What are the pros and cons of Medicare Supplement plans?

Medigap Pros and ConsMedigap ProsMedigap ConsPlans are easy to compareDifficult to switch once enrolledGuaranteed 6 month enrollment period when 1st eligibleMay not be able to enroll after initial enrollment periodAll plans offer an additional 365 days in hospitalNot all plans cover hospital deductible3 more rows•Sep 26, 2021

What is considered a Medicare Supplement plan?

Medicare Supplement insurance policies, also called Medigap, help pay the out-of-pocket expenses not covered by Original Medicare (Part A and B). It is not part of the government's Medicare program, but provides coverage in addition to it.Oct 1, 2021

What is the most basic Medicare Supplement plan?

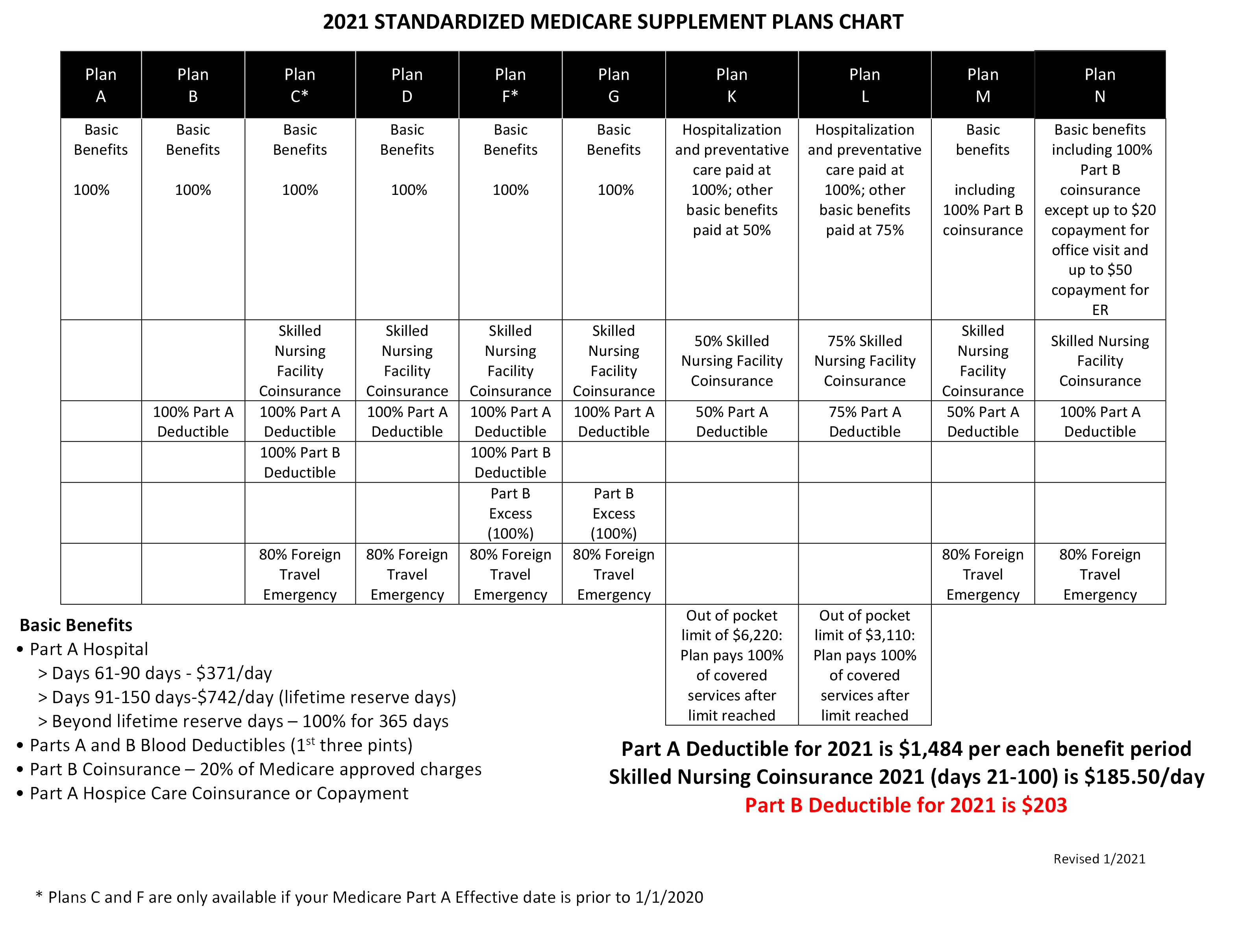

There are 10 different Medicare Supplement plans approved by Medicare, each with a different level of provided benefits. Three plans — Plan F, Plan G, and Plan N — are the most popular (accounting for over 80 percent of all plans sold).Sep 25, 2021

What is the difference between a Medicare Supplement and a Medicare Advantage Plan?

Keep in mind that Medicare Supplement insurance plans can only be used to pay for Original Medicare costs; they can't be used with Medicare Advantage plans. In contrast, Medicare Advantage plans are an alternative to Original Medicare. If you enroll in a Medicare Advantage plan, you're still in the Medicare program.

Is Medigap the same as supplemental?

Are Medigap and Medicare Supplemental Insurance the same thing? En español | Yes. Medigap or Medicare Supplemental Insurance is private health insurance that supplements your Medicare coverage by helping you pay your share of health care costs. You have to buy and pay for Medigap on your own.

Do you really need a Medicare Supplement plan?

Original Medicare: Key takeaways For many low-income Medicare beneficiaries, there's no need for private supplemental coverage. Only 19% of Original Medicare beneficiaries have no supplemental coverage. Supplemental coverage can help prevent major expenses.

What is the difference between Plan G and high deductible plan G?

What is the difference between Plan G and High Deductible Plan G? High Deductible Plan G offers the same benefits as Plan G. Yet, while High Deductible Plan G comes with a lower monthly premium, beneficiaries also must pay the higher deductible before receiving full coverage.Mar 1, 2022

What is the average cost of a Medicare Supplement plan?

The average cost of a Medicare supplemental insurance plan, or Medigap, is about $150 a month, according to industry experts. These supplemental insurance plans help fill gaps in Original Medicare (Part A and Part B) coverage.

Should I switch from Plan F to Plan G?

Two Reasons to switch from Plan F to G Plan G is often considerably less expensive than Plan F. You can often save $50 a month moving from F to G. Even though you will have to pay the one time $233 for the Part B deductible on Medigap G, the monthly savings will be worth it in the long run.Sep 5, 2019

Can you switch back and forth between Medicare and Medicare Advantage?

Yes, you can elect to switch to traditional Medicare from your Medicare Advantage plan during the Medicare Open Enrollment period, which runs from October 15 to December 7 each year. Your coverage under traditional Medicare will begin January 1 of the following year.

Why do doctors not like Medicare Advantage plans?

If they don't say under budget, they end up losing money. Meaning, you may not receive the full extent of care. Thus, many doctors will likely tell you they do not like Medicare Advantage plans because the private insurance companies make it difficult for them to get paid for the services they provide.

Can I change from Medicare Supplement to Medicare Advantage?

Can you switch from Medicare Supplement (Medigap) to Medicare Advantage? Yes. There can be good reasons to consider switching your Medigap plan. Maybe you're paying too much for benefits you don't need, or your health needs have changed and now you need more benefits.Jun 24, 2021

What is a Medigap policy?

Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

What happens if you buy a Medigap policy?

If you have Original Medicare and you buy a Medigap policy, here's what happens: Medicare will pay its share of the. Medicare-Approved Amount. In Original Medicare, this is the amount a doctor or supplier that accepts assignment can be paid. It may be less than the actual amount a doctor or supplier charges.

What is Medicare Advantage?

Medicaid. A joint federal and state program that helps with medical costs for some people with limited income and resources.

How many people does a Medigap policy cover?

for your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies.

What is the difference between Medicare and Original Medicare?

Original Medicare. Original Medicare is a fee-for-service health plan that has two parts: Part A (Hospital Insurance) and Part B (Medical Insurance). After you pay a deductible, Medicare pays its share of the Medicare-approved amount, and you pay your share (coinsurance and deductibles). and is sold by private companies.

Can you buy a Medigap and Medicare?

If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments. Contact the company to find out how to pay your premiums. It's illegal for anyone to sell you a Medigap policy if you have a Medicare Advantage Plan, unless you're switching back to Original Medicare.

Can you cancel a Medigap policy?

This means the insurance company can't cancel your Medigap policy as long as you pay the premium. Some Medigap policies sold in the past cover prescription drugs. But, Medigap policies sold after January 1, 2006 aren't allowed to include prescription drug coverage.

What is the benefit of accendo?

Another great benefit to having an Accendo Medicare supplement for those who live with someone is that they will qualify for a 14% household discount, whether that other person is applying or not . Accendo Medicare supplement plans are designed to help pay the gaps, or expenses, of both Part A and B Medicare.

What is the most economical Medicare Supplement Plan?

One of the most economical plans that is being offered for the coming year is Medicare Supplement Plan G in 2020. This is one of the high coverage plans, and it has so much to offer seniors who are looking to cut down on their medical costs.

What is Medicare Supplement Plan G?

These are not sold by Medicare directly, but instead are offered by various insurance companies. One of the most economical plans that is being offered for the coming year is Medicare Supplement Plan G in 2020.

When did CVS buy Aetna?

Three additional states were released on April 25 th of 2020, and those states are: DE, TX, & WI. CVS purchased Aetna in 2019 and has been extremely competitive in the Medicare supplement market, and the new Accendo Medicare supplement plans appear to be even more competitively priced.

When will Mutual of Omaha Medicare Supplement be available?

Seniors who sign up for Mutual of Omaha Medicare Supplement plans for 2020 will receive guaranteed coverage that lasts through the entire year, starting on January 1 st. The rates will also be locked in, and the rate you agree to when you sign up in 2019 will still be what you are paying in December of 2020.

Which is the most valuable Medicare supplement plan for 2020?

Compare Medicare supplement plans 2020. For 2020 Medicare Supplement Plan G is going to be the most valuable plan for most people. This one covers you for just about everything we listed up above, but it costs less than Plan F and it leaves off coverage for Medicare’s annual Part B deductible.

Is Aetna Medicare Supplement available for seniors?

The Aetna Medicare Supplement Plans for 2020 have been carefully selected based on what seniors tend to sign up for, so the most popular plans should be available there, as well as the ones that are highly rated and useful for the largest number of seniors.

How the Plans Changed

We need to talk now about how some of the Supplement plans have changed over the last few years. The coverage on the plans has not changed at all, so you can rest easy in that regard. If you are signed up for one of these plans already, then the changes don’t affect what you already have.

Which Medicare Supplement Plans Are the Best?

That leaves us with the question of which plans would be called the best. The thing about that question is that we can’t simply answer it by saying one plan is the best or another plan is the best. There simply isn’t a single best plan, and that’s always been true of the Supplement plans.

How to choose a Medigap plan?

Medigap policies are standardized, and in most states are named by letters, Plans A-N. Compare the benefits each plan helps pay for and choose a plan that covers what you need. See benefits of each plan. Step 2.

What is Medigap insurance?

Medicare Supplement Insurance (Medigap) is extra insurance you can buy from a private company that helps pay your share of costs.

What is Medicare Supplement Plan N?

The United Healthcare Medicare Supplement Plan N comes with tons of coverage, and only a few other Supplement plans can top it for total coverage. We want to talk to you about this plan and show you how it stacks up to some of the other options. Our hope is that with this information you will be able to make an informed choice about the coverage plan that is right for you.

Is Medicare Part A deductible covered?

Your Medicare Part A deductible is covered too, which is due for each coverage term.

Does Plan G cover Medicare Part B?

It may be able to save you even more moneys since it does cover a bit more for you. If you were to take all of Plan G’s coverage and add on coverage for Medicare Part B excess charges and those copayments you have to pay each time you visit the emergency room or doctor, then you would have Plan G’s coverage.

Is Medicare covered by Plan F?

You will still find other medical expense not covered under this plan, such as your medications, your hearing tests, vision checkups and more, but all expenses related to Medica re and most hospital expenses are covered under Plan F. The full coverage package it provides makes it an attractive plan to many seniors.

Can United Healthcare change plans?

United Healthcare, it needs to be said, cannot change the coverage on any of these plans we discussed. It can sell them, and it can decide how much to charge for them. It can even decide which plans it wants to sell, to some extent. What it cannot do is decide that the coverage on Plan N or one of the other plans is going to change.

Is Plan N a part of United Healthcare?

Plan N is sold by other insurance companies besides just United Healthcare. Some of them may be offering you better rates or different member services. United Healthcare is worth considering because of how prestigious this company is and how well it is regarded among consumers.

What is coinsurance in Medicare?

Coinsurance is usually a percentage (for example, 20%). The amount you must pay for health care or prescriptions before Original Medicare, your prescription drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible).

How much is Medicare deductible for 2020?

With this option, you must pay for Medicare-covered costs (coinsurance, copayments, and deductibles) up to the deductible amount of $2,340 in 2020 ($2,370 in 2021) before your policy pays anything. (Plans C and F aren't available to people who were newly eligible for Medicare on or after January 1, 2020.)

What states have Medigap policies?

In Massachusetts, Minnesota, and Wisconsin, Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies:

What is covered benefits?

benefits. The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents. but some offer additional benefits, so you can choose which one meets your needs.

Is Medigap standardized?

Medigap policies are standardized. Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance.". Insurance companies can sell you only a "standardized" policy identified in most states by letters. All policies offer the same basic.

Where do you live in Medigap?

You live in Massachusetts, Minnesota, or Wisconsin. If you live in one of these 3 states, Medigap policies are standardized in a different way. You live in Massachusetts. You live in Minnesota. You live in Wisconsin.

Do insurance companies have to offer every Medigap plan?

Insurance companies that sell Medigap policies: Don't have to offer every Medigap plan. Must offer Medigap Plan A if they offer any Medigap policy. Must also offer Plan C or Plan F if they offer any plan.

What is SelectQuote Senior?

SelectQuote Senior is one of several brokers that refers prospective clients to various insurance companies for Medicare Supplement Plans. You'll get quotes for 20+ different providers through this service, depending on which companies are issuing policies where you live. Those companies may include Aetna, Cigna, Anthem and Humana; all insurers with whom they partner are at least A- rated. The business itself has an "A+" rating and accreditation from the BBB, which means that in the company's 36 years in operation, they've done a good job of treating their clients fairly and honestly.

What about once you've selected your Medicare Supplement Plan?

What about once you've selected your Medicare Supplement Plan? According to our agent, all servicing is handled directly with Aetna - or whichever insurance company you choose. She suggested that customers check in with Medicare-Plans in the future to do price comparisons as rates may change. If you like a "don't call me, I'll call you" arrangement, that might be ideal. But, if you want a broker that will give you support once you've enrolled, or that will keep track of rates and other changes on your behalf, you won't find that with this service.

What is the name of the insurance company that offers Medicare Supplement Plans?

Blue Cross Blue Shield. BlueCross Blue Shield (known as Anthem in some states, as well as BCBS) is one of the biggest names in insurance. They have a website specifically dedicated to Medicare Supplement Plans, so you don't have to worry about sorting through health insurance information that doesn't apply to you.

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company?

Why go through a broker like United Medicare Advisors instead of buying your Medicare Supplement Plan directly from an insurance company? First, there's no guarantee that any insurance company will always have the most affordable plan for your needs. United Medicare Advisors gives you access to a vast range of companies. They constantly monitor premiums and plans so that you can get the provider and the plan that best fits your needs.

How to find Medicare premiums with United Medicare Advisors?

When it comes to finding plans and premiums with United Medicare Advisors, they provide a simple online form where you enter contact information such as your name, phone number, and email address. This same information is required by almost all Medicare Supplement Plan sites.

How much is the BCBS discount?

There is also a household discount of 5% if more than one household member is enrolled in a BCBS Medicare Supplement Plan. That discount is lower than many other insurers, who typically offer anywhere from 7% to 15% off, and sometimes that applies even if no one else is currently enrolled with you.

How long has Aetna been around?

Aetna. Aetna has been around for a LONG time: over 160 years, as a matter of fact. And, as the insurer most often quoted during our process of finding Medicare Supplement Plans, Aetna is an obvious company to consider for your coverage needs.

What is a Medigap Plan F?

As discussed above, Medigap Plan F is popular because it leaves no gap – or, covers 100 percent of the costs – after the benefits from Medicare Parts A and B have reached their limit. For example, Medicare Plan F helps with Part B excess charges, hospital costs, Part B coinsurance, skilled nursing facility costs, nursing facility care, hospice care coinsurance and more. It also covers the Medicare Part B deductible, which sets it apart from the other most popular plans. Like Plans C, D, G, M, and N, Plan F covers some of the expenses incurred if you have a foreign travel emergency. Learn more about Medicare Plan F and the high-deductible version, high deductible Plan F; you may like that this plan covers more than any of the other plan on the comparison Medigap plan comparison chart.

What is Medicare Supplement Plan A?

Medicare Supplement Plan A: Medigap plan A is one of the lowest-cost plans with the least amount of coverage. Medicare Part A coinsurance payments for inpatient hospital care up to an additional 365 days. Learn more about Medigap Plan A.

How many Medigap plans are there?

There are 10 Medigap plans commonly offered in the United States, and it’s essential to check out a Medigap plan comparison chart to assess the various benefits and drawbacks of each plan.

Why are Medicare plans G and N so popular?

Plans G and N are popular because they are also quite comprehensive but demand lower annual premiums. Both Plan G and Plan N still leave a little of the gap we talked about earlier, so there will be some out-of-pocket expenses involved if Medicare Part A or Part B do not cover all your medical costs.

Will Medicare Supplement Plan 2020 stop allowing Part B deductible?

While viewing the Medicare Supplement plan comparison chart, it’s important to note some changes that are on the horizon. In 2020, federal regulations will stop allowing Medigap plans to cover the Medicare Part B deductible, thereby precluding any new Medicare beneficiaries from enrolling in Plan F or Plan C.

Does Medicare Supplement Plan N require a deductible?

Medicare Supplement Plan N: Although Medicare Supplement Plan N offers lower premium rates than Plans G and F, it does require you to cover the Part B deductible, as well as your co-pays for your doctor and emergency room visits. Learn more about Medicare Plan N.

Is Medigap Plan G the same as Plan F?

Medigap plan G is a very comprehensive plan that covers almost all the same bases as Plan F, except any excess costs that arise after the Medicare Part B deductible. In other words, your deductible is covered, but anything above that you must pay out of pocket.