Here are all the new Medicare payment figures:

- Part B premium: $170.10 (was $148.50)

- Part B deductible: $233 (was $203)

- Part A deductible: $1,556 (was $1,484)

- Co-payment for hospital stay days 61-90: $389/day (was $371)

- Co-payment for hospital stay days 91 and beyond: $778/day (was $742)

- Skilled nursing facility co-payment, days 21-100: $194.50/day (was $185.50)

Full Answer

What is the monthly premium for Medicare Part B?

The standard monthly premium for Medicare Part B is $148.50 per month in 2021. Some Medicare beneficiaries may pay more or less per month for their Part B coverage. The Part B premium is based on your reported income from two years ago (2019).

How are Medicare Part B premiums determined?

- You married, divorced, or became widowed.

- You or your spouse stopped working or reduced your work hours.

- You or your spouse lost income-producing property because of a disaster or other event beyond your control.

- You or your spouse experienced a scheduled cessation, termination, or reorganization of an employers pension plan.

How much does Medicare Part B cost?

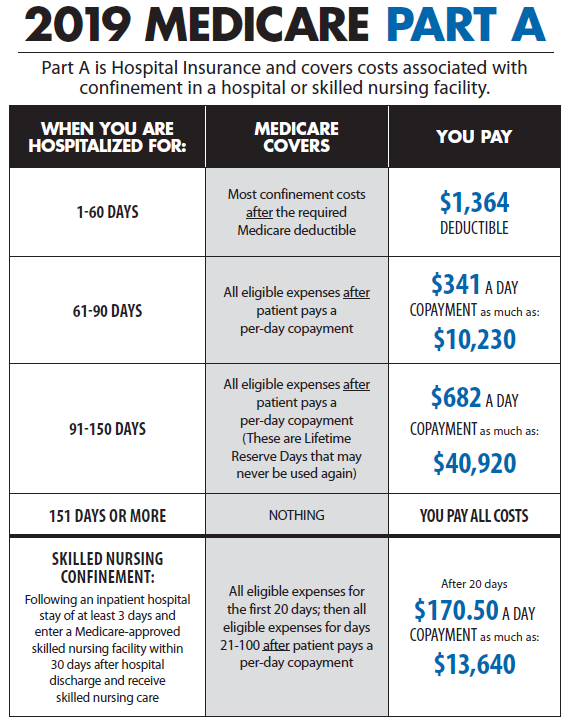

- $1,484 ($1,556 in 2022) deductible for each benefit period

- Days 1-60: $0 coinsurance for each benefit period

- Days 61-90: $371 ($389 in 2022) coinsurance per day of each benefit period

- Days 91 and beyond: $742 ($778 for 2022) coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime)

How much does Medicare premium cost?

Medicare. Medicare Premiums explained: Which part is more convenient for you? Medicare. Medicare Costs 2022: Does Medicare cover Home Health Care? The US Centers for Medicare & Medicaid Services have announced the increases for both the standard premium ...

What is the monthly premium for Medicare Part B in 2020?

$144.60The Centers for Medicare & Medicaid Services has announced that the standard monthly Part B premium will be $144.60 in 2020, an increase from $135.50 in 2019. However, some Medicare beneficiaries will pay less than this amount.

What is the standard Medicare Part B premium for 2021?

$148.50Medicare Part B Premium and Deductible The standard monthly premium for Medicare Part B enrollees will be $170.10 for 2022, an increase of $21.60 from $148.50 in 2021. The annual deductible for all Medicare Part B beneficiaries is $233 in 2022, an increase of $30 from the annual deductible of $203 in 2021.

What is the usual premium for Medicare Part B coverage?

The standard Part B premium amount is $170.10 (or higher depending on your income). In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What were Medicare premiums for 2020?

For 2020, the Medicare Part B monthly premiums and the annual deductible are higher than the 2019 amounts. The standard monthly premium for Medicare Part B enrollees will be $144.60 for 2020, an increase of $9.10 from $135.50 in 2019.

What is the cost of Medicare Part B for 2022?

$170.10The standard Part B premium amount in 2022 is $170.10. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA).

How can I lower my Medicare Part B premium?

To request a reduction of your Medicare premium, contact your local Social Security office to schedule an appointment or fill out form SSA-44 and submit it to the office by mail or in person.

How much is taken out of your Social Security check for Medicare?

Medicare Part B (medical insurance) premiums are normally deducted from any Social Security or RRB benefits you receive. Your Part B premiums will be automatically deducted from your total benefit check in this case. You'll typically pay the standard Part B premium, which is $170.10 in 2022.

Why is my Medicare Part B premium so high?

If you file your taxes as “married, filing jointly” and your MAGI is greater than $182,000, you'll pay higher premiums for your Part B and Medicare prescription drug coverage. If you file your taxes using a different status, and your MAGI is greater than $91,000, you'll pay higher premiums.

At what income level do Medicare premiums increase?

For example, when you apply for Medicare coverage for 2022, the IRS will provide Medicare with your income from your 2020 tax return. You may pay more depending on your income. In 2022, higher premium amounts start when individuals make more than $91,000 per year, and it goes up from there.

Are Medicare Part B premiums going up in 2021?

In November 2021, CMS announced the monthly Medicare Part B premium would rise from $148.50 in 2021 to $170.10 in 2022, a 14.5% ($21.60) increase.

Are Medicare premiums based on income?

Medicare premiums are based on your modified adjusted gross income, or MAGI. That's your total adjusted gross income plus tax-exempt interest, as gleaned from the most recent tax data Social Security has from the IRS.

Is Medicare Part A and B free?

While Medicare Part A – which covers hospital care – is free for most enrollees, Part B – which covers doctor visits, diagnostics, and preventive care – charges participants a premium. Those premiums are a burden for many seniors, but here's how you can pay less for them.

Medicare Part B Income-Related Monthly Adjustment Amounts

Every beneficiary’s Part B monthly premium is based on his or her income. The 2020 Part B total premiums for high income beneficiaries are shown in the following table:

Senior65.com Next Steps

If you want to find a plan that will help pay for the deductibles and coinsurance amounts not covered by Medicare, give us a call at 800-930-7956. We would be glad to discuss your options and help you select and enroll in a plan that meets your needs. There is never a cost or hidden fee to work with us.

Stay in touch

Subscribe to be always on top of news on Medicare, Medigap, Medicare Advantage, Part D and more!

How much will Medicare premiums increase in 2020?

On November 8, 2019, the Centers for Medicare and Medicaid Services (CMS) released the new Medicare costs for 2020. Medicare Part B premiums will increase by about 7% for nearly 70% of all beneficiaries.

How long do you have to work to get Medicare Part A?

Medicare Part A is premium-free for 99 percent of Medicare beneficiaries who have worked for about 10 years and accumulated at least 40 quarters of work credit . However, beneficiaries who do not have 40 or more quarters of work credit will need to pay a premium according to how many credits they or their spouse have.

What is the minimum premium for Part B insurance?

The minimum premium for Part B coverage in 2020 is $144.60 each month, which is a $9 increase from 2019’s minimum premium of $135.50 each month. In 2020, certain income brackets that determine if high-income recipients pay more for their Part B premium each month were changed for the first time.

How much is the deductible for Medicare Part B?

Medicare recipients must meet an annual deductible with Medicare Part B, which is $198 for 2020. If a Medicare enrollee was eligible for a Medigap plan that pays for the Part B deductible prior to 2020, they can still receive that benefit. Medigap plans that pay the Part B deductible are no longer offered as of January 1st, 2020.

What is the COLA for 2020?

For 2020, the COLA is 1.6%; if this change in a beneficiary’s Social Security payment does not cover the rise in their premium cost, their premium will only increase by 1.6% of the prior year’s premium. If you qualify as a dual eligible enrollee with Medicare and Medicaid, your Medicare premium will be $144.60 a month and is paid by Medicaid.

How much do you pay a month if you are married in 2020?

between $87,000 and $413,000, you pay $462.70 a month in 2020. more than $413,000, you pay $491.60 a month in 2020.

How much do you make a month in 2020?

between $109,000 and $136,000, you pay $289.20 a month in 2020. between $136,000 and $163,000, you pay $376.20 a month in 2020. between $163,000 and $500,000, you pay $462.70 a month in 2020. more than $500,000, you pay $491.60 a month in 2020.

Does Medicare go up in 2020?

2020’s changes to the Medicare Part B premium may also be dependent on the recipient’s tax filing status for 2018.

Has Medicare changed its coinsurance policy?

Medicare has not changed policies that determine share-of-cost obligations regarding copayments or coinsurance amounts for 2020.

How much will Medicare cost in 2021?

Most people don't pay a monthly premium for Part A (sometimes called " premium-free Part A "). If you buy Part A, you'll pay up to $471 each month in 2021. If you paid Medicare taxes for less than 30 quarters, the standard Part A premium is $471. If you paid Medicare taxes for 30-39 quarters, the standard Part A premium is $259.

How much is the Part B premium for 91?

Part B premium. The standard Part B premium amount is $148.50 (or higher depending on your income). Part B deductible and coinsurance.

How long does a SNF benefit last?

The benefit period ends when you haven't gotten any inpatient hospital care (or skilled care in a SNF) for 60 days in a row. If you go into a hospital or a SNF after one benefit period has ended, a new benefit period begins. You must pay the inpatient hospital deductible for each benefit period. There's no limit to the number of benefit periods.

How much does Medicare pay for outpatient therapy?

After your deductible is met, you typically pay 20% of the Medicare-approved amount for most doctor services (including most doctor services while you're a hospital inpatient), outpatient therapy, and Durable Medical Equipment (DME) Part C premium. The Part C monthly Premium varies by plan.

What is Medicare Advantage Plan?

A Medicare Advantage Plan (Part C) (like an HMO or PPO) or another Medicare health plan that offers Medicare prescription drug coverage. Creditable prescription drug coverage. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.

How much is coinsurance for days 91 and beyond?

Days 91 and beyond: $742 coinsurance per each "lifetime reserve day" after day 90 for each benefit period (up to 60 days over your lifetime). Beyond Lifetime reserve days : All costs. Note. You pay for private-duty nursing, a television, or a phone in your room.

What happens if you don't buy Medicare?

If you don't buy it when you're first eligible, your monthly premium may go up 10%. (You'll have to pay the higher premium for twice the number of years you could have had Part A, but didn't sign up.) Part A costs if you have Original Medicare. Note.

When will Medicare Part A and Part B be released?

On November 8, 2019 , the Centers for Medicare & Medicaid Services (CMS) released the 2020 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What does Medicare Part A cover?

About 99 percent of Medicare beneficiaries do not have a Part A premium since they have at least 40 quarters of Medicare-covered employment.

What is the deductible for Medicare Part B in 2021?

The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase of $5 from the annual deductible of $198 in 2020. The Part B premiums and deductible reflect the provisions of the Continuing Appropriations Act, 2021 and Other Extensions Act (H.R. 8337).

When will Medicare Part A and B be released?

Medicare Parts A & B. On November 6, 2020, the Centers for Medicare & Medicaid Services (CMS) released the 2021 premiums, deductibles, and coinsurance amounts for the Medicare Part A and Part B programs.

What is the Medicare deductible for 2021?

For 2021, the Medicare Part B monthly premiums and the annual deductible are higher than the 2020 amounts. The standard monthly premium for Medicare Part B enrollees will be $148.50 for 2021, an increase of $3.90 from $144.60 in 2020. The annual deductible for all Medicare Part B beneficiaries is $203 in 2021, an increase ...

How much is Medicare Part A in 2021?

The Medicare Part A inpatient hospital deductible that beneficiaries will pay when admitted to the hospital will be $1,484 in 2021, an increase of $76 from $1,408 in 2020. The Part A inpatient hospital deductible covers beneficiaries’ share of costs for the first 60 days of Medicare-covered inpatient hospital care in a benefit period.

What is Part B for 2021?

The 2021 Part B total premiums for high-income beneficiaries are shown in the following table: Premiums for high-income beneficiaries who are married and lived with their spouse at any time during the taxable year, but file a separate return, are as follows: Beneficiaries who are married and lived with their spouses at any time during the year, ...

How much is coinsurance for 2021?

In 2021, beneficiaries must pay a coinsurance amount of $371 per day for the 61st through 90th day of a hospitalization ($352 in 2020) in a benefit period and $742 per day for lifetime reserve days ($704 in 2020). For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services in ...

What is Medicare Part B?

Medicare Part B covers physician services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A.

What is the standard Part B premium for 2021?

The standard Part B premium amount in 2021 is $148.50. Most people pay the standard Part B premium amount. If your modified adjusted gross income as reported on your IRS tax return from 2 years ago is above a certain amount, you'll pay the standard premium amount and an Income Related Monthly Adjustment Amount (IRMAA). IRMAA is an extra charge added to your premium.

What is Medicare Part B?

Some people automatically get. Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services. , and some people need to sign up for Part B. Learn how and when you can sign up for Part B. If you don't sign up for Part B when you're first eligible, ...

How much do you pay for Medicare after you meet your deductible?

After you meet your deductible for the year, you typically pay 20% of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

How much is Part B deductible in 2021?

Part B deductible & coinsurance. In 2021, you pay $203 for your Part B. deductible. The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. . After you meet your deductible for the year, you typically pay 20% of the.

What happens if you don't sign up for Part B?

If you don't sign up for Part B when you're first eligible, you may have to pay a late enrollment penalty.

Do you pay Medicare premiums if your income is above a certain amount?

If your modified adjusted gross income is above a certain amount, you may pay an Income Related Monthly Adjustment Amount (IRMAA). Medicare uses the modified adjusted gross income reported on your IRS tax return from 2 years ago.