How do you calculate Medicare penalty?

Dec 03, 2020 · In most cases, if you don’t sign up for Medicare when you’re first eligible, you may have to pay a higher monthly premium. More information on Medicare late enrollment penalties: Part A Late Enrollment Penalty (Medicare.gov) Part B Late Enrollment Penalty (Medicare.gov) Part D Late Enrollment Penalty (Medicare.gov)

What is the penalty for not having Medicare?

Your Part B premium penalty is 20% of the standard premium, and you’ll have to pay this penalty for as long as you have Part B. (Even though you weren't covered a total of 27 months, this included only 2 full 12-month periods.) Find out what Part B covers. Find out who to call about Medicare options, claims and more. Talk to Someone

Is there a penalty for refusing Medicare?

What Are Medicare's Penalties? Medicare makes you pay extra for signing up late for its Part A (inpatient hospital services), Part B (outpatient medical services), and …

How do you avoid Medicare penalty?

The parts of Medicare that charge a late enrollment fee are: Part A (inpatient hospital insurance. Part B (outpatient medical insurance) Part D (prescription drug coverage)

How do I avoid Medicare penalty?

Enroll in Medicare drug coverage when you're first eligible. Even if you don't take drugs now, you should consider joining a Medicare drug plan or a Medicare Advantage Plan with drug coverage to avoid a penalty. You may be able to find a plan that meets your needs with little to no monthly premiums.

How does Medicare penalty work?

Medicare calculates the penalty by multiplying 1% of the "national base beneficiary premium" ($33.37 in 2022) times the number of full, uncovered months you didn't have Part D or creditable coverage. The monthly premium is rounded to the nearest $. 10 and added to your monthly Part D premium.

Why does Medicare have a penalty?

You could face a lifetime late enrollment penalty for a Part D plan if: You don't get prescription drug coverage via Part D or Medicare Advantage. You don't have “creditable” drug coverage (prescription coverage through some employers, for instance)

What is Medicare premium penalty?

If you didn't get Part B when you're first eligible, your monthly premium may go up 10% for each 12-month period you could've had Part B, but didn't sign up. In most cases, you'll have to pay this penalty each time you pay your premiums, for as long as you have Part B.

Are you automatically enrolled in Medicare if you are on Social Security?

Yes. If you are receiving benefits, the Social Security Administration will automatically sign you up at age 65 for parts A and B of Medicare. (Medicare is operated by the federal Centers for Medicare & Medicaid Services, but Social Security handles enrollment.)

How long is a member responsible for a late enrollment penalty?

For most people, you have to pay the LEP as long as you are enrolled in the Medicare prescription drug benefit. There are some exceptions: If you receive Extra Help, your penalty will be permanently erased. If you are under 65 and have Medicare, your LEP will end when you turn 65.

What is the grace period for Medicare payment?

When you're in traditional Medicare The original billing notice is the regular one that requests payment by a specified due date — the 25th of the month. The grace period for paying this bill is three months, ending on the last day of the third month after the month in which the bill was sent.

What is the penalty for canceling Medicare Part B?

What is the Penalty for Not Taking Medicare Part B? The Part B penalty increases your monthly Part B premium by 10% for each full 12-month period you were eligible to enroll but didn't. The penalty is based on the standard Part B premium, regardless of the premium amount you actually pay.

What are the income limits for Medicare 2021?

In 2021, the adjustments will kick in for individuals with modified adjusted gross income above $88,000; for married couples who file a joint tax return, that amount is $176,000. For Part D prescription drug coverage, the additional amounts range from $12.30 to $77.10 with the same income thresholds applied.Nov 10, 2020

Can you drop Medicare Part B anytime?

You can voluntarily terminate your Medicare Part B (medical insurance). However, since this is a serious decision, you may need to have a personal interview. A Social Security representative will help you complete Form CMS 1763.Nov 24, 2021

What happens if I miss Medicare open enrollment?

If you missed your Initial Enrollment Period (IEP) and need to enroll in Medicare, you likely will have to enroll during either a Special Enrollment Period (SEP) or the General Enrollment Period (GEP).

How Do Medicare Late Enrollment Penalties Work?

Medicare has late enrollment penalties in place for its three main parts:

What is the Medicare Part A Late Enrollment Penalty?

The rule: For every year you weren’t enrolled in Part A, you’ll pay a 10% penalty for two years.

What Is the Medicare Part B Late Enrollment Penalty?

The rule: You’re assessed a 10% penalty for every year you didn’t sign up after becoming eligible. You’ll continue to pay this late enrollment pena...

What Is the Medicare Part D Late Enrollment Penalty?

The rule: You’ll pay an extra 1% of the average Part D premium for each month you don’t enroll and don’t have creditable coverage.

I Have Health Insurance -- Can I Delay Enrollment and Avoid a Penalty?

You can delay enrolling in Medicare and avoid late enrollment penalties if you have other creditable coverage.

Can I appeal my late enrollment penalty?

If you were given incorrect information that caused you to make an error when enrolling, you may qualify for equitable relief. If this happens, you...

How do I know when my enrollment deadline is?

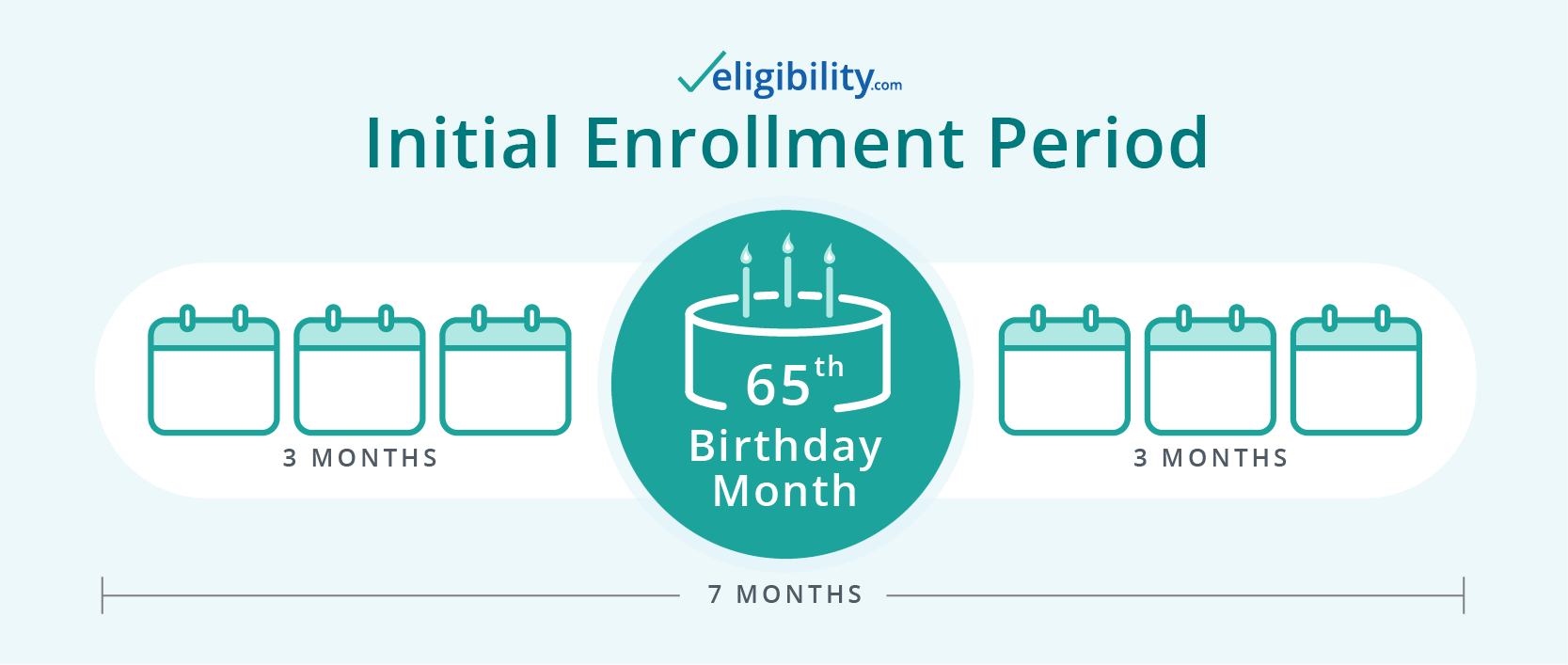

This is known as your Initial Enrollment Period, and it’s a seven-month window around the month you turn 65. It begins three months before your bir...

When can I sign up if I missed my IEP?

There are a few things you can do if you missed your IEP. The first place to start may be finding your next available Medicare enrollment period. M...

What happens if you delay Medicare enrollment?

Delaying enrollment in Medicare can subject you to long-lasting financial penalties added to your premiums each month. A late enrollment penalty can significantly increase the amount of money you’re required to pay for each part of Medicare for years. Share on Pinterest.

Why is Medicare charging late fees?

Charging late fees helps to reduce these costs overall and encourage people to enroll on time.

How long does it take to enroll in Medicare Part D?

You can enroll in Medicare Part D without incurring a late enrollment penalty during the 3-month period that begins when your Medicare parts A and B become active. If you wait past this window to enroll, a late enrollment penalty for Medicare Part D will be added to your monthly premium. This fee is 1 percent of the average monthly prescription ...

What happens if you don't sign up for Medicare?

If you’re not automatically enrolled and don’t sign up for Medicare Part A during your initial enrollment period, you’ll incur a late enrollment penalty when you do sign up. The late enrollment penalty amount is 10 percent of the cost of the monthly premium. You’ll have to pay this additional cost each month for twice the number ...

How long does Medigap last?

This period starts on the first day of the month you turn 65 and lasts for 6 months from that date. If you miss open enrollment, you may pay a much higher premium for Medigap.

How long does Medicare Part B take to enroll?

Part B late enrollment penalty. You’re eligible for Medicare Part B starting 3 months before your 65th birthday until 3 months after it occurs. This period of time is known as the initial enrollment period.

How long do you have to enroll in Medicare?

make sure to enroll during the 8-month period when your current coverage ends, known as a special enrollment period.

How much is Medicare Part D penalty?

These range from $12.30 to $77.10 per month. Because there’s not a standard payment amount, the Medicare Part D penalty is calculated using the national average for Part D premiums. That amount is $32.74 in 2020, and $33.06 in 2021.

How much is the 10% penalty for a late enrollment?

10% penalty: $25.90 per month. Part A premium amount with penalty: $284.20 for six years. The Part A Late Enrollment Penalty will be tacked onto your premium for six years because you signed up three years late. When the six years is over, your Part A premium will drop back to the regular amount.

What happens if you don't enroll in Medicare?

If you don’t enroll in Medicare in time, you may accrue three separate late enrollment penalties for each if you don’t have other coverage. Even worse, you’re not just hit with a one-time fee. Instead, Medicare’s late enrollment penalties increase over time and can last as long as you’re enrolled.

What is Medicare Part A?

Medicare late enrollment penalties are applied to Part A. Medicare Part A, also called "hospital insurance," covers the care you receive while admitted to the hospital, skilled nursing facility, or other inpatient services. Medicare Part A is part of Original Medicare. , Part B.

What is the penalty for late enrollment in Part D?

The Part D late enrollment penalty is a lifetime penalty you’ll pay as long as you have a plan that covers your prescription drug costs. The longer you delay enrollment in Part A, the longer you’ll pay a late enrollment penalty. If you had other coverage, you may be able to delay enrollment without penalty.

How much is the Part B late penalty?

Remember, the Part B late enrollment penalty is a lifetime penalty, so you’ll pay the extra $43.74 per month as long as you’re enrolled in your Part B plan. If you’re in the higher income brackets, missing your Part B enrollment could mean you’re stuck paying hundreds, or more, in enrollment penalties each year.

When do you have to sign up for Part D?

Part D is optional and is offered by private insurance companies. . To avoid Part A and Part B penalties, you must sign up when you turn 65. The Part D penalty is applied when you go more than 63 days without prescription drug coverage.

What happens if Medicare decides the penalty is wrong?

What happens if Medicare's contractor decides the penalty is wrong? If Medicare’s contractor decides that all or part of your late enrollment penalty is wrong, the Medicare contractor will send you and your drug plan a letter explaining its decision. Your Medicare drug plan will remove or reduce your late enrollment penalty. ...

What is the late enrollment penalty for Medicare?

Part D late enrollment penalty. The late enrollment penalty is an amount that's permanently added to your Medicare drug coverage (Part D) premium. You may owe a late enrollment penalty if at any time after your Initial Enrollment Period is over, there's a period of 63 or more days in a row when you don't have Medicare drug coverage or other.

What happens if Medicare pays late enrollment?

If Medicare’s contractor decides that your late enrollment penalty is correct, the Medicare contractor will send you a letter explaining the decision, and you must pay the penalty.

What is creditable prescription drug coverage?

creditable prescription drug coverage. Prescription drug coverage (for example, from an employer or union) that's expected to pay, on average, at least as much as Medicare's standard prescription drug coverage. People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, ...

How long do you have to pay late enrollment penalty?

You must do this within 60 days from the date on the letter telling you that you owe a late enrollment penalty. Also send any proof that supports your case, like a copy of your notice of creditable prescription drug coverage from an employer or union plan.

How long does it take for Medicare to reconsider?

In general, Medicare’s contractor makes reconsideration decisions within 90 days. The contractor will try to make a decision as quickly as possible. However, you may request an extension. Or, for good cause, Medicare’s contractor may take an additional 14 days to resolve your case.

Do you have to pay a penalty on Medicare?

After you join a Medicare drug plan, the plan will tell you if you owe a penalty and what your premium will be. In general, you'll have to pay this penalty for as long as you have a Medicare drug plan.