The Benefits of Medicare Supplement Insurance Plans

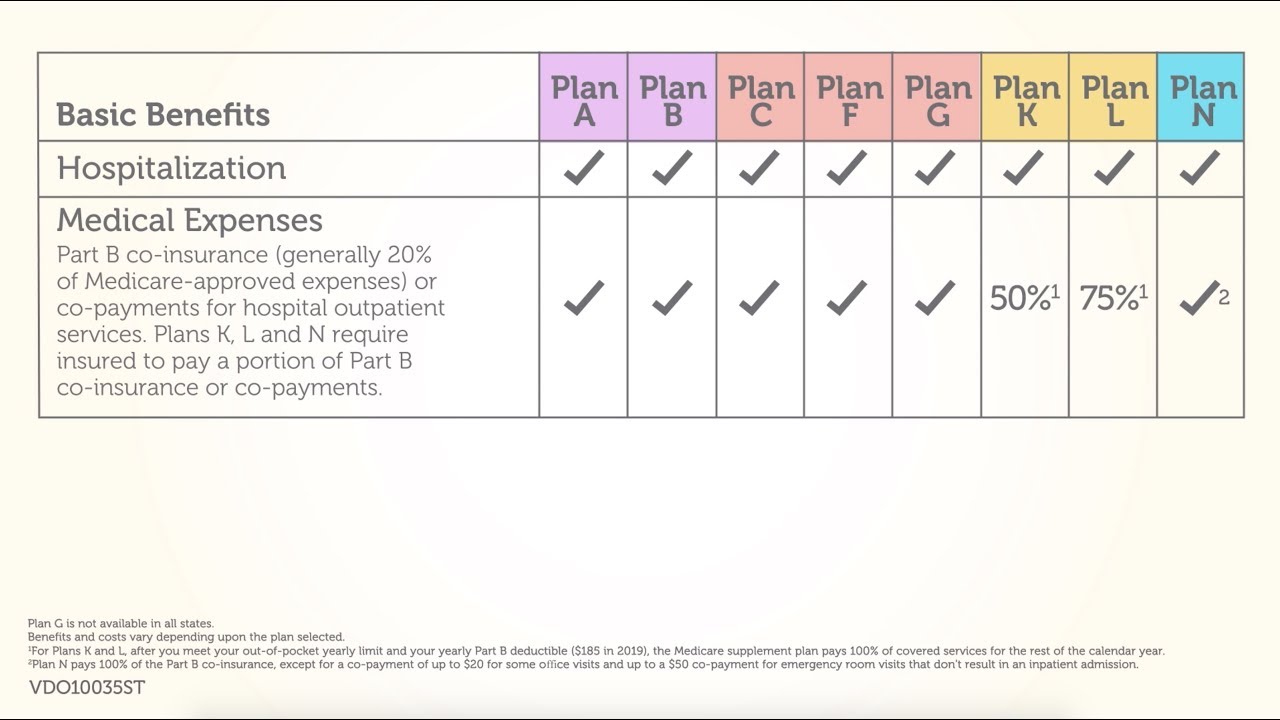

| Medicare Supplement Benefits | K 2 | L 3 |

| Part A coinsurance and hospital coverage | ||

| Part B coinsurance or copayment | 50% | 75% |

| Part A hospice care coinsurance or copay ... | 50% | 75% |

| First 3 pints of blood | 50% | 75% |

Full Answer

How much does a Medicare supplement insurance plan cost?

· Medicare Supplement (Medigap) plans are designed to help pay your share of health-care costs under Medicare Part A and Part B. For example, they may pay your Medicare Part B coinsurance for Medicare-approved doctor visits and lab tests.

What is the best and cheapest Medicare supplement insurance?

· A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits.

When can you sign up for Medicare supplement insurance?

A Medicare Supplement Insurance plan, also called a Medigap plan, is offered by a Medicare-approved private insurance company to help bridge the gap between the charges you pay and what is covered by the federal Medicare program.

What are the best Medicare supplement programs?

· Medicare Supplement insurance (sometimes referred to as “Medigap”) works with Original Medicare to pay some of the out-of-pocket costs that Parts A and B alone do not. Learn more about Medicare Supplement plans. Find Medicare Supplement Plans (Medigap) Enter your ZIP code to see available plans in your area. ZIP code.

What is considered a Medicare supplement plan?

Medicare Supplement insurance plans work with Original Medicare, Part A and Part B, and may help pay for certain costs that Original Medicare doesn't cover. These plans don't provide stand-alone coverage; you need to remain enrolled in Part A and Part B for your hospital and medical coverage.

What are the top 3 Medicare supplement plans?

Three Popular Medicare Supplement PlansBlue Cross Blue Shield. According to Blue Cross Blue Shield (BCBS), Plans F and N are available in most areas. ... AARP United Healthcare. The United Healthcare Medicare Supplement plan is also very popular. ... Humana.

What is the difference between Medicare Advantage plans and Medicare supplement plans?

Medicare Advantage and Medicare Supplement are different types of Medicare coverage. You cannot have both at the same time. Medicare Advantage bundles Part A and B often with Part D and other types of coverage. Medicare Supplement is additional coverage you can buy if you have Original Medicare Part A and B.

What is the difference between a Medigap plan and a supplemental plan?

Medicare Supplement and Medigap are different names for the same type of health insurance plan – you can use either name. To explain the terms themselves, you can think of “Medigap” as a plan that fills in some of the “gaps” for benefits that Original Medicare (Part A and Part B) doesn't cover.

What is the average cost of a Medicare supplement plan?

Medicare Supplemental Insurance (Medigap) Costs. In 2020, the average premium for Medicare supplemental insurance, or Medigap, was approximately $150 per month or $1,800 per year, according to Senior Market Sales, a full-service insurance organization.

What is the difference between Plan N and Plan G?

Plan G and Plan N premiums are lower to reflect that. Plan G will typically have higher premiums than Plan N because it includes more coverage. But it could save you money because out-of-pocket costs with Plan N may equal or exceed the premium difference with Plan G, depending on your specific medical needs.

What are the advantages and disadvantages of Medicare Supplement plans?

Medicare Advantage offers many benefits to original Medicare, including convenient coverage, multiple plan options, and long-term savings. There are some disadvantages as well, including provider limitations, additional costs, and lack of coverage while traveling.

Can I switch from Medicare Advantage to Medicare Supplement?

Once you've left your Medicare Advantage plan and enrolled in Original Medicare, you are generally eligible to apply for a Medicare Supplement insurance plan. Note, however, that in most cases, when you switch from Medicare Advantage to Original Medicare, you lose your “guaranteed-issue” rights for Medigap.

What are the negatives of a Medicare Advantage plan?

Medicare Advantage can become expensive if you're sick, due to uncovered copays. Additionally, a plan may offer only a limited network of doctors, which can interfere with a patient's choice. It's not easy to change to another plan. If you decide to switch to a Medigap policy, there often are lifetime penalties.

What is the downside to Medigap plans?

Some disadvantages of Medigap plans include: Higher monthly premiums. Having to navigate the different types of plans. No prescription coverage (which you can purchase through Plan D)

Is Part B the same as Medigap?

The various Medigap plan types cover different amounts of your Medicare out-of-pocket costs. Note that Medigap Plan B is different from Original Medicare Part B, although their similar names may be confusingly similar. Medigap Plan B includes the following coverage: Medicare Part B copayments and coinsurance.

What is the deductible for plan G in 2022?

$2,490Medigap Plan F and Plan G have high-deductible options that include an annual deductible of $2,490 in 2022. Plan members must meet this deductible before the plan begins to cover any of Medicare out-of-pocket expenses.

How Do Medicare Supplement (Medigap) Plans Work With Medicare?

Medigap plans supplement your Original Medicare benefits, which is why these policies are also called Medicare Supplement plans. You’ll need to be...

What Types of Coverage Are Not Medicare Supplement Plans?

As a Medicare beneficiary, you may also be enrolled in other types of coverage, either through the Medicare program or other sources, such as an em...

What Benefits Do Medicare Supplement Plans Cover?

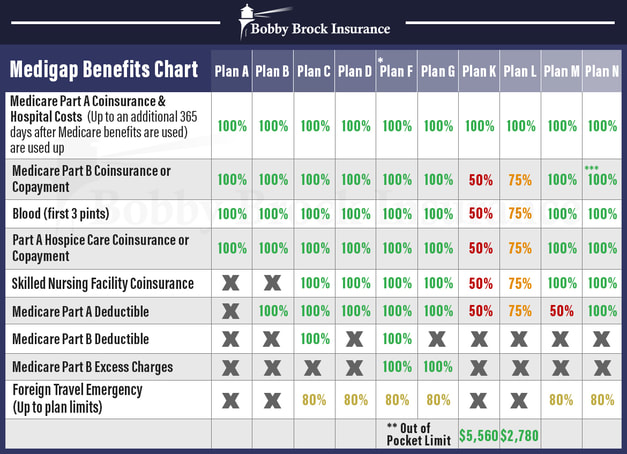

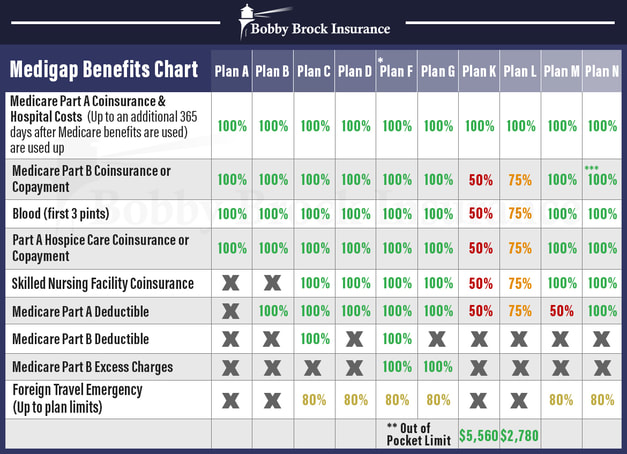

Currently, there are 10 standardized Medigap plans, each represented by a letter (A, B, C, D, F, G, K, L, M, N; there’s also a high-deductible vers...

What Benefits Are Not Covered by Medicare Supplement Plans?

Medigap policies generally do not cover the following health services and supplies: 1. Long-term care (care in a nursing home) 2. Routine vision or...

Additional Facts About Medicare Supplement Plans

1. You must have Medicare Part A and Part B to get a Medicare Supplement plan. 2. Every Medigap policy must be clearly identified as “Medicare Supp...

Is Medicare Supplement Plan A the same as Medicare Part A?

Please note that Medicare Supplement Plan A is not the same as Medicare Part A. There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

How many Medicare Supplement Plans are there?

There are four “parts” of Medicare, and there are up to 10 lettered, standardized Medicare Supplement plans in most states.

What are the benefits of Medicare Supplement?

All Medicare Supplement plans typically cover: 1 Your Medicare Part A hospital coinsurance, plus an additional full year of benefits after your Medicare benefits are exhausted 2 Some or all of your Medicare Part B coinsurance 3 Some or all of your Part A hospice coinsurance 4 Some or all of your first three pints of blood

Does Medicare Supplement cover out of pocket expenses?

Out-of-pocket costs with Part A and Part B can pile up, especially if you have a chronic health condition or a medical emergency. Medica re Supplement plans help cover those out-of-pocket Medicare costs so it’s easier to budget for your health care.

How long does Medicare Supplement open enrollment last?

Your Medicare Supplement Open Enrollment Period (OEP) typically begins the month you are both age 65 or over and enrolled in Part B, and lasts for six months. If you think you will ever want coverage, it’s important to buy it during the OEP.

Is there an annual enrollment period for Medicare Supplement?

Unlike with Medicare Advantage and Medicare Part D prescription drug plans, there is no annual enrollment period for Medicare Supplement plans. You can apply for a plan anytime you want, as long as you’re enrolled in Medicare Part A and Part B.

What is community rated Medicare?

Medicare Supplement insurance companies can use one of three ways to rate, or price, their policies: Community-rated, which means everyone pays the same premium regardless of age. Issue-age rated, which means your premium is based on your age at the time you buy the policy.

What is Medicare Supplement Insurance Plan?

What Is a Medicare Supplement Insurance Plan? A Medicare Supplement Insurance plan (also called Medigap) can help cover some of the out-of-pocket costs that Original Medicare doesn't, such as copays and deductibles. Each type of plan offers a different combination of basic health insurance benefits. Use the following guide to compare Medicare ...

Which Medicare Supplement Insurance Plan covers all of the basic Medicare benefits?

Medicare Supplement Insurance Plan F is the most popular Medigap plan, largely because it offers the most comprehensive range of basic benefits. Plan F is the only Medigap plan that covers all nine of the basic Medigap benefits, including the Medicare Part B deductible and Part B excess charges.

Does Medicare Part A require coinsurance?

Medicare Part A and Part B both require deductibles and coinsurance or copays. Medigap plans help beneficiaries fill in these cost "gaps" that can add up to potentially large dollar amounts.

When is the best time to buy Medicare Supplement?

The best time to buy a Medicare Supplement Insurance plan is during your Medigap open enrollment period. During your open enrollment period, insurance companies cannot consider any pre-existing conditions when deciding whether or not to offer you a policy. They also cannot charge you more for a Medigap plan based on pre-existing conditions.

How much is the deductible for Medicare 2021?

If you became eligible for Medicare. + Read more. 1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

How does Medicare Supplement insurance work?

A Medicare Supplement insurance plan will have a monthly premium cost that you pay to the private insurance company that you purchased the plan through. You’ll pay your monthly Medigap policy premium separately of any Medicare premiums. Costs can vary widely for Medicare Supplement plans because they are offered through private insurance companies, ...

What are the benefits of Medicare Supplement?

The specific coverage that Medicare Supplement plans offer vary based on the plan you purchase. Medicare.gov offers an in-depth look at the precise coverage of each plan, but in general, Medigap policies will either fully cover, partially cover, or not cover the following services and supplies: 1 Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up 2 Part B coinsurance or copayment 3 The first three pints of blood 4 Part A hospice care coinsurance or copayment 5 Skilled nursing facility care coinsurance 6 Part A deductible 7 Part B deductible 8 Part B excess charges 9 Foreign travel emergency services 10 Out-of-pocket limit

Why is Medicare Supplement Insurance called Medigap?

Medicare Supplement insurance plans are often referred to as Medigap policies, because they can help fill the gap between Medicare and healthcare needs. Many people use Medigap policies to help cover the costs of associated healthcare expenses, such as coinsurance payments, copays and deductibles.

Does Medicare cover hospital coinsurance?

Medicare.gov offers an in-depth look at the precise coverage of each plan, but in general, Medigap policies will either fully cover, partially cover, or not cover the following services and supplies: Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up.

Does Medicare Supplement cover travel?

There are also additional Medigap policies that are no longer for sale, but if you are already enrolled in them, they cover you for emergency care while traveling as well.

Does Medigap have a high deductible?

Medigap also offers high-deductible plans in some states. If you choose a high-deductible plan, you pay the $2,370 deductible (in 2021) before the policy kicks in. However, the high-deductible plans C and F aren’t available to anyone who is newly eligible for Medicare on or after January 1, 2020.

Does Medigap cover prescription drugs?

Current Medigap policies do not cover prescription drugs. In the past, before January 1, 2006, some Medigap policies offered prescription drug coverage, but current plans do not offer prescription drug coverage. In order to receive prescription drug cover, you can join a Medicare Part D prescription drug plan.

What is Medicare Supplement?

Medicare Supplement insurance (sometimes referred to as “Medigap”) works with Original Medicare to pay some of the out-of-pocket costs that Parts A and B alone do not. Learn more about Medicare Supplement plans. Find Medicare Supplement Plans (Medigap) Enter your ZIP code to see available plans in your area. ZIP code.

Does Medicare Supplement pay for everything?

While Original Medicare (Parts A and B) provides good health coverage, it doesn’t pay for everything. Medicare Supplement insurance (sometimes referred to as “Medigap”) works with Original Medicare to pay some of the out-of-pocket costs that Parts A and B alone do not.

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (also called Medigap) can help cover the costs of deductibles, copayments, coinsurance and other fees associated with Original Medicare (Part A and Part B). Compare the basic benefits of the 10 standardized Medigap plans listed below to find the right plan for your needs.

What is Medicare Part A?

Medicare Part A (hospital insurance) and Medicare Part B (medical insurance) offer benefits that help cover services such as hospital stays, doctor visits and preventive care — but they often come at a price. Medicare Part A Costs.

How much is Medicare Part A deductible in 2021?

The Medicare Part A deductible is $1,484 per benefit period in 2021, and you may have to pay coinsurance fees for hospital stays that last longer than 60 days. Medicare Part B Costs. Medicare Part B has an annual deductible that is $203 in 2021.

What is Medicare Part B excess charge?

Medicare Part B excess charge. Foreign travel emergency. Each of the nine Medigap health insurance plans cover the first four basic benefits listed above. Plans may cover some, all or none of the five additional benefits — partially or in full.

What is the deductible for 2021?

1 Plans F and G offer high-deductible plans that each have an annual deductible of $2,370 in 2021. Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year.

Is Medicare Supplement Insurance the only alternative?

Medicare Supplement Insurance isn’t the only alternative available for beneficiaries who are worried about covering those out-of-pocket costs remaining after Medicare pays its share. Medicare Advantage plans, also known as Medicare Part C, are health plans issued by a private insurer that cover your Medicare Part A and Part B benefits.

Does Massachusetts have Medicare Supplement?

Medicare Supplement Plans in Massachusetts. Like we mentioned above, Medicare Supplement Insurance plans are structured differently in Massachusetts. Residents of the Bay State only have two plans to choose from: the Core Plan and the Supplement 1 Plan. Both plans cover basic benefits:

Do you have to pay Medicare premiums if you are 65?

Part A covers inpatient hospital services, as well as care in a hospice or skilled nursing facility and some home health care expenses. Most people don’ t have to pay a premium for Part A ( premium-free Part A), but if you’re 65 and you didn’t pay the Medicare tax for 10 years or more, you may have to pay a premium.

How much is Medicare Part B deductible?

For 2019, the deductible for Medicare Part B is $185. After the deductible, you’ll pay 20% of most medical expenses.

Does Medicare pay for prescription drugs?

Medicare Part D helps you pay for prescription drugs. Depending on your plan, you may have to shop at preferred pharmacies to get the best price. You may also have to pay an out-of-pocket deductible before the insurance begins paying. Part D drug plans carry a premium which you must pay in addition to the Plan B premium.

How long do you have to be on Medicare if you have a disability?

If you have a disability and you’re receiving disability benefits from the Social Security Administration, you’ll automatically be enrolled in Parts A and B of Medicare once you’ve been receiving benefits for 24 months.

Does Medicare have a penalty for enrolling in Medicare?

In order to encourage people to enroll in Medicare, the federal government imposes a penalty on people who enroll in Medicare after their Initial Enrollment Period has passed and if they don’t qualify for any of the Special Enrollment Periods described above.

What is Medicare Supplement?

Medicare supplement insurance policies help fill in the gaps left by Original Medicare health care insurance. For many people, Medicare Supplement, also known as Medigap, insurance helps them economically by paying some of the out-of-pocket costs associated with Original Medicare.

Does Medicare Supplement cover prescriptions?

They only cover one person per plan. If you want coverage for your spouse, you must purchase a separate plan. These plans also do not include prescription drug coverage.

Does Medicare Supplement pay for coinsurance?

Most supplement plans pay for Medicare copayments, coinsurance, and deductibles. But the coverage may vary according to the plan you choose. Medicare Supplement plans work together with Original Medicare. First, Medicare pays for a percentage, usually 80 percent, of the Medicare-approved cost of your health care service.

Does Medicare cover long term care?

Most plans do not cover long-term care, vision, dental, hearing care, or private nursing care. All Medicare Supplement insurance coverage comes with a monthly premium which you pay directly to your provider. How much you pay depends on which plan you have.

How old do you have to be to qualify for medicare?

To be eligible for Medicare, you must be at least 65 years old, a citizen of the United States or permanent legal resident for at least five consecutive years. Also, you, or your spouse, must have worked and paid federal taxes for at least ten years (or 40 quarters).

What is Medicare Supplement Insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.

What is Medigap insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.

What is a Medigap plan?

Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need.

Do all Medicare Supplement plans have the same benefits?

All 10 of the standardized Medicare Supplement policies are regulated by law; all the benefits from each separate plan are the same, regardless of who your insurer is or (in most states) where you live .

What are the advantages of Medicare Supplement?

Ten advantages of Medicare Supplement plans. Large medical bill protection. Let’s say you regularly need to purchase Medicare-covered, but costly, medical supplies. Under Medicare Part B, 80 percent of your total costs may be taken care of, but 20 percent of the bill is still your responsibility. You’ll need to reach the yearly Medicare Part B ...

What is Medicare Part A?

Part A provides hospital insurance, and Part B (medical insurance) covers doctor visits; preventive services like certain screenings and vaccinations; durable medical equipment; and other services and items.

What is a select Medicare plan?

An exception is a Medicare SELECT policy, which is a type of Medicare Supplement plan that may require you to use providers and hospitals in its network. Wide variety of plans. The 10 standard Medicare Supplement policies offer a wide variety of coverage to help pay your Original Medicare costs. Those plans with the most coverage tend ...

Is Medicare Part D a supplement?

A stand-alone Medicare Part D plan works alongside your Original Medicare coverage and isn’t part of the Medicare Supplement plan. (You may have a Medicare Supplement plan that offers prescription drug coverage if your plan had that coverage when you bought it, but you can’t buy a new Medicare Supplement plan with drug coverage anymore.)

How many states have standardized Medicare Supplement Plans?

There are 10 standardized Medicare Supplement plans in 47 states sold by private insurers. These plans are named by letter (Plan A through Plan N; Plans E, H, I, and J are no longer sold). The plans are standardized such that each plan of the same name provides the same coverage no matter where it’s sold; for example, Plan N in North Dakota is the same as Plan N in California. Medicare Supplement plan costs, however, may vary regionally and by company. Massachusetts, Wisconsin, and Minnesota have their own standardized Medicare Supplement plans.

Does Medicare Part B have a deductible?

Medicare Part B also has copayments, coinsurance, a monthly premium, and an annual deductible. Medicare Supplement (also known as Medigap and MedSupp) insurance can help downsize your Original Medicare cost burden. For example, some plans pay the Medicare Part A deductible.