Medicare Premiums Increase for Many Beneficiaries in 2018

| Income | Part B monthly premium amount |

| Individuals with income between $85,000 ... | Standard premium + $53.50 = $187.50 |

| Individuals with income between $107,000 ... | Standard premium + $133.90 = $267.90 |

| Individuals with income between $133,500 ... | Standard premium + $214.30 = $348.30 |

| Individuals with income above $160,000 o ... | Standard premium + $294.60 = $428.60 |

...

What You'll Pay for Medicare in 2018.

| Income (adjusted gross income plus tax-exempt interest income): | ||

|---|---|---|

| $85,001 to $107,000 | $170,001 to $214,000 | $187.50 |

How does Medicare calculate my premium?

Nov 17, 2017 · The standard monthly premium for Medicare Part B enrollees will be $134 for 2018, the same amount as in 2017. However, a statutory “hold harmless” provision applies each year to about 70 percent of enrollees. For these enrollees, any increase in Part B premiums must be lower than the increase in their Social Security benefits.

What is the monthly premium for Medicare Part B?

In 2018, however, average premiums for Medicare Advantage plans are expected to decrease slightly over 2017 rates. Enrollees in MA plans will pay around $30 a month, on average, which is nearly $2 less per month than last year. If you’d like to learn more about Advantage, check out our guide to the program. Medicare Part D In 2018

How much does Medicare premium cost?

Nov 20, 2017 · The Centers for Medicare and Medicaid Services (CMS) has announced that the 2018 premium for Part B of Medicare will remain at $134 a month.

How much will Medicare cost this year?

Feb 23, 2018 · The Centers for Medicare and Medicaid Services (CMS) has announced the new Medicare premiums for 2018. Although there is no change in the premium for Medicare Part B in 2018, which is $134 per month, millions of individuals who receive Social Security benefits will end up with much higher Part B premiums.

How much is Medicare premium in 2017?

The standard premium in 2017 is $134 a month for new enrollees, but this number actually only applies to about 30 percent of Part B beneficiaries. The remaining majority pay about $109 a month – but this will change in 2018. The standard premium applies to:

How much is the penalty for Medicare Part B?

For Part B, the penalty is 10 percent of your premium (charged on top of the premium rate) for each 12-month period that you didn’t have Part B coverage when you could have. The penalty lasts for as long as you have Part B. Medicare Part B has other costs as well.

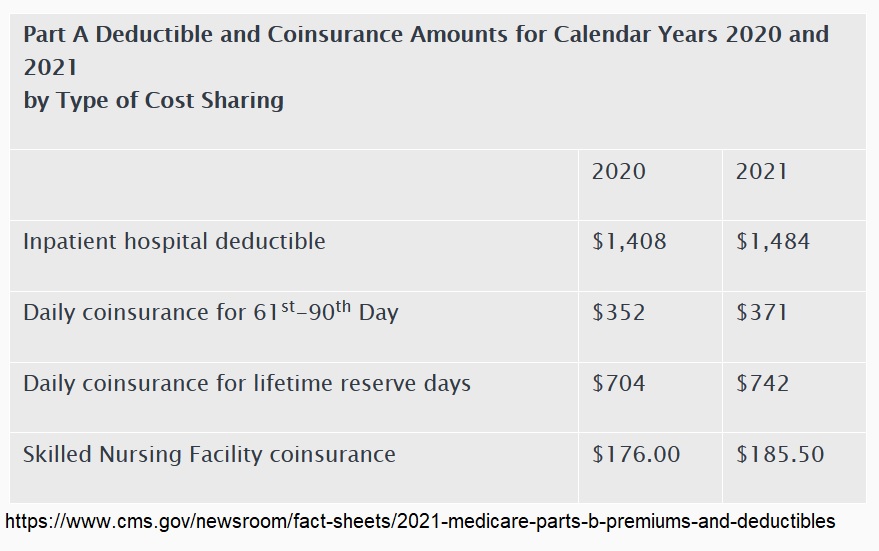

What is Medicare Part A?

Medicare Part A is the hospital portion, covering services related to hospital stays, skilled nursing facilities, nursing home care, hospice and home healthcare. Under the Affordable Care Act, Part A alone counts as minimum essential coverage, so if this is all you sign up for, you’ll meet the law’s requirements. Most people don’t pay a premium for Part A because it’s paid for via work-based taxes. If, over the course of your working life, you’ve accumulated 40 quarter credits, then you won’t pay a premium for Part A. This applies to nearly all enrollees, but some do pay a premium as follows:

What is the donut hole in Medicare?

If you have Medicare Part D, then you may face a situation known as the donut hole (or coverage gap). This happens when you hit your plan’s initial coverage limit ($3,750 in 2018) but still need to buy prescriptions. Until you hit the catastrophic coverage limit – i.e., the other side of the “donut” – you’ll be responsible for the full cost of your medications.

Does Medicare Advantage cover Part B?

If you have Medicare Advantage, then you will pay the Part B premium as well as any premiums that your plan charges. Medicare Advantage must cover Part B services. Income thresholds will change in 2018.

What is the discount for generic drugs?

If you fall into the donut hole, you’ll get a discount on the cost of your prescriptions. In 2018, the discount is: 56 percent for generic medications (you pay 44 percent) 65 percent for brand name drugs (you pay 35 percent)

What is catastrophic limit?

This will effectively close the coverage gap. As it stands, the catastrophic limit prevents you from paying higher prescription drug costs forever. Once you hit the catastrophic limit ($5,000 in 2018), you’ll only be responsible for about 5 percent of the cost of your medications for the rest of your plan year.

What is the Medicare premium for 2018?

Medicare announced its premiums for 2018. Here’s what you need to know. The Centers for Medicare and Medicaid Services (CMS) has announced that the 2018 premium for Part B of Medicare will remain at $134 a month . But even with no change, millions of Social Security recipients will pay sharply higher ...

Who is Phil Moeller?

Phil Moeller is the author of “Get What’s Yours for Medicare: Maximize Your Coverage, Minimize Your Costs” and the co-author of the updated edition of The New York Times bestseller “How to Get What’s Yours: The Revised Secrets to Maxing Out Your Social Security,” with Making Sen$e’s Paul Solman and Larry Kotlikoff.

What is the Medicare premium for 2018?

What are Medicare premiums in 2018? The standard premium of $134 for Medicare Part B won't change, but some recipients will still end up paying more. by: Kimberly Lankford. October 12, 2018.

How much is Medicare Part B?

Answer: The standard premium for Medicare Part B will continue to be $134 per month in 2018. However, even though the standard premium remains the same, many people will have to pay much more for Part B in 2018 than they did in 2017.

How much is the Part B premium?

Some 42% of Part B enrollees who are subject to the hold-harmless provision for 2018 will pay the full monthly premium of $134 because the increase in their Social Security benefit will cover the additional Part B premiums.

When will Medicare Part B premiums increase?

For example, if your initial enrollment period ended on September 30, 2015, but you don't sign up for Medicare Part B until March 2018, your premiums will be 20 percent higher as long as you are enrolled in Medicare due to two full years of delayed enrollment. In this case, the late enrollment penalty would increase the 2018 premium ...

How much is Medicare Part B?

The standard Medicare Part B monthly premium will be $134 in 2018 (or higher, depending on your income), the same amount as in 2017. But many beneficiaries who have been paying less than the standard rate for the past several years will see a jump in their premiums.

Who is Emily Brandon?

18, 2017, and has been updated to include new information. Emily Brandon is the senior editor for retirement at U.S. News & World Report.

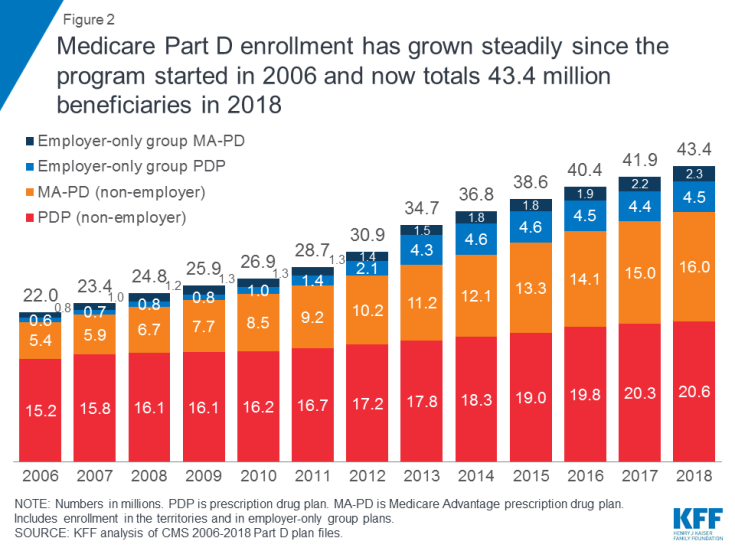

What is Medicare Part D?

Prescription drug coverage, or Medicare Part D, is a relatively new feature of Medicare, but millions of seniors take advantage of the program to help lower their prescription drug costs. Here’s what you need to know about Medicare Part D and the costs for 2018.

What is the coverage gap for prescription drugs?

Once your out-of-pocket drug costs have reached $3,750, you fall into the coverage gap, also known as the donut hole. This means your plan stops paying for your prescription drugs until you reach catastrophic coverage. For 2018, catastrophic coverage begins once your out-of-pocket expenses have reached $5,000. Until you reach that, there are coverage gap discounts available to you: in 2018, name brand drugs will be discounted 65% and generic drugs will be discounted 56%. All payments (including discounts) will count toward your out-of-pocket costs and help you reach catastrophic coverage.

How long do you have to enroll in Part D?

If you want to enroll in Part D coverage, make sure you do it at the right time: the seven-month period around your 65 th birthday month, including the three months leading up to it. If not, you could be penalized for signing up 63 days or more after your Initial Enrollment Period is over. If you don’t sign up during your Initial Enrollment Period, you will have to wait for the Fall Open Enrollment Period, which is October 15 – December 7, and you could be penalized.

Do Part D plans require copays?

Copays and coinsurance are also typical under Part D plans. Some plans require you to pay a certain percentage of prescription drug costs (coinsurance), while others charge a fixed dollar amount (copayment). Prescription drug costs also depend on whether the drug is name brand or generic.