Medicare Recovery Audit Contractor Audits (RACs, or RAs) were introduced beginning in 2005 to identify and recover improper payments made in Medicare and Medicaid

Medicaid

Medicaid in the United States is a federal and state program that helps with medical costs for some people with limited income and resources. Medicaid also offers benefits not normally covered by Medicare, including nursing home care and personal care services. The Health Insurance As…

Full Answer

What is the goal of the RAC audit?

Their goal is to uncover improper Medicaid and Medicare claim payments and get the money back. RAC auditors have collected back over $2 billion for CMS.

What Medicare claims do RACS review?

RACs in Regions 1-4 will perform post payment review to identify and correct Medicare claims specific to Part A and Part B. Region 5 RAC will be dedicated to review of Durable Medical Equipment, Prosthetics, Orthotics, and Supplies (DMEPOS) and Home Health / Hospice What Topics do RAC's Review?

What is the Medicare Part D RAC?

The Part D RAC employs a model similar to the one used in the Medicare Parts A and B RAC program to audit Part D plan sponsors. The Part D RAC: Reviews previously paid individual Medicare claims (prescription drug events) to sponsoring organizations and pharmacies to determine overpayment and underpayment

How does the review request for medical records (RAC) work?

RAC initiates Review Request for medical records Typically the process will begin with a notice of a possible overpayment and a request for medical records The RAC will request certain records to support the claim and provide a deadline for the provider to submit the records Typically, 45 calendar days from date of letter

What does RAC audit notification mean?

How long does it take for RAC to determine if you have overpaid?

How long does it take to get an overpayment letter from the RAC?

How long do you have to respond to a RAC request?

How long does it take to get a Medicare recoupment determination?

What is a RAC audit in Medicare?

What does a Recovery Audit Contractor (RAC) do? RAC's review claims on a post-payment basis. The RAC's detect and correct past improper payments so that CMS and Carriers, FIs, and MACs can implement actions that will prevent future improper payments.

What are RAC audits looking for?

The objective of this program is to discover any improper payments that are charged for uncovered services. These include services that are deemed “not reasonably necessary.” The RAC audits also focus on discrepancies such as fraud, duplicative services, wrong coding, and so on.

What triggers RAC audits?

RAC audits are not one-time or intermittent reviews and can be triggered by anything from an innocent documentation error to outright fraud. They are part of a systematic and concurrent operating process that ensures compliance with Medicare's clinical payment criteria, documentation and billing requirements.

What is a RAC review?

RAC Review Process RACs review claims on a post-payment basis and will be able to look back three years from the date the claim was paid. There are two main types of review - automated (no medical record required) and complex (medical record required).

How far back can Medicare RAC audits go?

three yearsMedicare RACs perform audit and recovery activities on a postpayment basis, and claims are reviewable up to three years from the date the claim was filed.

Are RAC audits random?

Look-back Period, Required Response Time and Appeals A Complex audit is a comprehensive review of charts and claims, while an automated audit is more of a random spot check of files. For each type, the “look-back” period is up to three (3) years of claims records.

How can we avoid RAC audit?

6 Critical Tips to Avoid RAC AuditsHave a Risk-Management Plan in Place. ... Use Task and Employee Performance Checklists. ... Pay Attention to EHR Templates and Software Up-Coding. ... Avoid the Overuse of Levels 4 and 5 in E/M Codes. ... Control Errors and Expenses with an Independent Audit.More items...

How do I prepare for a RAC audit?

5 Ways You Can Begin Preparing for a RAC AuditPerform an Internal Audit. This action will help you to determine the likelihood of coding and billing mistakes within your company.Identify and Correct Coding/Billing Issues. ... Review Problem Areas. ... Check Documentation. ... Find Assistance.

How far back can Medicare recoup payments?

(1) Medicare contractors can begin recoupment no earlier than 41 days from the date of the initial overpayment demand but shall cease recoupment of the overpayment in question, upon receipt of a timely and valid request for a redetermination of an overpayment.

How long do you have to respond to a RAC audit?

within 45 calendar daysThe response must be received within 45 calendar days or request an extension within those 45 days. The RAC may make a finding than an overpayment or underpayment exits if there is no timely response to a request for medical records.

Can RAC audits be appealed?

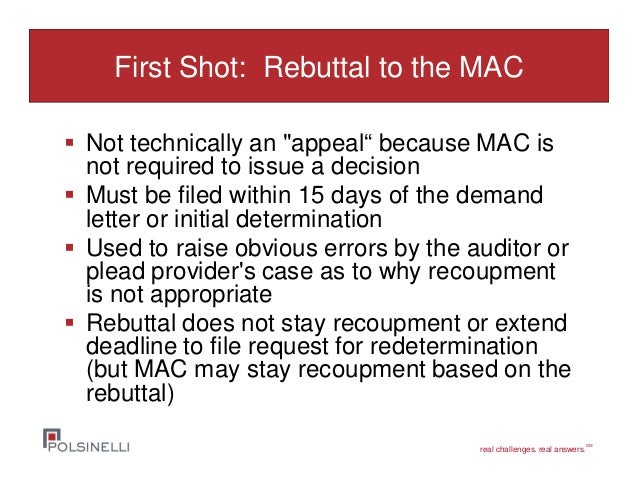

All providers may appeal the initial determination made by the Recovery Audit Contractors, either informally or formally. The informal process involves appealing directly to the contractor within 15 days of receiving a notice to recoup an overpayment from the RAC.

When did RAC audits start?

Part D RAC Program History In 2005, CMS implemented the Medicare Recovery Audit Contractor (RAC) Program as a demonstration program for Medicare fee-for-service (FFS); Medicare Parts A and Part B. The pilot program successfully corrected more than $1.03 Billion in Medicare improper payments.

4 things to know about RAC audits - Thornberry Ltd.

The skies may be sunny at your home health or hospice agency … and then you’re hit with a RAC audit. Such a notice can cause you and your staff’s stress levels to spike as you scramble to figure out what went wrong and when. You may worry about financial penalties and that the hard-earned reputation...

RAC Audit Update: Renewed Focus on the Two-Midnight Rule

In RAC news, on June 1, 2021, Cotiviti acquired HMS RAC region 4. Don’t be surprised if you see Cotiviti’s logo on RAC audits where you would have seen HMS. This change will have no impact in the day-to-day contract administration and audit timelines under CMS’ guidance. You will continue to follow the guidance in…

The Complete Guide to Recovery Audit Contractor (RAC) Audits

Learn about the role the Recovery Audit Contractor plays in healthcare today, and how providers can best respond to RAC audits and commercial audits in 2022 and beyond.

Medicare and Medicaid RAC Audits: How Auditors Get It Wrong

MedLearn Media, Inc. 445 Minnesota Street, Suite 514 St. Paul, MN 55101. Hours: 9AM – 5PM CT Phone: (800) 252-1578 Email: [email protected]

Approved RAC Topics | CMS

The .gov means it’s official. Federal government websites often end in .gov or .mil. Before sharing sensitive information, make sure you’re on a federal government site.

Will the RACs audit Critical Access Hospitals? | Healthcare Finance News

Critical Access Hospitals are different - well, at least for Medicare. Prospective payment systems like APCs and MS-DRGs are not used by CAHs. Does this mean that the RACs will not be interested in CAHs?

Introduction: What is a RAC Audit?

Medicare Recovery Audit Contractor Audits (RACs, or RAs) were introduced beginning in 2005 to identify and recover improper payments made in Medicare and Medicaid transactions between providers and payors. They were (and are) conducted by Recovery Audit Contractors (also known as RACs).

Chapter One: History of Recovery Audits

RAC audits were introduced in 2005, peaked around 2010 and experienced a slowdown from that point on. To understand the role of RAC audits in today’s healthcare finance space, it’s important to know how they started and why they have diminished.

Chapter Two: Types of RAC Audits

Before we look at the specific types of Recovery Audit Contractor audits, let’s review where they lie in the overall audit landscape.

Chapter Three: RAC Audit FAQ

With so many levels and types, it’s clear that audits can be complex. Adding in government legislation doesn’t necessarily make the process easier. The following frequently asked questions can provide additional clarity on the why and how of RAC audits.

Chapter Four: The Audit Process

The timing of an audit is dependent entirely upon the payor. If a RAC auditor wishes to conduct an audit, the provider must comply. Once an audit begins, the initial response process is largely the same regardless of whether it was triggered by a RAC auditor, commercial payor or other audit contractors.

Chapter Five: What Can You Do To Improve Your RAC Audit Process?

Before the ADR even arrives on your doorstep, you can take steps to train your team and implement processes designed to simplify your response process.

Chapter Six: Technology as an Audit Management Solution

When RAC audits were introduced, providers received an unmanageable volume of audit requests from payors. Now, changes in Recovery Audits have led to fewer audits and less paperwork, giving hospitals the opportunity to focus more broadly on all types of payor audits.

What does RAC audit notification mean?

If your practice receives a RAC audit notification letter, it’s generally to investigate suspicion of an improper payment on a claim (either an overpayment or an underpayment). RAC auditors will usually request medical records to complete the audit.

How long does it take for RAC to determine if you have overpaid?

Once you submit the requested medical records, the RAC has 60 days to get a determination to you. If all goes well, this could be the end of the audit. If the RAC determines you received an overpayment, the process will continue, and you could be required to pay the money back.

How long does it take to get an overpayment letter from the RAC?

After receiving a demand letter, you are required to call the RAC within 15 days to discuss how you plan to proceed. In response to an overpayment demand letter, you essentially have three options:

How long do you have to respond to a RAC request?

If you receive a letter from a RAC contractor requesting medical records, don’t delay. You have 45 calendar days to either submit a response or file an extension. If you don’t respond at all, the RAC could simply make a determination that you were overpaid, and take their money back.

How long does it take to get a Medicare recoupment determination?

Level 1: The first appeal level is redetermination. You have 120 days to file the first appeal but if you get it in within 30 days you can avoid Medicare recoupment action. You should get a determination within 60 days of receipt of your redetermination request. Level 2: The second appeal level is reconsideration.

What is the first step in RAC audit?

Step 1: The RAC Obtains Audit Scope and Documentation. CMS/CPI determines the specific criteria on which the Part D RAC must review audit packages. To direct the RAC's review, CMS/CPI mandates review of files that fall within a particular year and contract for a particular plan.

How long does Medicare Part D RAC take?

The Medicare Part D RAC will allow the plan sponsor a period of 60 or 90 days (90 days if prescriptions are requested) to provide additional information to refute all or some of the RAC’s findings. The RAC will not factor into the improper payment calculation any documentation it receives after this timeframe, and the RAC will render a decision based only on the data and the PDE records that plan sponsors submit during the appropriate timeframe. Once the RAC finalizes a decision and the DVC validates and concurs with this decision, plan sponsors will receive a Notification of Improper Payment (NIP).

What does the DVC need to validate RAC findings?

Further, the DVC must validate the RAC's improper payment findings before the RAC is permitted to actively pursue overpayments from sponsors.

What is a DVC in Medicare?

The DVC is an independent reviewer to protect the integrity of the Medicare Part D RAC program and ensure that improper payment determinations are accurate and unbiased before issuing the NIPs to plan sponsors. The DVC is also responsible for measuring the Part D RAC’s accuracy rate on CMS’ behalf.

Do RACs get paid?

RACs are paid on a contingency basis. They only collect payment improper payments recovered by CMS. Sponsors may appeal RAC findings (see the Part D RAC Appeals section). Should a sponsor appeal a RAC finding, the RAC will not receive payment until the appeal process has been completed and the audit finding upheld.

Can the RAC accept the DVC?

The RAC may either accept or reject the DVC's analysis findings. If rejected, the DVC must collaborate with the RAC to attempt resolution. CMS is the final decision maker to resolve disagreements on improper payment findings between the Medicare Part D DVC and RAC. Further, the DVC must validate the RAC's improper payment findings before ...

What does RAC audit notification mean?

If your practice receives a RAC audit notification letter, it’s generally to investigate suspicion of an improper payment on a claim (either an overpayment or an underpayment). RAC auditors will usually request medical records to complete the audit.

How long does it take for RAC to determine if you have overpaid?

Once you submit the requested medical records, the RAC has 60 days to get a determination to you. If all goes well, this could be the end of the audit. If the RAC determines you received an overpayment, the process will continue, and you could be required to pay the money back.

How long does it take to get an overpayment letter from the RAC?

After receiving a demand letter, you are required to call the RAC within 15 days to discuss how you plan to proceed. In response to an overpayment demand letter, you essentially have three options:

How long do you have to respond to a RAC request?

If you receive a letter from a RAC contractor requesting medical records, don’t delay. You have 45 calendar days to either submit a response or file an extension. If you don’t respond at all, the RAC could simply make a determination that you were overpaid, and take their money back.

How long does it take to get a Medicare recoupment determination?

Level 1: The first appeal level is redetermination. You have 120 days to file the first appeal but if you get it in within 30 days you can avoid Medicare recoupment action. You should get a determination within 60 days of receipt of your redetermination request. Level 2: The second appeal level is reconsideration.