above $114,000 u ... | Standard premium + $170.10 | Your plan premium + $32.10 |

| Individuals with a MAGI above $142,000 u ... | Standard premium + $272.20 | Your plan premium + $51.70 |

Full Answer

How does income affect monthly Medicare premiums?

- Marriage

- Divorce/Annulment

- Death of Your Spouse

- Work Stoppage or Reduction

- Loss of Income-Producing Property

- Loss of Pension Income

- Employer Settlement Payment

Does Medicare have monthly premiums?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021 ($499 in 2022). If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471 ($499 in 2022).

How much does Medicare cost per month?

- $1,556 deductible

- Days 1 â 60: $0 coinsurance

- Days 61 â 90: $389 coinsurance

- Days 91+: $778 coinsurance per âlifetime reserve day,â which caps at 60 days

- Beyond lifetime reserve days: You pay all costs

How to calculate Medicare premiums?

- Deductions for what you give to charity 8

- Deductions for adoption expenses 9

- Dependent tax credits 10

- The earned income tax credit (EITC) 11

What is a monthly Medicare premium?

Monthly premium: The Part D monthly. premium. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage. varies by plan (higher-income consumers may pay more).

Do Medicare patients pay monthly premiums?

$170.10 each month (or higher depending on your income). The amount can change each year. You'll pay the premium each month, even if you don't get any Part B-covered services.

How does Medicare determine monthly premiums?

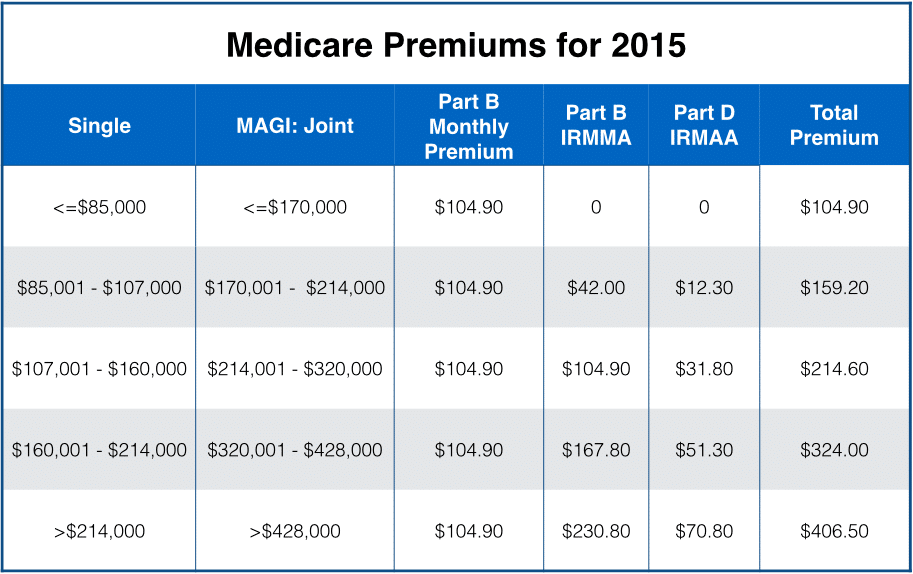

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

What are the Medicare premiums for 2021?

The Centers for Medicare & Medicaid Services (CMS) has announced that the standard monthly Part B premium will be $148.50 in 2021, an increase of $3.90 from $144.60 in 2020.

Is Medicare free at age 65?

You are eligible for premium-free Part A if you are age 65 or older and you or your spouse worked and paid Medicare taxes for at least 10 years. You can get Part A at age 65 without having to pay premiums if: You are receiving retirement benefits from Social Security or the Railroad Retirement Board.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

What income level affects Medicare premiums?

How much will I pay for premiums in 2022?Yearly income in 2020: singleYearly income in 2020: married, joint filing2022 Medicare Part B monthly premium> $114,000–$142,000> $228,000–$284,000$340.20> $142,000–$170,000> $284,000–$340,000$442.30> $170,000– < $500,000> $340,000– < $750,000$544.30≥ $500,000≥ $750,000$578.302 more rows•Nov 16, 2021

How does your income affect your Medicare premium?

If you have higher income, you'll pay an additional premium amount for Medicare Part B and Medicare prescription drug coverage. We call the additional amount the income-related monthly adjustment amount.

How much will be deducted from my Social Security check for Medicare in 2021?

The standard Medicare Part B premium for medical insurance in 2021 is $148.50. Some people who collect Social Security benefits and have their Part B premiums deducted from their payment will pay less.

Why is my Medicare Part B premium so high?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

What is the Medicare Part B premium for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

Medicare Advantage Plan (Part C)

Monthly premiums vary based on which plan you join. The amount can change each year.

Medicare Supplement Insurance (Medigap)

Monthly premiums vary based on which policy you buy, where you live, and other factors. The amount can change each year.